Nitheesh NH

What’s the Story?

We provide an overview of the US consumer products rental market, covering market players and growth drivers within five key segments. We also discuss three trends we are seeing in the market, plus potential headwinds, to help brands retailers and brands better understand and capitalize on rental opportunities in a changing retail environment. In this report, we define the US consumer products rental market as comprising the following segments: [wpdatatable id=1371]We exclude car rental, commercial and industrial appliance rental (such as lawn and garden equipment, home repair tools, and office equipment) and home health equipment rental (such as wheelchairs). This allows us to present the best picture of growth in personal and household goods that can be rented from a retail or store-front facility.

Why It Matters

Although the rental model is not new, this report considers the impact of pandemic-related restriction easing as an important turning point for this model. While we reported an estimated decline in the US consumer products rental market in 2020 due to the pandemic, we are seeing positive signs of market growth in the coming years, including strong demand and sales recovery among key players and new rental service launches in 2021.The US Consumer Products Rental Market: Coresight Research Analysis

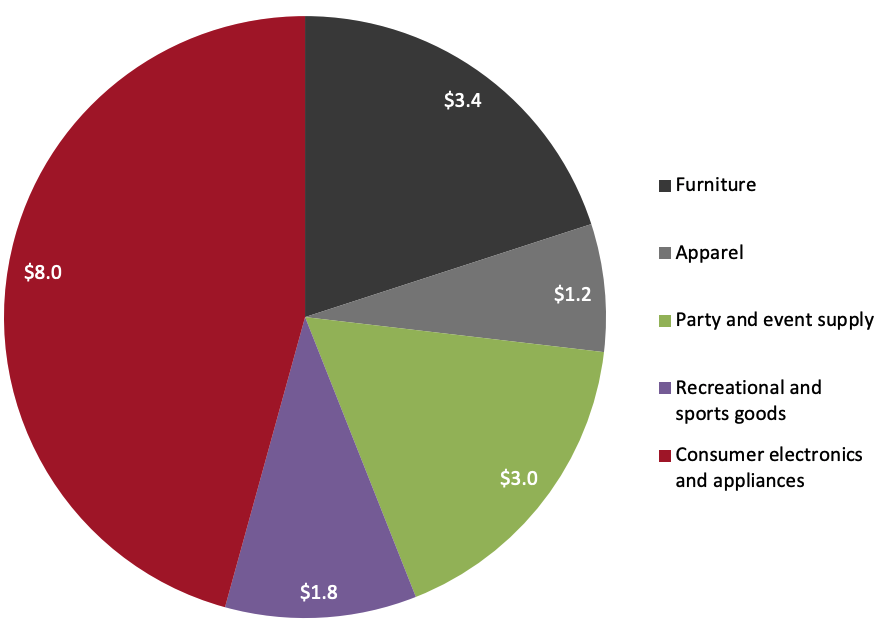

Market Overview Coresight Research estimates that the US consumer products rental market totaled $16.1 billion in 2020, a 5% drop from 2019. However, we expect the market to grow 8.4% to $17.5 billion in 2021. The three fastest-growing rental segments in 2021 are set to be party and event supply rental, apparel rental, and recreational and sports goods rental. Figure 1 displays our estimates for the market by sales per segment, with consumer electronics and appliances rental comprising a 46% share of the market. We expect this to be followed by furniture rental with a 20% share and party and event supply rental with a 17% share.Figure 1. US Consumer Products Market, Estimated Sales by Segment in 2021 (USD Bil.) [caption id="attachment_134815" align="aligncenter" width="580"]

Source: Statista/IBIS/US Census Bureau/American Rental Association/Coresight Research[/caption]

1. Apparel Rental

We estimate that the total US apparel rental market reached approximately $1.1 billion in 2020, a year-over-year decline of 15.4%, primarily due to the pandemic. This equates to a deeper decline than the total apparel market, which was down 12.2% in 2020. We expect the market to recover in 2021, which we discuss in the subsequent section.

Figure 2 provides an overview of the US apparel rental market.

Source: Statista/IBIS/US Census Bureau/American Rental Association/Coresight Research[/caption]

1. Apparel Rental

We estimate that the total US apparel rental market reached approximately $1.1 billion in 2020, a year-over-year decline of 15.4%, primarily due to the pandemic. This equates to a deeper decline than the total apparel market, which was down 12.2% in 2020. We expect the market to recover in 2021, which we discuss in the subsequent section.

Figure 2 provides an overview of the US apparel rental market.

Figure 2. US Apparel Rental Market: 2019–2021E

| 2019 | 2020 | 2021E | |

| Market size (USD Bil.) | $1.3 | $1.1 | $1.2 |

| Year-over-year growth | 30% | (15.4)% | 9.1% |

| Key market influence | Consumers demonstrated demand to satisfy an immediate need for apparel (but with a limited budget) for events or occasions. | Overall consumer spending on apparel declined amid the pandemic year due to consumers spending more time at home, which reduced consumers’ needs for rental clothing, especially in dress wear categories. | As many consumers are vaccinated and meeting with friends and family, rental platforms allow consumers to refresh their wardrobes and experiment with new designers and trends without risk. Consumers are also attending events again (including postponed weddings and celebrations from 2020). |

| Key players | Le Tote

|

||

Source: Company reports/Coresight Research

Apparel rental businesses such as Nuuly and Rent the Runway faced significant challenges in 2020.- Rent the Runway cut costs in early 2020 by laying off 35% of its employees and closing its brick-and-mortar stores. Its valuation in May 2020 dropped from $1 billion to $750 million, according to Bloomberg.

- Urban Outfitters mentioned on its earnings call in May 2020 that the company was reconsidering investment in its rental platform Nuuly because of the pandemic. However, Nuuly’s sales grew more than 100% in 2020 with a strong increase in subscription members in the second half of the year. We note that this growth rate can also be attributed to the rental service being relatively new—thus its recorded $24 million in revenue in 2020 was a big leap from its comparative revenue of $8 million in 2019.

- Rent the Runway began seeing sales recovery in February 2021, according to the company, with rentals of dresses and gown rentals increasing every consecutive week of 2021 as of April 19, 2021. In June 2021, the company announced plans to allow non-members to shop on its site.

- Urban Outfitter’s Nuuly saw strong recovery in the second half of 2020 with a 75% increase in active paying subscribers following the lows recorded in May 2020. The company’s site traffic and rental numbers have also increased quickly so far in 2021, according to the company.

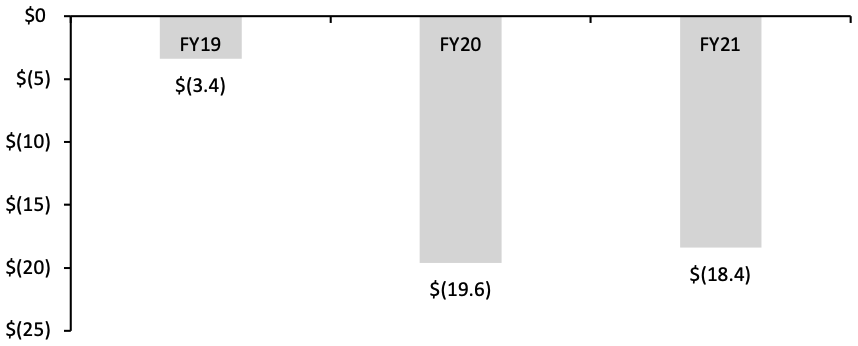

- Nuuly has seen sequential losses in its past three fiscal years, according to Urban Outfitters, with the company stating on its March 2020 earnings call that it acknowledged that the launch of the service in 2019 would have a negative impact on its gross profit margin for the year. Nuuly’s customer acquisition is ahead of plan, feedback remains positive and its back of house operations are functioning smoothly, even in areas such as laundry, where Nuuly had no prior experience. Management believes that Nuuly is still at an early stage and that they have much to learn about this business model but are excited for its future based on demand so far.

Figure 3. Nuuly: Loss From Operations (USD Mil.) [caption id="attachment_134817" align="aligncenter" width="580"]

Source: Urban Outfitters[/caption]

2. Consumer Electronics and Appliances Rental

Coresight Research estimates that the total US consumer electronics and appliances rental market reached $7.7 billion in 2020, with year-over-year growth of 2.7%, based on Census Bureau and Statista data. The growth was mainly driven by consumers being forced to spend more time at home and growing needs for appliances, electronics and household items.

As the majority of rental companies in consumer electronics and appliances operate with a rent-to-own model, which requires small and steady payments, most players were not negatively impacted by the pandemic. Those with an online presence benefited from increased online traffic. FlexShopper, for example, reported 15.1% revenue growth in the second quarter of 2020 and growth of 7.1% in the third quarter of 2020, which is notable amid a suppressed economic environment.

The US consumer electronics and appliances rental market will grow 3.9% to $8.0 billion in 2021, according to Statista. The growth rate is stable, with the market size seeing incremental growth from 2019, as shown in Figure 4. Demand for rent-to-own models in the consumer electronics and appliances market is relatively consistent, driven by typically high price points for electronics products.

Source: Urban Outfitters[/caption]

2. Consumer Electronics and Appliances Rental

Coresight Research estimates that the total US consumer electronics and appliances rental market reached $7.7 billion in 2020, with year-over-year growth of 2.7%, based on Census Bureau and Statista data. The growth was mainly driven by consumers being forced to spend more time at home and growing needs for appliances, electronics and household items.

As the majority of rental companies in consumer electronics and appliances operate with a rent-to-own model, which requires small and steady payments, most players were not negatively impacted by the pandemic. Those with an online presence benefited from increased online traffic. FlexShopper, for example, reported 15.1% revenue growth in the second quarter of 2020 and growth of 7.1% in the third quarter of 2020, which is notable amid a suppressed economic environment.

The US consumer electronics and appliances rental market will grow 3.9% to $8.0 billion in 2021, according to Statista. The growth rate is stable, with the market size seeing incremental growth from 2019, as shown in Figure 4. Demand for rent-to-own models in the consumer electronics and appliances market is relatively consistent, driven by typically high price points for electronics products.

Figure 4. US Consumer Electronics and Appliances Rental Market: 2019–2021E

| 2019 | 2020 | 2021E | |

| Market size (USD Bil.) | $7.5 | $7.7 | $8.0 |

| Year-over-year growth | 2.7% | 2.7% | 3.9% |

| Key market influence | Consumers demonstrated demand for trying out appliances and electronics through rental instead of owning one, with the added incentive of saving on upfront costs. | Amid the pandemic, budget-conscious consumers turned to rental options for electronics and appliances. Being forced to spend more time at home also led to increased demand for practical and entertainment-related home electronics and appliances. | Consumers continue to demonstrate demand for electronics and appliances with rent-to-own models due to persistent stay-at-home trends. |

| Key players | Aaron’s

|

||

Source: Census Bureau/Statista/company reports/Coresight Research

3. Furniture Rental We estimate that the total US furniture rental market reached $3.4 billion in 2020, representing year-over-year growth of 3.0%. The key driver for market growth in 2020 was strong demand for furniture and relevant home goods as consumers stayed at home more due to the pandemic. As such, furniture rental businesses showed resilience amid periods of forced store closures.- Rent-A-Center saw strong demand for furniture rental in 2020 according to its earnings calls in May and August 2020. The company posted 4.7% growth in its furniture rental business in 2020. We expect the market to grow with a low-single-digit rate in 2021 as consumers continue to work more from home than prior to the pandemic with the shift to hybrid schedules—and also face some remaining travel restrictions.

Figure 5. US Furniture Rental Market: 2019–2021E

| 2019 | 2020 | 2021E | |

| Market size (USD Bil.) | $3.3 | $3.4 | $3.5 |

| Year-over-year growth | 3.1% | 3.0% | 2.9% |

| Key market influence | With young consumers living in big cities typically moving frequently, they increasingly favored rental furniture options. Many consider it to be more viable for their lifestyle for its convenience, flexibility and cost-effectiveness. Moreover, with increasing consumer awareness of the impact of company supply chains on the environment, many consumers identified rental as more sustainable than throw-away furniture purchases. | Furniture saw strength as consumers adapted and invested in their homes to accommodate being forced to spend more time at home amid pandemic-related restrictions. | We expect many consumers to continue with hybrid home working schedules even as lockdowns ease. Consumers also continue to face international travel restrictions, freeing up time and budget to spend on furniture. |

| Key players | Aaron’s

|

||

Source: Company reports/Coresight Research

In addition to major legacy furniture rental players in the market, we are seeing relatively new furniture retailers such as IKEA and Wayfair launch rental services positioned as being more sustainable due to extended product life cycle in order to attract more consumers. Digitally native furniture rental companies, such as Feather, are also operating within the growing market. Click here to read our report on the success of digitally native vertical brands in the US furniture and home-furnishings market. 4. Party and Event Supply Rental The total US party and event supply rental market was worth $2.2 billion in 2020, representing a year-over-year decline of 29%, according to the American Rental Association. While the coronavirus pandemic understandably hit the party and event rental market hard in 2020, we expect the market to recover in 2021. The American Rental Association anticipates a 36.4% year-over-year increase in 2021, which will take the market size close to, but still below, 2019’s level, as shown in Figure 6.Figure 6. US Party and Event Supply Rental Market: 2019–2021E

| 2019 | 2020 | 2021E | |

| Market size (USD Bil.) | $3.1 | $2.2 | |

| Year-over-year growth | (8.8)% | (29.0)% | 36.4% |

| Key market influence | Consumers demonstrated need for party and event supplies and saw rental as a solution to limited budgets. | There was decreased demand for event and party goods amid the social distancing and stay-at-home mandates during the pandemic. | The easing of the pandemic will revive activities and events. |

| Key players |

|

||

Source: American Rental Association/Coresight Research

5. Recreational and Sports Rental The total US recreational and sports goods rental market reached $1.7 billion in 2020, comprising a year-over-year decline of 5.6%, according to Coresight Research analysis of US Census Bureau data. In 2021, we expect the recreational and sports goods rental market to grow 5.9% as shown in Figure 7.Figure 7. US Recreational and Sports Rental Market: 2019–2021E

| 2019 | 2020 | 2021E | |

| Market size (USD Bil.) | $1.8 | $1.7 | $1.8 |

| Year-over-year growth | 12.2% | (5.6)% | 5.9% |

| Key market influence | Consumers showed demand for immediate access to goods for outdoor sports and activities and turned to rental options | There was reduced consumer demand for recreational and sports equipment used outside of the home because of the pandemic. | Consumers are returning to recreational and sports activities such as golf, kayaking and fishing. However, as many do not carry out these activities on a regular basis, many will use renting equipment to satisfy their short-term needs. |

| Key players |

|

||

Source: Census Bureau/Coresight Research

Themes We Are Watching We discuss three key themes that brands and retailers should stay up to date with regarding the consumer products rental market. We also present headwinds that may present challenges going forward. 1. Digitalization Among Traditional Rental Companies We are seeing more traditional rental companies upgrading their digital offerings to enhance engagement with customers. 2020 was a turning point for traditional rental companies without digital capacity as the pandemic environment drove consumers to rely more on e-commerce. Rent-A-Center accelerated its digital transformation in late 2020 and has continued to expand its capabilities into this year. The company upgraded its digital platforms to include a mobile application (Preferred Digital) and marketplace (Preferred Marketplace), allowing consumers to select the items they want from any US retailers and lease them from the platform directly without needing to complete the transaction on the individual retailer’s website. Moreover, the company acquired virtual lease-to-own solution provider Acima in December 2020, aiming to expand its e-commerce platform and integrate point-of-sale to support its retail partners’ digital transactions. The company has seen positive results in relation to its digitalization, with its e-commerce sales growing 50% in the fourth quarter of fiscal 2020. This marks a 100% increase in fiscal 2020 from fiscal 2018, according to the company. On its February 2021 earnings call, management stated that digital payments account for almost 50% of Rent-A-Center’s sales, and they result in much stickier customer engagement—underpinning its plans to grow e-commerce to over 30% of revenues over the next few years. Traditional rental companies must continue to enhance digital shopping experiences, in relation to content, functionality and assortment. Companies should also focus on removing friction in purchase processes, allowing customers to find items they like, make purchases without any credit obstacles and manage their accounts easily. Digitalization of store fronts With significant offline footprints, traditional rental companies are adjusting their store front strategies to keep up with competitors. Aaron’s is executing a “GenNext” store strategy, which includes incorporating digitally enhanced showrooms, improved brand imaging in physical stores and technology-facilitated access to product information in stores. For instance, the former process of filling out paperwork for lease approval has been replaced by in-store computer kiosks and a mobile platform in Aaron’s GenNext store. As of the end of fiscal 2020, Aaron’s has 47 GenNext stores and more than 60 additional stores in the pipeline for this year. Management stated on the company’s February 2021 earnings call that the GenNext stores are performing well, delivering new lease volumes that are higher than the corporate averages and in line with the company’s expectations. Although the new stores represent a small portion of the company’s overall store count, we expect to see continued success in its technology-driven store strategy. We believe an online-offline integrated model for furniture rental companies will improve the in-store selling process and offer customers a seamless shopping experience. [caption id="attachment_134819" align="aligncenter" width="700"] The former process of filling out paperwork for lease approval has been replaced by in-store computer kiosks and a mobile platform in Aaron’s GenNext store

The former process of filling out paperwork for lease approval has been replaced by in-store computer kiosks and a mobile platform in Aaron’s GenNext storeSource: Aaron’s[/caption] 2. Increased Flexibility in Delivery Retailers and brands are increasingly recognizing the significance of faster deliveries of products to consumers. We expect rental companies to adopt solutions that get products to market faster and more efficiently in order to stay competitive.

- Aaron’s offers express delivery within two to three days for online leases and same-day delivery on selected merchandise for in-store leases.

- Brook Furniture Rental has optimized its delivery appointment scheduling and route planning ability by working with Descartes Systems Group, a technology company specializing in logistics solutions.

- Rent-A-Center offers same-day delivery for both online and in-store leases on the majority of its product assortment.

- Rising disposable personal income: As disposable income rises, the immediate access to goods beyond consumers’ budgets may become less appealing. We have seen overall momentum in disposable personal income growth in 2021, casting potential doubt on the rental market.

- Goods shortages: Supply chain disruption amid the pandemic poses a challenge to consumer goods rental companies. For instance, Rent-A-Center has faced inventory availability issues, despite implementing alternative inventory sourcing strategies earlier this year. Management stated on its August 2021 earnings call that the company is seeing inventory flow faster through the system, but expects constraints to continue.

- Cost management: For rental businesses, profitability is largely dependent on the company’s ability to effectively manage the array of costs they face. Inflationary pressures may lead to increases merchandise costs from suppliers or retail partners, increases in shipping costs and increases in labor costs as a result of wage inflation.

What We Think

Implications for Brands/Retailers- We expect the US consumer product rental market to grow 8.4% to $17.5 billion in 2021. The three fastest-growing rental segments we are seeing are party and event supply rental, apparel rental, and recreational and sports goods rental, driven by a return to in-person events, the recovery in apparel spending and increased participation in outdoor activities, respectively. We are closely monitoring the impact of the Delta variant, as fluctuations in case numbers may impact recovery. As of October 2021, the spread of the Covid-19 variant in the US has not yet materially negatively impacted these three categories.

- We are seeing more retailers and brands such as H&M, IKEA and Ralph Lauren test and launch rental services to capture a slice of the growing market. As well as new launches, we see opportunity for brands and retailers that offer rental services to increase their sales through this channel in 2021. However, the profitability of the model remains uncertain as the expansion of rental services requires major investment.

- Traditional rental companies must continue to enhance digital shopping experiences, in relation to content, functionality and assortment ranges. Brands and retailers must remove friction in shopping processes to enable customers to discover new products, make purchases without any credit obstacles and easily manage their accounts.

- It is important that retailers and brands expand their last-mile capabilities as online orders and demand for short delivery windows increases.