Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

4Q17 Results

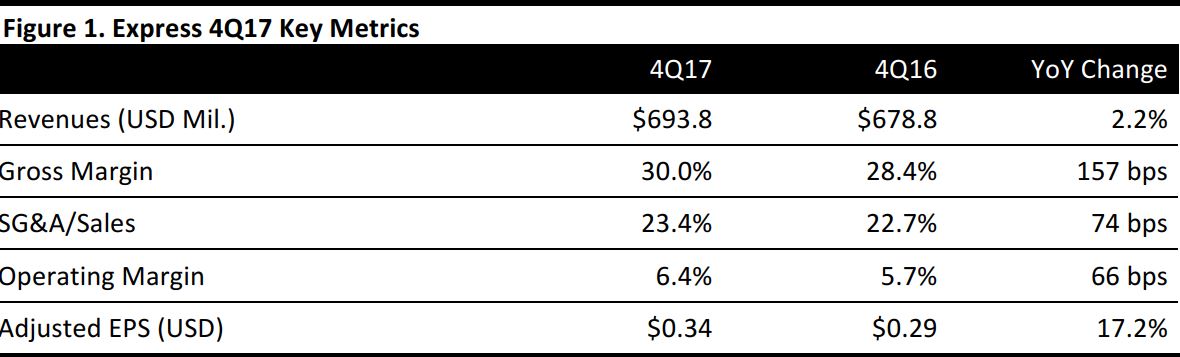

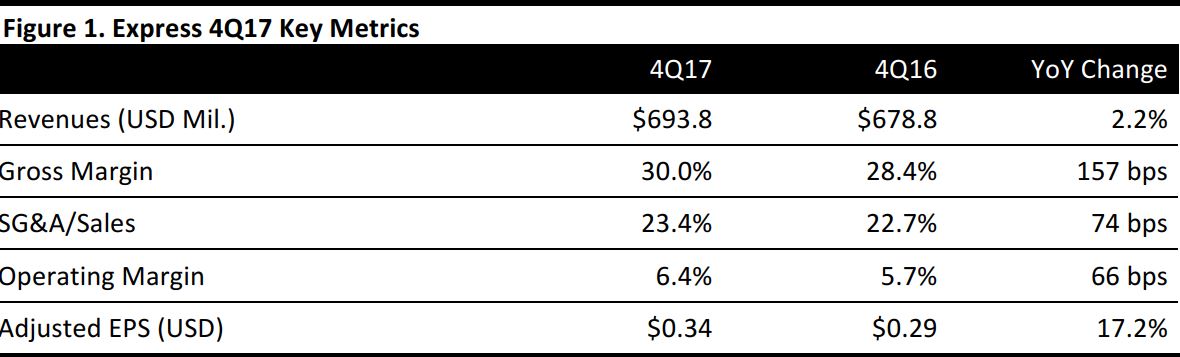

Express reported 4Q17 revenues of $693.8 million, up 2.2% year over year and beating the $686.8 million consensus estimate. Adjusted EPS was $0.34, above the consensus estimate of $0.32 and up 17.2% from the year-ago quarter.

Comparable sales, including e-commerce sales, decreased by 1%, beating the consensus estimate of (1.9)% and up from (13)% in the year-ago quarter. E-commerce sales increased by 20% year over year, to $203.3 million, and e-commerce comps increased by 17%. E-commerce sales represented 29% of net sales in the quarter, up from 25% in the year-ago period.

The men’s business performed slightly better than the women’s business, led by suits, denim, casual pants, outerwear and jackets. In the women’s categories, denim, pants and dressy woven tops, jackets, outerwear and fragrance all comped better than the company average. Sales of dresses and sweaters came in below the company’s expectations due to assortment issues.

Express is expanding its omnichannel capabilities by launching ship-from-store service in 200 stores and piloting buy-online, pick-up-in-store service in the Chicago market in order to determine if it should be rolled out more broadly.

FY18 Plans

In terms of store activity in FY18, Express plans to close 36 retail stories, 28 of which will be converted to outlets, and open 10 new outlet stores. The company plans to end FY18 with 637 stores, comprising 454 retail stores and 183 outlets, compared with 635 total stores at the end of FY17, comprising 490 retail stores and 145 outlets.

In May, the company will extend its size offerings for both women and men in approximately 130 of its retail stores. For women, the sizes will include double extra small and double extra large sizes, as well as double sizes in 0–18. In men’s, the company will offer extra small, double extra large, and 28-inch to 40-inch waist sizes.

Outlook

The company guided for 1Q18 diluted EPS of $(0.04)–$0.00, versus the $(0.01) consensus estimate. The company expects 1Q18 comp growth of (1.0)%–1.0%, compared with the consensus estimate of 0.5%.

For FY18, the company expects comp growth of (1.0)%–1.0% and diluted EPS of $0.32–$0.46, compared with the consensus EPS estimate of $0.53.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research