Nitheesh NH

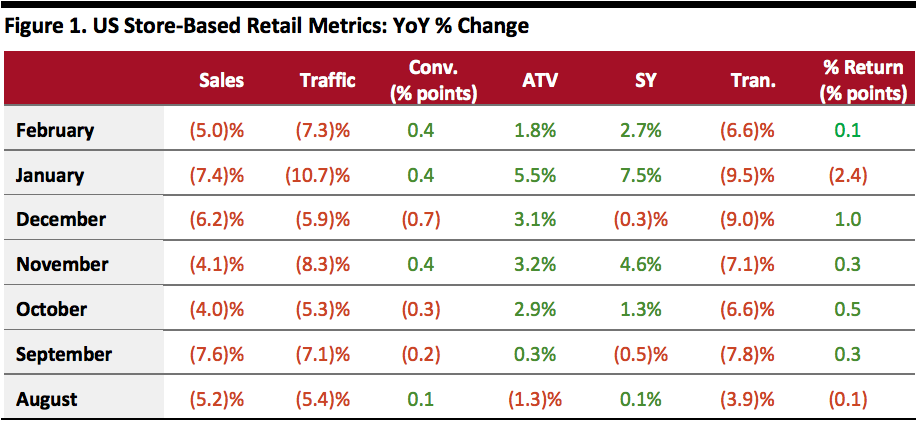

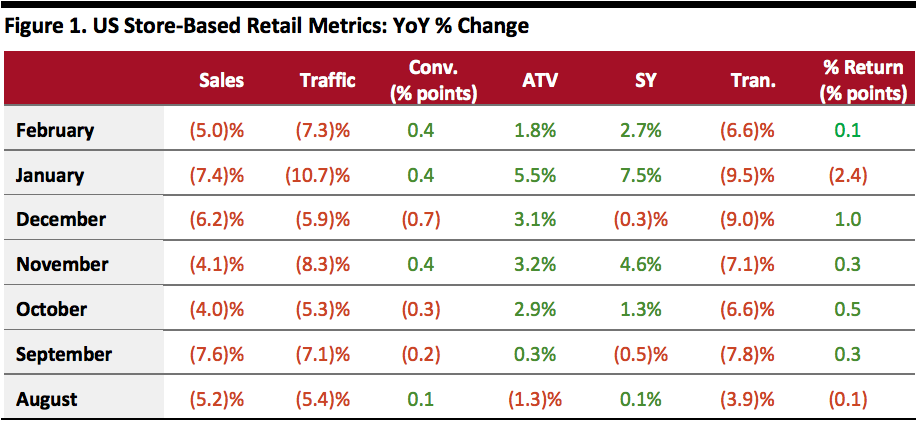

Our US Monthly Retail Traffic and In-Store Metrics Report reviews year-over-year changes in selected store-based metrics, including sales, traffic and conversion rates.

US store-based traffic and sales declined in February, while the conversion rate grew 0.4 percentage points, according to RetailNext. Average transaction value (ATV) grew 1.8%, slower than the 5.5% growth reported in January. The rate of product returns grew 0.1 percentage points in February, after declining 2.4 percentage points in January.

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and %

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and %

Return = percentage of goods returned to stores

Source: RetailNext[/caption]

- Retail traffic recorded a 7.3% decline year over year in February, easing from the 10.7% decline in December.

- Shopper yield (sales divided by traffic) grew 2.7% year over year in February following a notably strong 7.5% increase in January.

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and %

Conv. = conversion rate, ATV = average transaction value, SY = shopper yield, Tran. = number of transactions and %Return = percentage of goods returned to stores

Source: RetailNext[/caption]