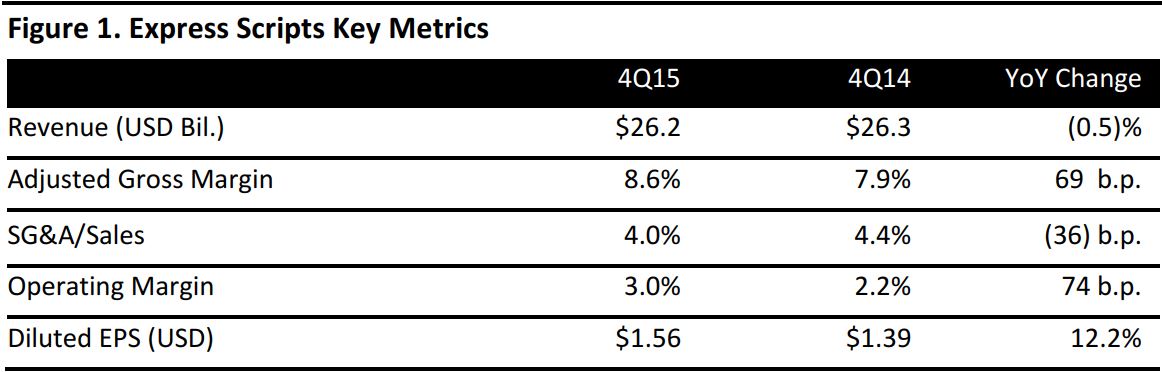

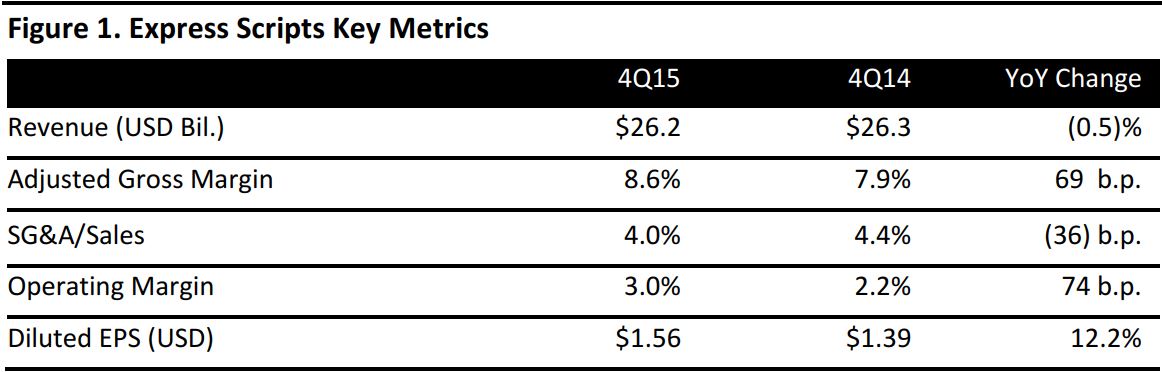

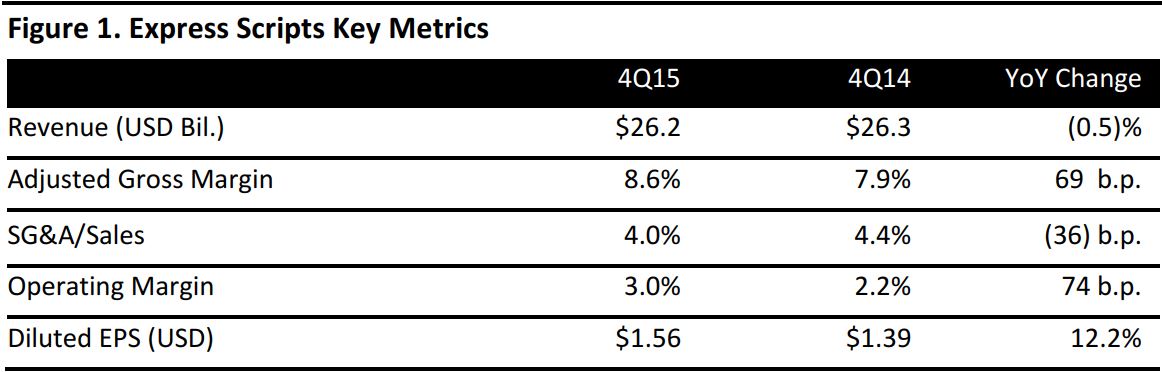

Source: Company reports

The largest pharmacy benefit manager (PBM) in the US, Express Scripts, reported mixed results for 4Q15; its earnings were in line with estimates, but it missed on revenue. Revenue dipped by less than 1% versus 4Q14, to $26.2 billion.

For the quarter, Express Scripts said that its number of adjusted claims—a measure that takes into account monthly prescriptions filled in retail pharmacies and 90-day fills through the company’s mail-order business—rose by 1.3%, to 341.5 million, which was in line with the consensus of 333–353 million. Adjusted home delivery and specialty claims decreased by 5%, to $91.5 million, but this was partially offset by adjusted network claims increasing by 4%.

The company reported quarterly profit of $773.5 million, or adjusted EPS of $1.56, up from $581.8 million, or adjusted EPS of $1.39, in the prior-year period.

For the year, the company reported net income of $2.48 billion, or $3.56 per share, up 23% from FY14. Revenue was reported as $101.75 billion, up 0.9% year over year.

Guidance

For FY16, Express Scripts narrowed its earnings guidance to a range of $6.10–$6.28, raising the lower end of the range by $0.02, versus the consensus estimate of $6.14. The company reiterated its expectation of adjusted claims of 1.26–1.30 billion or (3)%–flat year over year.

The company provided a 1Q16 EPS guidance range that was a bit lighter than consensus: Express Scripts expects adjusted earnings per share of $1.18–$1.22, as compared to the consensus estimate of $1.28. Express Scripts expects adjusted claims of 315–325 million, or 2%–6% year over year.

Investors are likely to focus on the status of Express Scripts’ contract with its largest client, Anthem (which accounted for 14% of revenue in 2014). The health insurer is working to renegotiate a pricing review, claiming that under the current market conditions, a new contract could save $3 billion annually on drug costs, primarily from lower generic drug pricing. Analysts consider the $3 billion estimate to be aggressive, given the relatively small size of Anthem’s relationship with Express Scripts. Lacking a renewed contract, Anthem would face a consolidated industry with just a handful of other major players.