Nitheesh NH

Fanatics

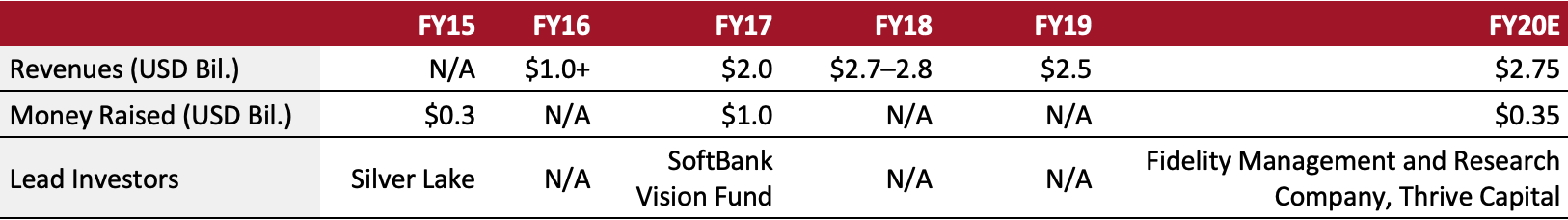

Sector: Apparel and footwear Countries of operation: Australia, China, the UK, the US and seven others Key product categories: Licensed sports accessories, apparel, collectibles and footwear Company owner: Kynetic (comprises three consumer Internet businesses: Fanatics, Rue La La and ShopRunner) Annual Metrics [caption id="attachment_127307" align="aligncenter" width="720"] We estimate metrics for fiscal 2020 as data are not yet released. Fiscal year ends on December 31

We estimate metrics for fiscal 2020 as data are not yet released. Fiscal year ends on December 31Source: Crunchbase/Forbes/NRF[/caption] Summary Founded in 1995 and headquartered in Jacksonville, Florida, Fanatics is a retailer of licensed sportswear, sports equipment and merchandise. The company operates a vertical commerce (or v-commerce) model and designs, manufactures and distributes licensed sports products across retail channels. Fanatics partners with sports leagues, including Major League Baseball and the National Basketball Association, and works with product vendors including Adidas, NIKE and Under Armour. Fanatics’ brands include two e-commerce marketplaces—FansEdge (acquired in 2012) and Kitbag (acquired in 2016)—and three apparel brands: Fanatics, Majestic (acquired in 2017) and Top of the World (acquired in 2020). The company operates more than 300 online and offline stores, as of June 2021. We estimate that Fanatics 2020 revenues reached $2.75 billion. Company Analysis Coresight Research insight: Fanatics reports strong sales for its direct-to-consumer (DTC) digital business, successfully leveraging the growing number of sports-fan consumers who desire a strong connection with sports and sports stars. We expect the company to remain competitive due to its unique market positioning and its relationships with key sports leagues and celebrities. However, an increasing number of orders and the company’s global expansion will add pressure to its supply chain—including on factory capacity, fulfillment center agility and delivery speed. In the future, Fanatics may also face rising license fees for big brands, sports leagues and sports celebrities. The company is still in the process of raising money to assure its financial capability.

| Tailwinds | Headwinds |

|

|

- Expand its omnichannel capabilities

- Improve its mobile app and website navigation functions to enable faster screen-loading times, add larger product images, reduce checkout friction and offer installment payment options.

- Deliver an on-demand supply chain with speed as the key driver

- Design, manufacture and deliver quality sports apparel and gear quickly and efficiently. For example, the company built its distribution centers to minimize storage and maximize picking across stock-keeping units (SKUs).

- Improve its NodeJS cloud commerce platform, its Elasticsearch engine and its deep data science capabilities.

- Make its retail manufacturing and supply chain technologies more responsive.

- Offer a wide selection of licensed products

- Focus on deepening its connection with sports fans and providing them with a way to commemorate unforgettable sports moments. The company’s products include game-used and signed jerseys, balls, framed photos and Championship items—many of which were presented by League-recognized authenticators at games and signing events.

- Build and maintain its range of exclusive relationships with sports stars. The company currently has relationships some of the biggest names in American sport, such as baseball player Aaron Judge, American football quarterback Carson Wentz and retired baseball player David Ortiz.

| Date | Development |

| September 23, 2021 | Fanatics opens a new flagship store in New York City. |

| March 3, 2021 | Fanatics appoints Earvin “Magic” Johnson, one of the most decorated professional basketball players in history, to its Board of Directors. |

| December 21, 2020 | Fanatics and Barnes & Noble Education announce a new partnership. |

| December 1, 2020 | Fanatics signs a 10-year strategic partnership with Shimizu S-Pulse, a professional Japanese soccer club. |

| November 19, 2020 | Fanatics enters a multiyear e-commerce partnership with National Lacrosse League, a men’s professional box lacrosse league in North America. |

| September 8, 2020 | Fanatics acquires the assets of headwear company Top of the World. |

| September 7, 2020 | Fanatics expands its headwear business with the acquisition of Vetta Brands assets. |

| August 14, 2020 | Fanatics completes its Series E funding stage, raising $350 million. |

- Michael Rubin—Executive Chairman

- Doug Mack—CEO

- Mich Chandlee—Chief Financial Officer

- Gina Sprenger—Chief Strategic Retail Officer

- Jack Boyle—Global Co-President, DTC

- Chris Orton—Global Co-President, DTC

Source: Company reports