Source: Company reports/Coresight Research

2Q18 Results

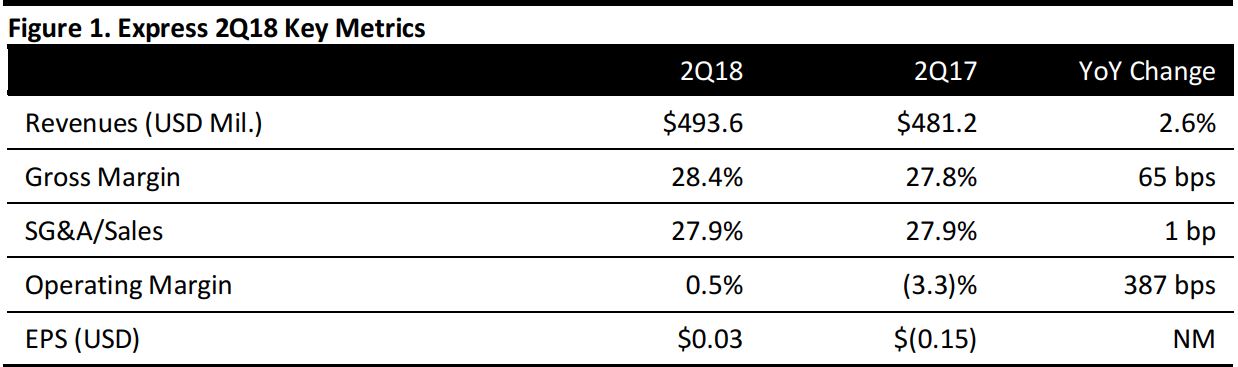

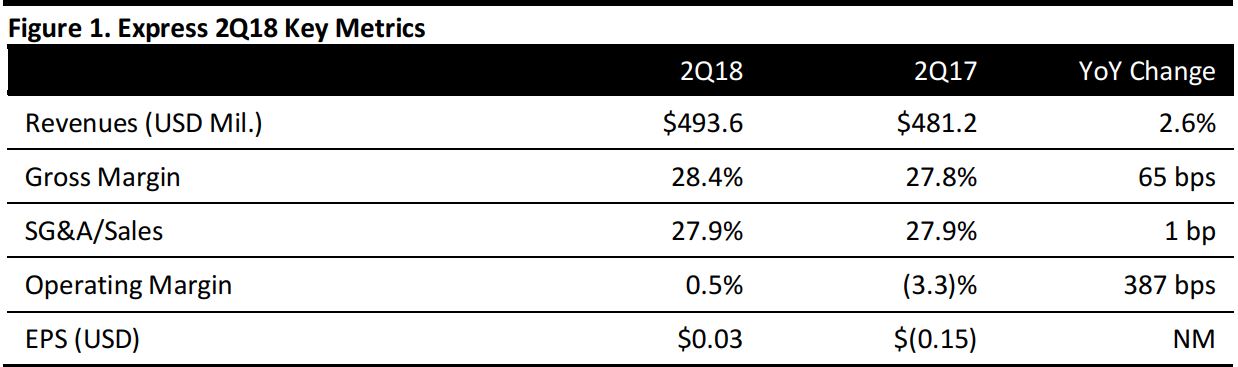

Express reported 2Q18 revenues $493.6 million, up by 2.6% year over year and beating the consensus estimate of $483.5 million.

E-commerce sales increased 37%, accounting for 25% of net sales.

Comps were up 1%, beating the consensus estimate of down 0.1%.

EPS was $0.03, beating the consensus estimate of breakeven.

Details from the Quarter

Management commented that results represented another step forward in returning the company to profitable long-term growth.

- Management commented that e-commerce sales growth was exceptional, owing to newly expanded omnichannel capabilities that are starting and good performance of outlet stores. Management continues to see positive trends within the loyalty program, in addition to realizing targeted cost savings.

- The business has regained its footing over the past two quarters, leading to both positive comps and increased earnings. Capital investments have also returned to a more normalized level. Management believes that it has positioned the business to move forward to return it to a mid-single-digit operating margin over the next three years.

- To achieve this, management outlined four key areas:

- Drive customer acquisition and retention through more consistent product execution, more effective marketing spend, and delivering a continuous and holistic brand and customer experience across all channels. This includes successful product introduction, like extended sizing, building customer engagement through more personalized service offerings such as styling and further growth in the loyalty program.

- Continue driving retail sales through double-digit e-commerce growth while improving overall store productivity. Management remains confident in the growth outlook for e-commerce and is focused on improving store performance.

- Realize the benefits from system investments and omnichannel capabilities. The company has begun to see the initial positive results and management expects to capture more significant benefits going forward.

- Be relentless in the way it continues to go after opportunities for cost savings. The company has been successful in realizing targeted savings to date and remain on track to achieve the $44–$54 million cost-savings target by the end of 2019. The company has also begun to benefit from reduced occupancy costs.

- The men’s business continued to perform well, with strength in denim, casual pants, shorts and suits. The company also saw a relative improvement in shirts, which is expected to further build in the third quarter as the company increases the penetration of performance shirts.

- Women’s saw above-average performance in dressy woven tops, knit tops, dress pants, casual pants, skirts, jackets and shoes. Dresses were also above average, showing solid improvement during the quarter. The extended size offering is performing well. The company is gaining good insight and customer feedback, which it is leveraging to build on this opportunity for the future. While only a small piece of its second quarter assortment, receipts are building, and management expects the category to contribute incrementally in the back half of 2018 and more significantly into 2019.

- The ship-from-store opportunity is expected to increase margin in the back half of 2018 and into 2019, which will help stabilize the pressure from the channel mix shift.

- The company continues to test buy online, pick up in store. In July, it added another five stores to the test in New York City and have installed lockers in certain locations to gain insights on the added convenience of self-service pickup and returns

Outlook

Management commented that it is focused on continuing to drive growth through initiatives across product, brand and customer experience. Management also made positive comments about the fall and holiday assortments, and it expects continued strong sales momentum in the e-commerce business.

The company offered the following guidance:

3Q:

- Comps are expected within the range of down 1% to up 1%.

- EPS is expected within the range of $0.08–$0.11.

Full year:

- Comps are expected within the range of up 0% to 1%, up from down 1% to up 1% previously.

- EPS is expected within the range of $0.43–$0.49, up from $0.32–$0.46 previously.