albert Chan

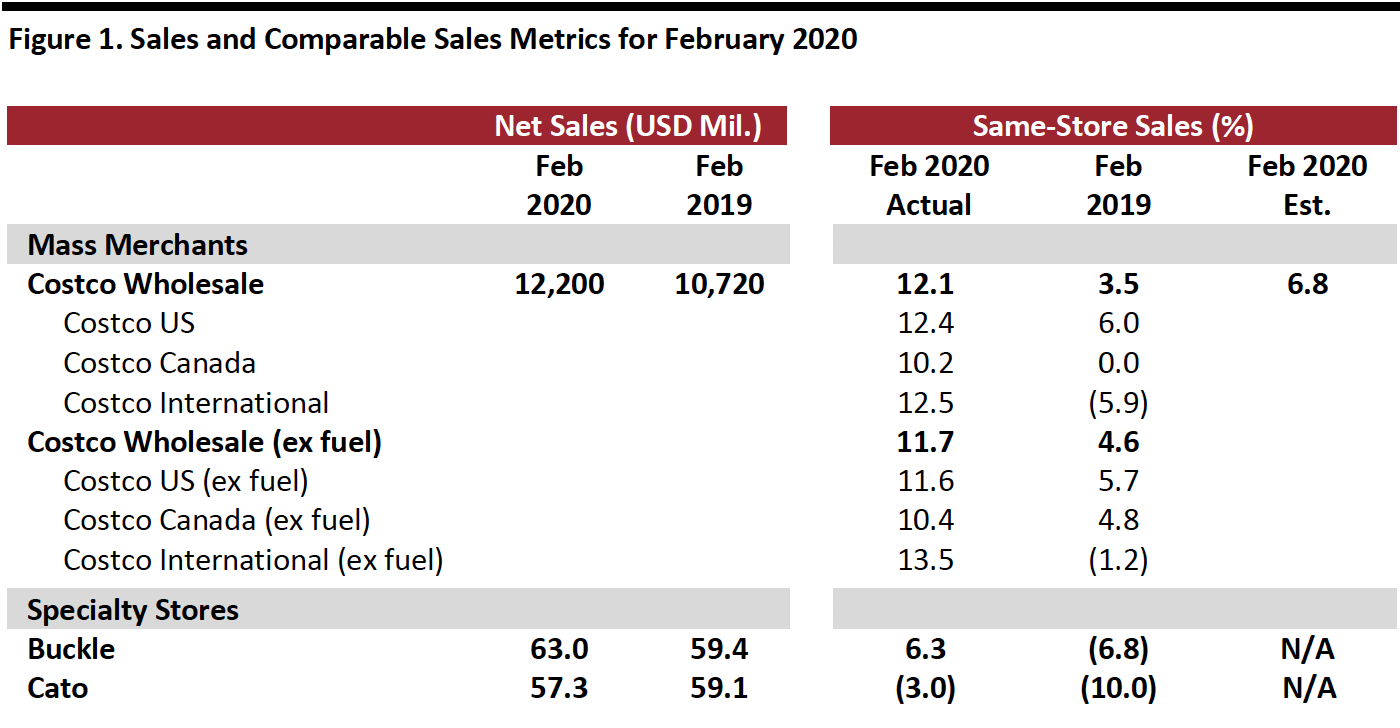

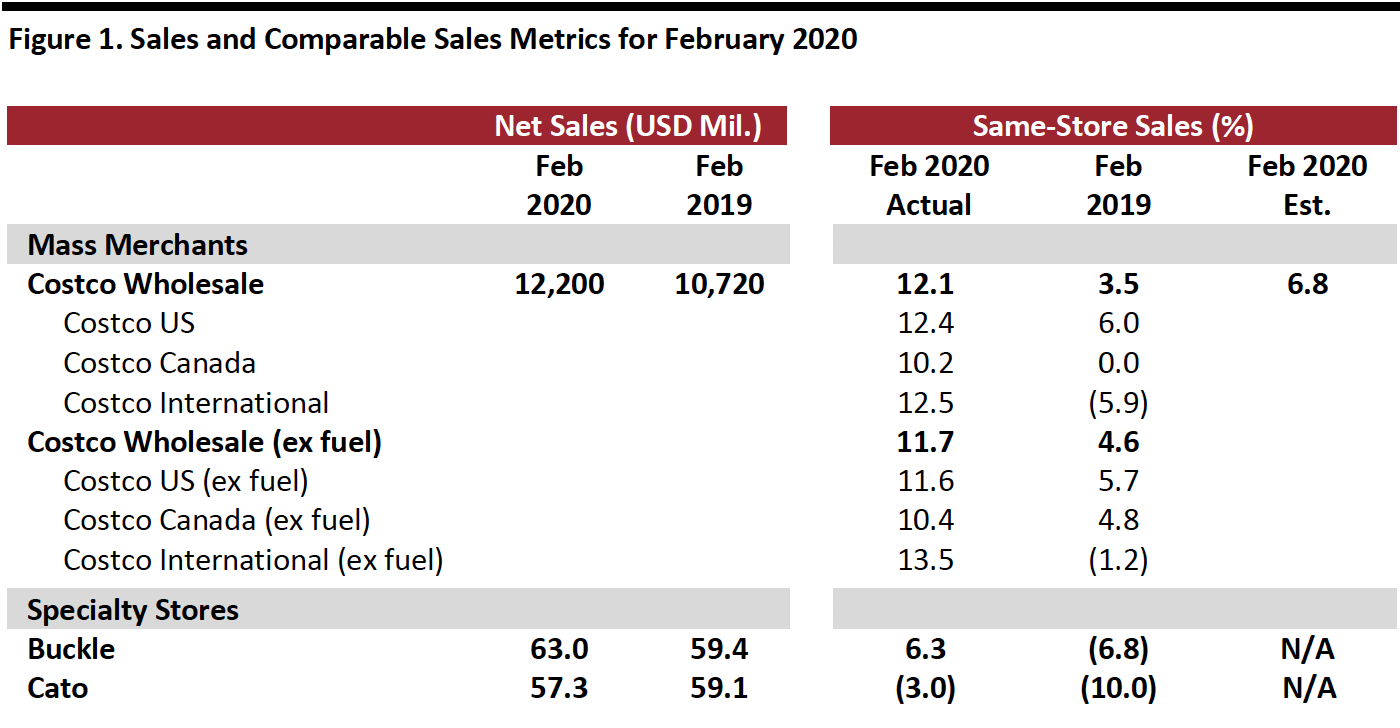

[caption id="attachment_104953" align="aligncenter" width="700"] Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Costco Comp Growth Accelerates, Online Comps Surge

- In February (specifically, the four weeks ended March 1), Costco’s global same-store sales jumped 12.1%, accelerating dramatically from January’s 6.6% growth and 530 basis points (bps) above the consensus estimate recorded by StreetAccount, as consumers bought up supplies amid growing fears about the coronavirus outbreak. Ex fuel, global comps were up 11.7% in February.

- The company stated in a release that “February sales benefited from an uptick in consumer demand in the fourth week of the reporting period. We attribute this to concerns over the coronavirus.” Management estimated that the impact added three percentage points to monthly comparable sales.

- Costco’s online comparable sales grew 22.6% in February, compared to January’s 17.6% growth.

- Ex fuel, Costco US comps were up 11.6% in February, versus 5.6% in January. In the US, the regions with the strongest results were the Midwest, the Northwest and Texas. Internationally, Costco saw strongest results in Japan, Mexico, Spain and Taiwan.

- Currency fluctuations negatively impacted overall comps by about 20 bps. Canada same-store sales were negatively impacted by around 60 bps by foreign exchange rates, while Costco’s “other international” segment was hurt by about 110 bps.

- Cannibalization from newly opened locations negatively impacted US comps by about 10 bps and the company’s other international segment by 140 bps. Overall, cannibalization negatively impacted comparable sales by 30 bps.

- In the merchandise segment, excluding currency effects, comps for food and sundries were positive in the low teens: candy, foods, frozen foods and sundries departments showed the strongest results. Hardlines posted positive high-single digit comps: health and beauty aids, lawn and garden, and tires were better-performing departments. Softlines grew up in the mid-single digits: Domestics, housewares and jewelry performed better than other departments.

- Fresh-food comparable sales were up in the low double digits, with meat and produce performing better than other departments.

- In the ancillary businesses, gas, hearing aids and pharmacy saw the strongest comp sales increases.

- Gasoline price inflation positively impacted total comps by about 60 bps, with the overall average selling price increasing to $2.75 per gallon this year from $2.55 last year.

- As of March 1, 2020, the company operates 785 warehouses (546 in the US), versus 770 warehouses (535 in the US) on March 3, 2019.

Buckle Comp Growth Slowed Slightly, Women’s Segment Outperforms Men’s

- Buckle’s comparable sales increased 6.3% in February (the four weeks ended February 29), following 7.4% growth in January. February net sales increased 6.0% year over year after January’s 3.2% increase.

- By business segment, total sales in the men’s segment were up about 3.0% year over year. The men’s business accounted for approximately 50.5% of total sales in February 2020 versus 51.5% in February 2019. Price points in the men’s segment were down about 2.5%.

- Total sales in the women’s segment were up 7.5% year over year, while price points were down 0.5%. The women’s segment accounted for around 49.5% of total monthly sales in February 2020 versus 48.5% in February 2019.

- By product type, accessory sales were up 6.5% year over year in February and accounted for 8.5% of total sales. Footwear sales were up 38% year over year in February and accounted for 9.0% of total sales. Average accessory price points were down about 1.5% while average footwear price points were down about 7.0%.

- February units per transaction decreased about 0.5%.

- As of February 29, 2020, the company operates 446 stores across 42 states.

Cato Same-Store Sales Declines

- Cato’s comparable sales were down 3.0% in February (the four weeks ended February 29), compared to an increase of 1.0% in January. Cato’s total sales slipped 3.0% year over year to $57.3 million in February following January’s 1.0% fall.

- CEO John Cato said, “February same-store sales were below our expectations.”

- As of February 29, 2020, the company operates 1,294 stores in 31 states, down from 1,308 stores in 31 states on March 2, 2019.