Source: Company reports/Fung Global Retail & Technology

4Q16 Results

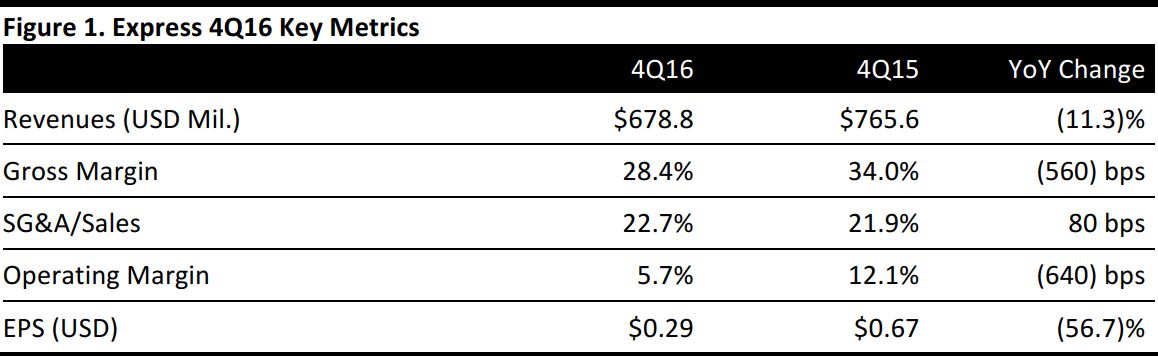

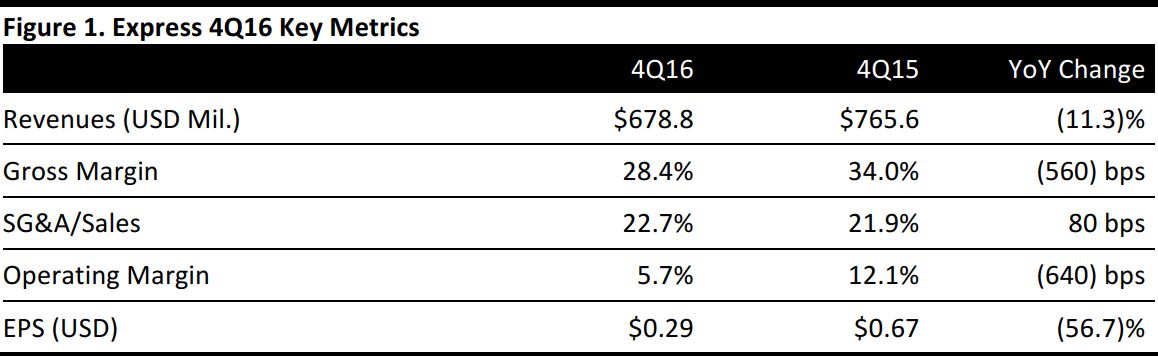

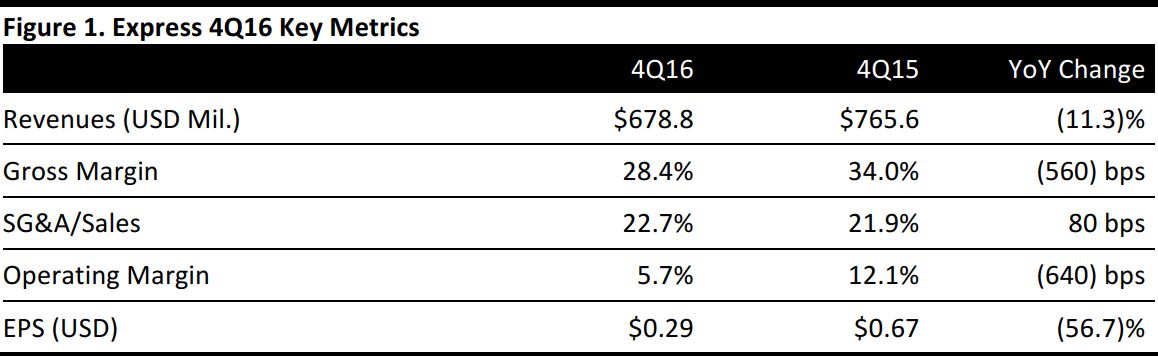

Express reported total revenues of $678.8 million for 4Q16, down 11.3% from the year-ago quarter and slightly above the $675.8 million consensus estimate. Same-store sales, which includes e-commerce, declined by 13% from the year-ago quarter, versus the consensus estimate of a 12.2% decline. That compares with a 4% increase in same-store sales in 4Q15. E-commerce sales increased by 9%, to $170.1 million in the quarter, accounting for 25% of net sales, versus 20% in the year-ago quarter.

The men’s division overall performed slightly better than the company average, with denim outwear and accessories outperforming. The women’s business saw weaker results, driven by reduced units available in dressy pants and dressy woven tops. Within the women’s division, casual knits, dresses, denims, sweaters and shoes saw better-than-average performance.

The company saw a decrease of 330 basis points in merchandise margins, driven by more promotional offers. SG&A as a percentage of sales increased by 80 basis points, or $13 million less than in the year-ago quarter, to 22.7%.

Express reported 4Q16 EPS of $0.29, down 56.7% from the year-ago quarter and in line with company’s guidance of $0.26–$0.30.

Management commented that store performance continued to be impacted by challenging mall traffic and a promotional retail environment.

FY16 Results

For FY16, Express reported revenue of $2.19 billion, down 6.7% from FY15, and a same-store sales decline of 9% year over year.E-commerce sales increased by 5%, to $400 million, accounting for 19% of total sales for the year.

The retailer reported full-year adjusted EPS of $0.81, down 41.3% from $1.38 the previous year. GAAP EPS was $0.7 for FY16.

Express realized $9 million in cost savings in FY16, most of which was in SG&A, and is on track to deliver $44–$54 million in total cost savings over the next three years.

FY17 Outlook

For FY17, Express projects EPS of $0.65–$0.73, versus the consensus estimate for adjusted EPS of $0.87. The company noted that the additional week in 2017 represents approximately $28 million in incremental revenues and approximately $0.04 in diluted earnings per share, which have been factored into its annual guidance.

Same-store sales for the full year are expected to be flat to up by low single digits, versus the consensus estimate of a 0.4% decline.

Management noted that FY17 initiatives include improving the “fashion clarity” in its stores through reduced product counts, launching a new brand campaign and improving in key existing categories. The company also expects to benefit from the relaunch of its customer loyalty program, Express Next, and its new IT system. Express will introduce ship-from-store in 2Q17 and pilot buy-online, pick-up-in-store service later in the year.

The retailer expects to open 19 new outlet stores this year, convert 20 additional retail stores in malls to outlets and close three retail stores. Express projects it will operate 143 outlet stores, and a total of 522 stores, by FY17 year-end.