Source: Company reports/Fung Global Retail & Technology

2Q17 RESULTS

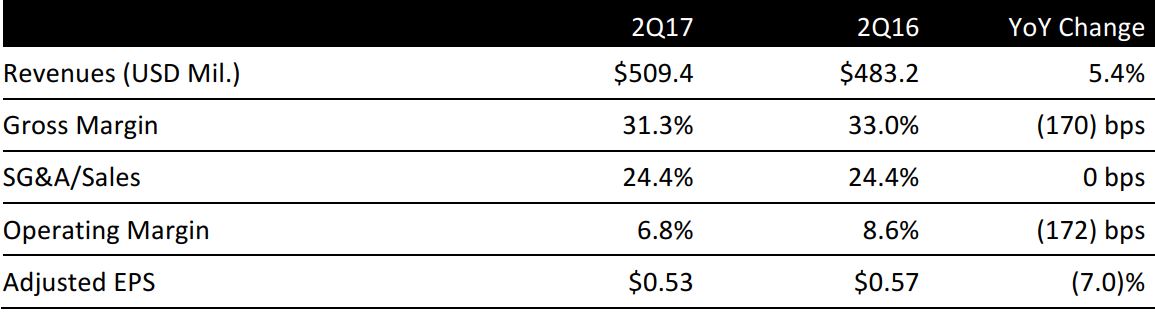

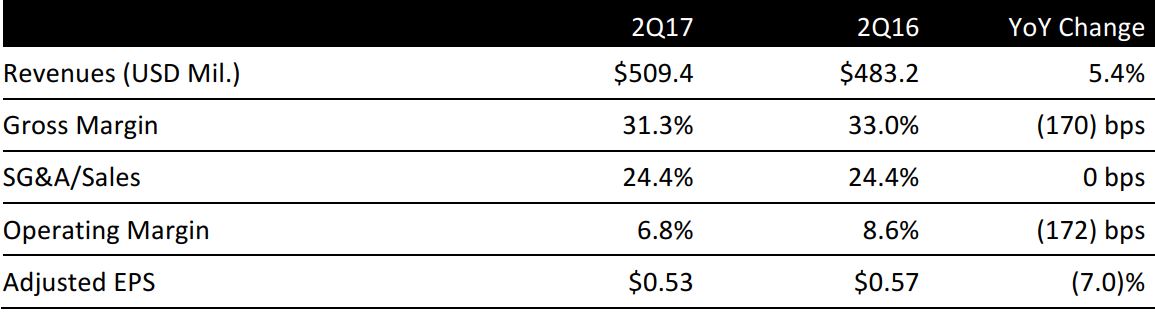

Finish Line reported fiscal 2Q17 revenues of $509.4 million, up 5.4% year over year and above the consensus estimate.

Adjusted EPS was $0.53, in line with consensus estimate but down 7.0% year over year due to an increased promotional cadence during the quarter that was designed to right-size inventories.

Finish Line’s comparable store sales increased by mid-single digits quarter over quarter, including a high-single-digit comp gain for footwear that was driven by strength in the running, basketball and athletic casual categories. Comps were up 6.2% in June, up 7.2% in July and up 3% in August. Finish Line’s Macy’s business increased in the mid-20% range.

Mobile sales were up by double digits, fueled by a mid-20% increase in conversion. Mobile traffic now makes up more than two-thirds of the company’s total digital visits.

During 2Q17, Finish Line closed five locations, bringing the year-to-date closures to 11. The company plans to close an additional 12 stores this year, in order to have a smaller, more profitable brick-and-mortar footprint.

Product Category Performance

- Footwear: The company saw an acceleration of its footwear business compared to 1Q17, driven by a combination of an improving category assortment and better in-stock positions. Retro running and basketball shoes, along with casual running styles from several brand partners, were in high demand.

- Men’s: Sales were led by Nike running products, including multiple iterations of the Huarache, Max Air and Presto models. The company’s Adidas business was led by the Superstar, Stan Smith, NMD, Alphabounce and Ultra Boost lines. Under Armour’s Slingshot knit running shoe was also successful. Men’s basketball category sales were helped by the debut of the Curry 2.5 from Under Armour.

- Women’s: Comps increased by low double digits, led by the Nike Pegasus, Roshe, Huarache and Thea lines; sales were strong across Adidas’s offerings as well. The Puma business was fueled by the company’s classic offerings, the Fierce line by Kylie Jenner and the Fenty line by Rihanna.

- Kids’: Kids’ footwear comps increased by high single digits. The Jordan Retro and Adidas Originals lines resonated strongly with younger consumers.

- Soft goods: Soft goods comps declined by double digits in the quarter due to ongoing overall weakness in the apparel and accessories sectors.

2017 OUTLOOK

Finish Line’s full-year guidance remains unchanged from 1Q17. The company continues to expect comp growth of 3%–5% and diluted EPS of $1.50–$1.56. The company is working to make its operating model more efficient and to optimize its organizational structure. These efforts are expected to generate net cost savings of approximately $6 million. The company will continue to see benefits in the fourth quarter, with approximately $1 million in savings.