albert Chan

[caption id="attachment_78470" align="aligncenter" width="680"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

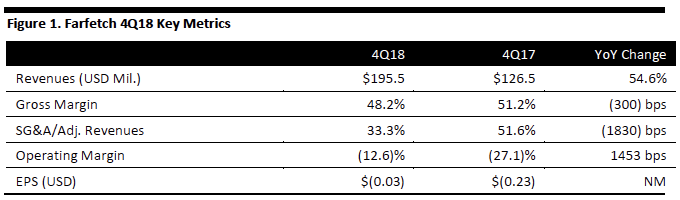

Farfetch’s 4Q18 revenues grew 54.6% to $195.5 million, beating the $180.3 million consensus estimate. GMV rose 50.1%, or $155.8 million, to $466.5 million. Adjusted revenues, net of platform fulfillment revenue, was $170.1 million, up 66.0%. Full year 2018 GMV was $1.40 billion, up 54.7%, 2018 revenue rose 56.1% to $602.4 million and adjusted revenue rose 61.8% to $504.6 million.

Active customers rose 44.6% to 1.35 million, and the number of orders increased 57.8% to 945,000 as the average transaction value declined 4.9% or $33.10 to $637.30. The decline in average transaction value reflects foreign currency translation impacts as well as a reduced level of fulfillment revenue as Farfetch increased customer investments.

The company’s gross margin decreased 300 bps, to 48.1%, primarily driven increases in first-party sales as well as delivery, packaging and transaction processing expenditures increased with the increased number of orders.

SG&A expense as a percentage of sales decreased 1,830 bps to 33.3% of sales as G&A expenses grew less rapidly than the topline, up 7.2% to $56.7 million. Demand generation expense increased 45.9% YoY to $33.9 million, or 20.5% of platform services revenue, a YoY improvement of 309 bps, which primarily resulted from performance marketing efficiencies in driving platform GMV growth. The 4Q operating margin improved 1,453 bps to (12.6)% of sales. The operating loss was $24.6 million.

The company reported a 4Q $(0.03) loss per share, beating the $(0.09) loss per share estimate and a $(0.23) loss in the year ago quarter.

With the luxury industry projected to approach $500 billion in the coming decade and online sales potentially representing an incremental $100 billion opportunity, with much of the increment stemming from the Chinese consumer, Farfetch separately announced the expansion of its strategic partnership with JD.com (the largest retailer in China) to provide what it calls the “Premier Luxury Gateway to China.” Under the agreement, JD.com’s Toplife will merge with Farfetch China. Farfetch gains Level 1 entry point on the JD.com app, giving JD.com’s 300 million customers instant access to the more than 3,000 brands on Farfetch’s network of more than 1,000 luxury brand and boutique partners.

Outlook

The outlook for 2019 includes 40% YoY growth in GMV and full year adjusted EBITDA margin of (18)%–(19)%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

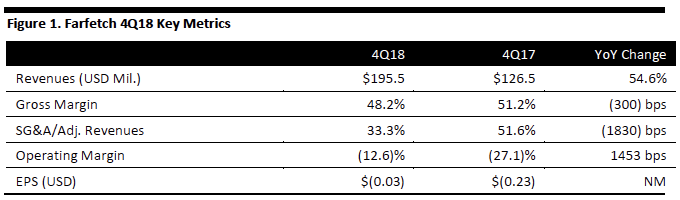

Farfetch’s 4Q18 revenues grew 54.6% to $195.5 million, beating the $180.3 million consensus estimate. GMV rose 50.1%, or $155.8 million, to $466.5 million. Adjusted revenues, net of platform fulfillment revenue, was $170.1 million, up 66.0%. Full year 2018 GMV was $1.40 billion, up 54.7%, 2018 revenue rose 56.1% to $602.4 million and adjusted revenue rose 61.8% to $504.6 million.

Active customers rose 44.6% to 1.35 million, and the number of orders increased 57.8% to 945,000 as the average transaction value declined 4.9% or $33.10 to $637.30. The decline in average transaction value reflects foreign currency translation impacts as well as a reduced level of fulfillment revenue as Farfetch increased customer investments.

The company’s gross margin decreased 300 bps, to 48.1%, primarily driven increases in first-party sales as well as delivery, packaging and transaction processing expenditures increased with the increased number of orders.

SG&A expense as a percentage of sales decreased 1,830 bps to 33.3% of sales as G&A expenses grew less rapidly than the topline, up 7.2% to $56.7 million. Demand generation expense increased 45.9% YoY to $33.9 million, or 20.5% of platform services revenue, a YoY improvement of 309 bps, which primarily resulted from performance marketing efficiencies in driving platform GMV growth. The 4Q operating margin improved 1,453 bps to (12.6)% of sales. The operating loss was $24.6 million.

The company reported a 4Q $(0.03) loss per share, beating the $(0.09) loss per share estimate and a $(0.23) loss in the year ago quarter.

With the luxury industry projected to approach $500 billion in the coming decade and online sales potentially representing an incremental $100 billion opportunity, with much of the increment stemming from the Chinese consumer, Farfetch separately announced the expansion of its strategic partnership with JD.com (the largest retailer in China) to provide what it calls the “Premier Luxury Gateway to China.” Under the agreement, JD.com’s Toplife will merge with Farfetch China. Farfetch gains Level 1 entry point on the JD.com app, giving JD.com’s 300 million customers instant access to the more than 3,000 brands on Farfetch’s network of more than 1,000 luxury brand and boutique partners.

Outlook

The outlook for 2019 includes 40% YoY growth in GMV and full year adjusted EBITDA margin of (18)%–(19)%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Farfetch’s 4Q18 revenues grew 54.6% to $195.5 million, beating the $180.3 million consensus estimate. GMV rose 50.1%, or $155.8 million, to $466.5 million. Adjusted revenues, net of platform fulfillment revenue, was $170.1 million, up 66.0%. Full year 2018 GMV was $1.40 billion, up 54.7%, 2018 revenue rose 56.1% to $602.4 million and adjusted revenue rose 61.8% to $504.6 million.

Active customers rose 44.6% to 1.35 million, and the number of orders increased 57.8% to 945,000 as the average transaction value declined 4.9% or $33.10 to $637.30. The decline in average transaction value reflects foreign currency translation impacts as well as a reduced level of fulfillment revenue as Farfetch increased customer investments.

The company’s gross margin decreased 300 bps, to 48.1%, primarily driven increases in first-party sales as well as delivery, packaging and transaction processing expenditures increased with the increased number of orders.

SG&A expense as a percentage of sales decreased 1,830 bps to 33.3% of sales as G&A expenses grew less rapidly than the topline, up 7.2% to $56.7 million. Demand generation expense increased 45.9% YoY to $33.9 million, or 20.5% of platform services revenue, a YoY improvement of 309 bps, which primarily resulted from performance marketing efficiencies in driving platform GMV growth. The 4Q operating margin improved 1,453 bps to (12.6)% of sales. The operating loss was $24.6 million.

The company reported a 4Q $(0.03) loss per share, beating the $(0.09) loss per share estimate and a $(0.23) loss in the year ago quarter.

With the luxury industry projected to approach $500 billion in the coming decade and online sales potentially representing an incremental $100 billion opportunity, with much of the increment stemming from the Chinese consumer, Farfetch separately announced the expansion of its strategic partnership with JD.com (the largest retailer in China) to provide what it calls the “Premier Luxury Gateway to China.” Under the agreement, JD.com’s Toplife will merge with Farfetch China. Farfetch gains Level 1 entry point on the JD.com app, giving JD.com’s 300 million customers instant access to the more than 3,000 brands on Farfetch’s network of more than 1,000 luxury brand and boutique partners.

Outlook

The outlook for 2019 includes 40% YoY growth in GMV and full year adjusted EBITDA margin of (18)%–(19)%.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

Farfetch’s 4Q18 revenues grew 54.6% to $195.5 million, beating the $180.3 million consensus estimate. GMV rose 50.1%, or $155.8 million, to $466.5 million. Adjusted revenues, net of platform fulfillment revenue, was $170.1 million, up 66.0%. Full year 2018 GMV was $1.40 billion, up 54.7%, 2018 revenue rose 56.1% to $602.4 million and adjusted revenue rose 61.8% to $504.6 million.

Active customers rose 44.6% to 1.35 million, and the number of orders increased 57.8% to 945,000 as the average transaction value declined 4.9% or $33.10 to $637.30. The decline in average transaction value reflects foreign currency translation impacts as well as a reduced level of fulfillment revenue as Farfetch increased customer investments.

The company’s gross margin decreased 300 bps, to 48.1%, primarily driven increases in first-party sales as well as delivery, packaging and transaction processing expenditures increased with the increased number of orders.

SG&A expense as a percentage of sales decreased 1,830 bps to 33.3% of sales as G&A expenses grew less rapidly than the topline, up 7.2% to $56.7 million. Demand generation expense increased 45.9% YoY to $33.9 million, or 20.5% of platform services revenue, a YoY improvement of 309 bps, which primarily resulted from performance marketing efficiencies in driving platform GMV growth. The 4Q operating margin improved 1,453 bps to (12.6)% of sales. The operating loss was $24.6 million.

The company reported a 4Q $(0.03) loss per share, beating the $(0.09) loss per share estimate and a $(0.23) loss in the year ago quarter.

With the luxury industry projected to approach $500 billion in the coming decade and online sales potentially representing an incremental $100 billion opportunity, with much of the increment stemming from the Chinese consumer, Farfetch separately announced the expansion of its strategic partnership with JD.com (the largest retailer in China) to provide what it calls the “Premier Luxury Gateway to China.” Under the agreement, JD.com’s Toplife will merge with Farfetch China. Farfetch gains Level 1 entry point on the JD.com app, giving JD.com’s 300 million customers instant access to the more than 3,000 brands on Farfetch’s network of more than 1,000 luxury brand and boutique partners.

Outlook

The outlook for 2019 includes 40% YoY growth in GMV and full year adjusted EBITDA margin of (18)%–(19)%.