DIpil Das

[caption id="attachment_87874" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

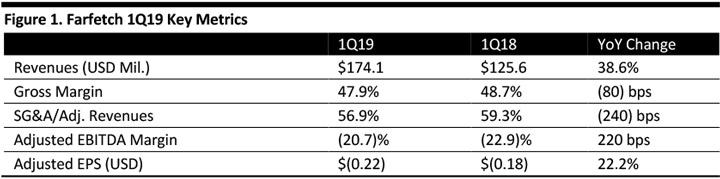

Farfetch’s 1Q19 revenues grew 38.6% to $174.1 million, beating the $171.1 million consensus estimate. GMV rose 43.2%, or $126.6 million, to $419.3 million. Adjusted revenues, net of platform fulfillment revenue, was $146.4 million, up 42%.

The number of active customers rose 64.3% to $1.7 million, and the average order value declined 7.1% or $46.1 to $647.1. The company’s gross margin decreased 80 bps, to 47.9%. SG&A expense as a percentage of sales decreased 240 bps to 56.9%.

Demand generation expense increased 62.3% year over year to $31.4 million, or 22.2% of platform services revenue, a year-over-year improvement of 260 bps. The 1Q19 adjusted EBITDA loss increased $6.6 million, or 27.8%, to $30.2 million. Adjusted EBITDA margin improved from (22.9)% to (20.7)% over the same period, primarily due to the impact of adopting different accounting standards in the first quarter of 2019.

The company reported adjusted EPS of $(0.22), missing the $(0.15) consensus estimate but improving from $(0.18) in the year-ago quarter.

Platform services revenue rose 43.2% to $141.8 million, platform fulfilment revenue increased 22.9% to $27.7 million. In-store revenue improved to $4.5 million, compared to $4 million in 1Q18.

The company added fashion labels Jil Sander, Etro, and Mulberry as direct brand partners and expanded direct supply with existing top brands. The company expanded department store relationships with On Pedder and Joyce of the Lane Crawford Joyce Group, the premier luxury department store group in greater China.

The company offers premium logistics solutions with 3PL warehouses in key regions including Italy, the UK, the US and China, and will continue to work with JD.com to drive sales growth in China. Through the acquisitions of Stadium Goods and Toplife, the company is entering the sneaker resale market.

Outlook

Guidance for 2019 includes 41% growth in GMV and an adjusted EBITDA margin of (16-17)%, slightly higher than 4Q18’s outlook of 40% growth in GMV and an adjusted EBITDA margin of (18-19)%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

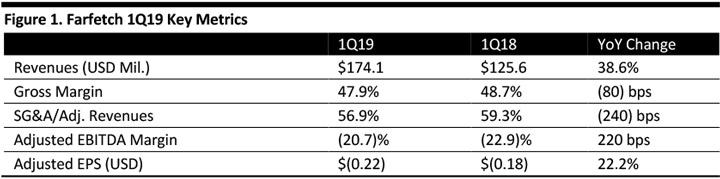

Farfetch’s 1Q19 revenues grew 38.6% to $174.1 million, beating the $171.1 million consensus estimate. GMV rose 43.2%, or $126.6 million, to $419.3 million. Adjusted revenues, net of platform fulfillment revenue, was $146.4 million, up 42%.

The number of active customers rose 64.3% to $1.7 million, and the average order value declined 7.1% or $46.1 to $647.1. The company’s gross margin decreased 80 bps, to 47.9%. SG&A expense as a percentage of sales decreased 240 bps to 56.9%.

Demand generation expense increased 62.3% year over year to $31.4 million, or 22.2% of platform services revenue, a year-over-year improvement of 260 bps. The 1Q19 adjusted EBITDA loss increased $6.6 million, or 27.8%, to $30.2 million. Adjusted EBITDA margin improved from (22.9)% to (20.7)% over the same period, primarily due to the impact of adopting different accounting standards in the first quarter of 2019.

The company reported adjusted EPS of $(0.22), missing the $(0.15) consensus estimate but improving from $(0.18) in the year-ago quarter.

Platform services revenue rose 43.2% to $141.8 million, platform fulfilment revenue increased 22.9% to $27.7 million. In-store revenue improved to $4.5 million, compared to $4 million in 1Q18.

The company added fashion labels Jil Sander, Etro, and Mulberry as direct brand partners and expanded direct supply with existing top brands. The company expanded department store relationships with On Pedder and Joyce of the Lane Crawford Joyce Group, the premier luxury department store group in greater China.

The company offers premium logistics solutions with 3PL warehouses in key regions including Italy, the UK, the US and China, and will continue to work with JD.com to drive sales growth in China. Through the acquisitions of Stadium Goods and Toplife, the company is entering the sneaker resale market.

Outlook

Guidance for 2019 includes 41% growth in GMV and an adjusted EBITDA margin of (16-17)%, slightly higher than 4Q18’s outlook of 40% growth in GMV and an adjusted EBITDA margin of (18-19)%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Farfetch’s 1Q19 revenues grew 38.6% to $174.1 million, beating the $171.1 million consensus estimate. GMV rose 43.2%, or $126.6 million, to $419.3 million. Adjusted revenues, net of platform fulfillment revenue, was $146.4 million, up 42%.

The number of active customers rose 64.3% to $1.7 million, and the average order value declined 7.1% or $46.1 to $647.1. The company’s gross margin decreased 80 bps, to 47.9%. SG&A expense as a percentage of sales decreased 240 bps to 56.9%.

Demand generation expense increased 62.3% year over year to $31.4 million, or 22.2% of platform services revenue, a year-over-year improvement of 260 bps. The 1Q19 adjusted EBITDA loss increased $6.6 million, or 27.8%, to $30.2 million. Adjusted EBITDA margin improved from (22.9)% to (20.7)% over the same period, primarily due to the impact of adopting different accounting standards in the first quarter of 2019.

The company reported adjusted EPS of $(0.22), missing the $(0.15) consensus estimate but improving from $(0.18) in the year-ago quarter.

Platform services revenue rose 43.2% to $141.8 million, platform fulfilment revenue increased 22.9% to $27.7 million. In-store revenue improved to $4.5 million, compared to $4 million in 1Q18.

The company added fashion labels Jil Sander, Etro, and Mulberry as direct brand partners and expanded direct supply with existing top brands. The company expanded department store relationships with On Pedder and Joyce of the Lane Crawford Joyce Group, the premier luxury department store group in greater China.

The company offers premium logistics solutions with 3PL warehouses in key regions including Italy, the UK, the US and China, and will continue to work with JD.com to drive sales growth in China. Through the acquisitions of Stadium Goods and Toplife, the company is entering the sneaker resale market.

Outlook

Guidance for 2019 includes 41% growth in GMV and an adjusted EBITDA margin of (16-17)%, slightly higher than 4Q18’s outlook of 40% growth in GMV and an adjusted EBITDA margin of (18-19)%.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Farfetch’s 1Q19 revenues grew 38.6% to $174.1 million, beating the $171.1 million consensus estimate. GMV rose 43.2%, or $126.6 million, to $419.3 million. Adjusted revenues, net of platform fulfillment revenue, was $146.4 million, up 42%.

The number of active customers rose 64.3% to $1.7 million, and the average order value declined 7.1% or $46.1 to $647.1. The company’s gross margin decreased 80 bps, to 47.9%. SG&A expense as a percentage of sales decreased 240 bps to 56.9%.

Demand generation expense increased 62.3% year over year to $31.4 million, or 22.2% of platform services revenue, a year-over-year improvement of 260 bps. The 1Q19 adjusted EBITDA loss increased $6.6 million, or 27.8%, to $30.2 million. Adjusted EBITDA margin improved from (22.9)% to (20.7)% over the same period, primarily due to the impact of adopting different accounting standards in the first quarter of 2019.

The company reported adjusted EPS of $(0.22), missing the $(0.15) consensus estimate but improving from $(0.18) in the year-ago quarter.

Platform services revenue rose 43.2% to $141.8 million, platform fulfilment revenue increased 22.9% to $27.7 million. In-store revenue improved to $4.5 million, compared to $4 million in 1Q18.

The company added fashion labels Jil Sander, Etro, and Mulberry as direct brand partners and expanded direct supply with existing top brands. The company expanded department store relationships with On Pedder and Joyce of the Lane Crawford Joyce Group, the premier luxury department store group in greater China.

The company offers premium logistics solutions with 3PL warehouses in key regions including Italy, the UK, the US and China, and will continue to work with JD.com to drive sales growth in China. Through the acquisitions of Stadium Goods and Toplife, the company is entering the sneaker resale market.

Outlook

Guidance for 2019 includes 41% growth in GMV and an adjusted EBITDA margin of (16-17)%, slightly higher than 4Q18’s outlook of 40% growth in GMV and an adjusted EBITDA margin of (18-19)%.