Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

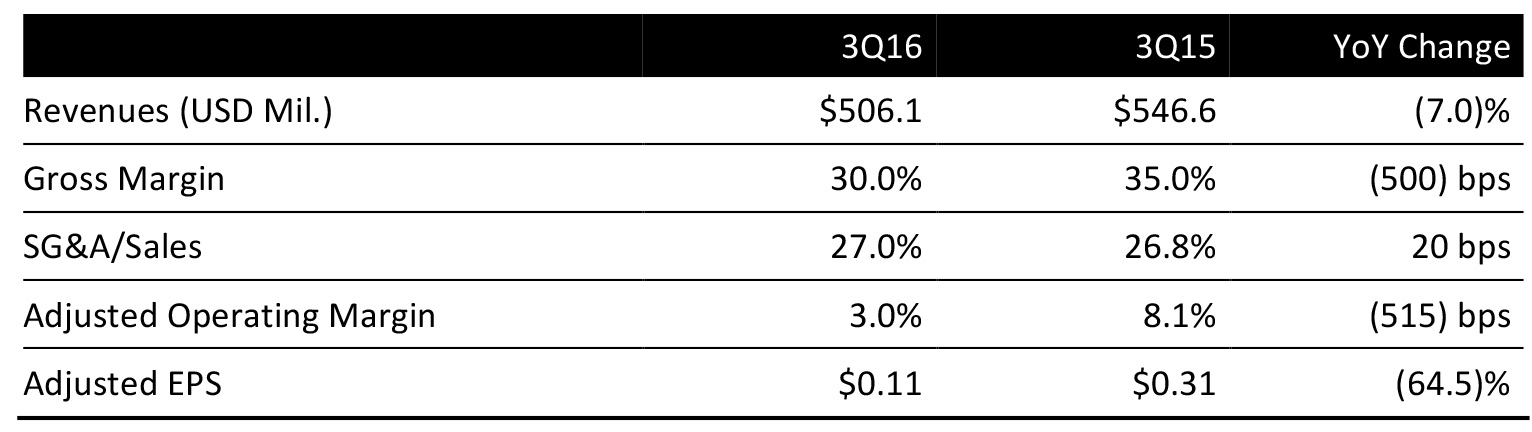

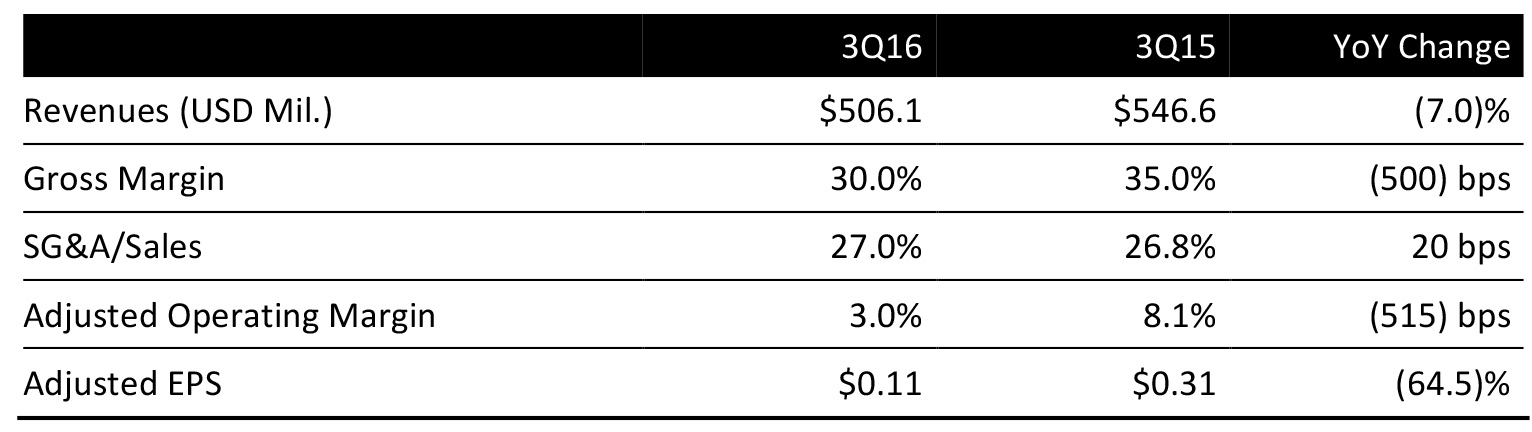

Express reported 3Q16 revenues of $506.1 million, down 7% year over year but above the consensus estimate of $497.3 million. Comparable store sales decreased by 8%, compared with a 6% increase in the year-ago quarter. E-commerce sales increased by 15%.

Adjusted EPS was $0.11, below the $0.13 consensus estimate and down 64.5% year over year.

The company faced difficulties from reduced mall traffic, along with errors in marketing and merchandising that skewed too young, according to management. Express is working to address the issues and expects improvements in the coming quarters. The company relaunched its Express NEXT loyalty program in the quarter in order to make it easier for NEXT customers to become fully engaged with the program and utilize their rewards.

Overall, the company expects the holiday season to be challenging due to soft mall traffic and heavy promotions among retailers.

Results by Product Category

- Women’s: Denim, dresses and shoes outperformed the company’s comp average; skirt sales were weaker. The company relaunched its studio pants business in September, offering newness in fabric, silhouettes and rise. Sweater sales were still down overall, but showed improvement, with the knits business responding well to promotional strategies.

- Men’s: Business, suits, woven tops, ties and accessories outperformed the company’s comp average, and the men’s business outperformed the women’s business. In suits, the company increased its offering both in stores and online.

OUTLOOK

For 4Q16, the company expects comparable sales in the negative low-double digits, compared with 4% growth in the year-ago quarter. Adjusted EPS is expected to be $0.26–$0.30, compared with $0.67 in 4Q15.

For the full year, the company expects comparable sales in the negative high-single digits, compared with 6% growth a year ago. Adjusted EPS is expected to be $0.78–$0.82, down from $1.45 a year ago. Prior guidance called for full-year adjusted EPS of $1.00–$1.14.