albert Chan

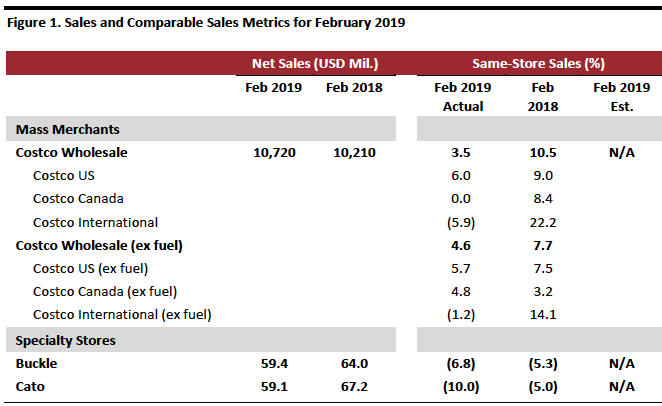

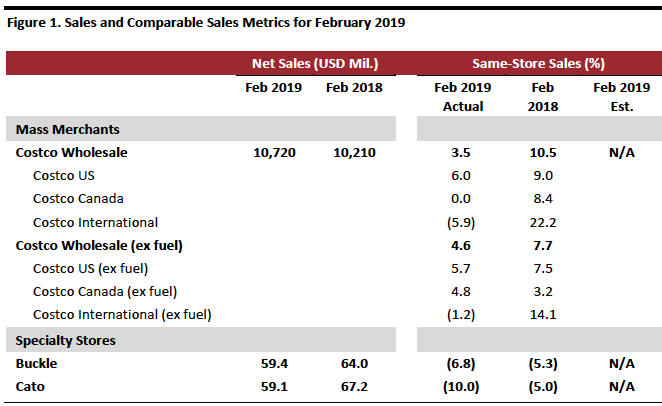

[caption id="attachment_80452" align="aligncenter" width="662"] Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Source: Company reports/StreetAccount[/caption]

Costco’s February Comps Decelerate, But E-Commerce Continues to Shine

- Costco’s February same-store sales grew 3.5% year over year, slower than the 5.2% growth in January. Adverse weather conditions, an early Chinese New Year and currency fluctuations negatively impacted Costco’s performance.

- Costco’s e-commerce comparable sales were up 24.2% in February, faster than January’s 22.1% growth.

- In February, comp traffic at Costco was up 3.1% in the US and 2.7% worldwide, including the adverse impact of weather and the early Chinese New Year.

- The retailer’s strongest results in the US were in the Midwest, Northeast and Southeast.

- Foreign currency fluctuations negatively impacted the company’s comps. Canada was hurt by about 460 basis points, while international comp sales were negatively impacted by approximately 450 basis points.

- Cannibalization negatively impacted the US by about 50 basis points, Canada by 80 basis points and other international segments by approximately 120 basis points. Overall, the company was negatively impacted by 70 basis points.

- Weather impacted February sales negatively throughout the US and Canada. The company estimates the impact on total sales was approximately 1% and slightly more than that in the US and Canada.

- Costco also noted that Lunar New Year (Chinese New Year) occurred 11 days earlier than the previous year, which negatively impacted February's International sales by 450 basis points and total company sales by about 50 basis points.

- The ancillary business segment, including hearing aids, food court and optical, saw the strongest comp sales increases during February. Gasoline price deflation negatively impacted Costco’s total reported comp sales by approximately 75 basis points. The average selling price of gasoline per gallon was down 6.3%, to $2.56, compared with $2.74 last year.

Buckle Reports Drop in Comparable Sales due to Poor Performance in Both Men’s’ and Women’s Segment

- Buckle’s comparable sales fell 6.8% year over year in February, compared to a 2.2% decline reported in January. Net sales declined 7.2% year over year, compared to a 17.9% decline in January.

- By business segment, total sales in men’s were down 4.0% year over year. The men’s segment accounted for approximately 51.5% of total sales in February 2019. Price points were down by about 0.5% for February in the men’s segment.

- Total sales in the women’s segment fell 10% year over year. The women’s segment accounted for 48.5% of total monthly sales in February 2019. Price points were down about 4.5% in the women’s business.

- By product type, accessories sales fell 7.0% year over year in February and accounted for 8.5% of total sales. Footwear sales grew 2.0% year over year and represented 6.5% of total sales. Average accessory price points were down by about 7.0% and average footwear price points were down 0.5%.

- In the current month, units per transaction grew 2.0% and the average transaction value decreased slightly compared to prior year February.

Cato’s Net Sales Decline Led by Slump in Comps

- Cato’s sales fell 12.0% year over year to $59.1 million, compared to a 17.9% decline in January. Comparable sales fell 10% year over year in February, compared to 2% growth in January.

- Cato noted that February comps were well below its own expectations.

- As of March 2, 2019, the company operated 1,308 stores in 31 states, down from 1,351 stores in 33 states as of March 3, 2018. In the month of February, Cato closed three stores.