Nitheesh NH

Introduction

The fashion industry underwent significant changes over the past decade and continues to evolve swiftly. Driven by advancements in digital, online natives are increasingly opening brick-and-mortar stores.

According to data from commercial real estate firm Jones Lang LaSalle Research (JLL Research) in 2018 digital natives said they plan to open 850 physical stores in the next five years.

We look at how consumer habits influence purchasing and how digitally native fashion brands are successfully moving into the physical space.

The Cost of Digital Advertising is Skyrocketing, Making Physical Retail an Economically Viable Alternative for Customer Acquisition

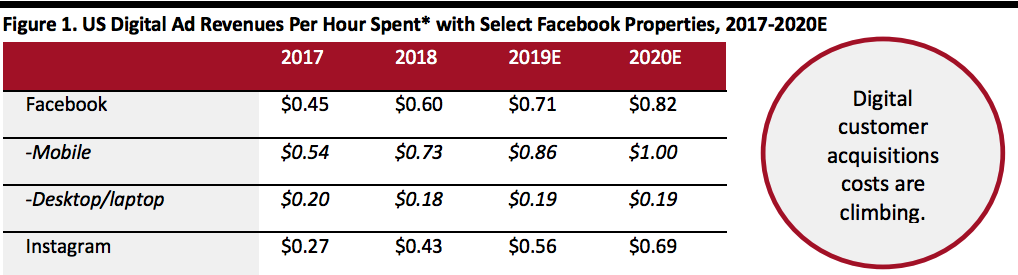

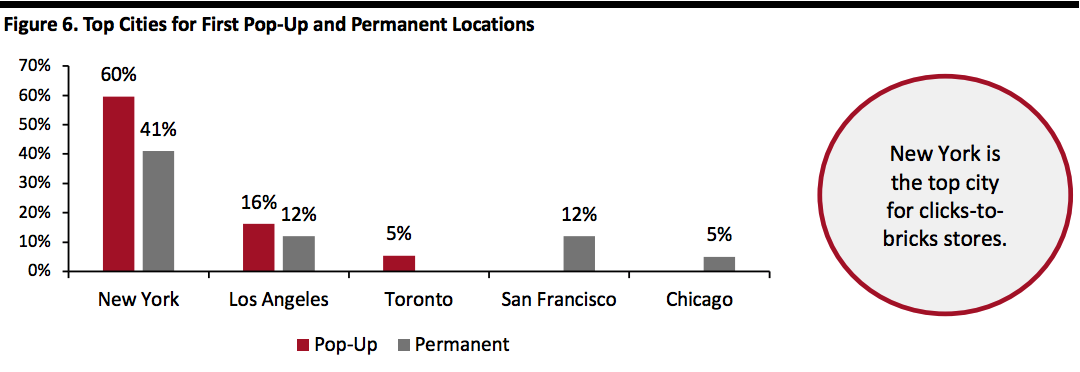

Rising online advertising costs are one factor making brick-and-mortar investments more appealing. According to data from AdStage the cost of a thousand ad impressions on Facebook rose 122% year over year in January 2018. In February 2018, the cost rose a further 77%. This marked the two highest year-over-year jumps in ad prices for Facebook over of the previous 14 months.

Meanwhile, retail rents are falling, even in eminent shopping destinations such as New York City, where the average overall decline in 15 of 17 retail corridors was 25% over the three-year period ended fall 2018, according to the Real Estate Board of New York (REBNY). The confluence of higher digital customer acquisition costs and declining, more flexible lease terms is supporting the online to offline migration.

[caption id="attachment_95173" align="aligncenter" width="700"] Notes: Ages 18+; included all time spent, regardless of multitasking; includes usage via desktop/laptop computers and mobil (smartphones and tablets); excludes spending by marketers that goes toward developing or maintaining a Facebook or Instagra, presence.

Notes: Ages 18+; included all time spent, regardless of multitasking; includes usage via desktop/laptop computers and mobil (smartphones and tablets); excludes spending by marketers that goes toward developing or maintaining a Facebook or Instagra, presence.

*Per adult

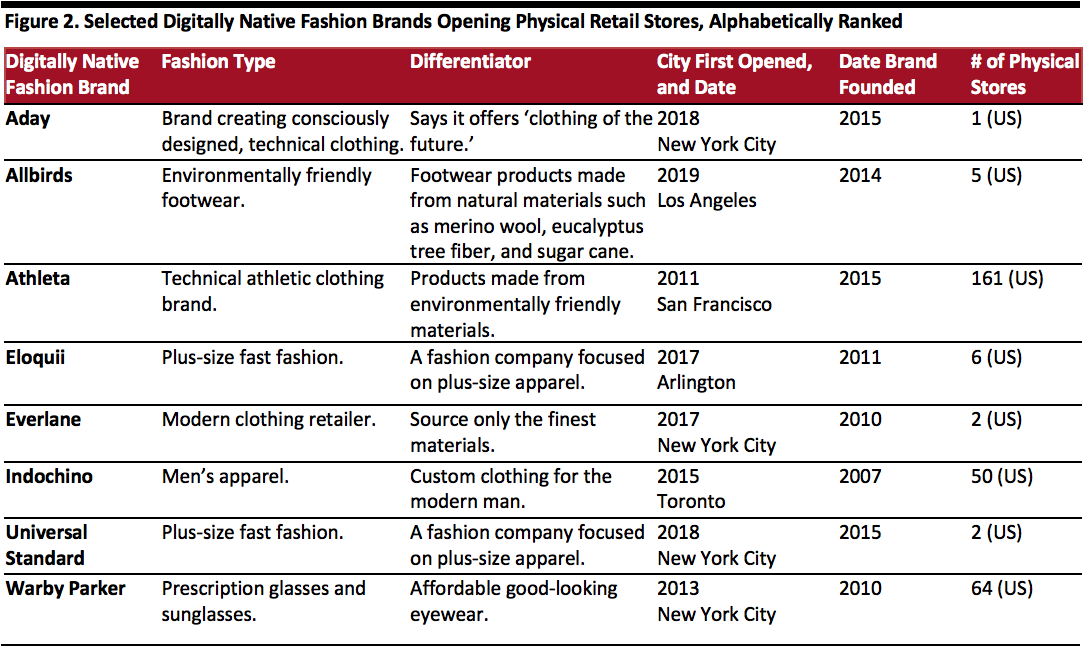

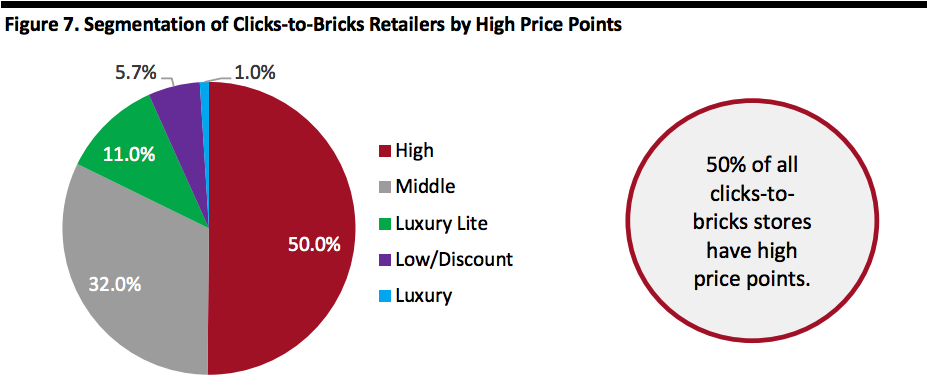

Source: eMarketer[/caption] Pure-Play Digital Retailers Are Creating Physical Storefronts to Provide All-Channel Experiences To service consumer demand for D2C brands, retailers are creating solutions for digitally native brands to find a home offline. Warby Parker was founded in 2010 as an online-only eyeglass retailer, looking to let customers buy designer glasses without having to visit an opthalmologist. But within a year, Warby Parker had opened eight brick-and-mortar stores and now has 64 physical locations in US. According to company reports, more than 50% of the sales now come from physical stores, and about 75% of in-store customers went to the website first – confirming the consumer behavior our research found. Bonobos, a menswear retailer that launched exclusively online in 2007, is now one of the fastest-growing clicks-to-bricks stores based on the number of newly opened physical stores. In 2011, the company expanded its physical footprint with its “guideshop” model, which offers appointments at a store to try on items first and then place the order online while in the store. The business model keeps inventory costs low by using the website as a virtual back room. In May this year, Rent the Runway, launched in 2009, opened its largest brick-and-mortar store (8,300 square feet) in San Francisco. The company has opened a total of six stores. [caption id="attachment_95174" align="aligncenter" width="700"] Source: Techcrunch

Source: Techcrunch

Rent the Runway Storefronts, San Francisco[/caption] [caption id="attachment_95175" align="aligncenter" width="700"] Source: Company websites/Coresight Research[/caption]

Among the clicks-to-bricks, there are also interactive places for consumers to not only try products, but also to attend events and learn from the store’s fashion advisors.

Fourpost combines what it considers the best brands and experiences under one roof. One of store now offers mini departments curated from digitally native brands. At other locations, the retailer brings together more than 30 brands and offers customization services, fashion classess and focus group discussions.

[caption id="attachment_95176" align="aligncenter" width="700"]

Source: Company websites/Coresight Research[/caption]

Among the clicks-to-bricks, there are also interactive places for consumers to not only try products, but also to attend events and learn from the store’s fashion advisors.

Fourpost combines what it considers the best brands and experiences under one roof. One of store now offers mini departments curated from digitally native brands. At other locations, the retailer brings together more than 30 brands and offers customization services, fashion classess and focus group discussions.

[caption id="attachment_95176" align="aligncenter" width="700"] Source: Design:retail[/caption]

Apparel Fashion Brands Going Offline Enjoy Great Popularity

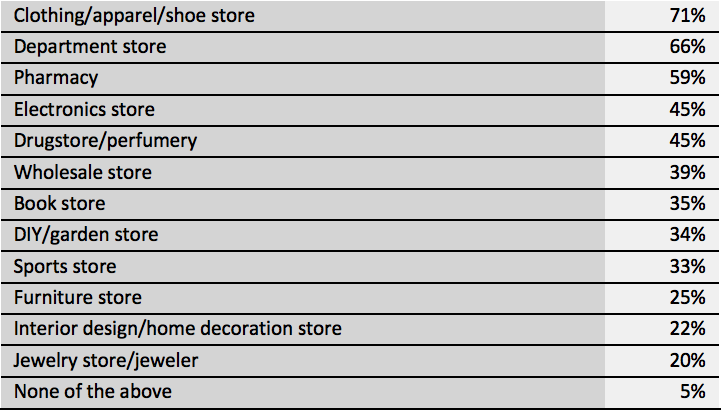

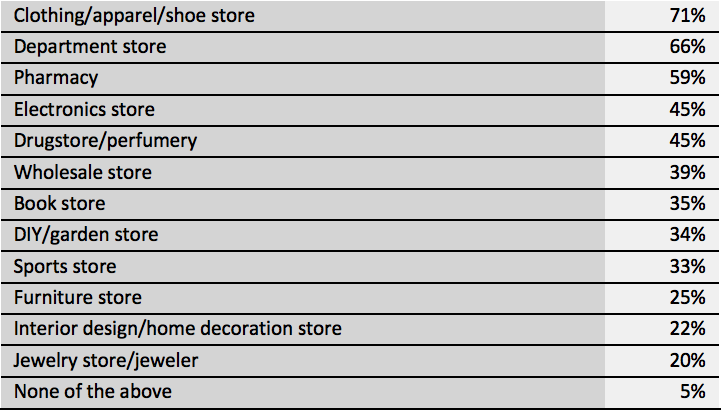

Almost three-quarters of all apparel and footwear sales occur in physical stores. The path to purchase often begins online but usually ends in store. According to a Statista US consumer survey, 71% of respondents say they purchased at a physical clothing, apparel or shoe specialty store in the past 12 months. Department stores (66%) and pharmacies (59%) are the second and third most frequently shopped offline retail formats.

[caption id="attachment_95177" align="aligncenter" width="700"]

Source: Design:retail[/caption]

Apparel Fashion Brands Going Offline Enjoy Great Popularity

Almost three-quarters of all apparel and footwear sales occur in physical stores. The path to purchase often begins online but usually ends in store. According to a Statista US consumer survey, 71% of respondents say they purchased at a physical clothing, apparel or shoe specialty store in the past 12 months. Department stores (66%) and pharmacies (59%) are the second and third most frequently shopped offline retail formats.

[caption id="attachment_95177" align="aligncenter" width="700"] Base: 4,120 US consumers aged 18-64, surveyed in March 2019

Base: 4,120 US consumers aged 18-64, surveyed in March 2019

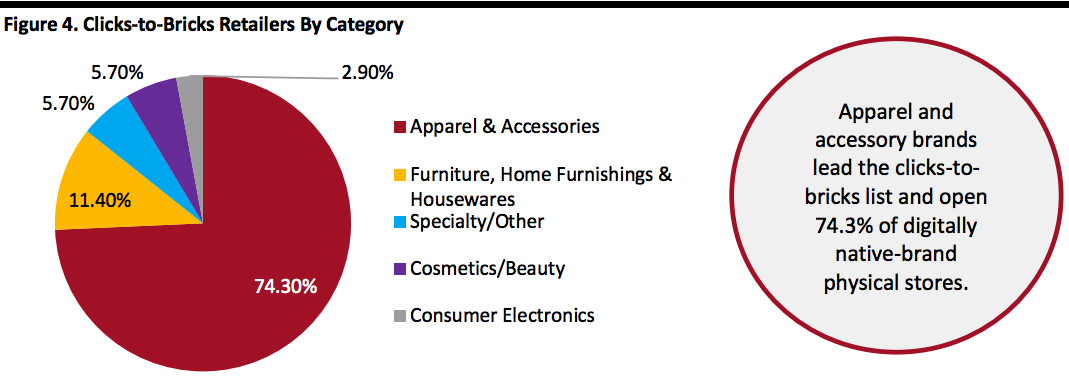

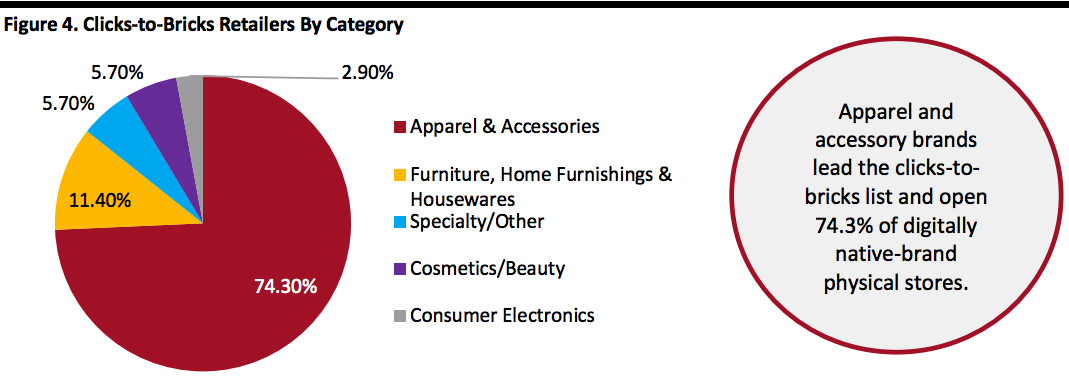

Source: Statista[/caption] According to JLL Research, apparel and accessories brands lead the clicks-to-bricks list and open nearly three-quarters of the digtally native-brand physical stores. The list includes brands such as Bonobos, Everlane and Indochino. Furniture, specialty, cosmetics and consumer electronics combined make up a mere quarter of clicks-to-bricks brands. [caption id="attachment_95178" align="aligncenter" width="700"] Source: JLL Research[/caption]

Consumers aren’t browsing when they shop physical stores, rather, they have an item, color, silouette or fashion in mind, they are focussed shoppers. Browsing and discovery has moved online.

A National Retail Federation (BRF) survey found 73% of respondents are much more likely to be looking for a specific item when they shop in-store, while only 27% say they are just browsing.

When shopping online, though, there was a closer split between searching for an item (54%) and browsing (46%). Given consumers are more purposeful when shopping in physical stores, retailers have to up their merchandising with better products to attract attention while also providing an engaging experience to drive incremental purchases when consumers arrive.

[caption id="attachment_95179" align="aligncenter" width="700"]

Source: JLL Research[/caption]

Consumers aren’t browsing when they shop physical stores, rather, they have an item, color, silouette or fashion in mind, they are focussed shoppers. Browsing and discovery has moved online.

A National Retail Federation (BRF) survey found 73% of respondents are much more likely to be looking for a specific item when they shop in-store, while only 27% say they are just browsing.

When shopping online, though, there was a closer split between searching for an item (54%) and browsing (46%). Given consumers are more purposeful when shopping in physical stores, retailers have to up their merchandising with better products to attract attention while also providing an engaging experience to drive incremental purchases when consumers arrive.

[caption id="attachment_95179" align="aligncenter" width="700"] Base: 2,000+ US consumers aged 18+, surveyed in January 2018

Base: 2,000+ US consumers aged 18+, surveyed in January 2018

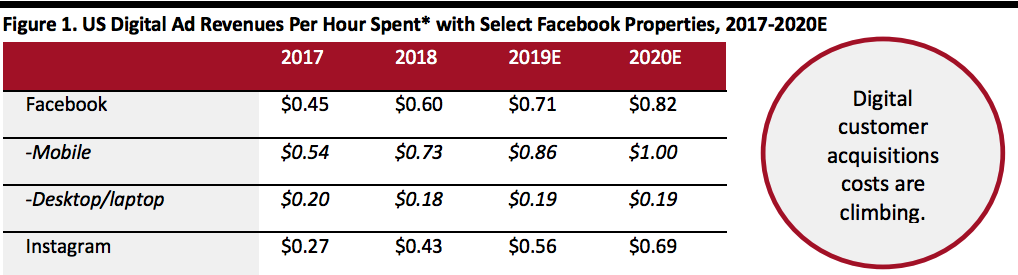

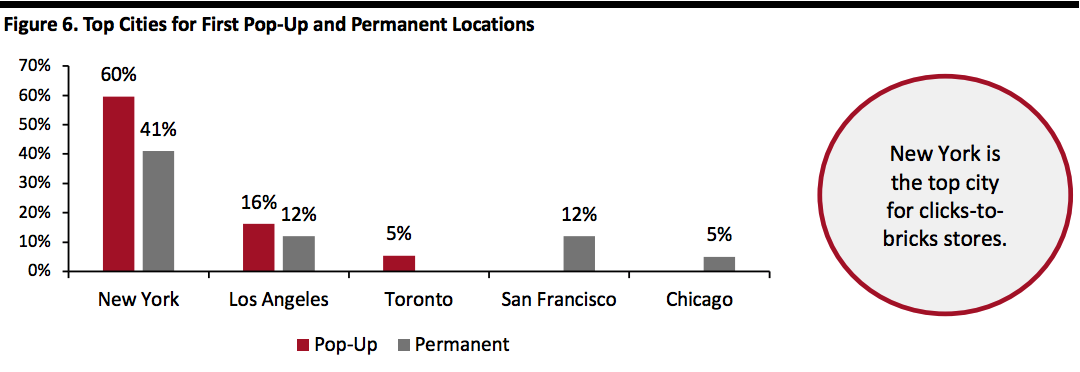

Source: NRF[/caption] New York is the Top City for Clicks-to-Bricks Stores According to JLL Research, almost 62% of permanent clicks-to-bricks stores have opened in the same city in which they launched their first pop-up store. And, New York is the most popular US city for brands and retailers to debut a pop-up (60%) and then set up a permanent store (41%). Los Angeles ranks second with 16% of pop-up and 12% permanent locations, two cities we have highlighted in our 30 Global Retail Cities Series. [caption id="attachment_95180" align="aligncenter" width="700"] Source: JLL Research[/caption]

In New York, 48% of clicks-to-bricks retailers chose SoHo for their first pop-up, according to JLL Research, for two primary reasons: First, SoHo and its surrounding neighborhoods are shopping destinations for locals and tourists, so offers exposure to different consumer types, and second, retail rents in SoHo have been on the decline since 2016 as vacancies increased.

According to CBRE’s Manhattan’s Retail Q1 2019 Marketview report, retail rental asking rates declined 8.6% in Q1 year-over-year in Manhattan. In SoHo, rent on Broadway increased 8.0%, but declined 14.1% on Prince Street (near the Apple store) and fell some 16.7% on Spring Street. Overall vacancy remains elevated.

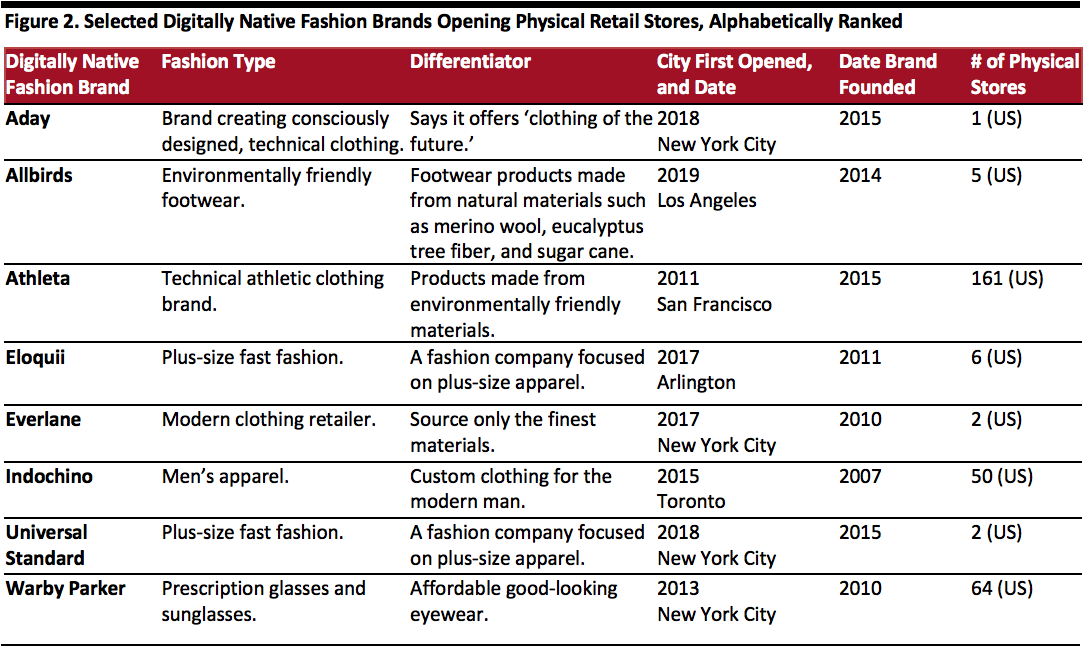

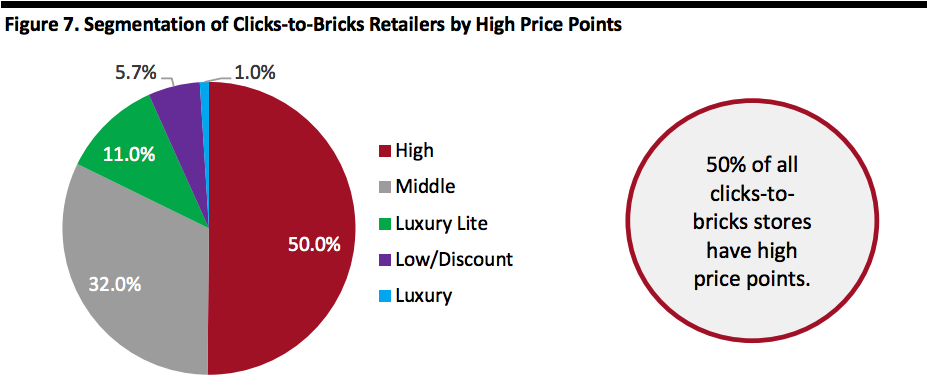

More than half of clicks-to-brick retailers are considered high, luxury or luxury lite with higher than average price points.

[caption id="attachment_95181" align="aligncenter" width="700"]

Source: JLL Research[/caption]

In New York, 48% of clicks-to-bricks retailers chose SoHo for their first pop-up, according to JLL Research, for two primary reasons: First, SoHo and its surrounding neighborhoods are shopping destinations for locals and tourists, so offers exposure to different consumer types, and second, retail rents in SoHo have been on the decline since 2016 as vacancies increased.

According to CBRE’s Manhattan’s Retail Q1 2019 Marketview report, retail rental asking rates declined 8.6% in Q1 year-over-year in Manhattan. In SoHo, rent on Broadway increased 8.0%, but declined 14.1% on Prince Street (near the Apple store) and fell some 16.7% on Spring Street. Overall vacancy remains elevated.

More than half of clicks-to-brick retailers are considered high, luxury or luxury lite with higher than average price points.

[caption id="attachment_95181" align="aligncenter" width="700"] Base: 3,172 US consumers aged 18+, surveyed in Q4 2017

Base: 3,172 US consumers aged 18+, surveyed in Q4 2017

Source: JLL Research[/caption] How Bricks Impact Clicks: The Halo Effect An International of Shopping Centers (ICSC) survey shows that having a offline retail presence boosts a brand’s online retail traffic. For emerging brands, defined as brands less than 10 years old, new store openings drive on average a 45% boost in web traffic. Established retailers, defined as those with more than 10 years of experience, see a 36% increase in web traffic following a new store opening. The 2018 ISCS Survey, The Halo Effect: How Bricks Impact Clicks assessed the relationship between offline retail and online retail. The survey analyzed store openings, closures, online traffic, and consumer perceptions from 804 retail stores in 145 US markets, from 4,000 consumers. The study found that for markets in which brands have physical stores, the brands perform better on “health metrics” including brand awareness, consumer perception, and willingness to recommend to friends. The study highlighted that 48% of respondents were aware of the brands in markets with physical stores, compared with 44% of respondents nationwide. Conversely, the ICSC survey revealed that closing offline stores causes a drop in web traffic, with the number of store closings impacting all brands and retailers in varying degrees. Key Insights Digitally native fashion brands are continuing to grow and move from online to offline.

Notes: Ages 18+; included all time spent, regardless of multitasking; includes usage via desktop/laptop computers and mobil (smartphones and tablets); excludes spending by marketers that goes toward developing or maintaining a Facebook or Instagra, presence.

Notes: Ages 18+; included all time spent, regardless of multitasking; includes usage via desktop/laptop computers and mobil (smartphones and tablets); excludes spending by marketers that goes toward developing or maintaining a Facebook or Instagra, presence.*Per adult

Source: eMarketer[/caption] Pure-Play Digital Retailers Are Creating Physical Storefronts to Provide All-Channel Experiences To service consumer demand for D2C brands, retailers are creating solutions for digitally native brands to find a home offline. Warby Parker was founded in 2010 as an online-only eyeglass retailer, looking to let customers buy designer glasses without having to visit an opthalmologist. But within a year, Warby Parker had opened eight brick-and-mortar stores and now has 64 physical locations in US. According to company reports, more than 50% of the sales now come from physical stores, and about 75% of in-store customers went to the website first – confirming the consumer behavior our research found. Bonobos, a menswear retailer that launched exclusively online in 2007, is now one of the fastest-growing clicks-to-bricks stores based on the number of newly opened physical stores. In 2011, the company expanded its physical footprint with its “guideshop” model, which offers appointments at a store to try on items first and then place the order online while in the store. The business model keeps inventory costs low by using the website as a virtual back room. In May this year, Rent the Runway, launched in 2009, opened its largest brick-and-mortar store (8,300 square feet) in San Francisco. The company has opened a total of six stores. [caption id="attachment_95174" align="aligncenter" width="700"]

Source: Techcrunch

Source: TechcrunchRent the Runway Storefronts, San Francisco[/caption] [caption id="attachment_95175" align="aligncenter" width="700"]

Source: Company websites/Coresight Research[/caption]

Among the clicks-to-bricks, there are also interactive places for consumers to not only try products, but also to attend events and learn from the store’s fashion advisors.

Fourpost combines what it considers the best brands and experiences under one roof. One of store now offers mini departments curated from digitally native brands. At other locations, the retailer brings together more than 30 brands and offers customization services, fashion classess and focus group discussions.

[caption id="attachment_95176" align="aligncenter" width="700"]

Source: Company websites/Coresight Research[/caption]

Among the clicks-to-bricks, there are also interactive places for consumers to not only try products, but also to attend events and learn from the store’s fashion advisors.

Fourpost combines what it considers the best brands and experiences under one roof. One of store now offers mini departments curated from digitally native brands. At other locations, the retailer brings together more than 30 brands and offers customization services, fashion classess and focus group discussions.

[caption id="attachment_95176" align="aligncenter" width="700"] Source: Design:retail[/caption]

Apparel Fashion Brands Going Offline Enjoy Great Popularity

Almost three-quarters of all apparel and footwear sales occur in physical stores. The path to purchase often begins online but usually ends in store. According to a Statista US consumer survey, 71% of respondents say they purchased at a physical clothing, apparel or shoe specialty store in the past 12 months. Department stores (66%) and pharmacies (59%) are the second and third most frequently shopped offline retail formats.

[caption id="attachment_95177" align="aligncenter" width="700"]

Source: Design:retail[/caption]

Apparel Fashion Brands Going Offline Enjoy Great Popularity

Almost three-quarters of all apparel and footwear sales occur in physical stores. The path to purchase often begins online but usually ends in store. According to a Statista US consumer survey, 71% of respondents say they purchased at a physical clothing, apparel or shoe specialty store in the past 12 months. Department stores (66%) and pharmacies (59%) are the second and third most frequently shopped offline retail formats.

[caption id="attachment_95177" align="aligncenter" width="700"] Base: 4,120 US consumers aged 18-64, surveyed in March 2019

Base: 4,120 US consumers aged 18-64, surveyed in March 2019Source: Statista[/caption] According to JLL Research, apparel and accessories brands lead the clicks-to-bricks list and open nearly three-quarters of the digtally native-brand physical stores. The list includes brands such as Bonobos, Everlane and Indochino. Furniture, specialty, cosmetics and consumer electronics combined make up a mere quarter of clicks-to-bricks brands. [caption id="attachment_95178" align="aligncenter" width="700"]

Source: JLL Research[/caption]

Consumers aren’t browsing when they shop physical stores, rather, they have an item, color, silouette or fashion in mind, they are focussed shoppers. Browsing and discovery has moved online.

A National Retail Federation (BRF) survey found 73% of respondents are much more likely to be looking for a specific item when they shop in-store, while only 27% say they are just browsing.

When shopping online, though, there was a closer split between searching for an item (54%) and browsing (46%). Given consumers are more purposeful when shopping in physical stores, retailers have to up their merchandising with better products to attract attention while also providing an engaging experience to drive incremental purchases when consumers arrive.

[caption id="attachment_95179" align="aligncenter" width="700"]

Source: JLL Research[/caption]

Consumers aren’t browsing when they shop physical stores, rather, they have an item, color, silouette or fashion in mind, they are focussed shoppers. Browsing and discovery has moved online.

A National Retail Federation (BRF) survey found 73% of respondents are much more likely to be looking for a specific item when they shop in-store, while only 27% say they are just browsing.

When shopping online, though, there was a closer split between searching for an item (54%) and browsing (46%). Given consumers are more purposeful when shopping in physical stores, retailers have to up their merchandising with better products to attract attention while also providing an engaging experience to drive incremental purchases when consumers arrive.

[caption id="attachment_95179" align="aligncenter" width="700"] Base: 2,000+ US consumers aged 18+, surveyed in January 2018

Base: 2,000+ US consumers aged 18+, surveyed in January 2018Source: NRF[/caption] New York is the Top City for Clicks-to-Bricks Stores According to JLL Research, almost 62% of permanent clicks-to-bricks stores have opened in the same city in which they launched their first pop-up store. And, New York is the most popular US city for brands and retailers to debut a pop-up (60%) and then set up a permanent store (41%). Los Angeles ranks second with 16% of pop-up and 12% permanent locations, two cities we have highlighted in our 30 Global Retail Cities Series. [caption id="attachment_95180" align="aligncenter" width="700"]

Source: JLL Research[/caption]

In New York, 48% of clicks-to-bricks retailers chose SoHo for their first pop-up, according to JLL Research, for two primary reasons: First, SoHo and its surrounding neighborhoods are shopping destinations for locals and tourists, so offers exposure to different consumer types, and second, retail rents in SoHo have been on the decline since 2016 as vacancies increased.

According to CBRE’s Manhattan’s Retail Q1 2019 Marketview report, retail rental asking rates declined 8.6% in Q1 year-over-year in Manhattan. In SoHo, rent on Broadway increased 8.0%, but declined 14.1% on Prince Street (near the Apple store) and fell some 16.7% on Spring Street. Overall vacancy remains elevated.

More than half of clicks-to-brick retailers are considered high, luxury or luxury lite with higher than average price points.

[caption id="attachment_95181" align="aligncenter" width="700"]

Source: JLL Research[/caption]

In New York, 48% of clicks-to-bricks retailers chose SoHo for their first pop-up, according to JLL Research, for two primary reasons: First, SoHo and its surrounding neighborhoods are shopping destinations for locals and tourists, so offers exposure to different consumer types, and second, retail rents in SoHo have been on the decline since 2016 as vacancies increased.

According to CBRE’s Manhattan’s Retail Q1 2019 Marketview report, retail rental asking rates declined 8.6% in Q1 year-over-year in Manhattan. In SoHo, rent on Broadway increased 8.0%, but declined 14.1% on Prince Street (near the Apple store) and fell some 16.7% on Spring Street. Overall vacancy remains elevated.

More than half of clicks-to-brick retailers are considered high, luxury or luxury lite with higher than average price points.

[caption id="attachment_95181" align="aligncenter" width="700"] Base: 3,172 US consumers aged 18+, surveyed in Q4 2017

Base: 3,172 US consumers aged 18+, surveyed in Q4 2017Source: JLL Research[/caption] How Bricks Impact Clicks: The Halo Effect An International of Shopping Centers (ICSC) survey shows that having a offline retail presence boosts a brand’s online retail traffic. For emerging brands, defined as brands less than 10 years old, new store openings drive on average a 45% boost in web traffic. Established retailers, defined as those with more than 10 years of experience, see a 36% increase in web traffic following a new store opening. The 2018 ISCS Survey, The Halo Effect: How Bricks Impact Clicks assessed the relationship between offline retail and online retail. The survey analyzed store openings, closures, online traffic, and consumer perceptions from 804 retail stores in 145 US markets, from 4,000 consumers. The study found that for markets in which brands have physical stores, the brands perform better on “health metrics” including brand awareness, consumer perception, and willingness to recommend to friends. The study highlighted that 48% of respondents were aware of the brands in markets with physical stores, compared with 44% of respondents nationwide. Conversely, the ICSC survey revealed that closing offline stores causes a drop in web traffic, with the number of store closings impacting all brands and retailers in varying degrees. Key Insights Digitally native fashion brands are continuing to grow and move from online to offline.

- Pure-play digital retailers are creating physical storefronts to provide an “all channel” experience.

- With digital advertising costs rising as effectiveness falls, digitally native brands are looking for other ways to reach customers and finding physical locations are a viable alternative.

- Physcial stores are a point of discovery for emerging brands: A new store opening generates an average 45% lift in web traffic, according to an International Council of Shopping Center (ICSC) survey.

- New York remains the top US city for offline stores and pop-ups, a testament to the power of internationally renowned flagship cities for fashion discovery.