Source: Company reports/Fung Global Retail & Technology

1Q17 Results

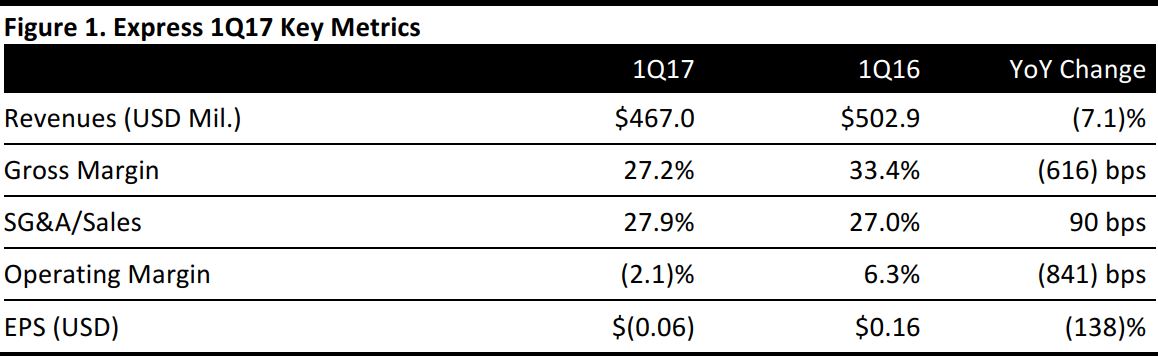

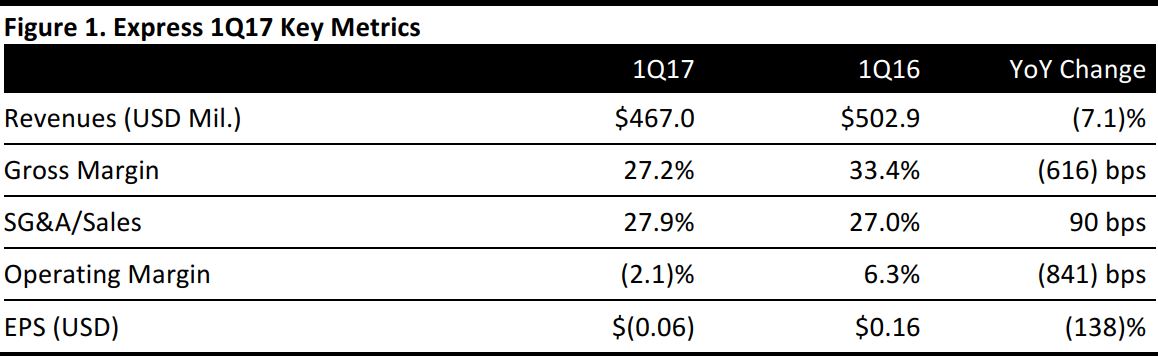

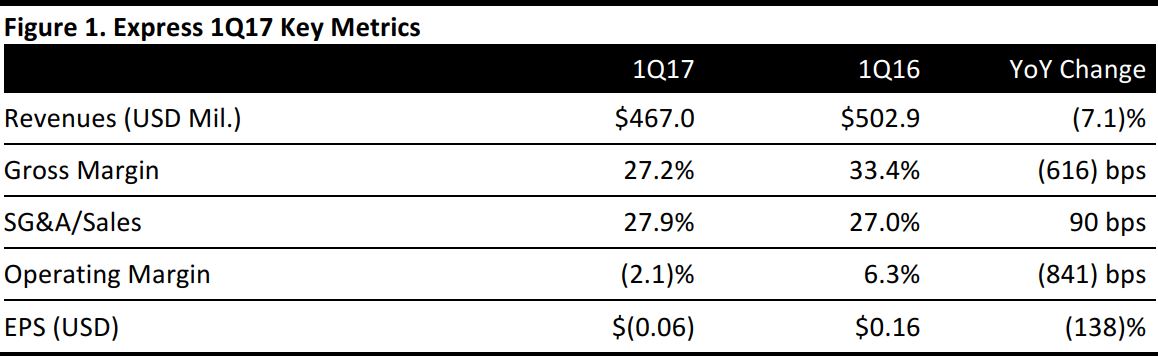

Express reported total revenues of $467.0 million for 1Q17, down 7.1% from the year-ago quarter and slightly below the consensus estimate. The company reported 1Q17 EPS of $(0.06), including a net negative impact of $0.03 per share related to discrete tax items and the exit of Canada. EPS was down 138% from the year-ago quarter and was below the consensus estimate of $(0.02).

Same-store sales, including e-commerce sales, declined by 10% from the year-ago quarter, versus the consensus estimate of an 8.3% decline.E-commerce sales increased by 27% year over year, to $97.6 million. E-commerce traffic and conversion improved, with the most significant growth coming from mobile devices. The company reported that e-commerce sales of women’s categories were strong, driven by expanded sizing and assortments and the launch of petite sizes.

The women’s business performed better than the men’s business in the quarter. The women’s categories that performed better than the comp average were dressy pants, dresses, sweaters, shorts and swim; woven tops and accessories saw weaker results. In the men’s categories, suits, sweaters, and accessories performed above the comp average, while bottoms had lower-than-average results.

The company’s selling, general and administrative (SG&A) expenses were $130.1 million versus $135.8 million in last year’s first quarter. As a percentage of net sales, SG&A expenses increased by 90 basis points year over year, to 27.9% from 27.0%.

Management commented that store performance continued to be impacted by challenging mall traffic and a promotional retail environment.

Outlook

Express projects 2Q17 adjusted EPS of $(0.03)–$0.01 compared with the $0.07 consensus estimate. For 2Q17, the company expects same-store sales in the negative mid-single digits.

For FY17, the company lowered its adjusted EPS guidance to $0.41–$0.48 from $0.65–$0.73, versus consensus of $0.67. The company expects same-store sales for the full year to be in the negative low-single digits versus prior guidance of flat to low-single-digit growth.

The company reports that it is on track to deliver $20 million in cost savings in 2017.