DIpil Das

The Time for Fast Retail is Now

Fast retail is Coresight Research’s term for a new approach to retail featuring shorter leases, more shared spaces and more short-term stores. In January, we identified fast retail as one of our retail trends to watch in 2019.

We expect a wave of investment in physical stores to be the key to retail reinvention. As retail stores diversify and enhance their ability to adapt to changing consumer behavior, we expect a surge in new retail formats, including those we characterize as fast retail.

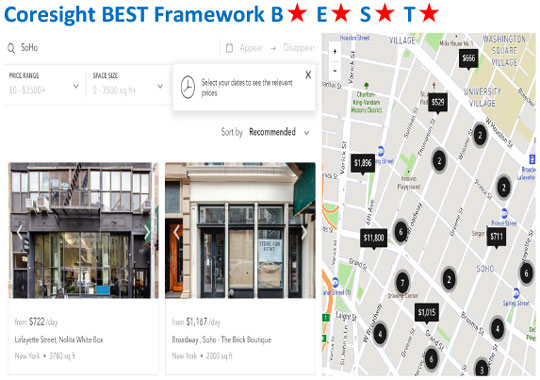

Coresight’s BEST Retail Framework

The reinvention of retail stores aligns with Coresight’s BEST retail framework, which is designed to help retailers frame their approach to physical retail around four themes: Brand building, Experiences, Service and Technology integration.

Brand building refers to using physical stores as more than distribution points: Stores become the physical expression of the brand from product to service, serving as a personification of the brand.

Store Experiences deepen engagement between brands and customers. From book readings to trunk shows, the store is an ever-changing format designed to connect customers culturally and socially with the brand.

With Service offerings, stores differentiate. Service should be brand-appropriate and can span manicure and body piercings to insurance, from high-touch luxury services to associate-less check out.

Technology integration refers to brands leveraging growing access to data (and reducing the in-store data deficit) to enhance service. For instance, Nike’s New York City flagship includes a Speed Shop that uses data to localize ranges, offers two customization studios and incorporates mobile integration across reserving, trying on and paying for products.

[caption id="attachment_92544" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Types of Fast Retail Formats

Consumers want an experience and retailers need to deliver – or the competition will. We look at what some innovative companies are doing in the fast retail space and rate each based on the BEST framework, with a red star meaning the format includes the characteristic and a black star being the lack of the characteristic. Most of these formats are executing along brand-building and experiences, and fewer along services and technology integration.

[caption id="attachment_92545" align="alignright" width="480"]

Source: Coresight Research[/caption]

Types of Fast Retail Formats

Consumers want an experience and retailers need to deliver – or the competition will. We look at what some innovative companies are doing in the fast retail space and rate each based on the BEST framework, with a red star meaning the format includes the characteristic and a black star being the lack of the characteristic. Most of these formats are executing along brand-building and experiences, and fewer along services and technology integration.

[caption id="attachment_92545" align="alignright" width="480"] Source: Brandbox Instagram[/caption]

Brandbox

Brandbox is a concept launched by retail landlord Macerich in November 2018. At Brandbox in Tysons Corner Center, Virginia, young brands can have their own mini store inside an 11,000-square-foot space for six to twelve months, with fixtures such as shelving, data on foot traffic, radio-frequency identification tagging for inventory, marketing and recruiting provided by Macerich. Each year, new brands and retailers come in and out, so the mall is continually changing, creating a new shopping experience on an ongoing basis. So far in 2019, the mall owner has housed eight brands, including apparel retailer Naadam and makeup company Winky Lux. Macerich has plan to locate more Brandbox stores in two other locations: Santa Monica Place in California and Scottsdale Fashion Square in Arizona.

[caption id="attachment_92546" align="alignright" width="480"]

Source: Brandbox Instagram[/caption]

Brandbox

Brandbox is a concept launched by retail landlord Macerich in November 2018. At Brandbox in Tysons Corner Center, Virginia, young brands can have their own mini store inside an 11,000-square-foot space for six to twelve months, with fixtures such as shelving, data on foot traffic, radio-frequency identification tagging for inventory, marketing and recruiting provided by Macerich. Each year, new brands and retailers come in and out, so the mall is continually changing, creating a new shopping experience on an ongoing basis. So far in 2019, the mall owner has housed eight brands, including apparel retailer Naadam and makeup company Winky Lux. Macerich has plan to locate more Brandbox stores in two other locations: Santa Monica Place in California and Scottsdale Fashion Square in Arizona.

[caption id="attachment_92546" align="alignright" width="480"] Source: Appear Here[/caption]

The Edit @ Roosevelt Field

Simon Property Group launched The Edit in its Roosevelt Field Mall in October 2017, a new retail concept akin to a permanent pop-up store, with a rotating cast of brands and services. The Edit is sub-divided into 12 micro spaces ranging from 20 to 200 square feet, each space featuring a modular design and tech-enabled walls for digital marketing. The Edit’s first launch theme was gifting and included over ten young brands such as Rhone and Cuzin’s Duzin. Each launch lasts four months, then new themes rotate in. The Edit has locations in nine different retail platforms, including regional malls, hotels and partner properties. It also has properties in 15 overseas locations including Japan, Italy, and Austria.

[caption id="attachment_92547" align="alignright" width="480"]

Source: Appear Here[/caption]

The Edit @ Roosevelt Field

Simon Property Group launched The Edit in its Roosevelt Field Mall in October 2017, a new retail concept akin to a permanent pop-up store, with a rotating cast of brands and services. The Edit is sub-divided into 12 micro spaces ranging from 20 to 200 square feet, each space featuring a modular design and tech-enabled walls for digital marketing. The Edit’s first launch theme was gifting and included over ten young brands such as Rhone and Cuzin’s Duzin. Each launch lasts four months, then new themes rotate in. The Edit has locations in nine different retail platforms, including regional malls, hotels and partner properties. It also has properties in 15 overseas locations including Japan, Italy, and Austria.

[caption id="attachment_92547" align="alignright" width="480"] Source: The Market @ Macy’s[/caption]

The Market @ Macy’s

The Market @ Macy's is the areas in Macy’s department stores for young brands to introduce products and services. Twelve Macy’s locations host The Market @ Macy’s, including New York City, Pittsburgh and Las Vegas. These stores are all in prime, high foot traffic locations, offering young brands higher exposure. Macy’s also provides rich data analytics such as daily sales data, foot traffic, customer engagement and conversion rates so new brands can optimize their performance.

[caption id="attachment_92548" align="alignright" width="480"]

Source: The Market @ Macy’s[/caption]

The Market @ Macy’s

The Market @ Macy's is the areas in Macy’s department stores for young brands to introduce products and services. Twelve Macy’s locations host The Market @ Macy’s, including New York City, Pittsburgh and Las Vegas. These stores are all in prime, high foot traffic locations, offering young brands higher exposure. Macy’s also provides rich data analytics such as daily sales data, foot traffic, customer engagement and conversion rates so new brands can optimize their performance.

[caption id="attachment_92548" align="alignright" width="480"] Source: Uppercase[/caption]

Uppercase

Founded in 2016, Uppercase is a retail rental agency that offers young brands tech-enabled flexible retail stores and a full service, set-up to clean-up operation. It also has a team of local retail experts to provide young brands development strategies, such as where the next store should be and how to create data-informed merchandising plans. So far, through 2Q19, Uppercase has stores in nine cities, including new offerings in Austin, Seattle, Brooklyn, San Francisco and Chicago.

[caption id="attachment_92550" align="alignright" width="480"]

Source: Uppercase[/caption]

Uppercase

Founded in 2016, Uppercase is a retail rental agency that offers young brands tech-enabled flexible retail stores and a full service, set-up to clean-up operation. It also has a team of local retail experts to provide young brands development strategies, such as where the next store should be and how to create data-informed merchandising plans. So far, through 2Q19, Uppercase has stores in nine cities, including new offerings in Austin, Seattle, Brooklyn, San Francisco and Chicago.

[caption id="attachment_92550" align="alignright" width="480"] Source: Appear Here[/caption]

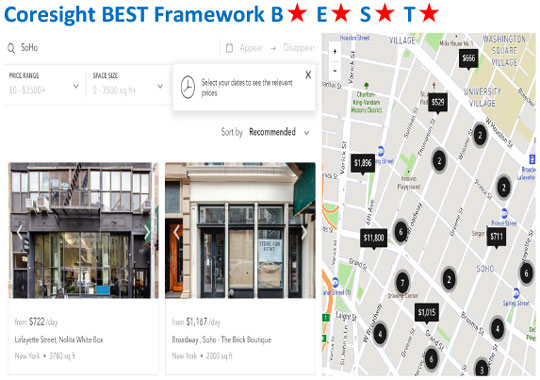

Appear Here

Founded in London in 2013 by then-20-year-old Ross Bailey, Appear Here is a marketplace for short-term retail space, connecting brands, retailers, designers and entrepreneurs with available space, all online. The company has expanded to France and New York. Through 2Q19, the startup says its marketplace has been used by more than 200,000 brands, including Nike, Loewe, Givenchy, Coca-Cola, Net-a-Porter and Kanye West, as well as numerous independents.

[caption id="attachment_92551" align="alignright" width="480"]

Source: Appear Here[/caption]

Appear Here

Founded in London in 2013 by then-20-year-old Ross Bailey, Appear Here is a marketplace for short-term retail space, connecting brands, retailers, designers and entrepreneurs with available space, all online. The company has expanded to France and New York. Through 2Q19, the startup says its marketplace has been used by more than 200,000 brands, including Nike, Loewe, Givenchy, Coca-Cola, Net-a-Porter and Kanye West, as well as numerous independents.

[caption id="attachment_92551" align="alignright" width="480"] Source: Macy’s[/caption]

STORY in Macy’s

Rachel Shechtman, founder of STORY, believes shopping should be about more than just buying things, and that was the genesis of STORY. Unlike most stores, it changes every couple of months and brings to life a new editorial theme. STORY completely changes its merchandise, design, and event programming to tell different stories. Some examples of past stories include Remember When, Wellness and Home for the Holidays. Over the span of seven years, STORY changed more than 40 times, worked with more than 5,000 different brands and hosted more than 500 events from book panels to a trunk show by Iris Apfel. In April 2018, STORY was officially acquired by Macy's.

[caption id="attachment_92552" align="alignright" width="480"]

Source: Macy’s[/caption]

STORY in Macy’s

Rachel Shechtman, founder of STORY, believes shopping should be about more than just buying things, and that was the genesis of STORY. Unlike most stores, it changes every couple of months and brings to life a new editorial theme. STORY completely changes its merchandise, design, and event programming to tell different stories. Some examples of past stories include Remember When, Wellness and Home for the Holidays. Over the span of seven years, STORY changed more than 40 times, worked with more than 5,000 different brands and hosted more than 500 events from book panels to a trunk show by Iris Apfel. In April 2018, STORY was officially acquired by Macy's.

[caption id="attachment_92552" align="alignright" width="480"] Source: Showfields Instagram[/caption]

Showfields

Showfields, a four-story, 14,707-square-foot building in New York City's NoHo shopping neighborhood, wants to be the most interesting store in the world. Seeking to bridge the gap between online and offline retail and make it easier for digital natives to open a store, it hosts a rotating selection of up to 30 digital brands. At Showfields, experience is the thing. The store spans four levels: innovative retail on the first floor, a collection of rising Shopify merchants on the second floor, an interactive art exhibition on the third floor, and a community space featuring rotating programming on the fourth floor – and a slide for easy and fun transport between floors, down, mainly.

[caption id="attachment_92553" align="alignright" width="480"]

Source: Showfields Instagram[/caption]

Showfields

Showfields, a four-story, 14,707-square-foot building in New York City's NoHo shopping neighborhood, wants to be the most interesting store in the world. Seeking to bridge the gap between online and offline retail and make it easier for digital natives to open a store, it hosts a rotating selection of up to 30 digital brands. At Showfields, experience is the thing. The store spans four levels: innovative retail on the first floor, a collection of rising Shopify merchants on the second floor, an interactive art exhibition on the third floor, and a community space featuring rotating programming on the fourth floor – and a slide for easy and fun transport between floors, down, mainly.

[caption id="attachment_92553" align="alignright" width="480"] Source: Fourpost Instagram[/caption]

Fourpost

Fourpost, founded by Mark Ghermezian in 2018, operates two stores: one in Edmonton, Canada and one at the Mall of America. Fourpost seeks to connect shoppers and brands through community and experiences. Fourpost lowers the barriers to entry and makes it easier for local startups to secure retail space. With enough space to house at least 20 to 30 vendors at a time, Fourpost provides "Studio Shops" for lease to local purveyors, equipped with fixture options, lighting, Wi-Fi – and a short-term lease. Fourpost also aims to make mall shopping fun again. In addition to the unique, localized and frequently changing assortment, Fourpost hosts (almost) daily events.

[caption id="attachment_92554" align="alignright" width="480"]

Source: Fourpost Instagram[/caption]

Fourpost

Fourpost, founded by Mark Ghermezian in 2018, operates two stores: one in Edmonton, Canada and one at the Mall of America. Fourpost seeks to connect shoppers and brands through community and experiences. Fourpost lowers the barriers to entry and makes it easier for local startups to secure retail space. With enough space to house at least 20 to 30 vendors at a time, Fourpost provides "Studio Shops" for lease to local purveyors, equipped with fixture options, lighting, Wi-Fi – and a short-term lease. Fourpost also aims to make mall shopping fun again. In addition to the unique, localized and frequently changing assortment, Fourpost hosts (almost) daily events.

[caption id="attachment_92554" align="alignright" width="480"] Source: The Grove[/caption]

The Grove

Located on parts of the historic Farmers Market, the Grove is a 575,000-square-foot outdoor retail and entertainment complex in Los Angeles. With a fashion-forward collection of stores and ever-changing pop-up shops, the Grove delivers a dynamic shopping experience. Other than providing excellent shopping and dining experiences, the Grove connects with the local community via various events, such as high-energy fashion shows, a summer concert series and movies in its 14-screen art-deco influenced movie theater. Services include a concierge and a car wash.

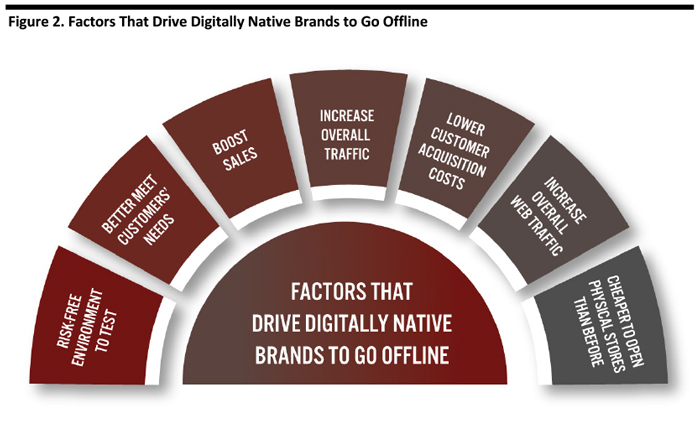

Why Digitally Native Brands Want to Go Offline

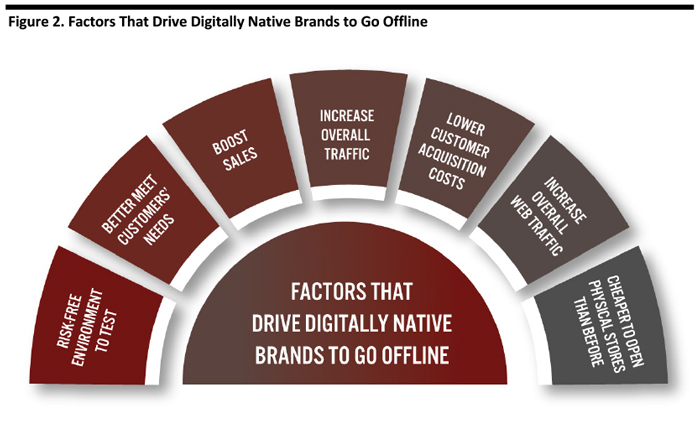

The diversity of fast retail formats perfectly maps to the needs of digitally native young brands from all sectors looking to go offline or to engage with customers face to face. Plus, while online has been growing at breakneck speed for years, 85% of retail still occurs in the physical world. In the past few years, 22 industry leading brands that were once online-only have opened 524 offline stores, according to Coresight Research data. Notable examples include Bonobos, an e-commerce-driven brand that designs and sells men's clothing, which has opened 62 stores since 2012. Glossier began as beauty blog “Into the Gloss,” grew into an online powerhouse and opened two physical stores in the past two years with plans to open more. In fact, the top 100 digital-native brands have announced plans to open at least 850 stores over the next five years, noted by JLL Retail in its 2018 report Digital Brands Get Physical. Below are some of the reason we believe account for the appearance of flexible formats.

[caption id="attachment_92562" align="aligncenter" width="700"]

Source: The Grove[/caption]

The Grove

Located on parts of the historic Farmers Market, the Grove is a 575,000-square-foot outdoor retail and entertainment complex in Los Angeles. With a fashion-forward collection of stores and ever-changing pop-up shops, the Grove delivers a dynamic shopping experience. Other than providing excellent shopping and dining experiences, the Grove connects with the local community via various events, such as high-energy fashion shows, a summer concert series and movies in its 14-screen art-deco influenced movie theater. Services include a concierge and a car wash.

Why Digitally Native Brands Want to Go Offline

The diversity of fast retail formats perfectly maps to the needs of digitally native young brands from all sectors looking to go offline or to engage with customers face to face. Plus, while online has been growing at breakneck speed for years, 85% of retail still occurs in the physical world. In the past few years, 22 industry leading brands that were once online-only have opened 524 offline stores, according to Coresight Research data. Notable examples include Bonobos, an e-commerce-driven brand that designs and sells men's clothing, which has opened 62 stores since 2012. Glossier began as beauty blog “Into the Gloss,” grew into an online powerhouse and opened two physical stores in the past two years with plans to open more. In fact, the top 100 digital-native brands have announced plans to open at least 850 stores over the next five years, noted by JLL Retail in its 2018 report Digital Brands Get Physical. Below are some of the reason we believe account for the appearance of flexible formats.

[caption id="attachment_92562" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Types of Fast Retail Formats

Consumers want an experience and retailers need to deliver – or the competition will. We look at what some innovative companies are doing in the fast retail space and rate each based on the BEST framework, with a red star meaning the format includes the characteristic and a black star being the lack of the characteristic. Most of these formats are executing along brand-building and experiences, and fewer along services and technology integration.

[caption id="attachment_92545" align="alignright" width="480"]

Source: Coresight Research[/caption]

Types of Fast Retail Formats

Consumers want an experience and retailers need to deliver – or the competition will. We look at what some innovative companies are doing in the fast retail space and rate each based on the BEST framework, with a red star meaning the format includes the characteristic and a black star being the lack of the characteristic. Most of these formats are executing along brand-building and experiences, and fewer along services and technology integration.

[caption id="attachment_92545" align="alignright" width="480"] Source: Brandbox Instagram[/caption]

Brandbox

Brandbox is a concept launched by retail landlord Macerich in November 2018. At Brandbox in Tysons Corner Center, Virginia, young brands can have their own mini store inside an 11,000-square-foot space for six to twelve months, with fixtures such as shelving, data on foot traffic, radio-frequency identification tagging for inventory, marketing and recruiting provided by Macerich. Each year, new brands and retailers come in and out, so the mall is continually changing, creating a new shopping experience on an ongoing basis. So far in 2019, the mall owner has housed eight brands, including apparel retailer Naadam and makeup company Winky Lux. Macerich has plan to locate more Brandbox stores in two other locations: Santa Monica Place in California and Scottsdale Fashion Square in Arizona.

[caption id="attachment_92546" align="alignright" width="480"]

Source: Brandbox Instagram[/caption]

Brandbox

Brandbox is a concept launched by retail landlord Macerich in November 2018. At Brandbox in Tysons Corner Center, Virginia, young brands can have their own mini store inside an 11,000-square-foot space for six to twelve months, with fixtures such as shelving, data on foot traffic, radio-frequency identification tagging for inventory, marketing and recruiting provided by Macerich. Each year, new brands and retailers come in and out, so the mall is continually changing, creating a new shopping experience on an ongoing basis. So far in 2019, the mall owner has housed eight brands, including apparel retailer Naadam and makeup company Winky Lux. Macerich has plan to locate more Brandbox stores in two other locations: Santa Monica Place in California and Scottsdale Fashion Square in Arizona.

[caption id="attachment_92546" align="alignright" width="480"] Source: Appear Here[/caption]

The Edit @ Roosevelt Field

Simon Property Group launched The Edit in its Roosevelt Field Mall in October 2017, a new retail concept akin to a permanent pop-up store, with a rotating cast of brands and services. The Edit is sub-divided into 12 micro spaces ranging from 20 to 200 square feet, each space featuring a modular design and tech-enabled walls for digital marketing. The Edit’s first launch theme was gifting and included over ten young brands such as Rhone and Cuzin’s Duzin. Each launch lasts four months, then new themes rotate in. The Edit has locations in nine different retail platforms, including regional malls, hotels and partner properties. It also has properties in 15 overseas locations including Japan, Italy, and Austria.

[caption id="attachment_92547" align="alignright" width="480"]

Source: Appear Here[/caption]

The Edit @ Roosevelt Field

Simon Property Group launched The Edit in its Roosevelt Field Mall in October 2017, a new retail concept akin to a permanent pop-up store, with a rotating cast of brands and services. The Edit is sub-divided into 12 micro spaces ranging from 20 to 200 square feet, each space featuring a modular design and tech-enabled walls for digital marketing. The Edit’s first launch theme was gifting and included over ten young brands such as Rhone and Cuzin’s Duzin. Each launch lasts four months, then new themes rotate in. The Edit has locations in nine different retail platforms, including regional malls, hotels and partner properties. It also has properties in 15 overseas locations including Japan, Italy, and Austria.

[caption id="attachment_92547" align="alignright" width="480"] Source: The Market @ Macy’s[/caption]

The Market @ Macy’s

The Market @ Macy's is the areas in Macy’s department stores for young brands to introduce products and services. Twelve Macy’s locations host The Market @ Macy’s, including New York City, Pittsburgh and Las Vegas. These stores are all in prime, high foot traffic locations, offering young brands higher exposure. Macy’s also provides rich data analytics such as daily sales data, foot traffic, customer engagement and conversion rates so new brands can optimize their performance.

[caption id="attachment_92548" align="alignright" width="480"]

Source: The Market @ Macy’s[/caption]

The Market @ Macy’s

The Market @ Macy's is the areas in Macy’s department stores for young brands to introduce products and services. Twelve Macy’s locations host The Market @ Macy’s, including New York City, Pittsburgh and Las Vegas. These stores are all in prime, high foot traffic locations, offering young brands higher exposure. Macy’s also provides rich data analytics such as daily sales data, foot traffic, customer engagement and conversion rates so new brands can optimize their performance.

[caption id="attachment_92548" align="alignright" width="480"] Source: Uppercase[/caption]

Uppercase

Founded in 2016, Uppercase is a retail rental agency that offers young brands tech-enabled flexible retail stores and a full service, set-up to clean-up operation. It also has a team of local retail experts to provide young brands development strategies, such as where the next store should be and how to create data-informed merchandising plans. So far, through 2Q19, Uppercase has stores in nine cities, including new offerings in Austin, Seattle, Brooklyn, San Francisco and Chicago.

[caption id="attachment_92550" align="alignright" width="480"]

Source: Uppercase[/caption]

Uppercase

Founded in 2016, Uppercase is a retail rental agency that offers young brands tech-enabled flexible retail stores and a full service, set-up to clean-up operation. It also has a team of local retail experts to provide young brands development strategies, such as where the next store should be and how to create data-informed merchandising plans. So far, through 2Q19, Uppercase has stores in nine cities, including new offerings in Austin, Seattle, Brooklyn, San Francisco and Chicago.

[caption id="attachment_92550" align="alignright" width="480"] Source: Appear Here[/caption]

Appear Here

Founded in London in 2013 by then-20-year-old Ross Bailey, Appear Here is a marketplace for short-term retail space, connecting brands, retailers, designers and entrepreneurs with available space, all online. The company has expanded to France and New York. Through 2Q19, the startup says its marketplace has been used by more than 200,000 brands, including Nike, Loewe, Givenchy, Coca-Cola, Net-a-Porter and Kanye West, as well as numerous independents.

[caption id="attachment_92551" align="alignright" width="480"]

Source: Appear Here[/caption]

Appear Here

Founded in London in 2013 by then-20-year-old Ross Bailey, Appear Here is a marketplace for short-term retail space, connecting brands, retailers, designers and entrepreneurs with available space, all online. The company has expanded to France and New York. Through 2Q19, the startup says its marketplace has been used by more than 200,000 brands, including Nike, Loewe, Givenchy, Coca-Cola, Net-a-Porter and Kanye West, as well as numerous independents.

[caption id="attachment_92551" align="alignright" width="480"] Source: Macy’s[/caption]

STORY in Macy’s

Rachel Shechtman, founder of STORY, believes shopping should be about more than just buying things, and that was the genesis of STORY. Unlike most stores, it changes every couple of months and brings to life a new editorial theme. STORY completely changes its merchandise, design, and event programming to tell different stories. Some examples of past stories include Remember When, Wellness and Home for the Holidays. Over the span of seven years, STORY changed more than 40 times, worked with more than 5,000 different brands and hosted more than 500 events from book panels to a trunk show by Iris Apfel. In April 2018, STORY was officially acquired by Macy's.

[caption id="attachment_92552" align="alignright" width="480"]

Source: Macy’s[/caption]

STORY in Macy’s

Rachel Shechtman, founder of STORY, believes shopping should be about more than just buying things, and that was the genesis of STORY. Unlike most stores, it changes every couple of months and brings to life a new editorial theme. STORY completely changes its merchandise, design, and event programming to tell different stories. Some examples of past stories include Remember When, Wellness and Home for the Holidays. Over the span of seven years, STORY changed more than 40 times, worked with more than 5,000 different brands and hosted more than 500 events from book panels to a trunk show by Iris Apfel. In April 2018, STORY was officially acquired by Macy's.

[caption id="attachment_92552" align="alignright" width="480"] Source: Showfields Instagram[/caption]

Showfields

Showfields, a four-story, 14,707-square-foot building in New York City's NoHo shopping neighborhood, wants to be the most interesting store in the world. Seeking to bridge the gap between online and offline retail and make it easier for digital natives to open a store, it hosts a rotating selection of up to 30 digital brands. At Showfields, experience is the thing. The store spans four levels: innovative retail on the first floor, a collection of rising Shopify merchants on the second floor, an interactive art exhibition on the third floor, and a community space featuring rotating programming on the fourth floor – and a slide for easy and fun transport between floors, down, mainly.

[caption id="attachment_92553" align="alignright" width="480"]

Source: Showfields Instagram[/caption]

Showfields

Showfields, a four-story, 14,707-square-foot building in New York City's NoHo shopping neighborhood, wants to be the most interesting store in the world. Seeking to bridge the gap between online and offline retail and make it easier for digital natives to open a store, it hosts a rotating selection of up to 30 digital brands. At Showfields, experience is the thing. The store spans four levels: innovative retail on the first floor, a collection of rising Shopify merchants on the second floor, an interactive art exhibition on the third floor, and a community space featuring rotating programming on the fourth floor – and a slide for easy and fun transport between floors, down, mainly.

[caption id="attachment_92553" align="alignright" width="480"] Source: Fourpost Instagram[/caption]

Fourpost

Fourpost, founded by Mark Ghermezian in 2018, operates two stores: one in Edmonton, Canada and one at the Mall of America. Fourpost seeks to connect shoppers and brands through community and experiences. Fourpost lowers the barriers to entry and makes it easier for local startups to secure retail space. With enough space to house at least 20 to 30 vendors at a time, Fourpost provides "Studio Shops" for lease to local purveyors, equipped with fixture options, lighting, Wi-Fi – and a short-term lease. Fourpost also aims to make mall shopping fun again. In addition to the unique, localized and frequently changing assortment, Fourpost hosts (almost) daily events.

[caption id="attachment_92554" align="alignright" width="480"]

Source: Fourpost Instagram[/caption]

Fourpost

Fourpost, founded by Mark Ghermezian in 2018, operates two stores: one in Edmonton, Canada and one at the Mall of America. Fourpost seeks to connect shoppers and brands through community and experiences. Fourpost lowers the barriers to entry and makes it easier for local startups to secure retail space. With enough space to house at least 20 to 30 vendors at a time, Fourpost provides "Studio Shops" for lease to local purveyors, equipped with fixture options, lighting, Wi-Fi – and a short-term lease. Fourpost also aims to make mall shopping fun again. In addition to the unique, localized and frequently changing assortment, Fourpost hosts (almost) daily events.

[caption id="attachment_92554" align="alignright" width="480"] Source: The Grove[/caption]

The Grove

Located on parts of the historic Farmers Market, the Grove is a 575,000-square-foot outdoor retail and entertainment complex in Los Angeles. With a fashion-forward collection of stores and ever-changing pop-up shops, the Grove delivers a dynamic shopping experience. Other than providing excellent shopping and dining experiences, the Grove connects with the local community via various events, such as high-energy fashion shows, a summer concert series and movies in its 14-screen art-deco influenced movie theater. Services include a concierge and a car wash.

Why Digitally Native Brands Want to Go Offline

The diversity of fast retail formats perfectly maps to the needs of digitally native young brands from all sectors looking to go offline or to engage with customers face to face. Plus, while online has been growing at breakneck speed for years, 85% of retail still occurs in the physical world. In the past few years, 22 industry leading brands that were once online-only have opened 524 offline stores, according to Coresight Research data. Notable examples include Bonobos, an e-commerce-driven brand that designs and sells men's clothing, which has opened 62 stores since 2012. Glossier began as beauty blog “Into the Gloss,” grew into an online powerhouse and opened two physical stores in the past two years with plans to open more. In fact, the top 100 digital-native brands have announced plans to open at least 850 stores over the next five years, noted by JLL Retail in its 2018 report Digital Brands Get Physical. Below are some of the reason we believe account for the appearance of flexible formats.

[caption id="attachment_92562" align="aligncenter" width="700"]

Source: The Grove[/caption]

The Grove

Located on parts of the historic Farmers Market, the Grove is a 575,000-square-foot outdoor retail and entertainment complex in Los Angeles. With a fashion-forward collection of stores and ever-changing pop-up shops, the Grove delivers a dynamic shopping experience. Other than providing excellent shopping and dining experiences, the Grove connects with the local community via various events, such as high-energy fashion shows, a summer concert series and movies in its 14-screen art-deco influenced movie theater. Services include a concierge and a car wash.

Why Digitally Native Brands Want to Go Offline

The diversity of fast retail formats perfectly maps to the needs of digitally native young brands from all sectors looking to go offline or to engage with customers face to face. Plus, while online has been growing at breakneck speed for years, 85% of retail still occurs in the physical world. In the past few years, 22 industry leading brands that were once online-only have opened 524 offline stores, according to Coresight Research data. Notable examples include Bonobos, an e-commerce-driven brand that designs and sells men's clothing, which has opened 62 stores since 2012. Glossier began as beauty blog “Into the Gloss,” grew into an online powerhouse and opened two physical stores in the past two years with plans to open more. In fact, the top 100 digital-native brands have announced plans to open at least 850 stores over the next five years, noted by JLL Retail in its 2018 report Digital Brands Get Physical. Below are some of the reason we believe account for the appearance of flexible formats.

[caption id="attachment_92562" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

- Flexible retail formats meet with consumers’ new needs better than traditional retail formats. Compared with the carbon-copy, cut and paste formulaic sameness of many traditional retail formats, modern formats are flexible, interactive and innovative. One example of innovative formats is the “guide shops” opened by Bonobos. The “guide shops” are curated, by-appointment showrooms for one-on-one attention from a customer representative.

- Physical stores boost sales. A physical store has the power of instant gratification, merchandising, employee service and dressing rooms to display products to consumers and expose brands to raise their profile, which helps get shoppers to buy more and return fewer items, according to Bloomberg. Profit margins are better, too, with no shipping charges and fewer returns and average ticket is often higher. Women’s shoe purveyor Margaux attracted over 200 women for a temporary loft space opening in Philadelphia – in heavy rain. The temporary space generated almost a month’s worth of sales in one day, according to co-founder Alexa Buckley. The founder noted similar results when testing in Atlanta and Boston, and that offline shoppers spent roughly 13% more than online shoppers and returned fewer items.

- Flexible formats offer a lower risk way for digitally native brands test offline. With physical stores and help from retail rental agencies, young brands can test products and different locations without the full investment of opening a traditional brick and mortar presence. More importantly, flexible rental services, such as Appear Here and Uppercase, enable young brands to showcase products in shopping areas at prices that fit their budgets.

- Test, learn and iterate is core to the DNA of digitally native brands. Flexible store formats are a natural way for digitally native brands to learn about physical retail and interact with customers. Physical stores also help collect consumer data, such as better understanding the customer base, gaining customer feedback on designs, and customer consideration sets, which online stores cannot provide, according to an ICSC survey report, the Halo Effect, How Bricks Impact Clicks.

- Opening a physical store drives up overall website traffic an average of 37%. The advantage is especially obvious for new brands. New store openings drive an average 45% increase in web traffic for emerging brands, while established retailers experience an average 36% boost, according to the ICSC survey.

- Customer acquisition costs on social media (Facebook, Instagram) are climbing for young digitally native brands. We have seen triple-digit increases in the cost of advertising on Facebook and Instagram in 2018-2019. Customer acquisition costs online now exceed the cost of customer acquisition offline or in a store environment. Digitally native brands are seeking alternative methods to connect with potential consumers, from micro-influencers to grassroot marketing at community events. Multiple marketing channels serve young brands well.

- Increasing mall vacancy has lowered the cost of opening a physical store. Coresight Research data shows US retailers have announced 6,986 store closures year to date in 2019, and estimates the figure could reach 12,000 by the end of 2019, almost twice as many as last year. Existing mall vacancy rates offer a real opportunity for young digitally native brands to open offline stores – and that opportunity is likely to grow as more traditional mall-based shops close their doors.

- The number of flexible stores will increase as mall vacancy rates remain high. The cost to open new stores will remain relatively low. Also, we believe that the demand for flexible stores will remain high as digitally native brands continue opening new stores.

- More retail rental agencies are expected to enter the market. We expect experienced retail landlords and real estate developers to start retail rental services to fill vacant mall space. Retail rental firms such as Uppercase and Appear Here are working with malls and local real estate agents to offer flexible leasing options for digital natives.

- We’ll see more innovative formats as retailers strive to capture consumer attention. One potential format may be kiosks: Retail rental agencies may turn bus stations into simple, energy-saving pop-up stores to display and sell products to people waiting for buses.