Source: Company reports/FGRT

Fiscal 3Q17 Results

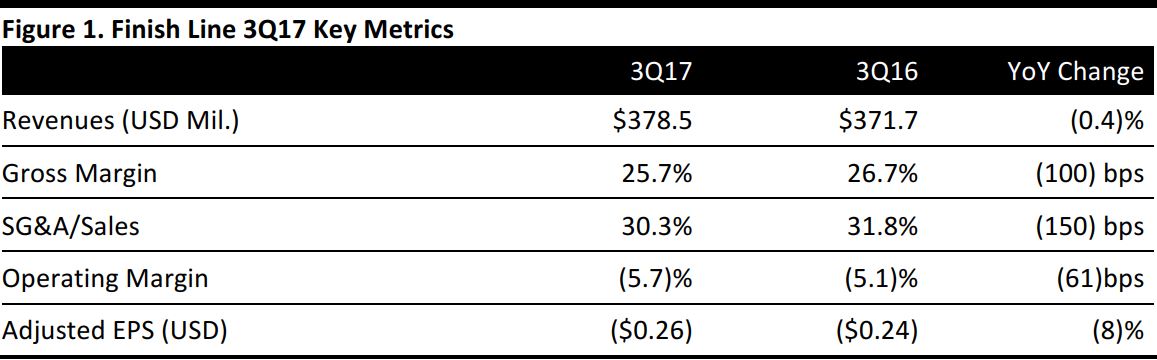

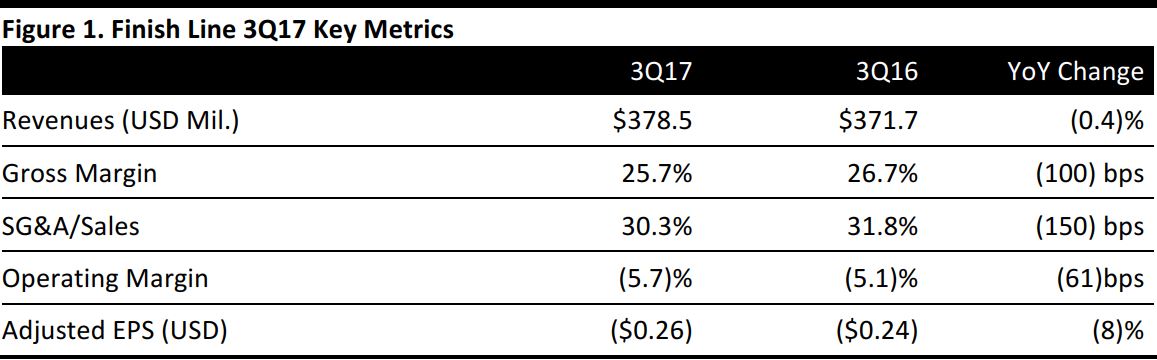

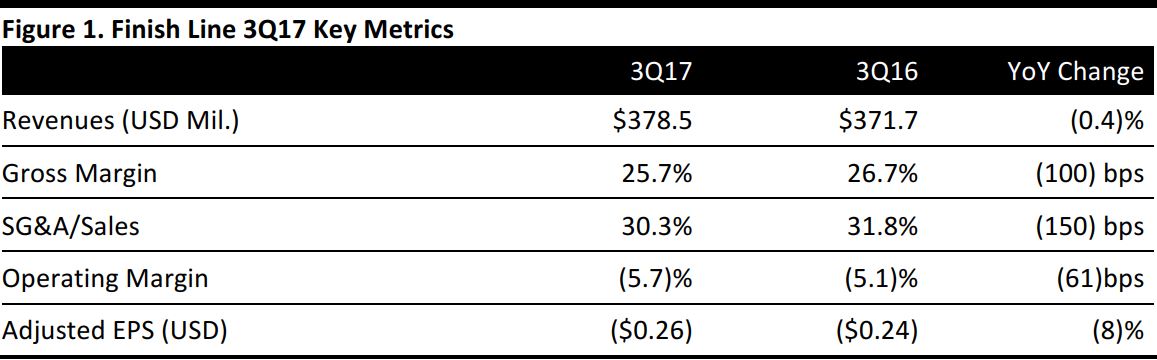

Finish Line reported fiscal 3Q17 revenues of $378.5 million, up 1.8% from 3Q16 and beat the consensus estimate of $361.0 million. Adjusted EPS was $(0.26), beating the consensus estimate of $(0.36). Gross margin was 25.7% versus the consensus of 25% and in line with expectations. Operating margin was (4.6)%, ahead of the estimate of (6.6)%.

The company ended the quarter with $392.1 million in inventory, down 2.3% year-over-year, versus sales growth of 1.8% during the quarter. Management was pleased with the 3Q results despite a highly promotional environment for athletic footwear. The recent growth initiatives have helped to increase traffic and conversion.

Comparable sales declined by 0.8% year over year, and above the consensus of (4.5)%.

Outlook

For FY18 (ending March 3, 2018), Finish Line expects a 2%-3% decrease and EPS of 0.59–$0.67, up from the prior guidance of $0.50-0.60 due to the outperformance in 3Q 2017. An additional calendar week is expected to contribute approximately $0.06 per share to the company’s 4Q18 and full fiscal year results. Comps are expected to be (2)% to (3)% versus the prior guidance of (3)%-(5)%

For 4Q ending March 3, 2018, the company still expects Finish Line comps to decrease 3%-5% and adjusted EPS to be in the range of $0.50-$0.58 inclusive of the $0.06 per share contribution from the extra week, versus the EPS of $0.50 for 4Q ended February 25, 2017.