Nitheesh NH

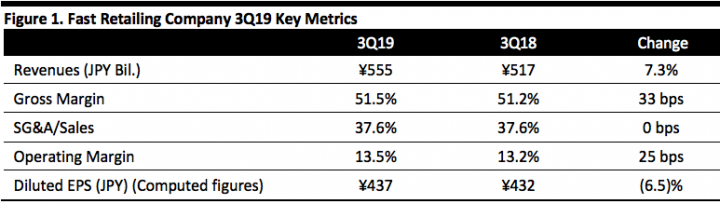

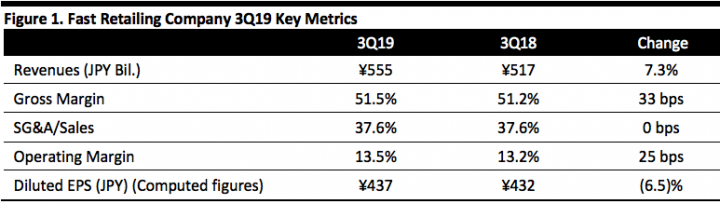

[caption id="attachment_92742" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

3Q19 Results

Fast Retailing reported third quarter revenue of ¥555 billion (+7.3% ) and operating profit of ¥74.7 billion ($0.69 billion), up 9.3% from ¥68.3 billion ($0.63 billion).

Its subsidiary performance:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Fast Retailing reported third quarter revenue of ¥555 billion (+7.3% ) and operating profit of ¥74.7 billion ($0.69 billion), up 9.3% from ¥68.3 billion ($0.63 billion).

Its subsidiary performance:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Fast Retailing reported third quarter revenue of ¥555 billion (+7.3% ) and operating profit of ¥74.7 billion ($0.69 billion), up 9.3% from ¥68.3 billion ($0.63 billion).

Its subsidiary performance:

Source: Company reports/Coresight Research[/caption]

3Q19 Results

Fast Retailing reported third quarter revenue of ¥555 billion (+7.3% ) and operating profit of ¥74.7 billion ($0.69 billion), up 9.3% from ¥68.3 billion ($0.63 billion).

Its subsidiary performance:

- UNIQLO Japan: The revenue and operating profit for the the third quarter were ¥209.7 billion ($1.93 billion) and ¥28.9 billion ($0.27 billion), down by 0.5% and 7.5%, respectively. Same-store sales, including online sales, declined by 0.1% during the third quarter due to the decision to defer holding the UNIQLO anniversary sale until June instead of May. The company reported that its sweat wear, UV-cut items, leggings, and t-shirts sold well throughout the quarter. It reported that online sales expanded by 16.1% year over year in the three months to May 31, 2019, to ¥19.0 billion ($0.17 billion), increasing their proportion of total sales to 9.1% from 7.8%.

- UNIQLO International: Revenue for 3Q19 was ¥240.5 billion ($1.93 billion) and operating profit was ¥36.3 billion ($0.33 billion), up 15.3% and 14.9%, respectively. Greater China (mainland China, Hong Kong and Taiwan) reported strong growth, while UNIQLO South Korea reported a dip in profits and a drop in same-store sales. UNIQLO USA performance was weaker than expected, partly due to unseasonal weather that dampened sales of spring and summer merchandise. UNIQLO Europe profit declined due to political uncertainty and unseasonable weather, but Russia performed well.

- GU Brand: Revenue for the GU brand business increased 12.1%, to ¥68.1 billion ($0.63 billion). Operating profit rose to ¥12.1 billion ($0.11 billion), increasing by 105.8%. The company reported that its stronger sales during the period were due to concentrating on the number of product items and focusing on mass fashion trends. The brand had lower discounting throughout the quarter.

- Global Brands: Revenue for the Global Brands business decreased 1.1%, to ¥35.9 billion ($0.33 billion). Operating profit decreased by 29.0% to ¥1.4 billion ($0.01 billion). The brands had lower discounting throughout the quarter. The company reported that its Theory brand generated a flat year-over-year performance in the third quarter, while its PLST brand saw slight profits, and its Comptoir des Cotonniers and Princesse tam.tam brands experienced losses.