Source: Company reports and Bloomberg

4Q15 RESULTS

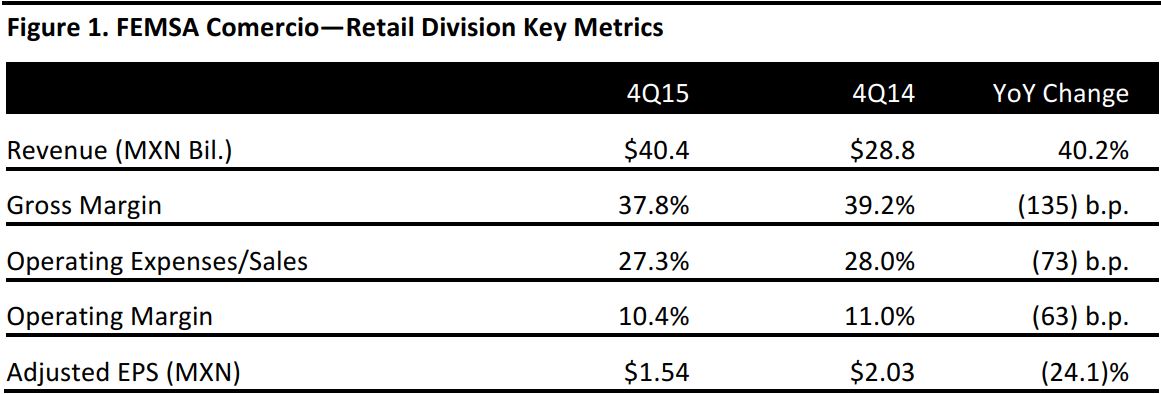

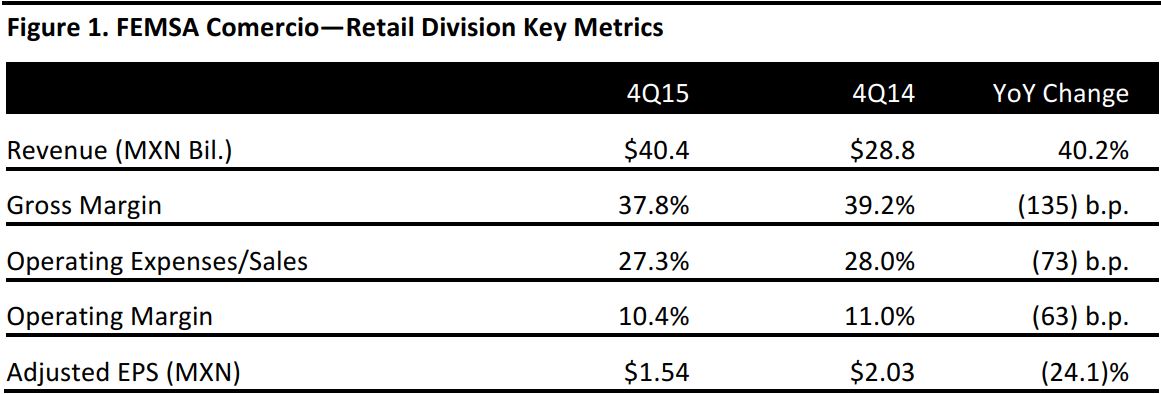

FEMSA Consolidated revenue growth was aided by the integration of Grupo Socofar and the addition of OXXO Gas Stations to the company’s fuel division. These acquisitions, combined with higher operating costs associated with opening new stores, generated a net loss. Revenues grew 7.6% organically.

FEMSA Comercio’s Retail Division increased revenues aided by the integration of Grupo Socofar, in which FEMSA made a controlling investment, and from the addition of 520 new OXXO stores.

Comps grew 8.6% for the quarter, and 6.9% for 2015 overall, reflecting a 6.0% increase in average purchase-price-per-customer and a 2.4% increase in store traffic overall.

FEMSA Consolidated’s EPS increased to MXN 1.54 in the quarter, but fell short of the MXN 2.15 consensus estimate.

2015 RESULTS

In 2015, FEMSA’s retail division added 1,208 new OXXO stores and reported a 6.9% increase in same-store sales. As of December 31, 2015, FEMSA Comercio’s Retail Division had a total of 14,061 OXXO stores, along with additional drug stores. Both the Fuel Division and Coca-Cola FEMSA experienced growth in 2015 as well.

FEMSA announced that the company had celebrated its 125th anniversary, surpassed 14,000 stores, and acquired Farmacon Mexico. The company shifted its top talent within the company, making changes to its senior management team in the first days of 2016 in order to prepare for expected headwinds due to the strong dollar and the weakening Brazilian economy.

EPS for FEMSA Consolidated was MXN 5.04 in 2015 versus MXN 4.67 in the prior year.

GUIDANCE

The company expects continued growth in 2016 owing to growth across new store formats including drug stores and fuel. Mexico’s consumer landscape continues to recover, and the company accordingly plans to offer more volume and options across its stores.

Consensus estimates are for revenues of MXN 355.3 billion and EPS of MXN 5.96 in 2016.