DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

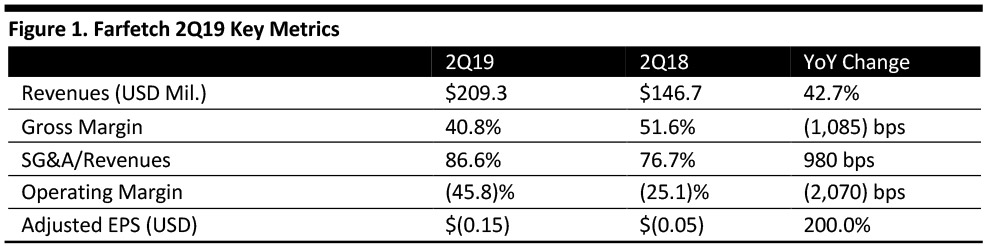

Farfetch 2Q19 revenues grew 42.7% to $209.3 million, beating the $199.7 million consensus estimate, as platform GMV expanded 44.3% to $488.5 million. Adjusted revenues, net of platform fulfillment revenue, was $180.7 million, up 52.3%. Active users increased 55.7% to 1.8 million and the average order declined modestly to $600.40 from $602.40.

Gross margin decreased 1,085 basis points (bps), to 40.8% and SG&A expense as a percentage of sales increased 980 bps to 86.9%. Farfetch reported an adjusted loss of $(0.15) per share, in line with the consensus estimate on a 21.5% increase in the share count and versus a $(0.05) per-share loss in the year ago quarter.

The company added luxury fashion labels Guiseppe Zanotti, Brunello Cucinelli and Stella McCartney as direct brand partners. In China, Farfetch’s second largest region, the integration with JD.com’s platform was completed during 2Q, enabling JD.com’s 310 million users to discover and shop the Farfetch luxury platform.

The company spoke to a tectonic shift in the luxury online wholesale business, in which a palpable and unhealthy increase in discounting and promotions during 1H19 culminated in sharper promotional activities in June and July with many retailers executing a path-to-the-bottom pricing (and profit) strategy.

Farfetch CEO José Neves anticipates the luxury industry will reshape itself in the coming few quarters, with luxury brands moving to a direct-to-consumer model to preserve brand value and luxury image.

Farfetch is well positioned with its e-concession model to assist luxury brands migrate from a wholesale online model to a direct-to-consumer model supported by Farfetch’s $1 billion and 10 years of tech investments.

Concurrent with the earnings release, Farfetch announced the acquisition of 100% of New Guards Group, a brand platform for luxury brand design, production and distribution, for a total enterprise value of $675 million.

Outlook

The outlook for 2019 GMV was increased to reflect the New Guards acquisition as well as the prevailing heightened promotional environment for luxury. GMV is projected at $2.1 billion, up about 50%; platform GMV is estimated at $1.91-1.95 billion, for a 37-40% gain and adjusted EBITDA loss of $(135) to $(145) million for an adjusted EBITDA margin of (15)% to (17)%.