albert Chan

Executive Summary

The global financial services industry experienced a period of huge turmoil as a consequence of the global financial crisis—and that turbulence led to the launch of an army of more nimble, competing startups. We see many parallels between that period and the current turmoil that the global retail industry is experiencing. In retail, too, turbulence is leading to the launch of army of startups seeking to provide solutions.

Some recently founded retail startups are addressing financial aspects of retail and can be considered fintech startups as well. Both the global financial services and retail markets are large and fragmented, totaling $15.6 trillion and $14.0 billion, respectively, and they offer ample room for fast-moving, agile startups to create a presence before the incumbents even take notice.

In this report, we profile four retail/fintech startups—Affirm, Returnly, Riskified and Signifyd—which represent the first wave in this new batch of startups. These companies are working to address a market with a combined estimated value of $83.4 billion and are serving consumers’ and retailers’ needs in the areas of short-term credit, fraud prevention and protection, and product returns.

Market Overview

The retail fintech market lies at the intersection of the global financial services market— which data from the OECD, McKinsey Global Institute and the World Bank indicate is worth $15.6 trillion—and the global retailing market, with Euromonitor International estimates is worth $14 trillion. Information compiled by venture capital database provider CB Insights illustrates the sheer size of the fintech universe. The firm maintains a database of 6,203 companies; 6,274 investors; 1,938 exits; and 1,500 acquirers.

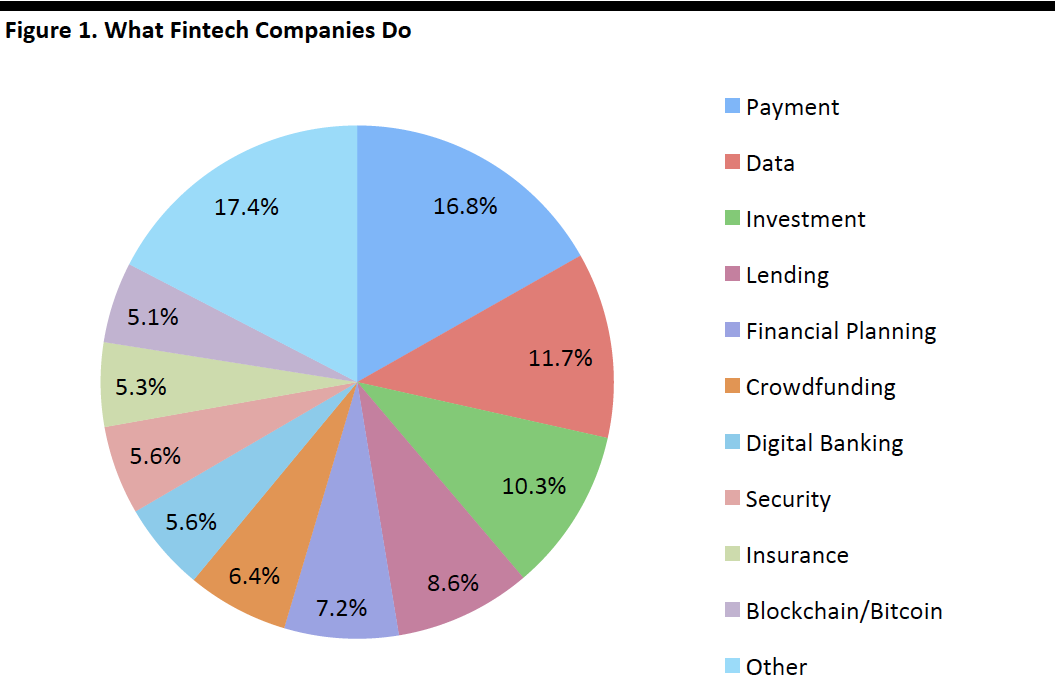

Website FintechWeekly.com has compiled a list of 1,351 companies engaged in the specific fintech categories shown in the figure below.

[caption id="attachment_112299" align="aligncenter" width="700"] Source: FintechWeekly.com[/caption]

Source: FintechWeekly.com[/caption]

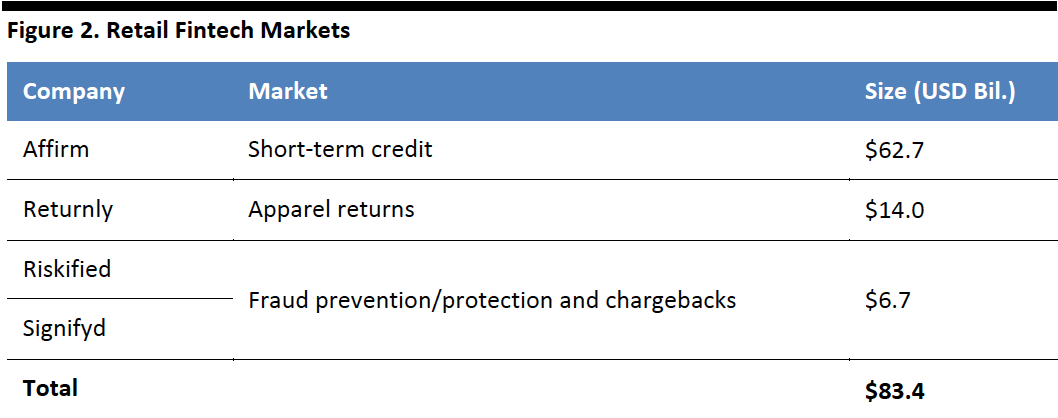

The four companies highlighted in this report—Affirm, Returnly, Riskified and Signifyd— serve various segments within the retail fintech market that have a combined estimated value of $83.4 billion.

[caption id="attachment_112300" align="aligncenter" width="700"] Source: Center for Financial Services Innovation/Chargeback.com/Euromonitor International/Fung Global Retail & Technology[/caption]

Source: Center for Financial Services Innovation/Chargeback.com/Euromonitor International/Fung Global Retail & Technology[/caption]

These four companies address various consumer and retailer needs, including short- term financing, processing of returns and the associated payments, and detection of fraud while enabling legitimate transactions. Below, we highlight each of these four retail fintech startups.

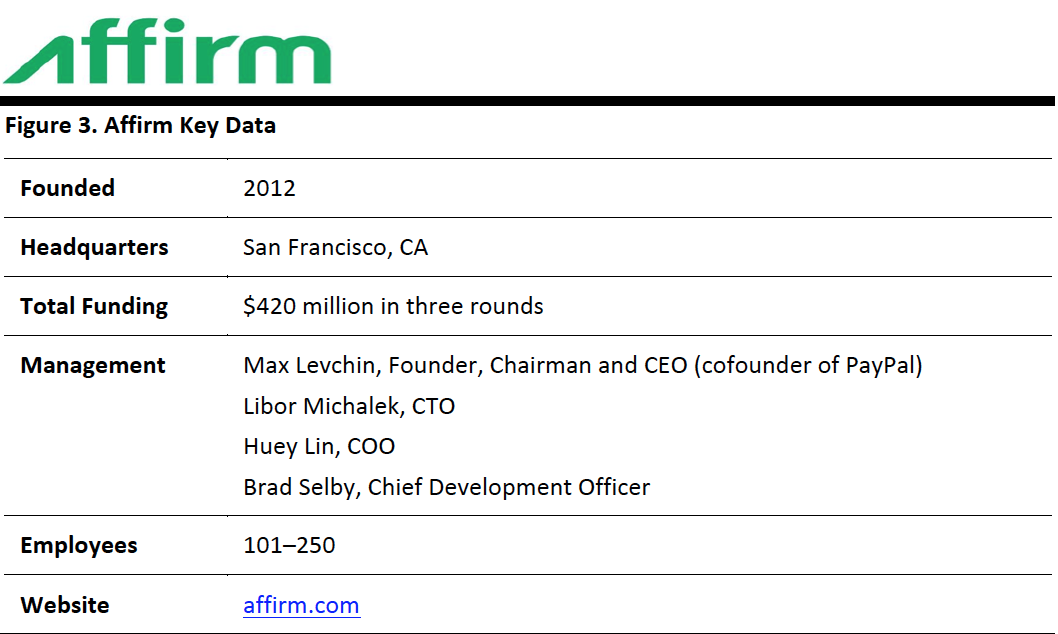

[caption id="attachment_112301" align="aligncenter" width="700"] Source: Crunchbase.com[/caption]

Source: Crunchbase.com[/caption]

Company Description

Affirm offers installment loans to consumers at the point of sale in the physical store. Loan volume at the end of 2016 amounted to hundreds of millions of dollars, and in April 2017, the company announced that it had served its one millionth loan. The company has more than 900 customers, including Expedia, Motorola and Tradesy.

Product/Service Description

Affirm lets shoppers pay for purchases across multiple months with transparent, reasonably priced fees built into every payment—which increases conversion and basket size for e-tailers at a lower cost than that of credit cards. The company claims vendors see a 75% average order value increase. Affirm claims that its solution reaches a broader population of consumers, as it uses advanced technology and analytics that look beyond traditional FICO scores.

Market Served

The nonprofit Center for Financial Services Innovation estimates that underserved consumers spent $62.7 billion on short-term credit (loans with terms of less than two years) and single-payment credit in 2015. Besides Affirm, other Bay Area microloan providers include Juvo (which partners with mobile network operators), LendUp (which focuses on socially responsible lending) and PayNearMe (which enables users to pay rent and utility bills in cash at nearly 28,000 locations).

Retail/Fintech Angle

The market for lower-income consumers is likely underserved, and Affirm can help narrow the gap. Consumers with incomes below $90,000 spent an average of $79 daily in May 2017 compared with $169 for those making more than $90,000 annually, according to Gallup. Some retailers are also looking to better address the market for lower-income consumers. For example, Amazon recently offered a reduced Prime membership fee for consumers receiving government benefits.

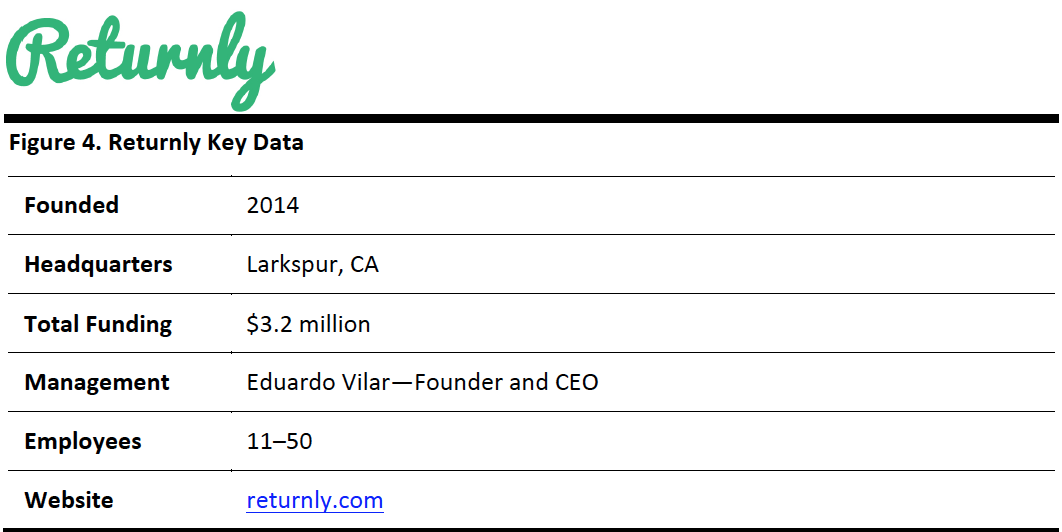

[caption id="attachment_112302" align="aligncenter" width="700"] Source: Crunchbase.com[/caption]

Source: Crunchbase.com[/caption]

Company Description

Returnly is a fintech platform that turns product returns into repurchases for online retailers and marketplaces. The company’s retail customers include Fruit of the Loom, Goop, Fanatics, Cotopaxi and Shopify.

Product/Service Description

Returnly enables merchants to offer shoppers a seamless online product return experience. Eligible shoppers receive an instant refund, which they can use to buy again at the store immediately. This turns product returns into repurchases. The app aims to reduce friction in the product return and refund process, which can sometimes take up to 21 days. This long refund period leads 91% of customers to avoid making repeat purchases. Returnly’s platform integrates with a variety of carriers and e-commerce platforms.

Market Served

According to Euromonitor, the global online apparel, footwear and accessories market will total $70 billion in 2017, and the firm estimates that a 20% return rate for apparel purchased online will result in $14 billion in annual returns. The return rates for some expensive items bought online can reach 50%, whereas return rates for brick-and- mortar stores are much lower, usually around 10%, as customers can see, touch and try on goods before buying them in stores.

Retail/Fintech Angle

Returns are a growing issue as e-commerce continues to take share within retail. Other startups that focus on handling returns, albeit not as fintech companies, include Happy Returns and SupplyAI (which aims to prevent returns).

[caption id="attachment_112303" align="aligncenter" width="700"] Source: Crunchbase.com[/caption]

Source: Crunchbase.com[/caption]

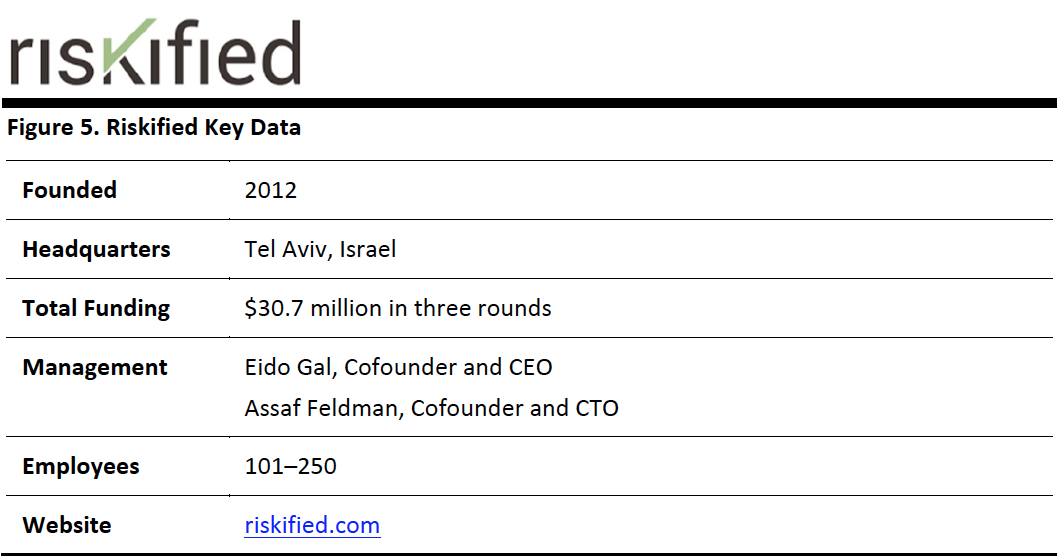

Company Description

Riskified is an all-in-one e-commerce fraud-prevention solution and chargeback- protection service for high-volume and enterprise merchants. It was built from the ground up as a chargeback-guarantee solution and offers a 100% chargeback-protection guarantee on every approved order, allowing merchants to have a greater degree of confidence in making sales. The company will close 2017 with $12 billion in approved transaction volume. Merchants that use Riskified’s solution include Burberry, Wish, Foot Locker and Viagogo.

Product/Service Description

Riskified provides an end-to-end fraud-prevention solution that gives retailers a definitive “approve” or “decline” recommendation for every order they review. The platform uses data from the customer’s device and browser, including behavioral analytics and information from other sources such as social media. Those data points are passed through advanced machine-learning algorithms to determine legitimacy. The process is invisible to the purchaser, and Riskified claims that its platform increases sales by 30% by approving those transactions that are actually valid although they may appear risky. The company, which guarantees 100% protection against chargebacks, says that this results in 66% fewer declines in transactions.

Market Served

Chargeback.com estimated the cost of e-commerce fraud at 1.16% of revenues, or $6.7 billion, in 2016, resulting from a combination of friendly fraud (fraudulently reporting that a credit-card charge is not genuine), identify theft and chargeback fraud.

Retail/Fintech Angle

Although fraud is likely to increase as e-commerce continues to grow, channel sales are already high enough that focusing on fraud prevention can make a significant impact. Merchants can increase revenue from transactions that might otherwise be needlessly declined. They can drastically limit their exposure to costly chargebacks and they can reduce their overhead by moving their e-commerce fraud prevention to an external vendor.

[caption id="attachment_112304" align="aligncenter" width="700"] Source: Crunchbase.com[/caption]

Source: Crunchbase.com[/caption]

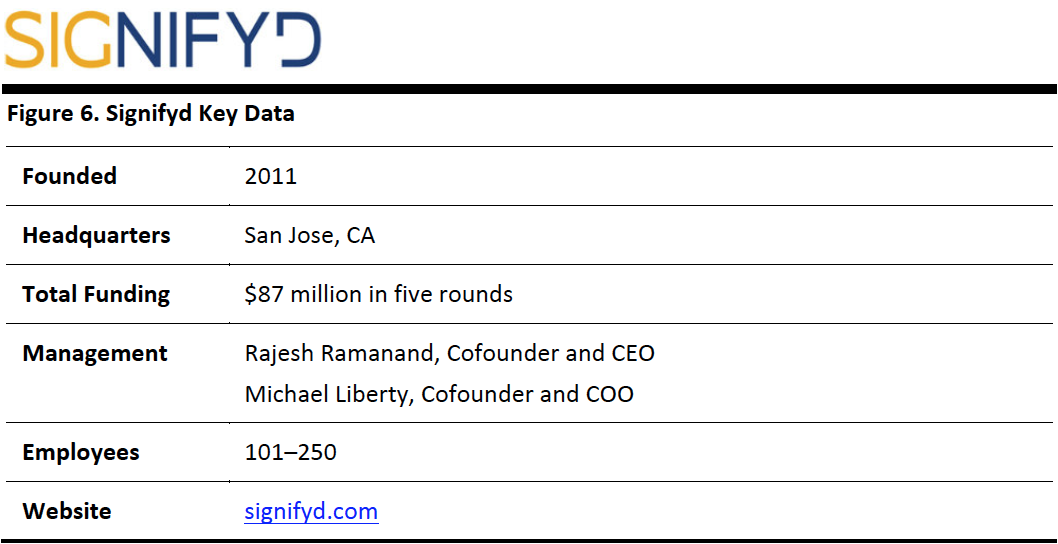

Company Description

Signifyd is a software-as-a-service, enterprise-grade fraud technology solution for e- commerce stores. The platform is used by multiple companies on the Fortune 1,000 and Internet Retailer Top 500 lists, including Build.com, Chegg, Jet.com, Lacoste, Peet’s Coffee & Tea, Samsung’s SmartThings, Tradesy and Wayfair. The company claims 5,000 active Signifyd stores, with a total of $437 billion worth of product protected.

Product/Service Description

The company’s solution simplifies fraud detection through a financial guarantee, which increases sales while reducing fraud losses. Signifyd was founded based on the belief that e-commerce businesses should be able to grow without fear of fraud. The platform has APIs that link to the most common e-commerce platforms and automate order fulfillment and cancellation, as well handle claim submissions and payouts for chargebacks.

Market Served

Chargeback.com estimated the cost of e-commerce fraud at 1.16% of revenues, or $6.7 billion in 2016, resulting from a combination of friendly fraud, identify theft and chargeback fraud.

Retail/Fintech Angle

With e-commerce approaching 10% of US retail sales and still growing at double-digit rates, the amount of fraud is also growing, and its cost is reaching high-single-digit billions of dollars.

Conclusion

The current volatility in the retail industry has opened the door for a large number of startups, including those focused on fintech for retail. The four retail/fintech startups we highlighted above, which offer solutions for consumers and retailers in the areas of short-term credit, returns and fraud prevention, have emerged early. Together, the four companies address a market that is estimated to be worth $83.4 billion.