Bringing Ultrafast Fashion to Market

Fast fashion is turning into ultrafast fashion. New players such as Boohoo.com, ASOS and Missguided are bringing products from design to sale in as little as one or two weeks—even faster than traditional fast-fashion pioneers such as Zara and H&M.

The new crop of online fast-fashion retailers is proving highly adept at rapidly responding to consumers’ increasing demands for immediacy and constant newness, in turn driving their rapid sales growth and success.

Boohoo.com, ASOS and Missguided are now able to produce merchandise in 2–4 weeks, compared to 5 weeks for Zara and H&M and the 6- to 9-month cycle for traditional retailers.

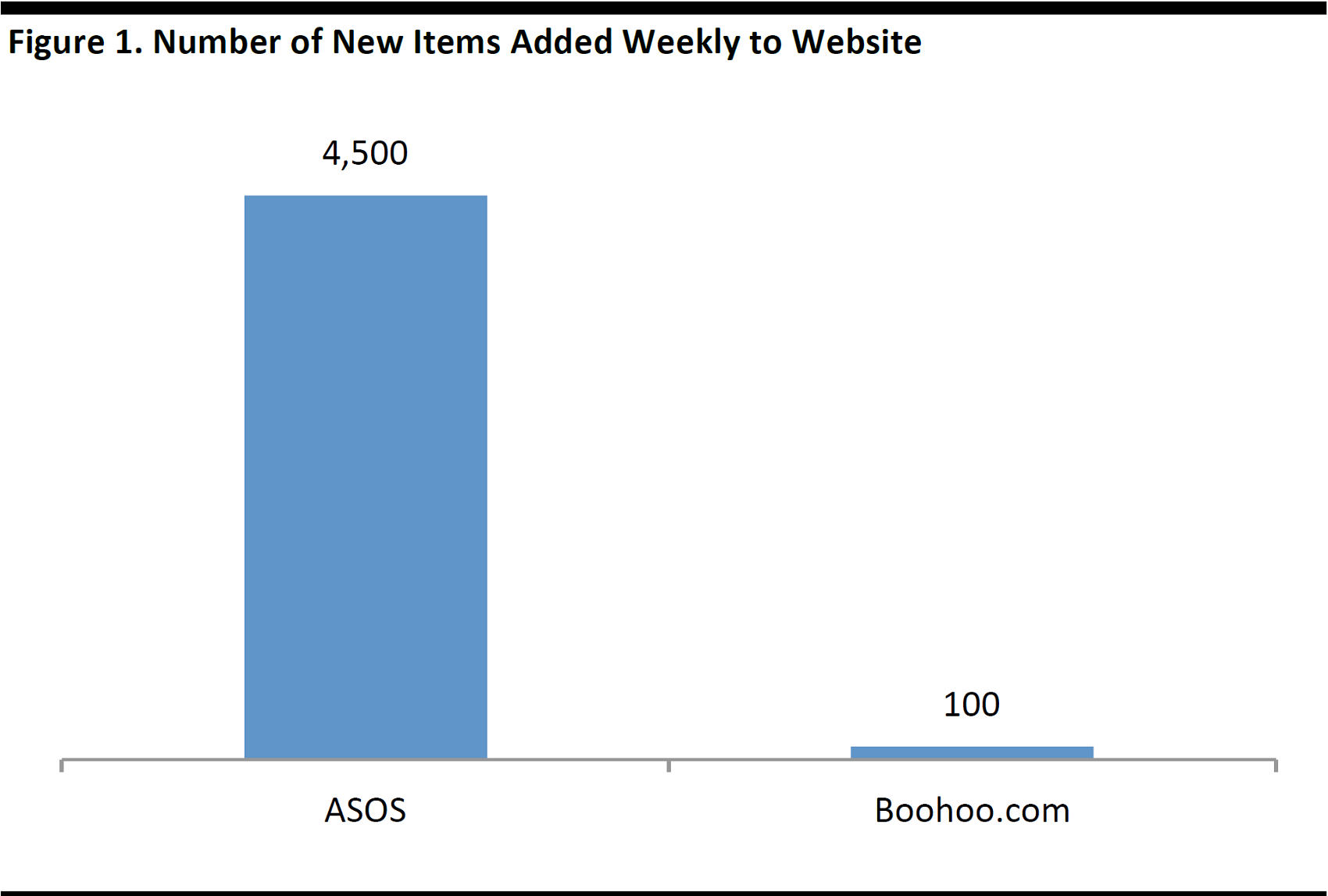

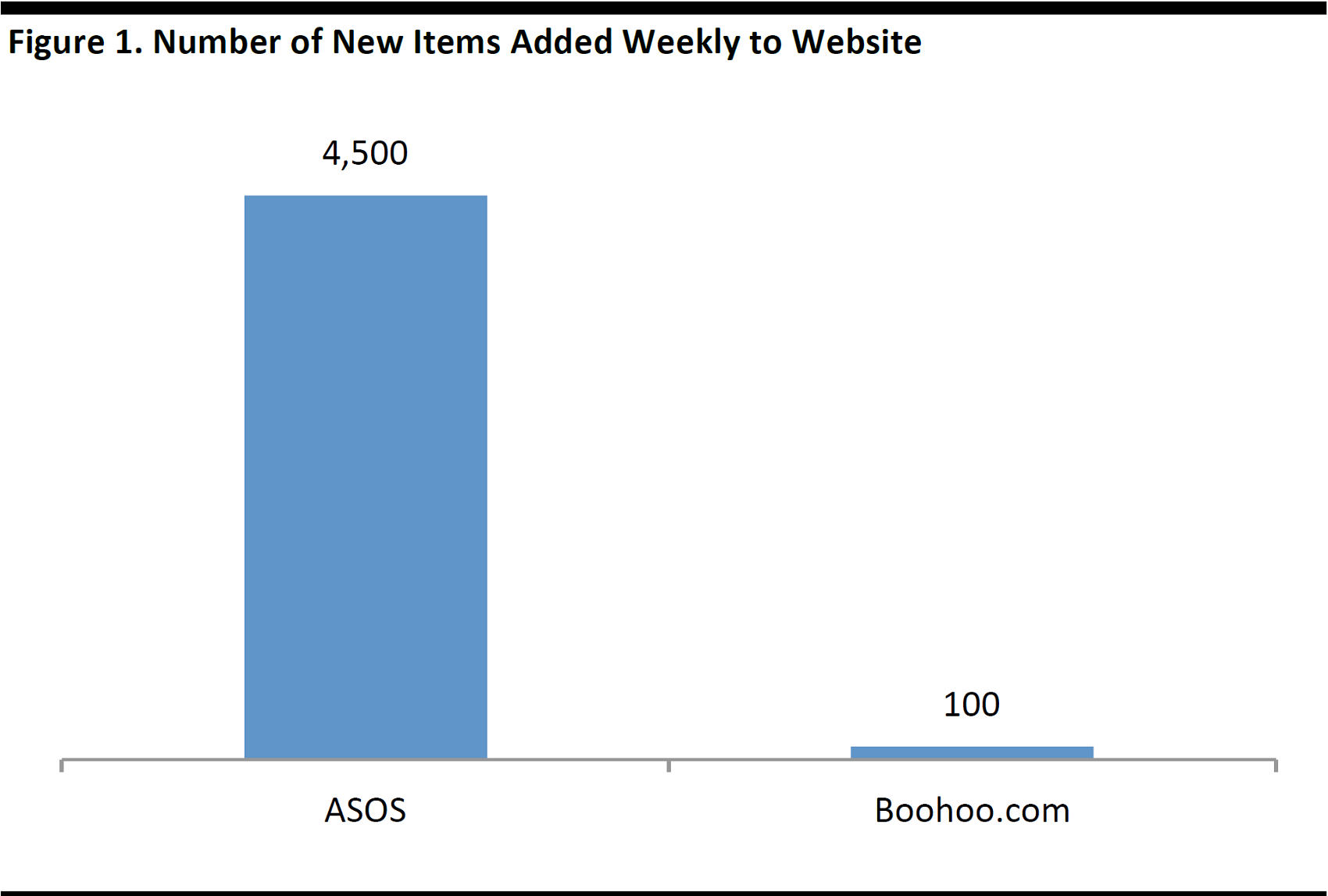

The fashion design process is faster than it has ever been, due to the digital revolution. It is much easier for retailers to copy or obtain design inspiration from fashion runways and digital influencers. Social media is now a key tool informing sourcing strategy because it provides data on emerging and popular trends and styles. Pure-play online fast-fashion retailers are able to continuously refresh and rotate a large part of their assortments to drive customer shopping frequency. For example, Boohoo and ASOS add up to 100 and 4,500 products daily to their website, respectively.

Source: Company reports/Fung Business Intelligence Centre/Fung Global Retail & Technology

“Test-and-Repeat” Model

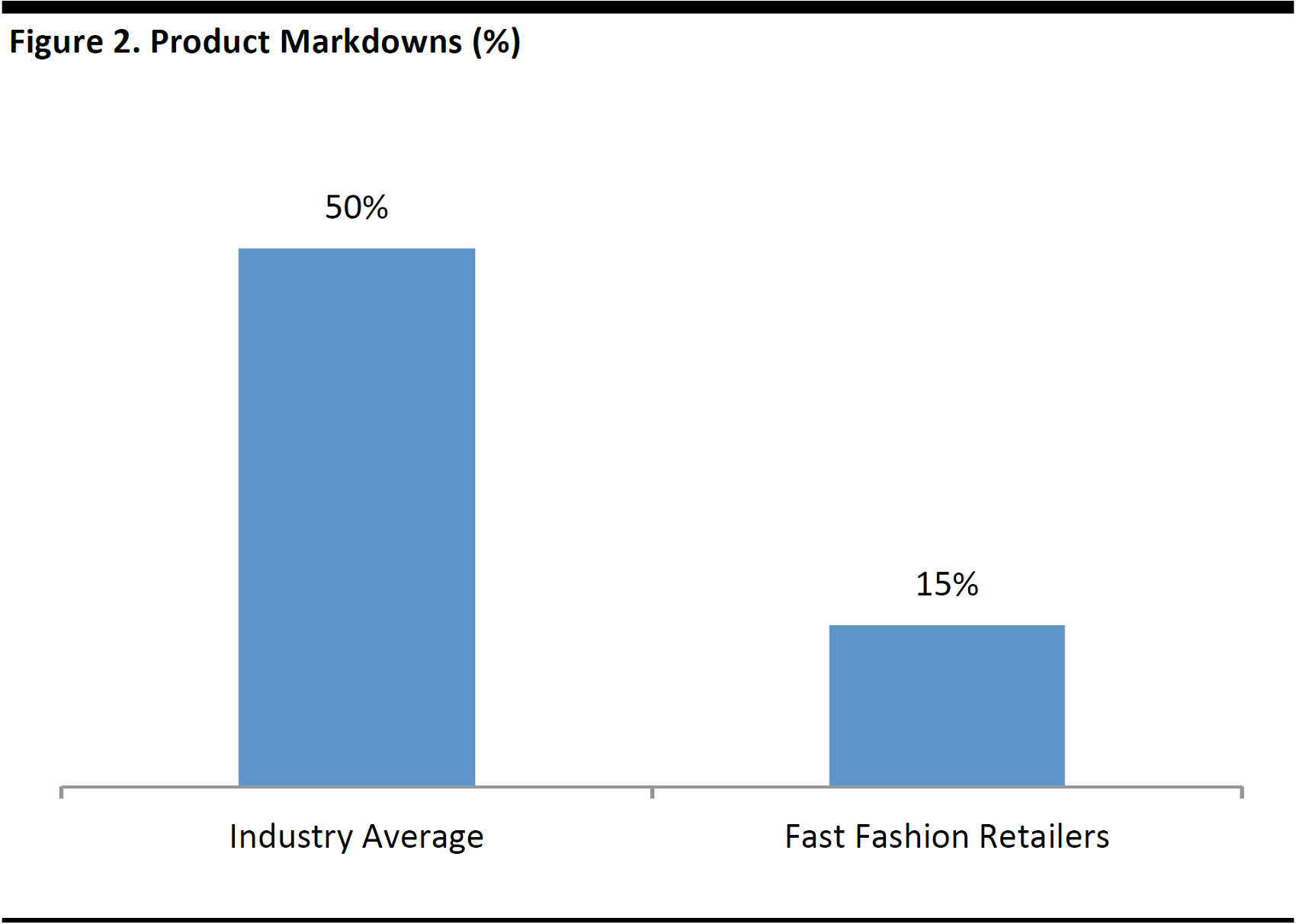

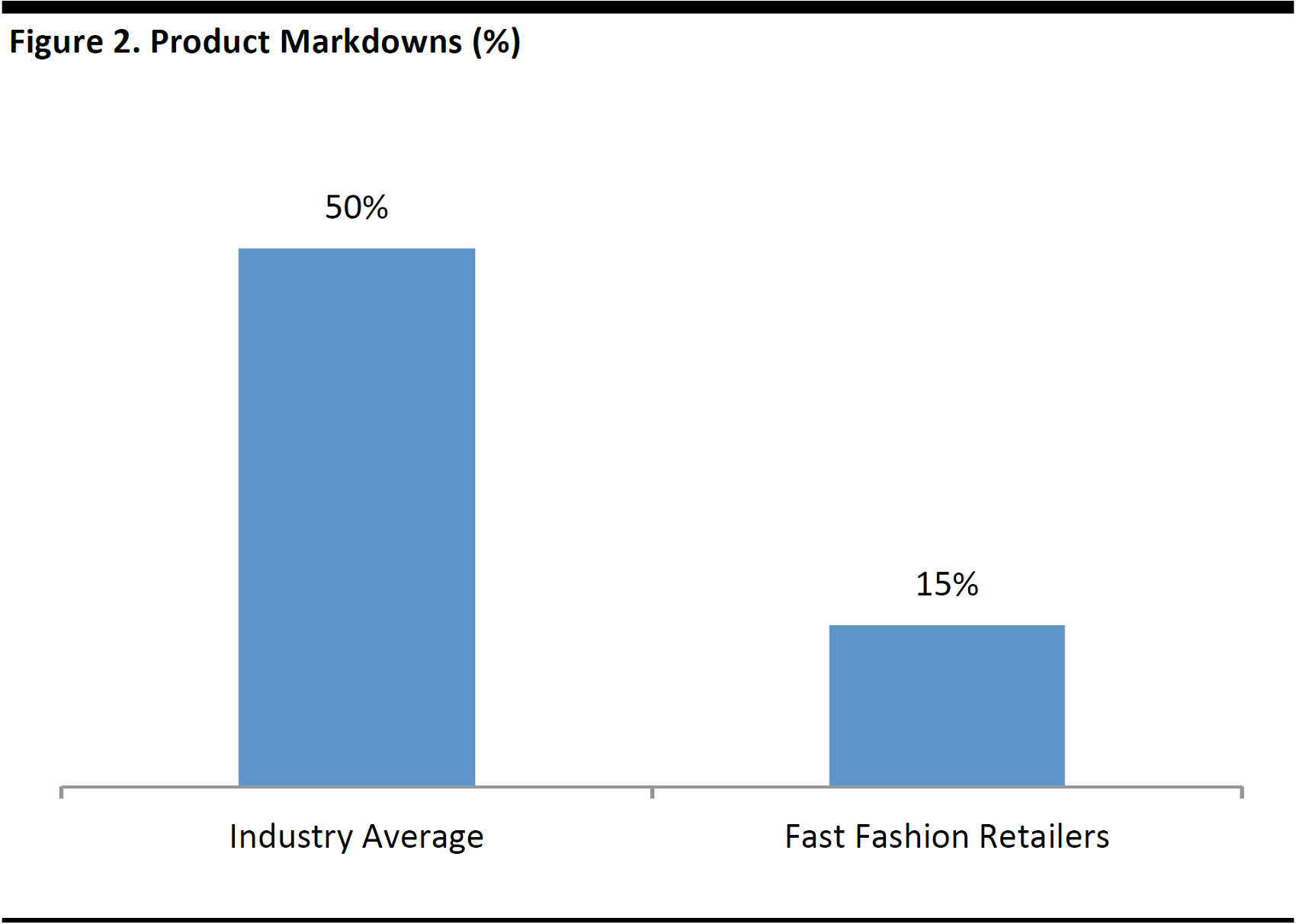

Ultrafast fashion retailers also avoid the historical retailer dilemma of product shortages versus excessive inventory, and ensuing markdowns and lower margins. Ultrafast apparel retailers operate agile supply chains to quickly match inventory supply with changing demand and strictly control inventory to create a balance between undersupply and markdowns. Initial designs are made in small batches to test demand, and, if successful, more items are quickly produced. The sourcing businesses target selling goods at full prices and reduced markdowns, hence fast-fashion retailers have much lower markdown levels than traditional retailers, as depicted by the table below.

Source: Fung Business Intelligence Centre/Fung Global Retail & Technology

Nearshoring and Onshoring

Fast-fashion retailers are able to bring products to market and adjust inventory levels rapidly by basing large quantities of production close to headquarters and key customer markets.

- Boohoo sources over 50% of its products from the UK, which allows the company to offer the latest trends and styles very quickly.

- ASOS’s CEO stated that he expects a growing resurgence of close-to-shore and onshore manufacturing to increase lead times, as younger consumers are becoming more demanding and fashion trends are changing more quickly.

- Inditex has stated that Zara sources approximately 60% of product in Europe, mainly Spain and Portugal.

- H&M has recently announced that it will invest to speed up its supply chain and is considering moving more production closer to Europe, to countries such as Turkey, in order to bring product to European stores faster.

Fast Fashion and Ultrafast Fashion Players

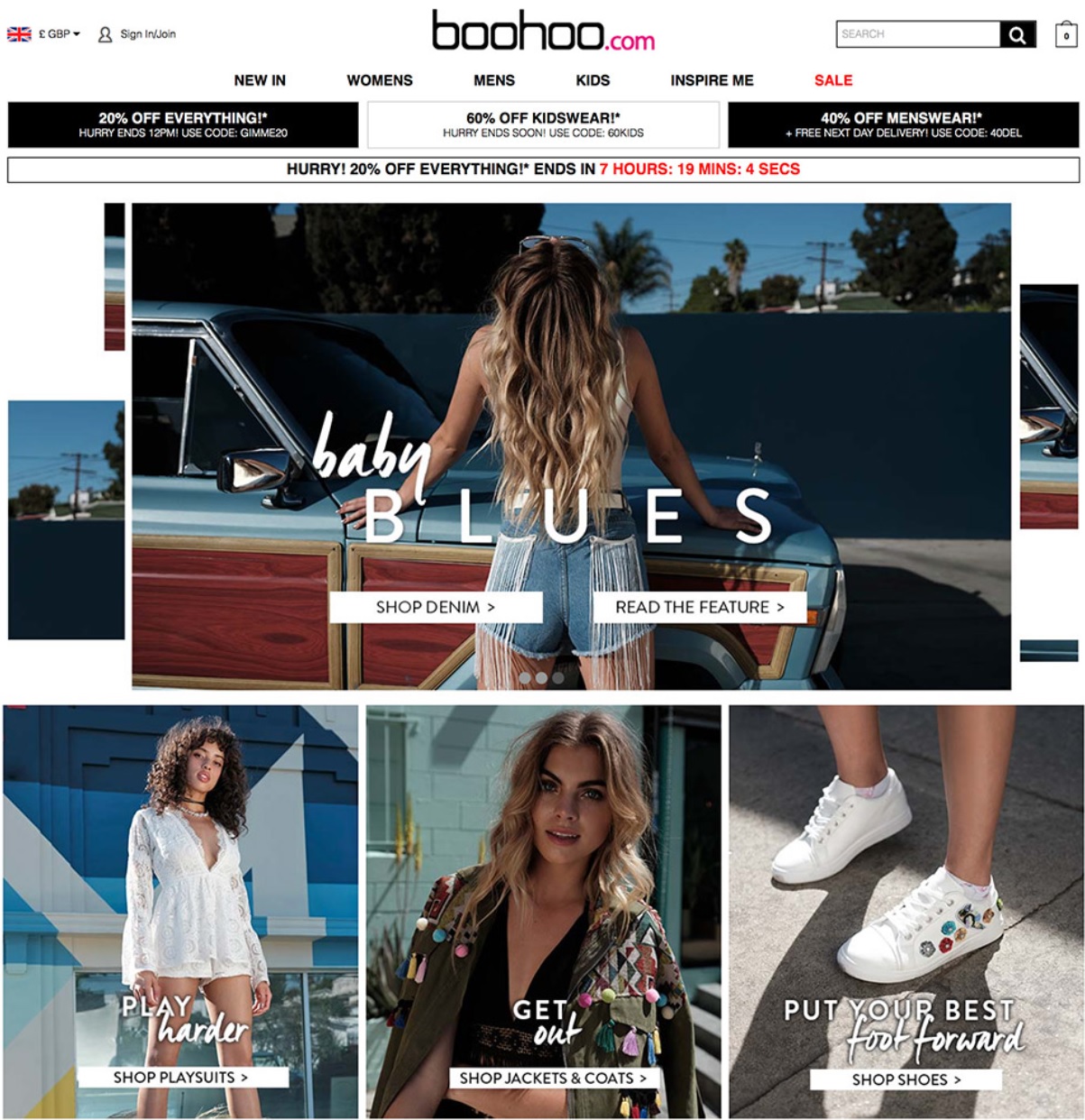

Boohoo.com: From Two Weeks

British online fashion retailer Boohoo sells own-brand clothing, shoes, and accessories, and targets 16–24 year-olds. Earlier this year, Boohoo.com acquired its remaining interest in Prettylittlething and US-based Nasty Gal.

Source: boohoo.com

The key to the company’s success is its business model focused on speed to market. Boohoo.com reportedly has the capability to get product from concept to sale in just 2 weeks.

The company operates a test-and-repeat model, which revolves around the concept of producing items in small batches initially and quickly reordering strong-selling product. The sourcing model reduces inventory-holding risk and enables rapid market response to quickly satisfy customer product demand.

- Boohoo has up to 29,000 products listed on its website and customers are continuously checking the website for new styles.

Boohoo.com collaborates with celebrities, artists and social media influencers to promote styles and to uncover the most recent fashion trends.

- Boohoo mines Instagram interactions to identify what styles are trending with its target customer age group.

- The company also creates unique seasonal capsule collections and enters into design partnerships with digital industry influencers and celebrities.

Boohoo has seen robust growth in the UK, Continental Europe and the US, and the company claims it is now the UK’s third-largest online fashion retailer by market share, following ASOS and Next.

- Boohoo reported constant currency revenue growth of 49% to £294.5 million in the fiscal year ending February 28, 2017, and expects revenues to increase by 50% year over year in fiscal year 2018.

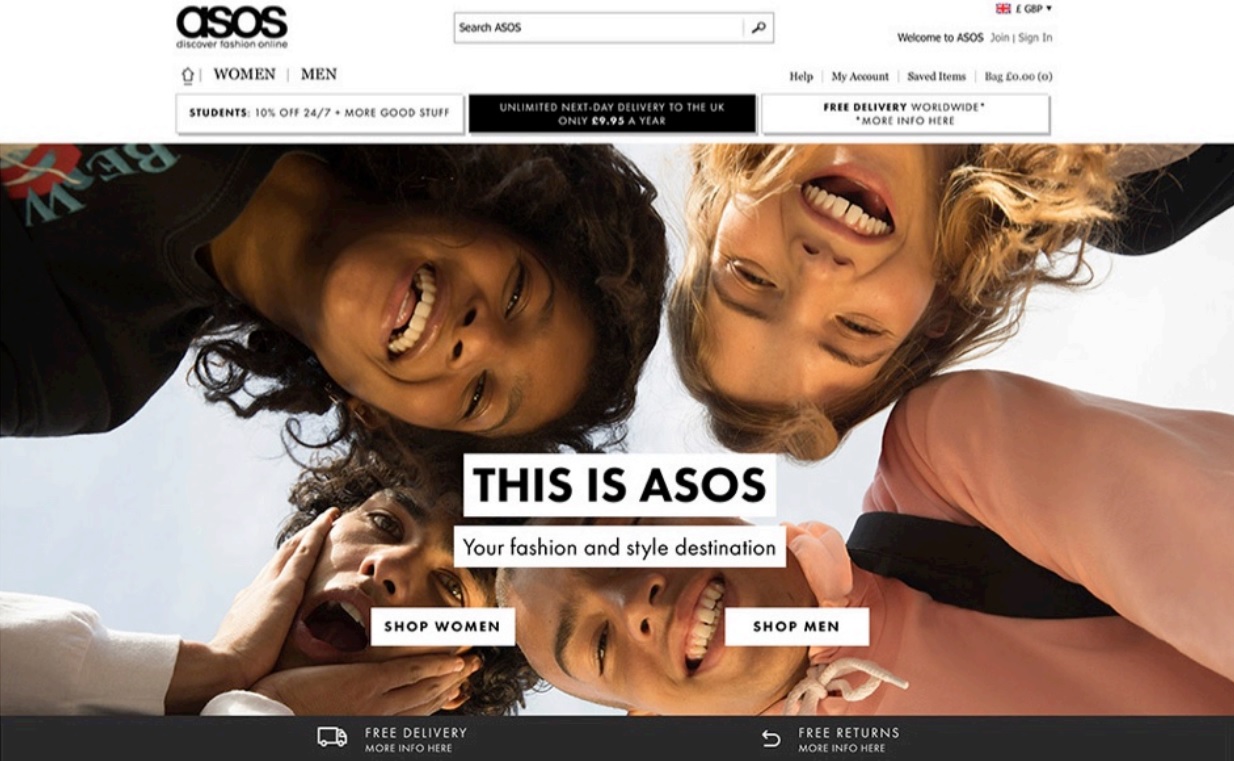

ASOS: 2–8 Weeks

UK online fast-fashion retailer ASOS offers 60% own-label product and the remainder by popular international brands. The company is able to bring product from design to store in 2–8 weeks, depending on the complexity of the product and sourcing location. The average time to market is around 6 weeks.

Source: asos.com

- ASOS is able to design and get product to customers in 2 weeks if it is a simple product manufactured in the UK. More detailed and embellished items, called fashion items, take longer.

- For items made in Turkey, the supply chain can take 4–6 weeks, and items made in Mauritius, where ASOS sources around 16% of its products, can take 4–8 weeks.

ASOS teams are trying to reduce lead times on ASOS own-label products. ASOS has increased the number of new own-label items launched per week by 10% year over year in fiscal year 2016.

Like Boohoo.com, ASOS has posted very strong sales growth in the past few years.

- ASOS reported first half fiscal year 2017 sales for the period ending February 28, 2017 up 38% year over year, and the company increased its sales forecast for fiscal year 2017, expecting revenues to increase between 30% and 35%.

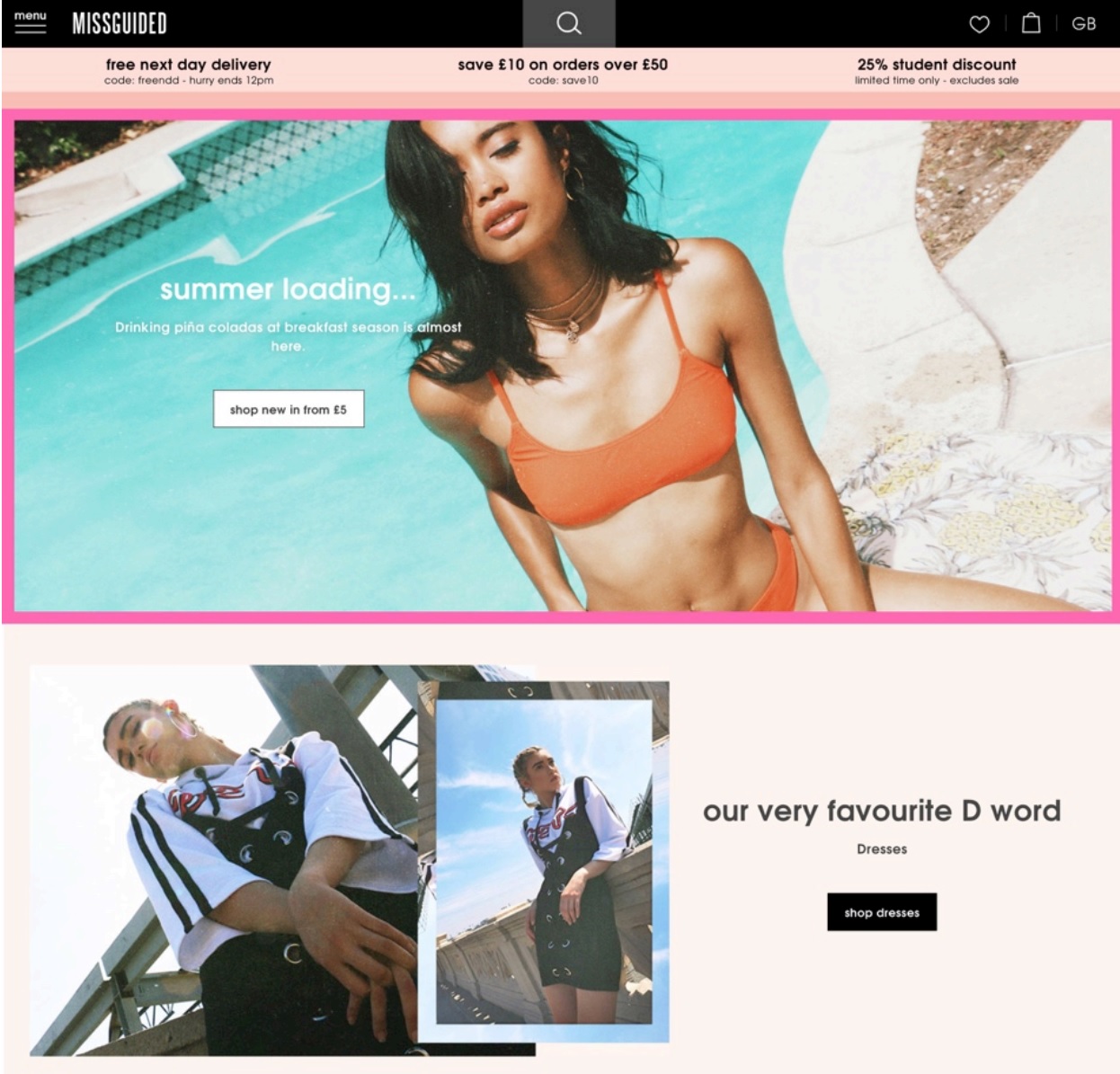

Missguided: From 1 Week

Privately-held British online fashion retailer Missguided has grown rapidly over the past few years, and is considering a sale or flotation due to this rapid growth.

Source: missguided.co.uk

- Missguided revenues increased by 75% to £206 million in the fiscal year ended March 31, 2017. International sales increased by 130% year over year.

- The company launches 1,000 new products each month and updates its site once a day with new stock. If a popular fashion trend surfaces, the company strives to have it available on its site in under a week. Like Boohoo.com, the company also runs marketing campaigns that feature influencers to spot and promote new fashion trends.

Zara: 5 Weeks

Traditional fast-fashion pioneer Zara used to produce a few collections a year and now the brand launches over 20 collections annually. Zara’s design-to-retail cycle is 5 weeks, while the company needs only 2 weeks for repeat orders of high-selling product. Stores worldwide receive new products twice a week.

Source: zara.com

- Zara’s fast supply chain is based on geographic proximity. Europe, especially Spain, accounts for 60% of Zara’s merchandise production, according to the company. Zara also sources around 10% of its merchandise from near-shore manufacturers in Morocco and Turkey. Only about 30% of product is sourced from Asia, mainly basics.

Zara’s sales growth continues to strongly outperform that of most other apparel brands. However, sales growth has been below that of young pure-play online retailers. Zara’s comparable store sales increased 10% year over year in fiscal year 2016, below the 30%+ rates for ASOS and 40%+ for Boohoo.

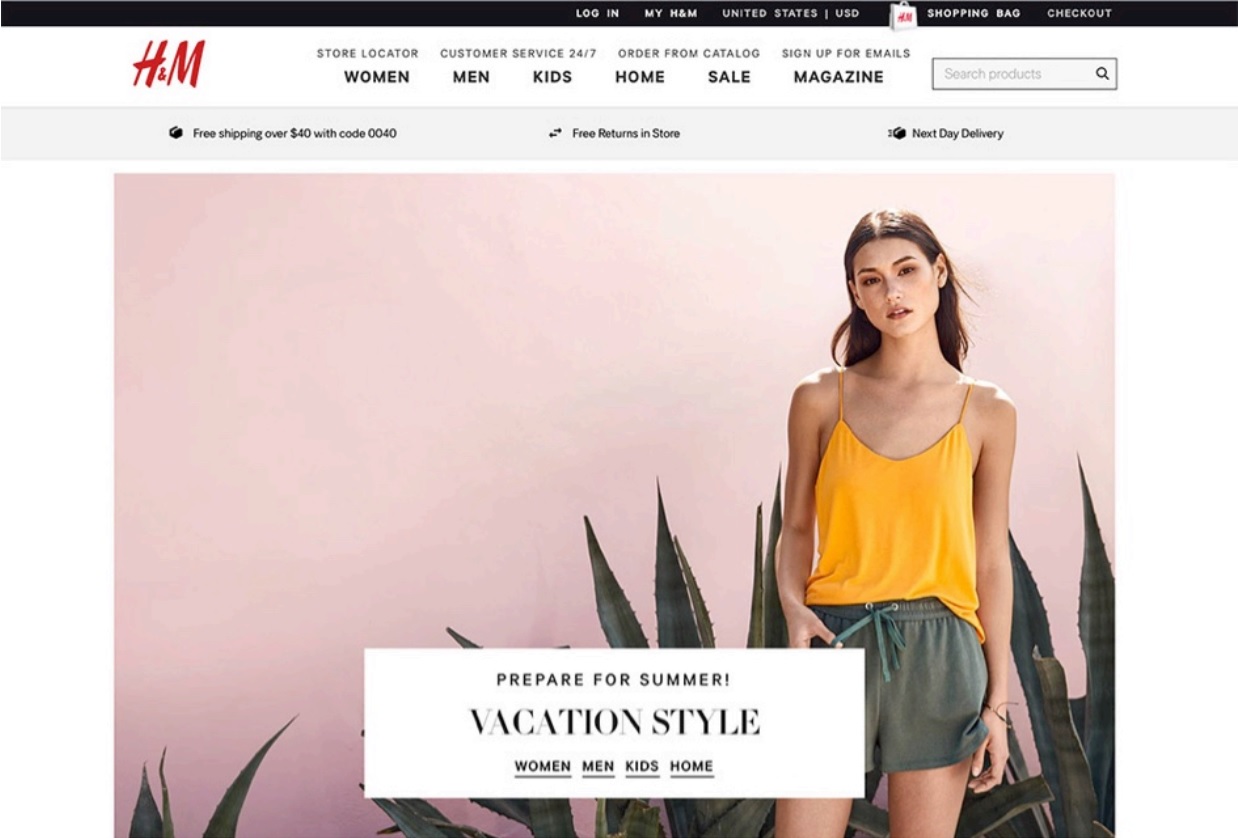

H&M: A Few Weeks to Six Months

Swedish retailer Hennes & Mauritz (H&M) has a long lead time (less flexible) supply-chain model compared to the new ultrafast fashion players, as well as Zara.

- H&M launches up to 16 collections a year. While new products are delivered to stores daily, H&M lead times vary from a few weeks to 6months. New garments such as basics and childrenswear are ordered in advance, while more trendy clothes that require smaller quantities may be produced at shorter notice.

- H&M sources about 80% of its product from Asia, according to the company. Suppliers are used in Europe for fashion-sensitive items and those that require rapid replenishment.

H&M, in particular, has seen sales and margins suffer due to lower customer demand and higher sourcing costs. The company’s first quarter constant currency revenues for the fiscal year ending February 28, 2017 increased 4%, missing its full-year target of 10%–15% year-over-year annual growth.

Source: hm.com

To address lackluster sales, H&M is investing significantly in its supply chain, such as new logistics solutions with greater levels of automation and optimized lead times.

Key Takeaways

- Fast fashion is turning into ultrafast fashion. New players such as Boohoo.com, ASOS and Missguided are bringing products from design to sale in as little as a week or two—even faster than traditional fast-fashion pioneers.

- The new crop of online fast-fashion retailers is proving highly adept at rapidly responding to consumers’ increasing demands for immediacy and constant newness, in turn driving their rapid sales growth and success.

- The fashion design process is faster than it has ever been, due to the digital revolution.

- Fast-fashion retailers are able to bring products to market and adjust inventory levels rapidly by basing large quantities of production close to headquarters and key customer markets.