DIpil Das

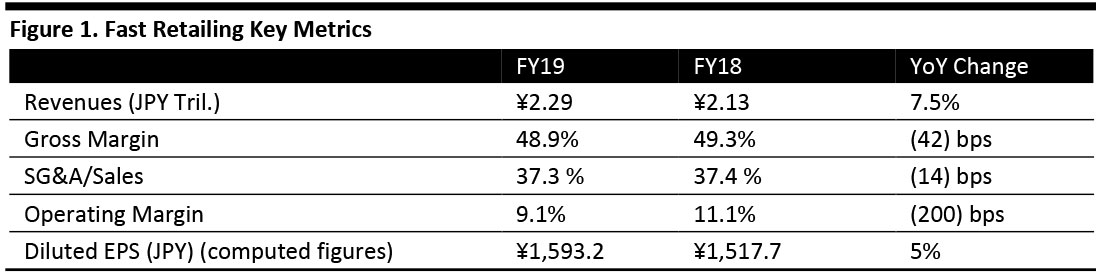

[caption id="attachment_97972" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

FY19 Results

Fast Retailing reported FY19 revenues of ¥2.29 trillion ($48.1 billion), up 7.5%, and operating profit of ¥275.0 billion ($2.55 billion), up 9.1% from ¥225 billion ($2.09 billion) in the year-ago period.

Its subsidiary performance:

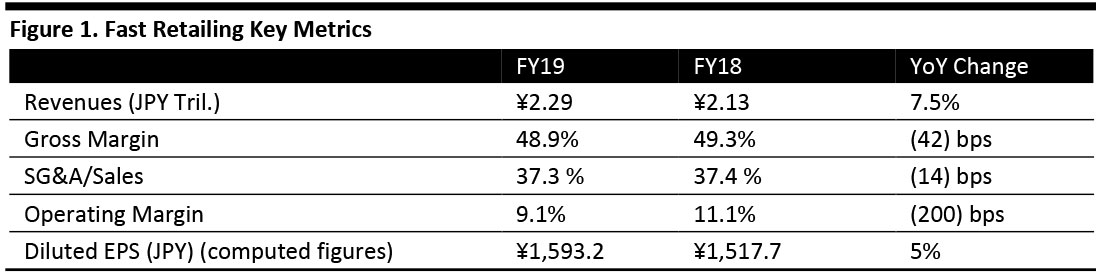

Source: Company reports/Coresight Research[/caption]

FY19 Results

Fast Retailing reported FY19 revenues of ¥2.29 trillion ($48.1 billion), up 7.5%, and operating profit of ¥275.0 billion ($2.55 billion), up 9.1% from ¥225 billion ($2.09 billion) in the year-ago period.

Its subsidiary performance:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Fast Retailing reported FY19 revenues of ¥2.29 trillion ($48.1 billion), up 7.5%, and operating profit of ¥275.0 billion ($2.55 billion), up 9.1% from ¥225 billion ($2.09 billion) in the year-ago period.

Its subsidiary performance:

Source: Company reports/Coresight Research[/caption]

FY19 Results

Fast Retailing reported FY19 revenues of ¥2.29 trillion ($48.1 billion), up 7.5%, and operating profit of ¥275.0 billion ($2.55 billion), up 9.1% from ¥225 billion ($2.09 billion) in the year-ago period.

Its subsidiary performance:

- Uniqlo Japan: Revenue and operating profit for FY19 were ¥872.9 billion ($8.09 billion) and ¥102.4 billion ($0.95 billion), representing a year-over-year change of 0.9% and (13.9)%, respectively. Same-store sales, including online sales, increased by 1% year over year. The company reported strong sales in the second half of the year in t-shirts, UV-cut mesh parkas, Kando (lightweight fabric) pants and wide pants. Uniqlo Japan’s e-commerce sales expanded by 32% year over year to ¥83.2 billion ($0.77 billion), increasing the proportion of total sales to 9.5% from 7.3%.

- Uniqlo International: Total revenue for FY19 was ¥1,026.0 billion ($9.51 billion) and operating profit was ¥138.9 billion ($1.29 billion), up 14.5% and 16.8%, respectively. Greater China (Mainland China, Hong Kong and Taiwan) reported strong growth, with revenue growing 14.3% year over year, and the company reported that Uniqlo established its position as the region’s number one apparel brand. Uniqlo Southeast Asia and Oceania grew by approximately 20% year over year in FY19. The company opened its first store in India in the Delhi metropolitan area in early October 2019. The company reported that its Uniqlo USA performance improved by reviewing product mixes for each region and improving sales planning accuracy. E-commerce sales were up 30% year over year and comprised 25% of total sales in FY19.

- GU brand: Revenue for the GU brand business increased 12.7%, to ¥238.7 billion ($2.21 billion). Operating profit rose to ¥28.1 billion ($0.26 billion), increasing by 139.2%. The company reported that sales during the period were due to the focus on mass fashion trends. The brand highlighted oversized sweaters, knitwear and t-shirts, which produced record sales of several million units each.

- Global Brands: Revenue for the Global Brands business decreased 2.9% to ¥149.9 billion ($1.39 billion). Operating profit increased to ¥3.6 billion ($0.03 billion) compared to a ¥4.1 billion ($0.38 billion) operating loss last year. Fast Retailing reported that its Theory brand saw a rise in revenue and profit, while the PLST brand saw a rise in revenue but a flat operating profit due to the high costs of new store openings. Comptoir des Cotonniers, Princesse tam.tam and J Brand reported continued losses forFY19.

- Uniqlo Japan: The company forecasts 1H and 2H rises in revenue and profit, and a double-digit FY20 profit rise. Fast Retailing expects same-store sales to rise 2.5% year over year, including a 30% increase in e-commerce sales.

- Uniqlo International: Management expects yen appreciation to exert a 5% downward pressure on results. The company anticipates that gross profit margin will dip slightly, SG&A ratio will improve slightly and Greater China will continue to report strong results. Uniqlo International plans to open 168 new stores globally, including around 100 stores in Greater China and 40 stores in Southeast Asia and Oceania.

- GU brand: The company aims to expand sales by continuing to focus on mass fashion sales.

- Global Brands: The company expects stable growth for its Theory brand.