Source: Company reports/Fung Global Retail & Technology

1Q17 Results

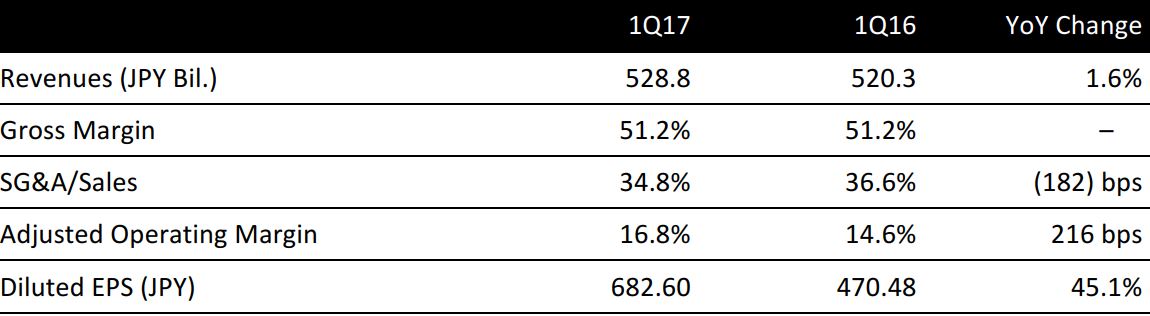

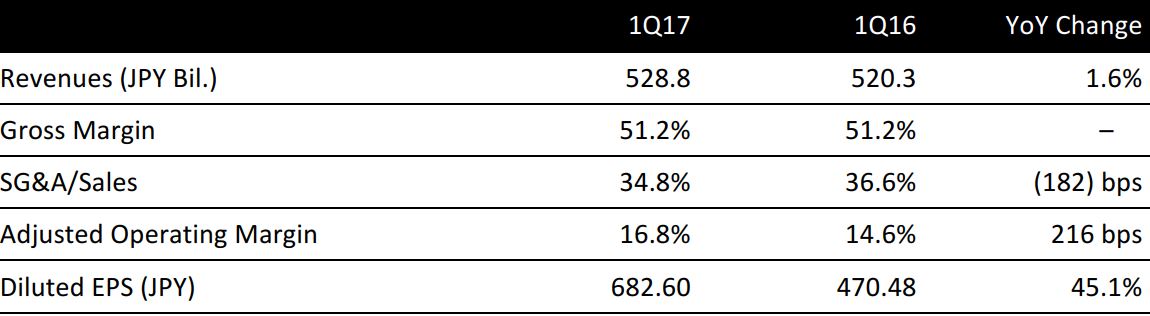

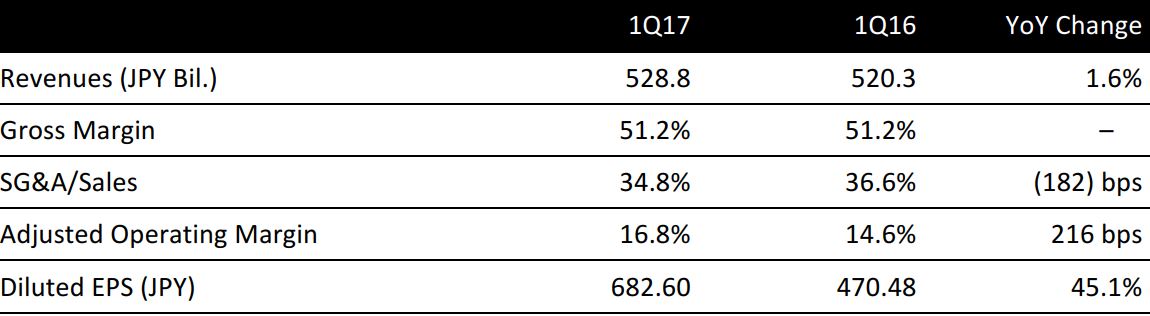

Fast Retailing Group reported 1Q17 consolidated revenues of ¥528.8 billion, up 1.6% year over year, and missed the consensus median estimate of ¥540.9 billion. Consolidated operating profit increased by 16.7% year over year to ¥88.5 billion. The selling, general and administrative expense ratio improved by 1.8%, due to the group’s cost-cutting initiatives.

The company recorded a foreign-exchange gain of ¥15.6 billion, due to yen depreciation, which boosted the carrying amount of long-term foreign-currency denominated assets in terms of yen. The retailer’s profit before taxes increased by 34.2% year over year to ¥104.2 billion, and diluted EPS jumped 45.1% to ¥682.60.

1Q17 Results by Business Segment

Fast Retailing Group’s business segments include UNIQLO Japan, UNIQLO International and Global Brands. UNIQLO Japan and UNIQLO International accounted for 45.2% and 37.2% of total revenues, respectively, while Global Brands accounted for 17.6%.

UNIQLO Japan

UNIQLO Japan’s revenues totaled ¥238.8 billion, up 3.4% year over year and operating profit increased by 1.8% year over year to ¥45.6 billion. Same-store sales including online sales increased by 2.5% year over year. The number of UNIQLO Japan stores excluding franchise stores was 800 at the end of November 2016.

UNIQLO International

UNIQLO International reported a 0.2% year-over-year fall in revenues to ¥196.5 billion, largely due to the stronger yen which pushed yen-based sales down by an average 16%. Operating profit increased by 44.6% year over year to ¥30.1 billion in 1Q17. The segment’s operating profit margin increased by 4.7% in the quarter, due to an improvement in the gross profit margin and a successful cost-cutting drive. The UNIQLO International network surpassed the1,000-store mark, for a total of 1,009 stores at the end of November 2016.

Global Brands

Global Brands’ revenues expanded to ¥92.7 billion, up 1.1% year over year, but operating profit declined to ¥9.5 billion, down 22.7% year over year. The retailer’s low-priced GU casual fashion brand contributed to the revenue increase. However, GU’s operating profit declined in 1Q17, as unseasonably warm weather in September stifled early sales of fall ranges.GU same-store sales expanded marginally over 1Q17.

Outlook

The company guides for a dividend of ¥175.00 per share in 2Q17 compared to ¥185.00 per share declared last year, a full-year dividend of ¥175.00 per share compared to ¥165.00 per share declared last year.

Fast Retailing forecasts full-year revenues of ¥1,850 billion, operating profit of ¥175 billion and profit before taxes of ¥175 billion, or ¥980.74 per basic share.