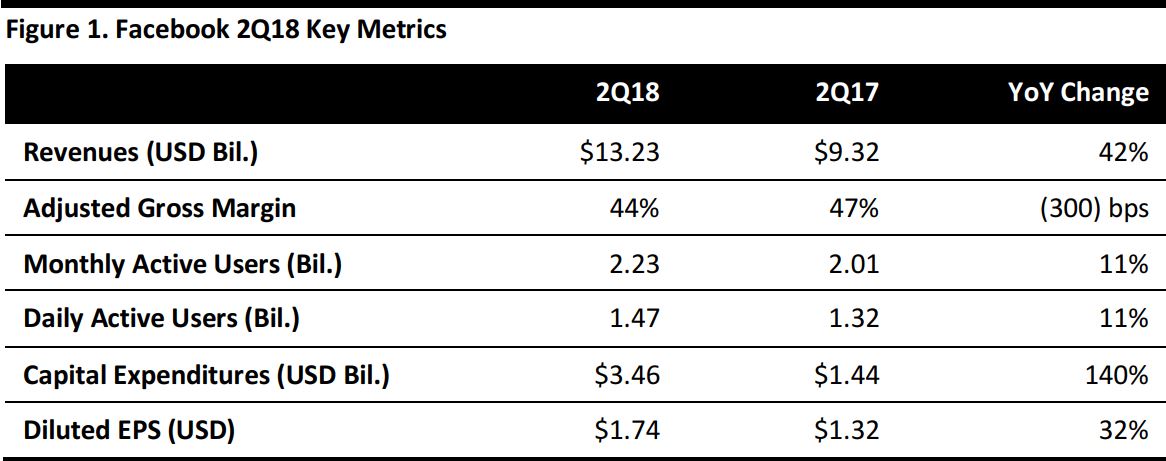

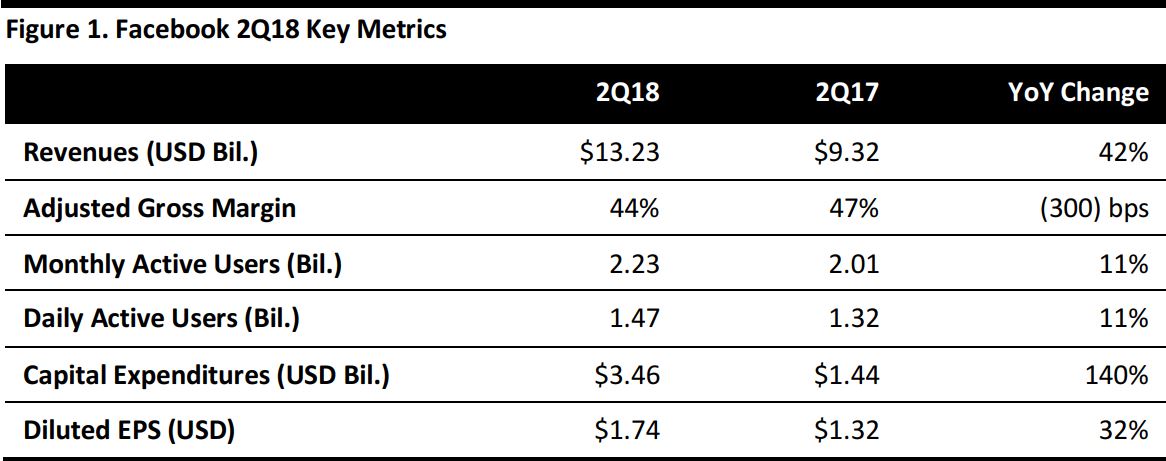

Source: Company reports/Coresight Research

2Q18 Results

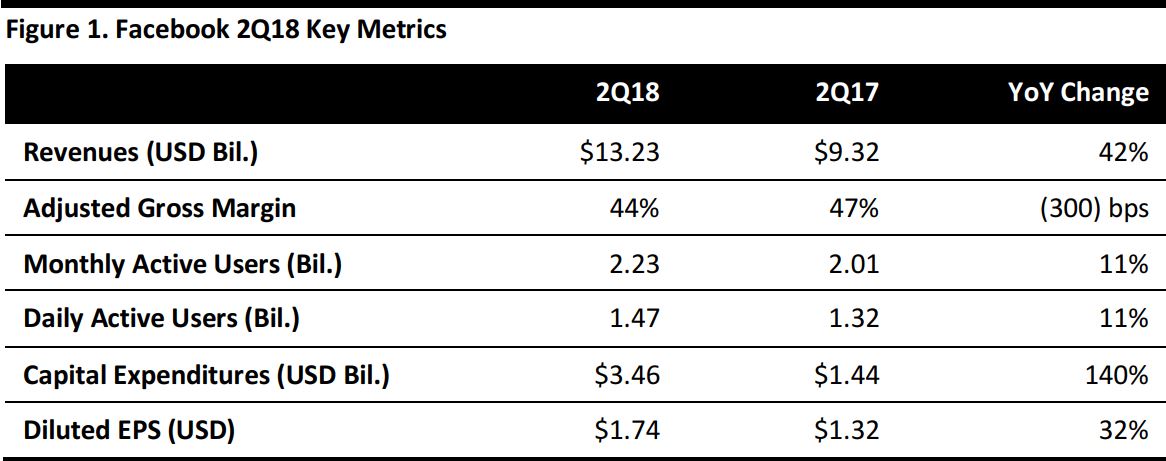

Facebook reported 2Q18 diluted EPS of $1.74, beating the $1.72 consensus estimate by $0.02 and up 32% year over year. Revenues were $13.23 billion, up 42% year over year but below the consensus estimate of $13.36 billion. Mobile ad revenues accounted for 91% of total ad revenues and were up 50% year over year, to $11.9 billion. Total ad revenues of $13.0 billion were up 42% year over year and accounted for 98.5% of all revenues.

Details from the Quarter

The company discussed its commitment to security and privacy on its platforms, and its commitment to fighting “fake news,” particularly in light of upcoming elections in the US and other countries. In addition, the company detailed new strategies and features designed to promote an interactive user experience and boost engagement on its platforms.

Cybersecurity

During the quarter, Facebook launched two new ways for users to learn more about the ads they see on its various platforms. Ads with political content now display who is paying for them, and users can now see all of the ads a page is running, even those not targeted at them. Facebook CEO Mark Zuckerberg said that he was pleased with Facebook’s handling of several recent elections, including last year’s French and German elections, as well as the Alabama special election in the US.

Facebook reaffirmed its commitment to fight fake news on its platforms. The company now uses artificial intelligence to identify posts purveying misinformation and even prevent them from being posted. Additionally, the company has removed any financial incentives that encourage the creation of fake news, and it no longer allows pages that consistently spread fake news to buy ads.

The company acknowledged that it had seen a decline in monthly active users in Europe, but stated its intent to make large investments in privacy and security. Citing a responsibility to keep people safe, the company warned that its commitment to privacy could negatively affect its profitability.

Product Development

More than 200 million people are now members of significant groups on Facebook, and the company believes that groups are key to developing both online and real-world social networks. The company has focused on making it easier to form and administer groups on Facebook as part of its goal of having 1 billion people in significant Facebook groups by 2023.

The company also emphasized the growing importance of video as a primary form of media intake on social media. During 2Q18, Facebook launched IGTV, a video app accessible on Instagram that optimizes videos for mobile viewing. Additionally, the company introduced Watch Party, a new feature on Facebook that enables users to watch videos and connect with their friends simultaneously. On the production side, the company released Ads Animator, a video creation tool that allows smaller companies to create visually appealing videos using content already posted to their Facebook page.

Facebook is also working to improve the effectiveness of its ads. During the quarter, the company continued to invest in improving the ad experience, in part by introducing a tool that enables companies to collect data on how their brand is affected by their various ad campaigns.

The company noted a shift toward private messaging on its platforms. Among other 2Q18 initiatives, the company began experimenting with payment transfers over its private messaging services.

Outlook

Management said that it expects revenue growth to decelerate by high-single-digit percentages in the remaining two quarters of FY18. The company also expects total expenses to grow by 50%–60% due to increased investments in product development, infrastructure and security. In FY19, the company expects expense growth to outpace revenue growth, causing operating margins to trend toward mid-30s percentages.