Nitheesh NH

As the negative impacts of the ongoing coronavirus pandemic continue to be felt around the world, we think that Western retailers and brands should look ahead to the opportunities that they could leverage from Singles’ Day 2020 on November 11. As the world’s largest 24-hour online shopping event in terms of GMV, Singles’ Day presents a means for brands to significantly boost sales following a bleak period of temporary store closures—a period that does not yet have a confirmed end date in the West.

Mitigating the Impact of the Coronavirus

Given the store closures and the depressed demand in Western markets, companies selling discretionary goods are likely to head toward the fall season with a glut of inventory. Singles’ Day will provide the chance to clear some of that inventory in non-Western markets—as long as products still have relevance.

Moreover, we retain a cautious outlook for European and US retail demand through the remainder of 2020: Even if the coronavirus shutdown turns out to be for a relatively short period of time, its profound effects on the economy and labor market are likely to inhibit consumer demand in the West throughout the rest of the year. Singles’ Day could therefore provide an opportunity for retailers to offset weak domestic markets, including what may be a very weak holiday period.

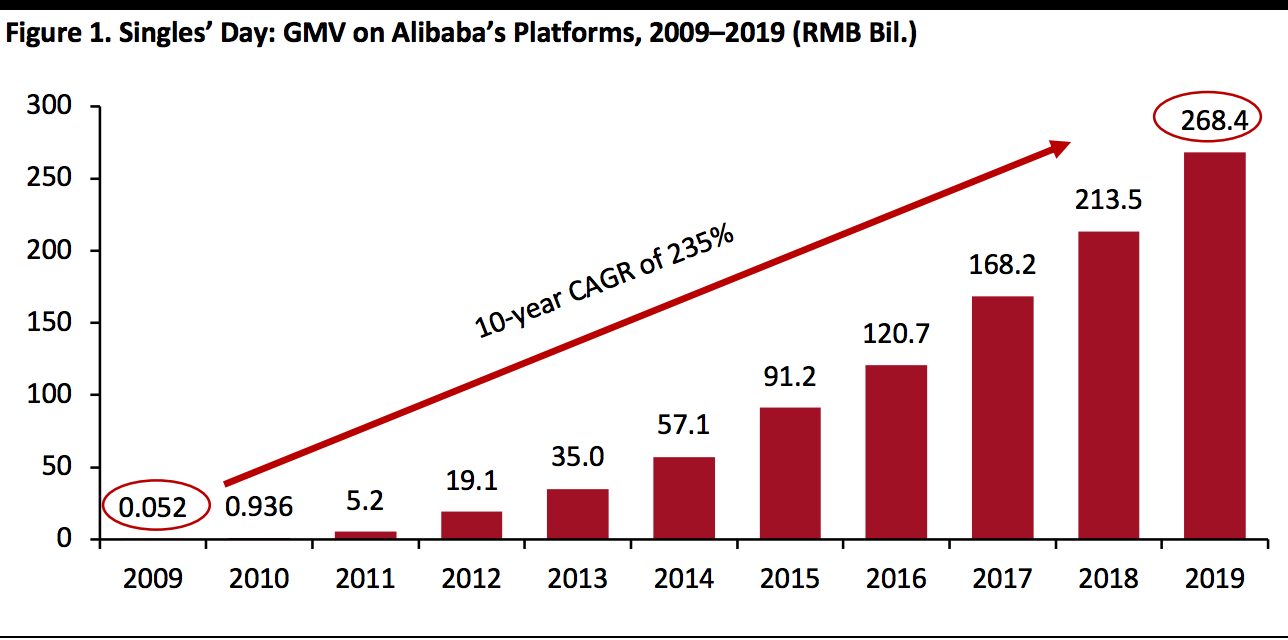

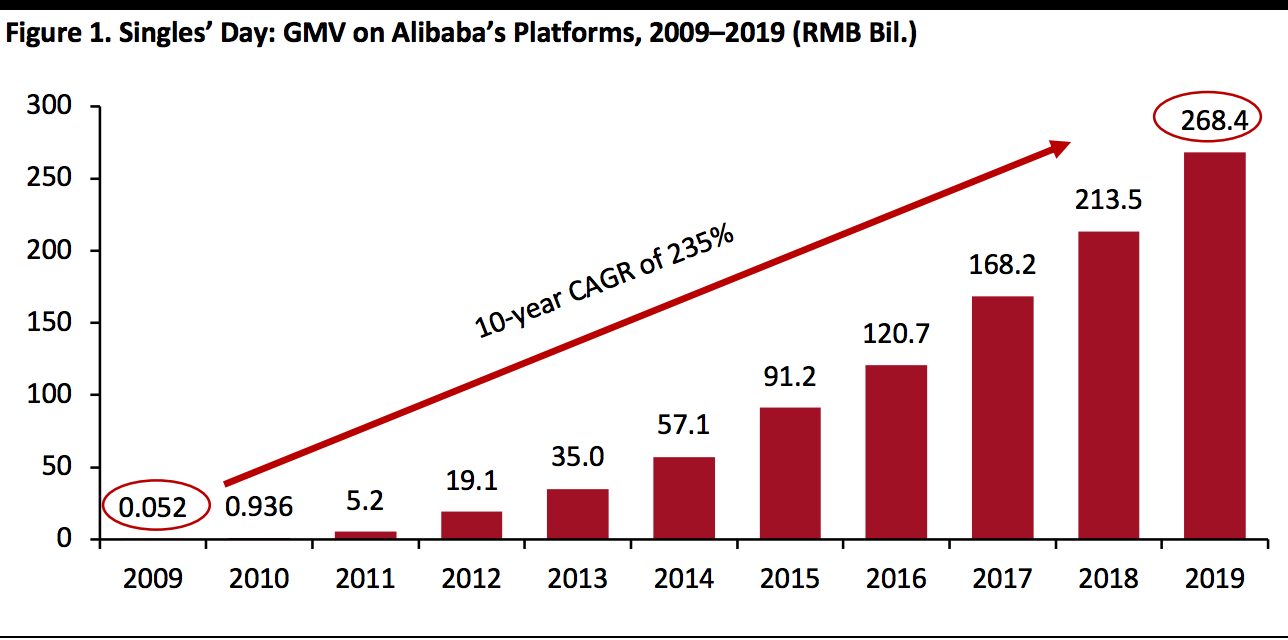

The annual Singles’ Day event began as a festival of young Chinese people celebrating their pride in being single (becoming a counterpart to Valentine’s Day in February). Chinese e-commerce giant Alibaba began promoting the day as a shopping holiday (officially called the 11.11 Global Shopping Festival) in 2009. Since then, the festival has grown exponentially: Last year, total GMV on Alibaba’s various e-commerce platforms reached a record ¥268.4 billion ($38.4 billion), up 26% from the prior year and representing a huge 235% CAGR over the past decade.

[caption id="attachment_107418" align="aligncenter" width="580"] Source: Alibaba/Coresight Research[/caption]

An Event Bigger than Prime Day, Black Friday and Cyber Monday Combined in the US

The scale of Singles’ Day compared to other major shopping festivals shows how important it should be for retailers. Amazon kicked off its fifth annual Prime Day shopping extravaganza in the US on July 15, 2019. The company extended the sale period to two full days from 2018’s 36 hours. We estimated that Amazon Prime Day collected $3.6 billion in online sales in the US. For Black Friday last year, Salesforce estimated that digital sales totaled $7.2 billion, with Cyber Monday bringing in $8.0 billion. By comparison, Alibaba’s GMV on Singles’ Day alone dwarfed the total digital sales of all three shopping holidays combined in the US.

Increased Participation and Product Offerings

When the Singles’ Day festival first started in 2009, only 27 brands participated, generating a total GMV of $7.7 million. Although this seems like a small amount, it was more than six times the average daily GMV of $1.2 million at the time. Showing the huge growth of the shopping event, more than 200,000 domestic and overseas brands participated in Singles’ Day 2019. The number of brands that achieved a GMV of ¥100 million ($14.3 million) reached 299 last year, up from 237 in 2018.

Singles’ Day also represents an opportunity for brands to reach new customers who are ready to shop. Last year, in order to drive consumer excitement for the event, Alibaba launched 1 million new products on Taobao and Tmall during the entire festival period (which started with the pre-sales period launch on October 21), with 240 of those themed specifically around Singles’ Day. Cosmetics brand MAC sold 60,000 units of its Double 11-exclusive lipstick in the first five minutes of pre-sales.

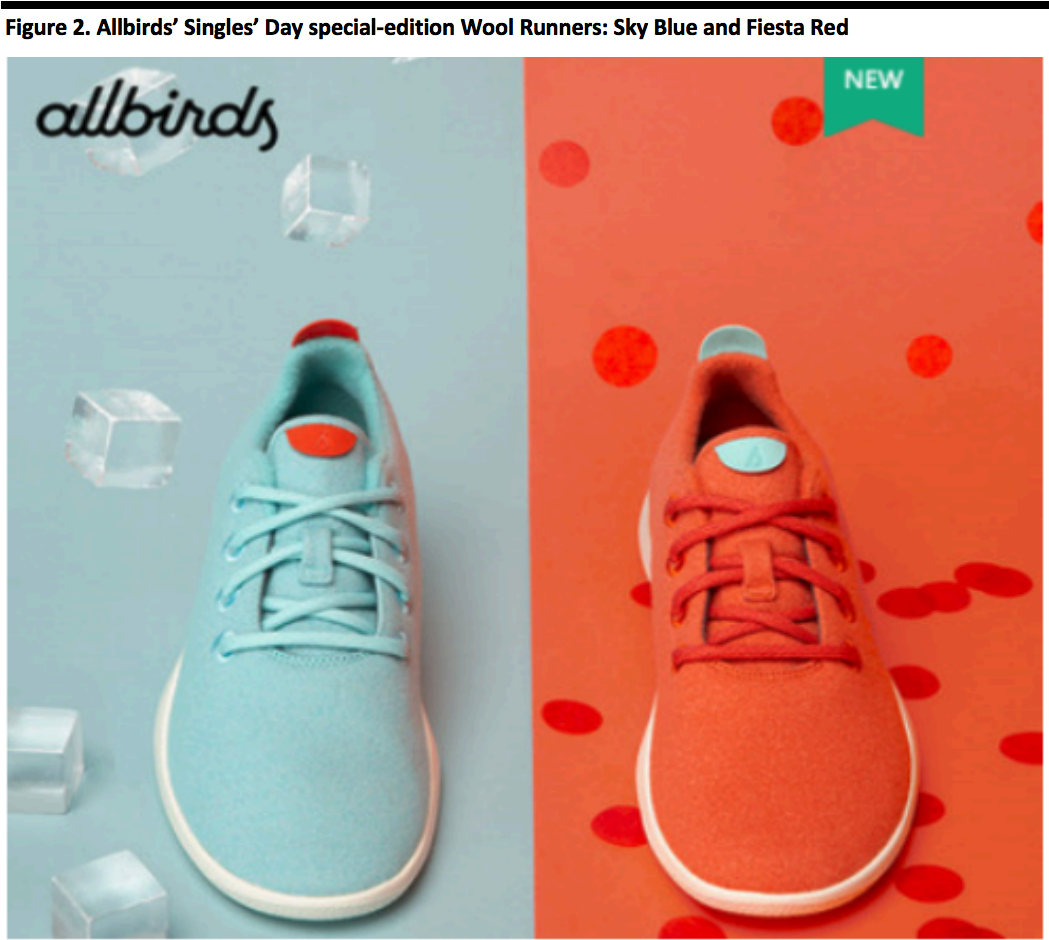

Shoe startup Allbirds opened a Tmall flagship store in April 2019 and created two new color combinations for its classic Wool Runners as part of its Singles’ Day campaign. The brand’s participation in the shopping festival led to an increase in new customers. According to Erick Haskell, Allbirds’ President of International, over 80% of shoppers on Allbirds’ Tmall store on November 11, 2019 were new customers.

[caption id="attachment_107419" align="aligncenter" width="580"]

Source: Alibaba/Coresight Research[/caption]

An Event Bigger than Prime Day, Black Friday and Cyber Monday Combined in the US

The scale of Singles’ Day compared to other major shopping festivals shows how important it should be for retailers. Amazon kicked off its fifth annual Prime Day shopping extravaganza in the US on July 15, 2019. The company extended the sale period to two full days from 2018’s 36 hours. We estimated that Amazon Prime Day collected $3.6 billion in online sales in the US. For Black Friday last year, Salesforce estimated that digital sales totaled $7.2 billion, with Cyber Monday bringing in $8.0 billion. By comparison, Alibaba’s GMV on Singles’ Day alone dwarfed the total digital sales of all three shopping holidays combined in the US.

Increased Participation and Product Offerings

When the Singles’ Day festival first started in 2009, only 27 brands participated, generating a total GMV of $7.7 million. Although this seems like a small amount, it was more than six times the average daily GMV of $1.2 million at the time. Showing the huge growth of the shopping event, more than 200,000 domestic and overseas brands participated in Singles’ Day 2019. The number of brands that achieved a GMV of ¥100 million ($14.3 million) reached 299 last year, up from 237 in 2018.

Singles’ Day also represents an opportunity for brands to reach new customers who are ready to shop. Last year, in order to drive consumer excitement for the event, Alibaba launched 1 million new products on Taobao and Tmall during the entire festival period (which started with the pre-sales period launch on October 21), with 240 of those themed specifically around Singles’ Day. Cosmetics brand MAC sold 60,000 units of its Double 11-exclusive lipstick in the first five minutes of pre-sales.

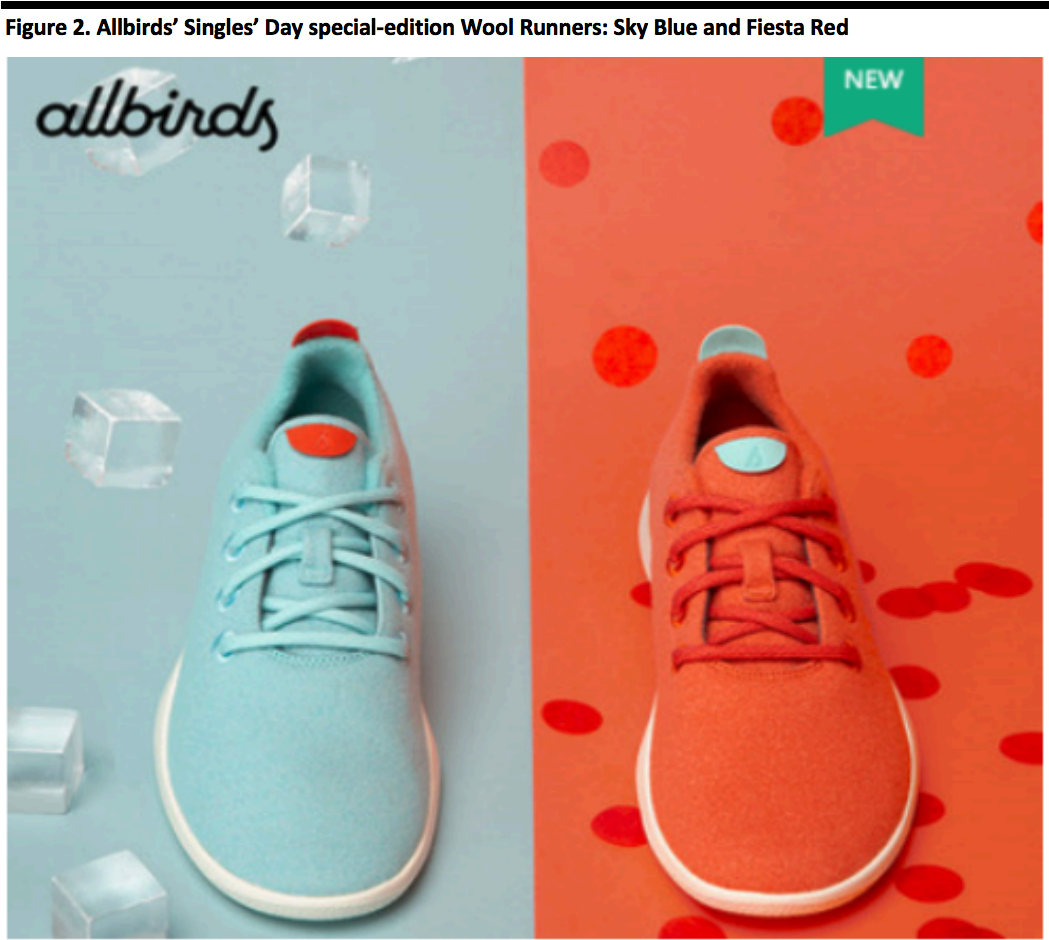

Shoe startup Allbirds opened a Tmall flagship store in April 2019 and created two new color combinations for its classic Wool Runners as part of its Singles’ Day campaign. The brand’s participation in the shopping festival led to an increase in new customers. According to Erick Haskell, Allbirds’ President of International, over 80% of shoppers on Allbirds’ Tmall store on November 11, 2019 were new customers.

[caption id="attachment_107419" align="aligncenter" width="580"] Source: Allbirds/Tmall[/caption]

No Longer an Alibaba-Exclusive Event

Although Singles’ Day was started by Alibaba, other online platforms have recognized its potential and jumped on board. JD.com reported that its total transaction volume exceeded ¥204.4 billion ($29 billion) in the 11-day sales event last year, from November 1 to 11—a 28% increase over 2018.

Similarly, the shopping festival is expanding its presence from China into Western countries. Many merchants in the US launched promotions on Singles’ Day last year, and US online sales increased 38% year over year to a record $2.7 billion, according to Adobe Analytics. However, this was only the equivalent of 7% of Alibaba’s GMV on Singles’ Day 2019, demonstrating significant room for growth. Given the current environment, perhaps it is time for more brands and retailers to recognize the potential of this major shopping festival and participate this year.

Source: Allbirds/Tmall[/caption]

No Longer an Alibaba-Exclusive Event

Although Singles’ Day was started by Alibaba, other online platforms have recognized its potential and jumped on board. JD.com reported that its total transaction volume exceeded ¥204.4 billion ($29 billion) in the 11-day sales event last year, from November 1 to 11—a 28% increase over 2018.

Similarly, the shopping festival is expanding its presence from China into Western countries. Many merchants in the US launched promotions on Singles’ Day last year, and US online sales increased 38% year over year to a record $2.7 billion, according to Adobe Analytics. However, this was only the equivalent of 7% of Alibaba’s GMV on Singles’ Day 2019, demonstrating significant room for growth. Given the current environment, perhaps it is time for more brands and retailers to recognize the potential of this major shopping festival and participate this year.

Source: Alibaba/Coresight Research[/caption]

An Event Bigger than Prime Day, Black Friday and Cyber Monday Combined in the US

The scale of Singles’ Day compared to other major shopping festivals shows how important it should be for retailers. Amazon kicked off its fifth annual Prime Day shopping extravaganza in the US on July 15, 2019. The company extended the sale period to two full days from 2018’s 36 hours. We estimated that Amazon Prime Day collected $3.6 billion in online sales in the US. For Black Friday last year, Salesforce estimated that digital sales totaled $7.2 billion, with Cyber Monday bringing in $8.0 billion. By comparison, Alibaba’s GMV on Singles’ Day alone dwarfed the total digital sales of all three shopping holidays combined in the US.

Increased Participation and Product Offerings

When the Singles’ Day festival first started in 2009, only 27 brands participated, generating a total GMV of $7.7 million. Although this seems like a small amount, it was more than six times the average daily GMV of $1.2 million at the time. Showing the huge growth of the shopping event, more than 200,000 domestic and overseas brands participated in Singles’ Day 2019. The number of brands that achieved a GMV of ¥100 million ($14.3 million) reached 299 last year, up from 237 in 2018.

Singles’ Day also represents an opportunity for brands to reach new customers who are ready to shop. Last year, in order to drive consumer excitement for the event, Alibaba launched 1 million new products on Taobao and Tmall during the entire festival period (which started with the pre-sales period launch on October 21), with 240 of those themed specifically around Singles’ Day. Cosmetics brand MAC sold 60,000 units of its Double 11-exclusive lipstick in the first five minutes of pre-sales.

Shoe startup Allbirds opened a Tmall flagship store in April 2019 and created two new color combinations for its classic Wool Runners as part of its Singles’ Day campaign. The brand’s participation in the shopping festival led to an increase in new customers. According to Erick Haskell, Allbirds’ President of International, over 80% of shoppers on Allbirds’ Tmall store on November 11, 2019 were new customers.

[caption id="attachment_107419" align="aligncenter" width="580"]

Source: Alibaba/Coresight Research[/caption]

An Event Bigger than Prime Day, Black Friday and Cyber Monday Combined in the US

The scale of Singles’ Day compared to other major shopping festivals shows how important it should be for retailers. Amazon kicked off its fifth annual Prime Day shopping extravaganza in the US on July 15, 2019. The company extended the sale period to two full days from 2018’s 36 hours. We estimated that Amazon Prime Day collected $3.6 billion in online sales in the US. For Black Friday last year, Salesforce estimated that digital sales totaled $7.2 billion, with Cyber Monday bringing in $8.0 billion. By comparison, Alibaba’s GMV on Singles’ Day alone dwarfed the total digital sales of all three shopping holidays combined in the US.

Increased Participation and Product Offerings

When the Singles’ Day festival first started in 2009, only 27 brands participated, generating a total GMV of $7.7 million. Although this seems like a small amount, it was more than six times the average daily GMV of $1.2 million at the time. Showing the huge growth of the shopping event, more than 200,000 domestic and overseas brands participated in Singles’ Day 2019. The number of brands that achieved a GMV of ¥100 million ($14.3 million) reached 299 last year, up from 237 in 2018.

Singles’ Day also represents an opportunity for brands to reach new customers who are ready to shop. Last year, in order to drive consumer excitement for the event, Alibaba launched 1 million new products on Taobao and Tmall during the entire festival period (which started with the pre-sales period launch on October 21), with 240 of those themed specifically around Singles’ Day. Cosmetics brand MAC sold 60,000 units of its Double 11-exclusive lipstick in the first five minutes of pre-sales.

Shoe startup Allbirds opened a Tmall flagship store in April 2019 and created two new color combinations for its classic Wool Runners as part of its Singles’ Day campaign. The brand’s participation in the shopping festival led to an increase in new customers. According to Erick Haskell, Allbirds’ President of International, over 80% of shoppers on Allbirds’ Tmall store on November 11, 2019 were new customers.

[caption id="attachment_107419" align="aligncenter" width="580"] Source: Allbirds/Tmall[/caption]

No Longer an Alibaba-Exclusive Event

Although Singles’ Day was started by Alibaba, other online platforms have recognized its potential and jumped on board. JD.com reported that its total transaction volume exceeded ¥204.4 billion ($29 billion) in the 11-day sales event last year, from November 1 to 11—a 28% increase over 2018.

Similarly, the shopping festival is expanding its presence from China into Western countries. Many merchants in the US launched promotions on Singles’ Day last year, and US online sales increased 38% year over year to a record $2.7 billion, according to Adobe Analytics. However, this was only the equivalent of 7% of Alibaba’s GMV on Singles’ Day 2019, demonstrating significant room for growth. Given the current environment, perhaps it is time for more brands and retailers to recognize the potential of this major shopping festival and participate this year.

Source: Allbirds/Tmall[/caption]

No Longer an Alibaba-Exclusive Event

Although Singles’ Day was started by Alibaba, other online platforms have recognized its potential and jumped on board. JD.com reported that its total transaction volume exceeded ¥204.4 billion ($29 billion) in the 11-day sales event last year, from November 1 to 11—a 28% increase over 2018.

Similarly, the shopping festival is expanding its presence from China into Western countries. Many merchants in the US launched promotions on Singles’ Day last year, and US online sales increased 38% year over year to a record $2.7 billion, according to Adobe Analytics. However, this was only the equivalent of 7% of Alibaba’s GMV on Singles’ Day 2019, demonstrating significant room for growth. Given the current environment, perhaps it is time for more brands and retailers to recognize the potential of this major shopping festival and participate this year.