Source: Company reports/S&P Capital IQ

FISCAL 1H16 RESULTS

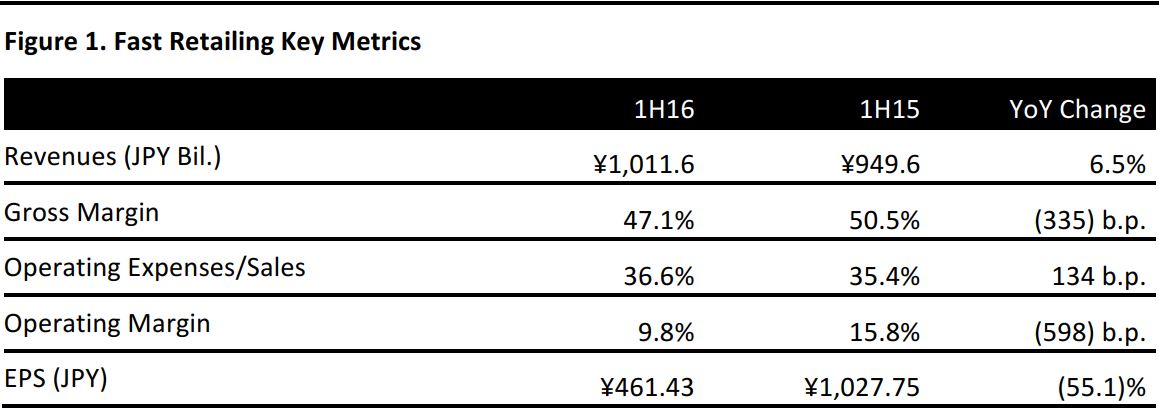

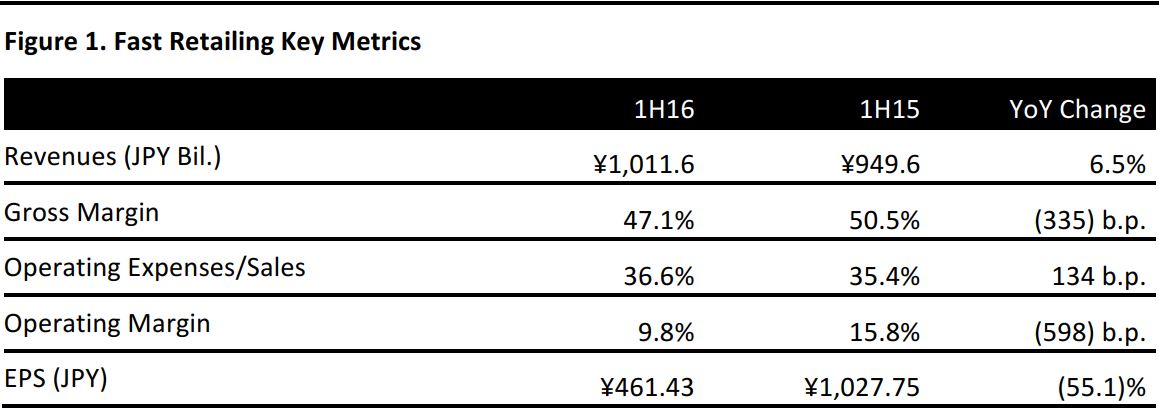

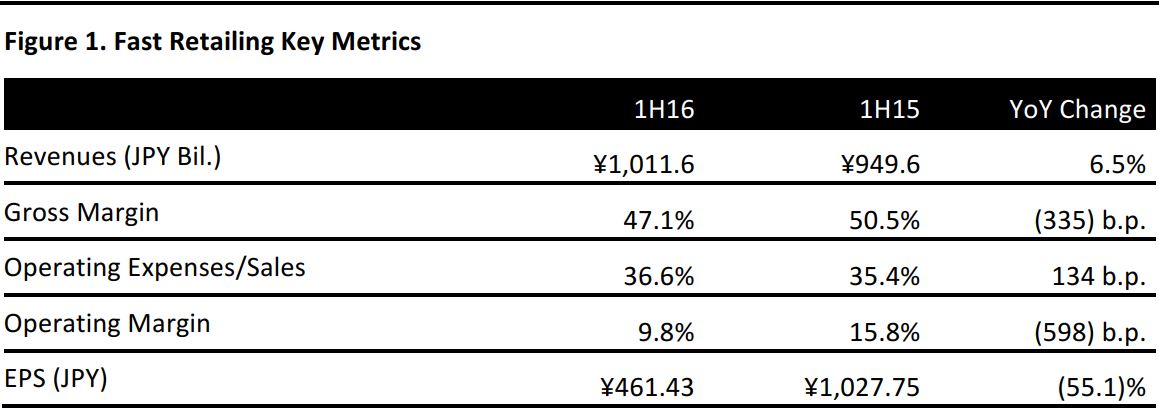

Fast Retailing’s 1H16 revenues were ¥1,011.6 billion, up 6.5% from ¥949.6 billion a year ago. EPS was ¥461.43, down 55.1% from ¥1,027.75 in 1H15.

Uniqlo Japan experienced soft sales during the high-volume months of November and December. Ineffective marketing and inadequate measures amid warm winter weather were cited as reasons for the softness. Comps decreased by 1.9%, while e-commerce revenues increased by 28.4% year over year. During the first half, the number of directly operated stores decreased by nine, to 805, while the number of franchise outlets increased from 28 to 39.

Uniqlo International reported weak performance for Uniqlo Greater China and Uniqlo South Korea. A warm winter and sluggish economic conditions in Hong Kong, Taiwan and South Korea were given as reasons for the softness. Yet operations in Southeast Asia and Europe recorded positive growth. The total international store count was 890, an increase of 174. Uniqlo’s first store in Belgium received a strong reception.

The Global Brands segment reported the strongest performance, with double-digit comps due to successful advertising campaigns and trendy items, including knitwear and jogging pants. The company noted the success of its spring 2016 collection.

GUIDANCE

Fast Retailing revised its fiscal 2016 estimates downward due to both the underperformance of the Uniqlo Japan and Uniqlo International segments and expected foreign exchange losses.

The company forecasted fiscal 2016 revenues of ¥1,800.0 billion, up 7.0% from ¥1,682 billion in the prior year. EPS is expected to be ¥588.55, down 45.5% from ¥1079.42 in fiscal 2015.