DIpil Das

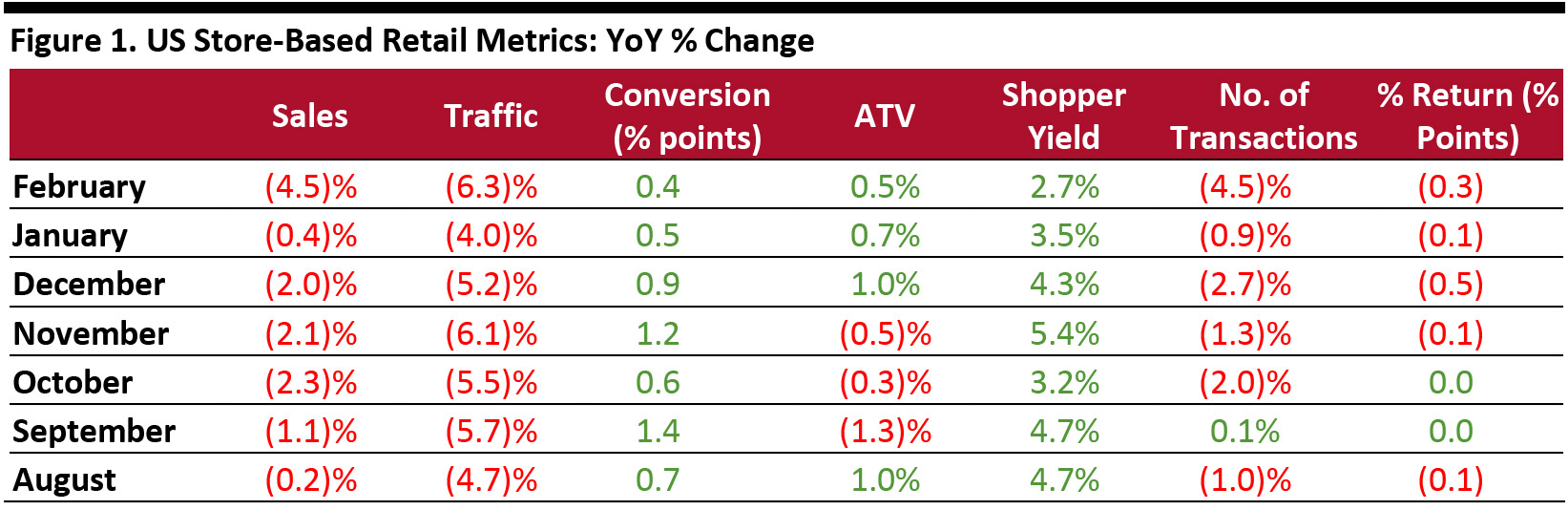

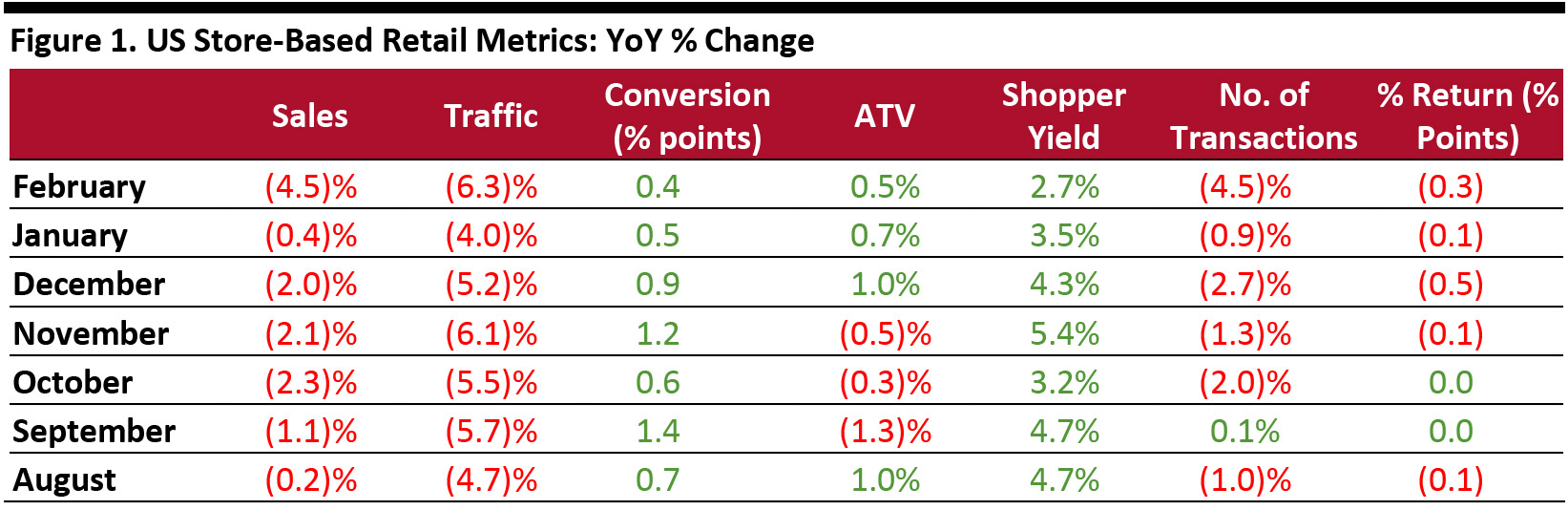

The Coresight Research US Retail Traffic and In-Store Metrics report reviews year-over-year changes in selected store-based metrics, including sales, traffic and conversion rates.

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores

Source: RetailNext [/caption] Data for February shows performance varied over the four weeks:

- US store-based traffic continued to fall in February, according to RetailNext, and the pace of decline accelerated sharply. Retail traffic slid 6.3% year over year in February following January’s 4.0% decline. February’s decline was the steepest since May 2019, likely due to changing shopper behavior amid the coronavirus outbreak.

- The conversion rate (sales transactions as a percentage of traffic) advanced 0.4 percentage points in February, slightly slower than the 0.5-percentage-point increase in January.

- Transaction volume slid 4.5% in February following a 0.9% decline in January.

- The product return rate further declined by 0.3 percentage points in February after posting a 0.1-percentage-point decrease in January.

Shopper yield (sales divided by traffic) continued a 13-month growth streak, while ATV (sales divided by transactions) gained for the third consecutive month.

- ATV grew 0.5% in February, slowing from 1.0% in December 2019 and 0.7% in January.

- Shopper yield grew 2.7% in February, decelerating from 3.5% growth in January.

ATV = average transaction value, % return = percentage of goods returned to stores

ATV = average transaction value, % return = percentage of goods returned to stores Source: RetailNext [/caption] Data for February shows performance varied over the four weeks:

- The third week performed the best for sales and traffic, while the fourth week performed the best for ATV.

- The first week saw the largest decline in sales, traffic and transactions, but the highest increase in shopper yield.

- February 15, the Saturday of President’s Day weekend, performed the best for traffic, while February 29 performed the best for sales and ATV. The conversion rate and shopper yield performed best on February 13, likely driven by last-minute Valentine’s Day shopping.

- February 10 recorded the lowest for sales, traffic and ATV. The conversion rate and shopper yield were lowest on February 23.