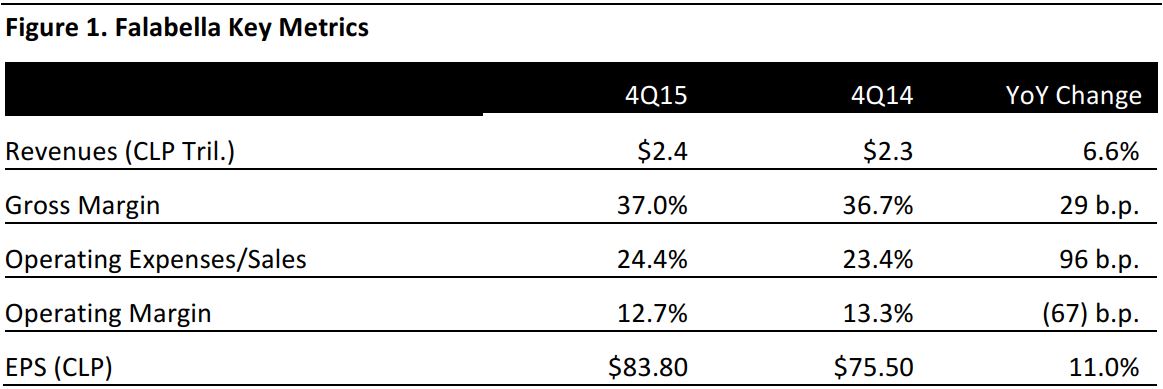

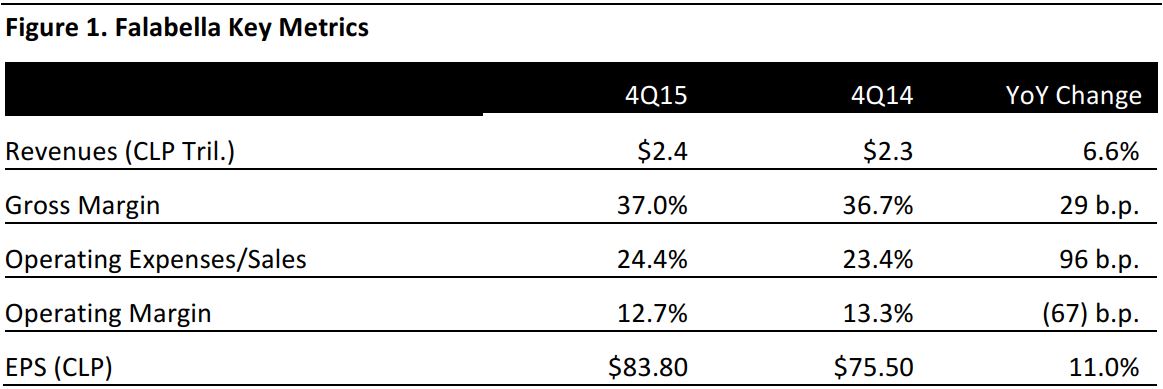

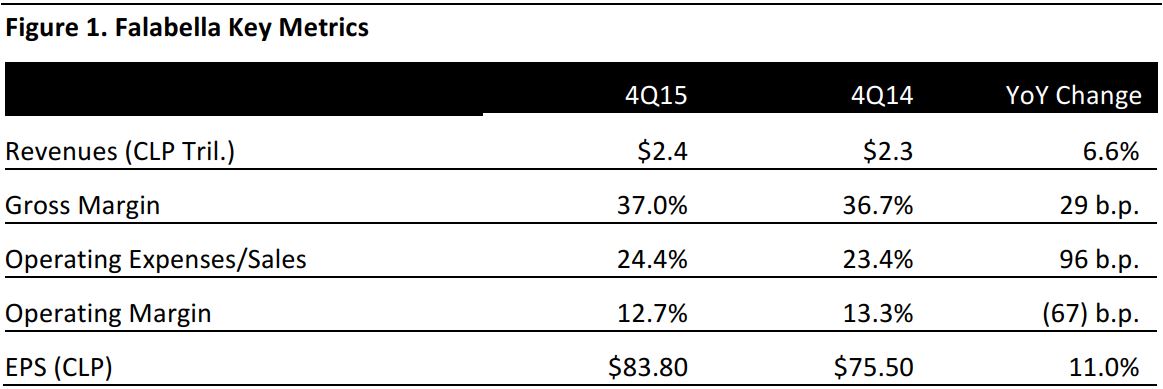

Source: Company reports/Bloomberg

4Q15 RESULTS

Falabella’s 4Q15 year-over-year revenue growth of 6.6% was due in part to increases in sales area and same-stores sales, particularly in Chile. The growth was partially offset by depreciation in the Colombian peso, Brazilian real and Argentine peso against the Chilean peso.

Comps increased the most in Argentina, where they grew by 20.3% for department stores and by 36.4% for home improvement stores. Chile saw significant growth in comps as well, with department store, home improvement store and supermarket comps up 8.7%, 4.9% and 2.7%, respectively.

All business units in Chile reported revenue growth in 4Q15; revenues at Sodimac and Falabella grew by 7.3% and 8.0%, respectively. Business units in Peru and Argentina reported revenue growth of 5.4% and 21.3%, respectively. Colombian and Brazilian revenues decreased year over year, however, mostly due to the depreciation of the Colombian peso and the Brazilian real against the Chilean peso.

2015 RESULTS

Falabella’s revenues for 2015 were CLP$8.4 billion, up 10.4% from 2014.

Comps in Chile increased in department stores, home improvement stores and supermarkets by 6.1%, 6.8% and 3.6%, respectively. Peru saw a decrease of 1.2% in same-store department store sales and a decrease of 3.4% in same-store home improvement store sales. Supermarkets in Peru saw comp growth of 0.7%. Colombian department store comps decreased by 1.0%, while home improvement store comps grew by 11.6%. Argentina saw high same-store sales growth in both department stores and home improvement stores, of 16.4% and 37.7%, respectively. Brazilian home improvement store comps decreased by 4.0%.

Bloomberg reported 2015 EPS of CLP$213.60, up 11.8% from CLP$191.06 in 2014 and slightly above the consensus estimate of CLP$212.03. The 2016 EPS consensus estimate is CLP$235.65.

GUIDANCE

The company intends to invest US$4.0 billion over the next four years to expand throughout Latin America. Of this amount, 44% will be allocated to opening 131 new stores and 10 new shopping centers, while 30% will be invested in logistics and IT in order to continue to grow omni-channel operations, which will help improve efficiency. The remaining 26% will be used to increase selling area and remodel existing shopping centers and stores.