Nitheesh NH

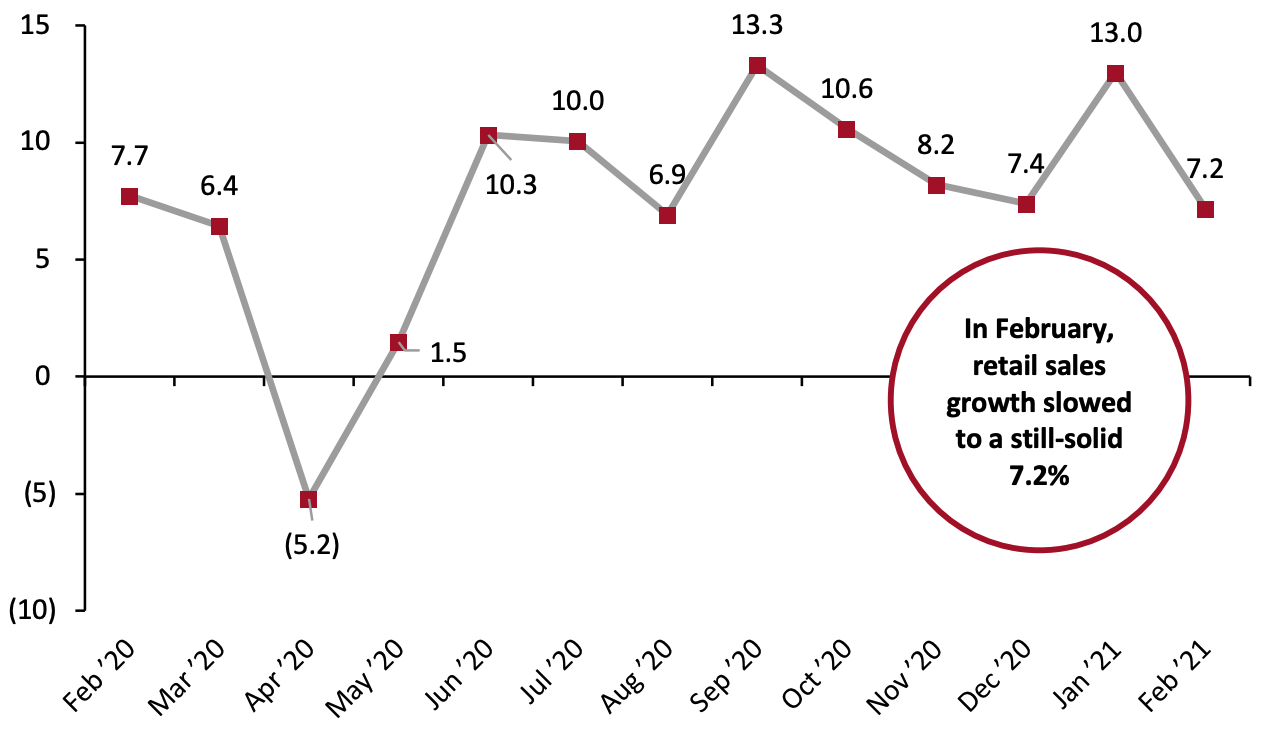

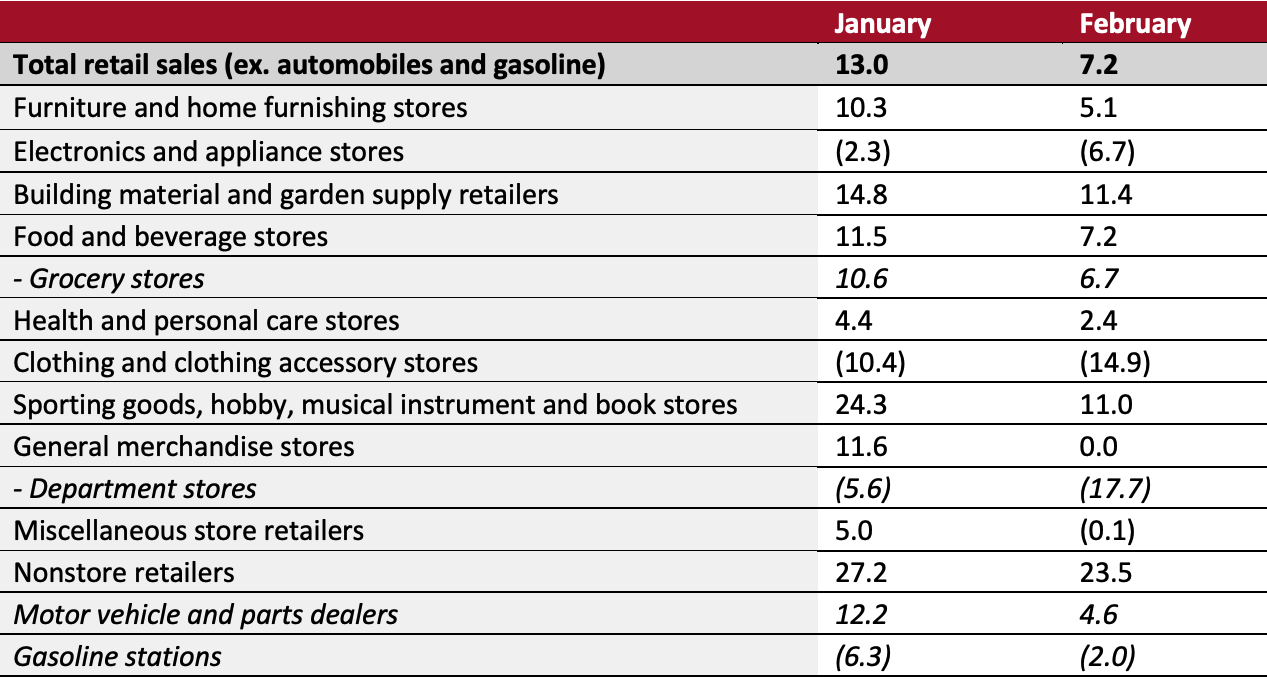

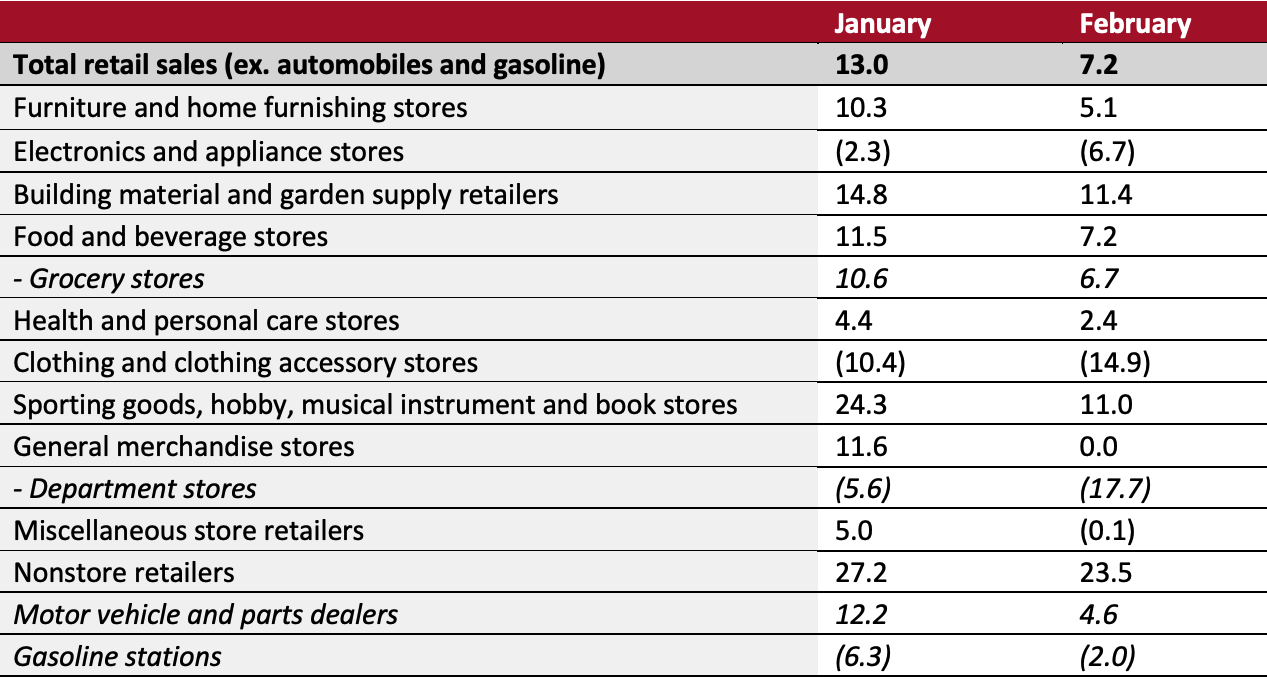

On March 15, 2021, the US Census Bureau reported that US retail sales growth (excluding automobile and gasoline sales) slowed to a still-solid 7.2% in February year over year, as consumers continued to purchase goods rather than services but pulled back spending in a month that saw no stimulus checks and a nearly nationwide winter storm keep millions inside for almost one week.

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric stood at 7.2% in February versus an upwardly revised 13.0% in January. Nonstore retailers saw the strongest growth in February, with a 23,5% rise in sales—equating to more than double the growth of the next fastest-growing sector.

February’s growth, while solid, was still the slowest year-over-year growth seen in retail sales since August 2020, as shown in Figure 1.

Figure 1. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change

[caption id="attachment_124634" align="aligncenter" width="720"] Data are not seasonally adjusted

Data are not seasonally adjusted

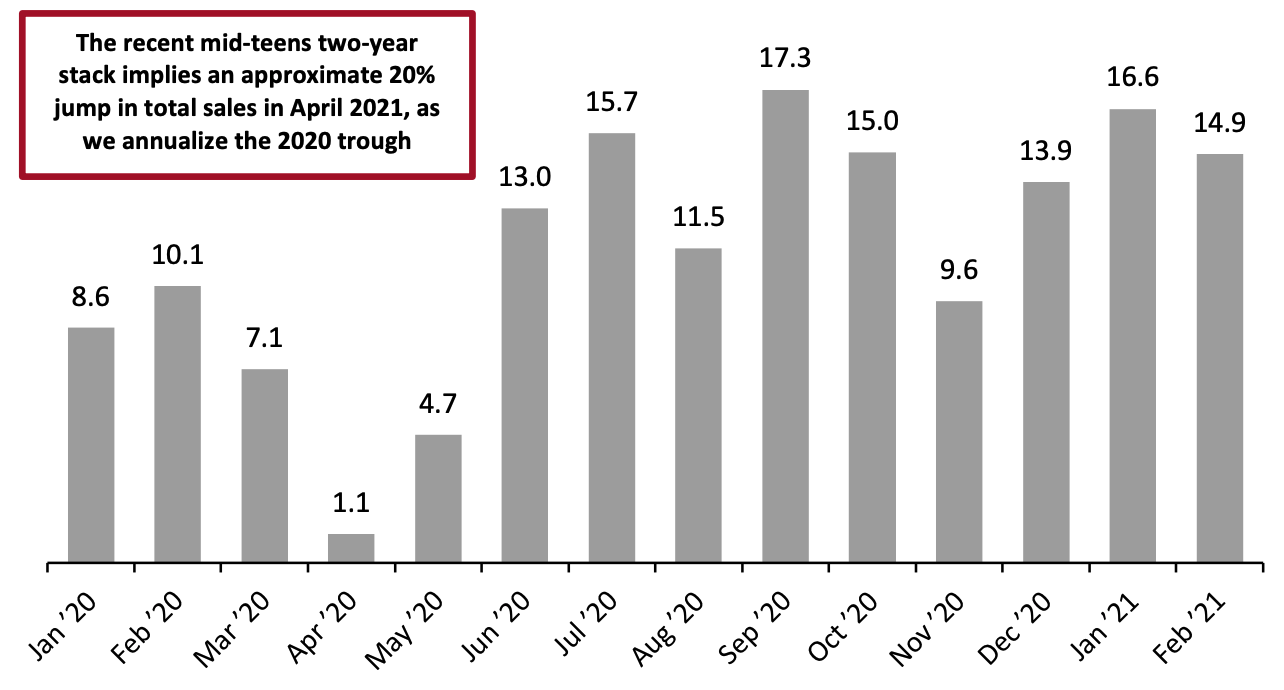

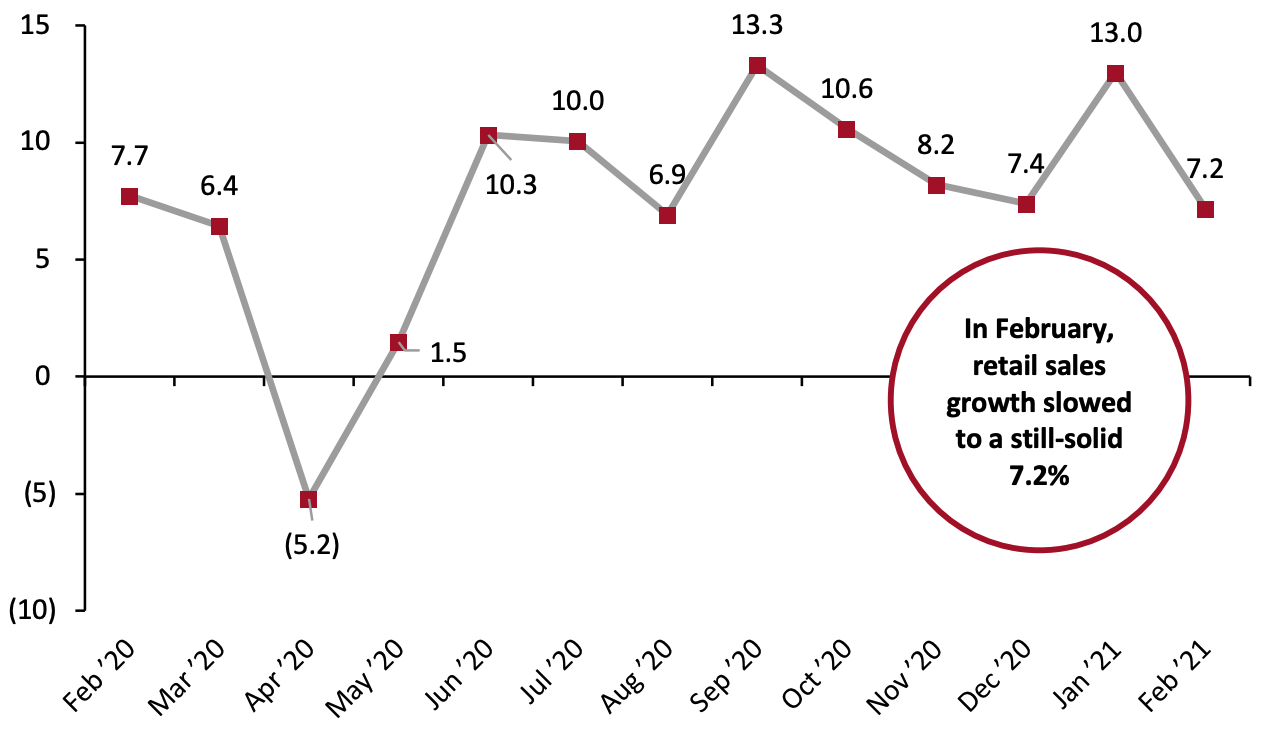

Source: US Census Bureau/Coresight Research[/caption] Figure 2 charts the two-year stack in growth for total retail sales. The most recently reported three months saw mid-teens percentage growth aggregated over two years—the two-year stack averaged 15.1% across December, January and February. Should this pace be sustained, we will be on track for a high-single-digit (circa-9%) year-over-year increase in total sales in March 2021 and an approximate 20% year-over-year increase in April 2021 as we lap the circa-5% decline of April 2020. Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: % Change, Two-Year Stack [caption id="attachment_124635" align="aligncenter" width="720"] Source: US Census Bureau/Coresight Research[/caption]

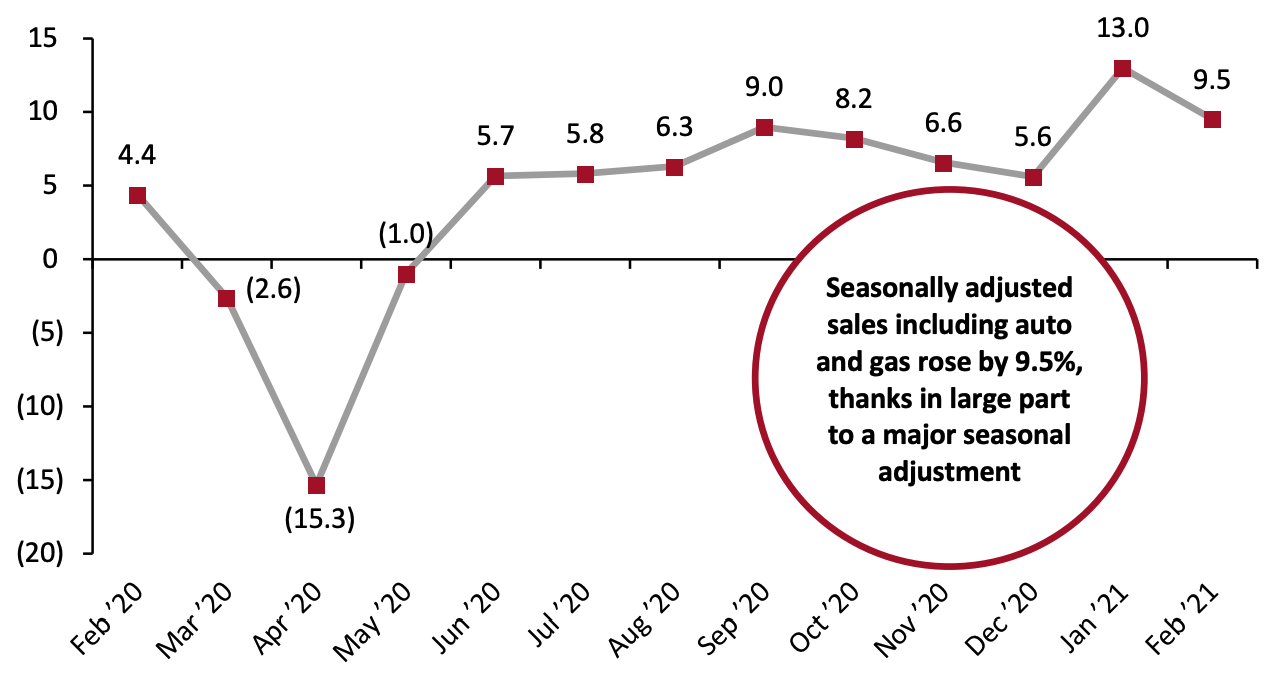

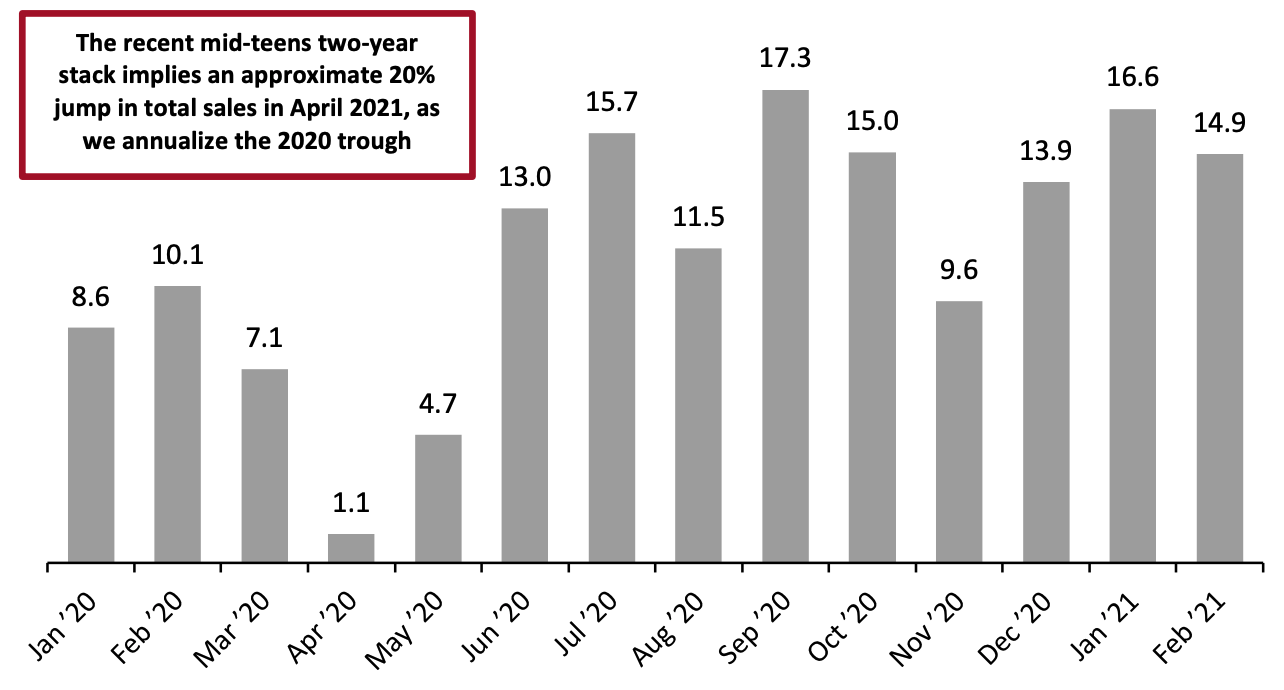

Seasonally adjusting retail sales data and including automobiles and gasoline, February saw the second strongest growth rate of the past 12 months, despite falling by more than four percentage points from January’s 13.0% growth. The major discrepancy in seasonally adjusted versus unadjusted numbers likely relates to the Census Bureau accounting for the widespread winter storm from February 13 to 17 that prevented consumers from spending.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change

[caption id="attachment_124636" align="aligncenter" width="720"]

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusting retail sales data and including automobiles and gasoline, February saw the second strongest growth rate of the past 12 months, despite falling by more than four percentage points from January’s 13.0% growth. The major discrepancy in seasonally adjusted versus unadjusted numbers likely relates to the Census Bureau accounting for the widespread winter storm from February 13 to 17 that prevented consumers from spending.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change

[caption id="attachment_124636" align="aligncenter" width="720"] Data are seasonally adjusted

Data are seasonally adjusted

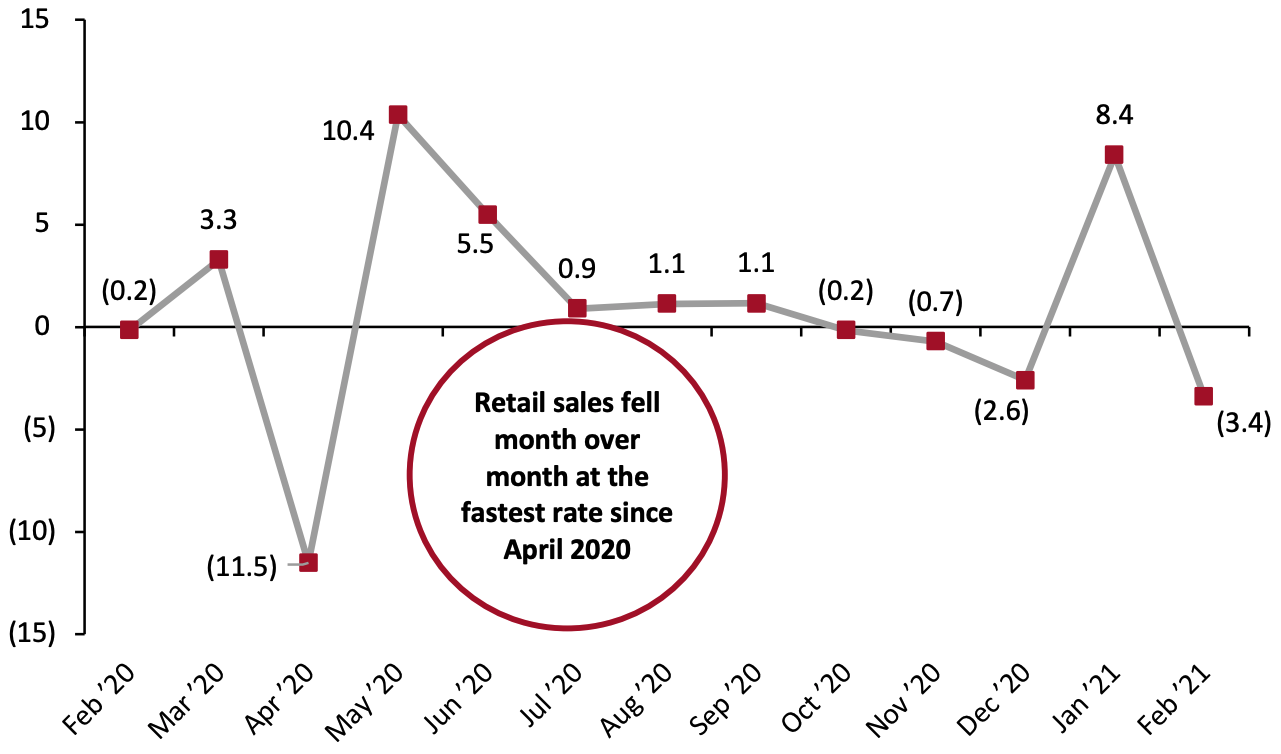

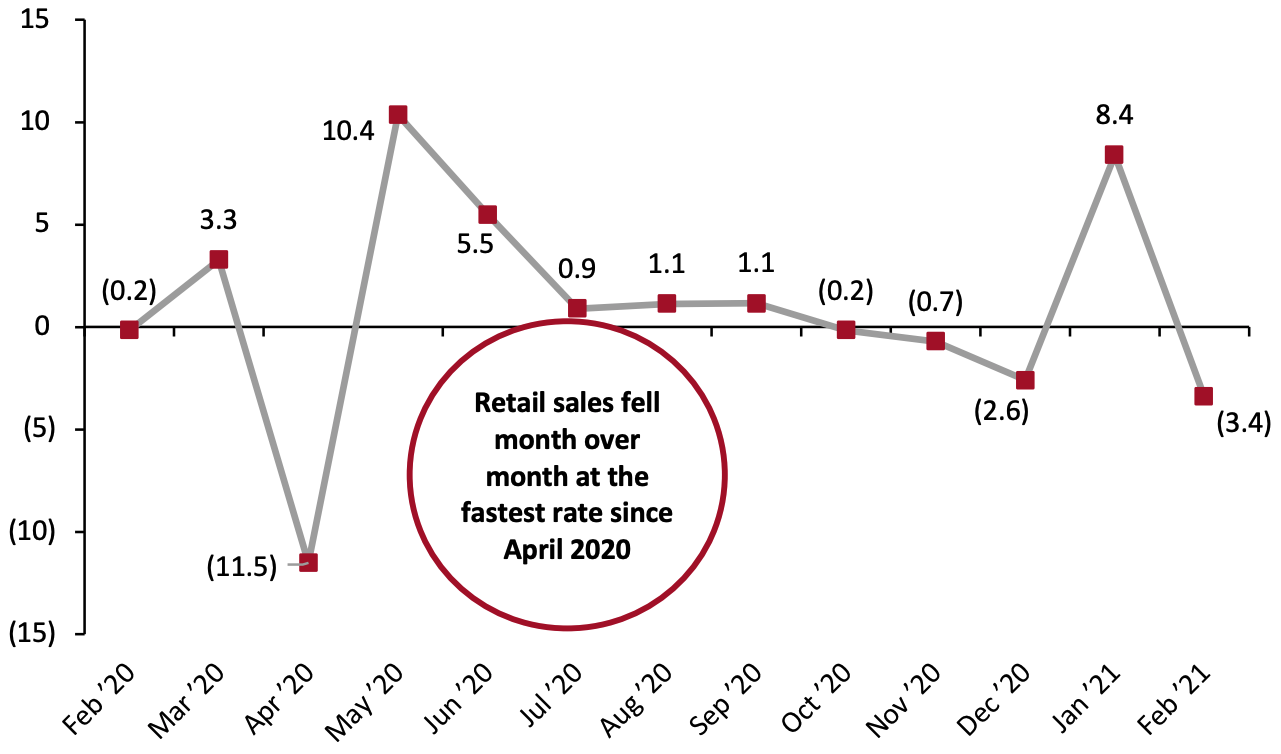

Source: US Census Bureau/Coresight Research[/caption] Adjusted Retail Sales Fall at the Highest Rate Since April 2020 After growing month over month in January 2021 for the first time since September 2020, adjusted retail sales excluding gasoline and automobiles in February 2021 shrunk at the greatest rate since April 2020. However, the 3.4% decline in February is set against the comparative of very strong 8.4% month-over-month growth in January. In March, with the issuance of a third round of stimulus checks, we expect to see a month-over-month increase in retail sales—largely mirroring what we witnessed in January. However, over the course of the spring and summer, we may begin to see month-over-month declines in adjusted sales numbers, as consumers increase spending at service providers and begin to travel more as virus restrictions ease. Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_124637" align="aligncenter" width="720"] Data are seasonally adjusted

Data are seasonally adjusted

Source: US Census Bureau/Coresight Research[/caption] Retail Sales Growth by Sector Several sectors that have thrived throughout much of the pandemic saw strong year-over-year growth in unadjusted sales: Data are not seasonally adjusted

Data are not seasonally adjusted

Source: US Census Bureau/Coresight Research[/caption]

Data are not seasonally adjusted

Data are not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Figure 2 charts the two-year stack in growth for total retail sales. The most recently reported three months saw mid-teens percentage growth aggregated over two years—the two-year stack averaged 15.1% across December, January and February. Should this pace be sustained, we will be on track for a high-single-digit (circa-9%) year-over-year increase in total sales in March 2021 and an approximate 20% year-over-year increase in April 2021 as we lap the circa-5% decline of April 2020. Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: % Change, Two-Year Stack [caption id="attachment_124635" align="aligncenter" width="720"]

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusting retail sales data and including automobiles and gasoline, February saw the second strongest growth rate of the past 12 months, despite falling by more than four percentage points from January’s 13.0% growth. The major discrepancy in seasonally adjusted versus unadjusted numbers likely relates to the Census Bureau accounting for the widespread winter storm from February 13 to 17 that prevented consumers from spending.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change

[caption id="attachment_124636" align="aligncenter" width="720"]

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusting retail sales data and including automobiles and gasoline, February saw the second strongest growth rate of the past 12 months, despite falling by more than four percentage points from January’s 13.0% growth. The major discrepancy in seasonally adjusted versus unadjusted numbers likely relates to the Census Bureau accounting for the widespread winter storm from February 13 to 17 that prevented consumers from spending.

Figure 3. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change

[caption id="attachment_124636" align="aligncenter" width="720"] Data are seasonally adjusted

Data are seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Adjusted Retail Sales Fall at the Highest Rate Since April 2020 After growing month over month in January 2021 for the first time since September 2020, adjusted retail sales excluding gasoline and automobiles in February 2021 shrunk at the greatest rate since April 2020. However, the 3.4% decline in February is set against the comparative of very strong 8.4% month-over-month growth in January. In March, with the issuance of a third round of stimulus checks, we expect to see a month-over-month increase in retail sales—largely mirroring what we witnessed in January. However, over the course of the spring and summer, we may begin to see month-over-month declines in adjusted sales numbers, as consumers increase spending at service providers and begin to travel more as virus restrictions ease. Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_124637" align="aligncenter" width="720"]

Data are seasonally adjusted

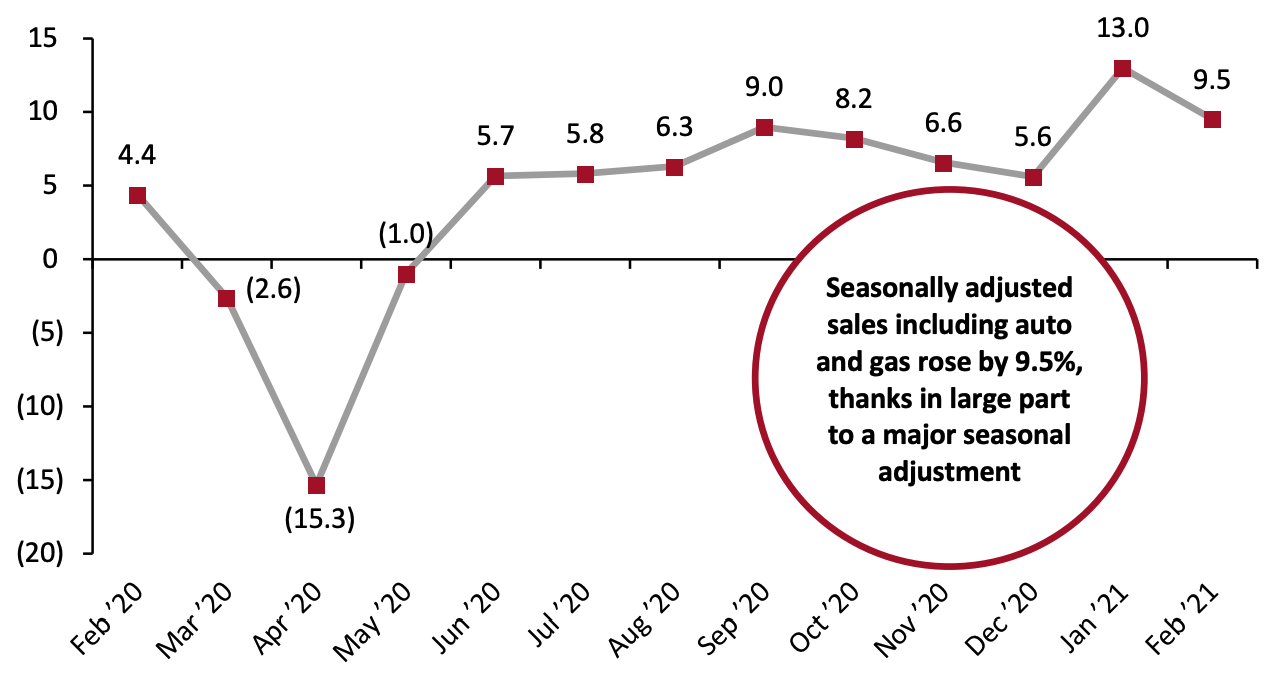

Data are seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Growth by Sector Several sectors that have thrived throughout much of the pandemic saw strong year-over-year growth in unadjusted sales:

- Nonstore retailers saw 23.5% growth in February, more than twice the pace of growth of the next fastest-expanding sector, but still slightly less than the revised 27.2% growth for these retailers in January.

- Home-improvement retailers saw sales jump by 11.4%, also less than their revised 14.8% growth in January, but continuing a trend of strong sales in the sector throughout the pandemic. After increasing consistently throughout the second half of 2020, housing starts have finally started to slow, indicating that we may continue to see decreasing growth in the home-improvement sector.

- Sports and hobby goods retailers saw their growth decline by more than half, from a very strong January to 11.0% in February, keeping these retailers among the top three fastest-growing sectors despite a slowdown from January’s stimulus-driven spending growth.

- Food and beverage stores saw sales climb by 7.2%, reflecting solid growth but also the slowest rise in sales in the sector since January 2020. This indicates that consumers’ focus on essentials during the crisis may be fading. Recent results from our weekly US consumer survey show that consumers are increasing spending on discretionary products, while essentials spending has stalled.

- Furniture and home furnishing stores saw 5.1% growth, less than half of the 10.3% growth among these retailers in January.

- Health and personal care stores saw just 2.4% growth in February, a slowdown in growth in a sector that has done well through much of the pandemic as consumers have focused on wellness.

- General merchandise stores overall saw sales stay exactly level, but department stores saw sales decline by 17.7%. This is a far more substantial decline than the sector experienced in January, when it recovered substantially and saw sales decline by just 5.6% year over year. February’s data indicate that January’s relative rebound was likely due more to the issuance of stimulus checks than it was to structural recovery in the sector.

- Clothing store sales continued to suffer, declining by 14.9% in January—down further from a decline of 10.4% in January.

- Electronics and appliance stores saw sales decline by 6.7%, nearly three times the 2.3% decline in sales the sector experienced in January. While consumer spending on electronics has been solid during the pandemic, electronics retailers have struggled to compete with online retailers.

Data are not seasonally adjusted

Data are not seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]