Nitheesh NH

Introduction

Each report in our Sector Overview series analyzes a particular retail sector or consumer market. In this report, we dive into the diverse European retail sector and look specifically at the UK, Germany and France. This report includes:

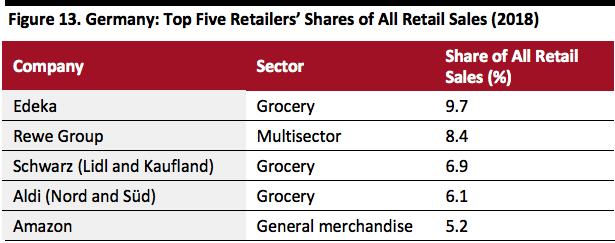

Source: ONS/Destatis/Eurostat/Coresight Research[/caption]

Focus on Germany

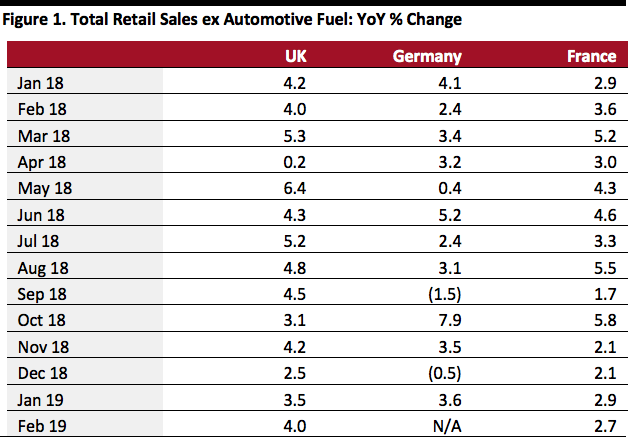

Apparently alarmed by world events such as Brexit and tariff wars, and in a context of slowly climbing inflation, German consumers retrenched discretionary spending through much of 2018.

In 2018, German GDP rose 1.4%, versus 2.2% in both 2017 and 2016. However, unemployment fell to an annual rate of 3.2% in 2018 versus 3.5% in 2017.

Consumer caution dragged Germany’s economy into a decline in the third quarter of 2018: The country’s gross domestic product contracted by 0.2% quarter over quarter in real terms, in part due to a 0.3% contraction in total consumer spending on the same basis. In the fourth quarter of 2018, GDP was flat, quarter over quarter, with the national statistics office noting a slight quarter-over-quarter increase in consumer spending.

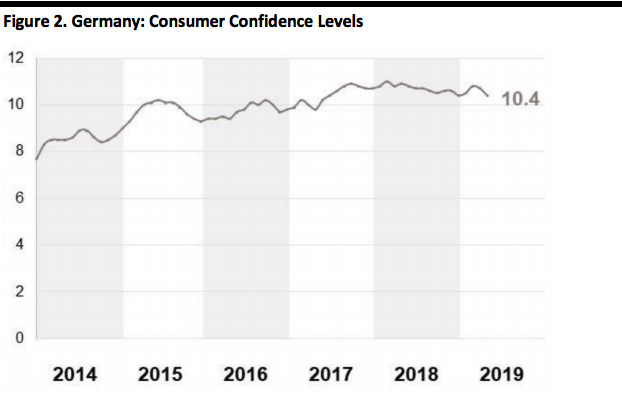

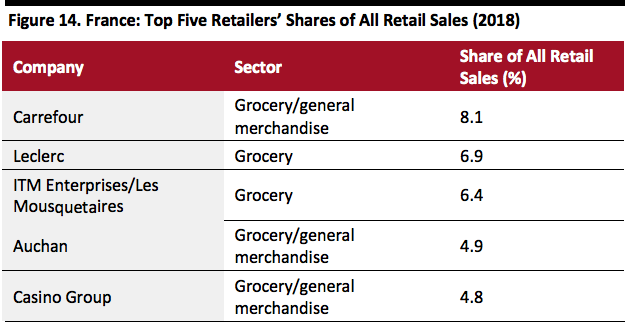

Confirming that shoppers’ caution continues into 2019, research firm GfK noted a slight decline in consumer confidence in March 2019, though the overall trend appears to be leveling confidence levels.

[caption id="attachment_84202" align="aligncenter" width="500"]

Source: ONS/Destatis/Eurostat/Coresight Research[/caption]

Focus on Germany

Apparently alarmed by world events such as Brexit and tariff wars, and in a context of slowly climbing inflation, German consumers retrenched discretionary spending through much of 2018.

In 2018, German GDP rose 1.4%, versus 2.2% in both 2017 and 2016. However, unemployment fell to an annual rate of 3.2% in 2018 versus 3.5% in 2017.

Consumer caution dragged Germany’s economy into a decline in the third quarter of 2018: The country’s gross domestic product contracted by 0.2% quarter over quarter in real terms, in part due to a 0.3% contraction in total consumer spending on the same basis. In the fourth quarter of 2018, GDP was flat, quarter over quarter, with the national statistics office noting a slight quarter-over-quarter increase in consumer spending.

Confirming that shoppers’ caution continues into 2019, research firm GfK noted a slight decline in consumer confidence in March 2019, though the overall trend appears to be leveling confidence levels.

[caption id="attachment_84202" align="aligncenter" width="500"] Source: GfK, on behalf of the European Commission[/caption]

German consumers are notoriously sensitive to macroeconomic and political events — in fact, the prospect of Brexit appears to be impacting German shoppers’ behavior much more than that of their British peers — and there has been a consequent cyclical pullback in German consumer spending. German retail is likely to remain sluggish until we see greater security and certainty in world and European affairs.

Underlying Softness in Clothing Sales Is a Structural Challenge

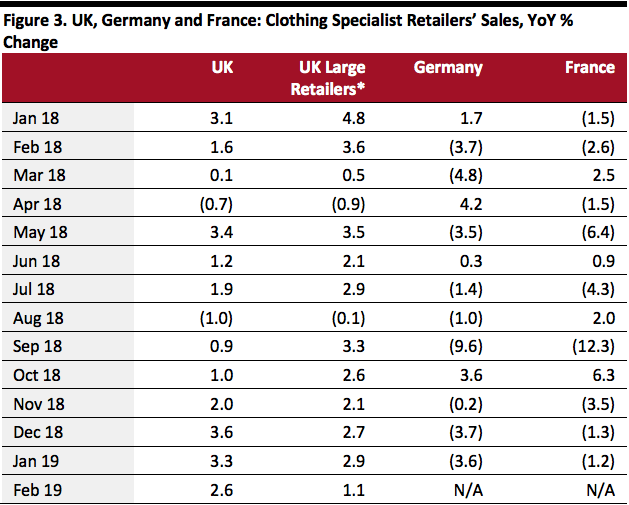

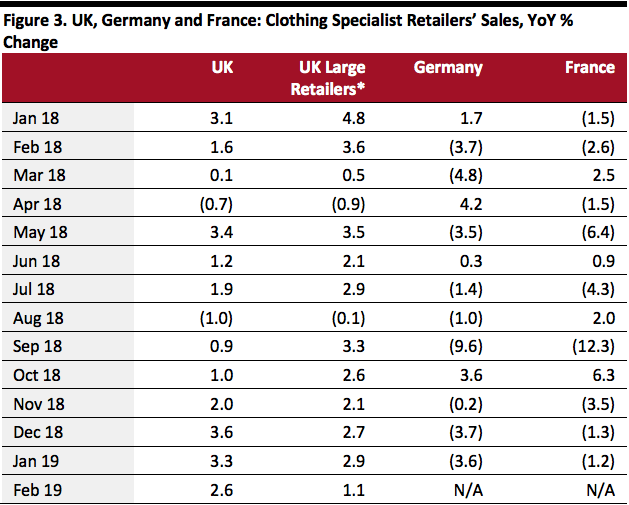

Reflecting soft demand for apparel and structural channel shifts, the clothing specialist sectors in Germany and France have continued to see meaningful declines.

The relative strength of UK sector sales has at times been driven by reported strong growth for small retailers (defined as one with fewer than 100 employees or with revenues of £60 million or less per year). According to the ONS, this segment, which accounts for only around 10% of the UK clothing specialist sector, has proven volatile, sometimes growing at double-digit rates — and such growth is hard to account for. We include data for large UK clothing specialist retailers in the table below, as we believe these are a more meaningful measure of sector growth.

[caption id="attachment_84204" align="aligncenter" width="500"]

Source: GfK, on behalf of the European Commission[/caption]

German consumers are notoriously sensitive to macroeconomic and political events — in fact, the prospect of Brexit appears to be impacting German shoppers’ behavior much more than that of their British peers — and there has been a consequent cyclical pullback in German consumer spending. German retail is likely to remain sluggish until we see greater security and certainty in world and European affairs.

Underlying Softness in Clothing Sales Is a Structural Challenge

Reflecting soft demand for apparel and structural channel shifts, the clothing specialist sectors in Germany and France have continued to see meaningful declines.

The relative strength of UK sector sales has at times been driven by reported strong growth for small retailers (defined as one with fewer than 100 employees or with revenues of £60 million or less per year). According to the ONS, this segment, which accounts for only around 10% of the UK clothing specialist sector, has proven volatile, sometimes growing at double-digit rates — and such growth is hard to account for. We include data for large UK clothing specialist retailers in the table below, as we believe these are a more meaningful measure of sector growth.

[caption id="attachment_84204" align="aligncenter" width="500"] Source: ONS/Destatis/INSEE/Coresight Research[/caption]

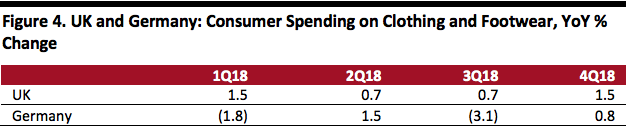

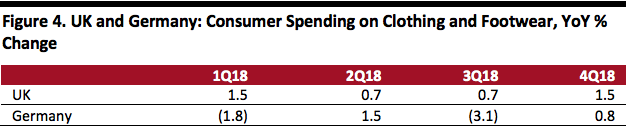

High-growth Internet pure plays partially account for weak sector performance (these pure plays are not included in the sector data for clothing specialists). Yet quarterly consumer spending data confirm sporadic declines in total demand in Germany — as we show below, a year-over-year decline in the third quarter of 2018 was followed by a modest increase in the fourth quarter.

The weekly apparel sales index from trade publication TextilWirtschaft recorded a very weak January in Germany followed by a strong recovery in February (including year-over-year growth of 15% in week 4 of February) and then a mixed March (ranging from a 6% decline in week 1 to an 8% increase in week 3).

In the UK, the ONS estimates that consumer spending on clothing and footwear continues to rise. In 2018, the sector grew at a slower pace than the ONS reported in prior years, when ONS estimates for apparel growth outpaced those reported by other sources, such as market measurement service Kantar Worldpanel. A comparable quarterly breakout of spending is not available for France.

Primark owner Associated British Foods pointed to a “difficult German market” for the fashion chain in its January 2019 trading update. ASOS noted a “challenging performance” in Germany and France in its half-year results, published in April. However, Zalando reported a strong, 20% increase in revenues in the Germany region in the final quarter of 2018 (see later).

[caption id="attachment_84205" align="aligncenter" width="500"]

Source: ONS/Destatis/INSEE/Coresight Research[/caption]

High-growth Internet pure plays partially account for weak sector performance (these pure plays are not included in the sector data for clothing specialists). Yet quarterly consumer spending data confirm sporadic declines in total demand in Germany — as we show below, a year-over-year decline in the third quarter of 2018 was followed by a modest increase in the fourth quarter.

The weekly apparel sales index from trade publication TextilWirtschaft recorded a very weak January in Germany followed by a strong recovery in February (including year-over-year growth of 15% in week 4 of February) and then a mixed March (ranging from a 6% decline in week 1 to an 8% increase in week 3).

In the UK, the ONS estimates that consumer spending on clothing and footwear continues to rise. In 2018, the sector grew at a slower pace than the ONS reported in prior years, when ONS estimates for apparel growth outpaced those reported by other sources, such as market measurement service Kantar Worldpanel. A comparable quarterly breakout of spending is not available for France.

Primark owner Associated British Foods pointed to a “difficult German market” for the fashion chain in its January 2019 trading update. ASOS noted a “challenging performance” in Germany and France in its half-year results, published in April. However, Zalando reported a strong, 20% increase in revenues in the Germany region in the final quarter of 2018 (see later).

[caption id="attachment_84205" align="aligncenter" width="500"] Source: ONS/Destatis/Coresight Research[/caption]

We do not expect to see a sustained near-term reversal of the weakness in apparel demand for two main reasons: First, many younger consumers in Europe appear to have deprioritized spending on apparel. Second, shoppers have an abundance of price-competitive options, both online and offline, that help them cut spending on clothing. In this context, fashion-sensitive discounters and price-competitive Internet-only retailers look set to continue to capture share.

Recovery Follows a Weak Autumn for Europe’s Major Apparel Pure Plays

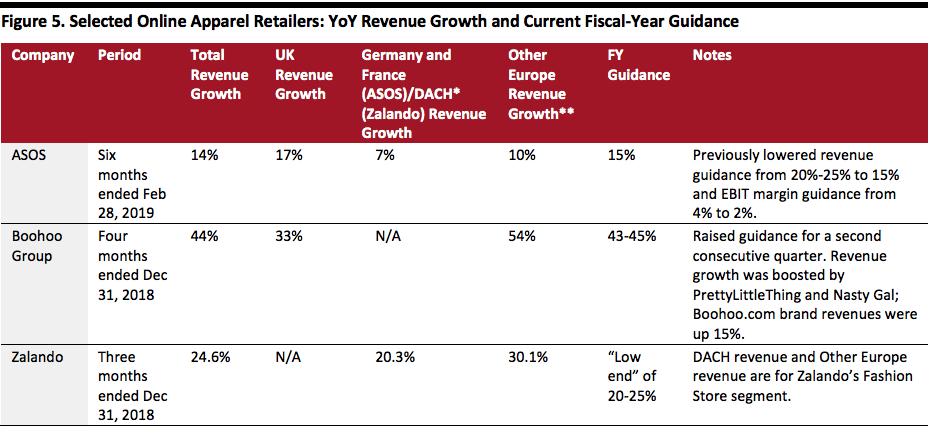

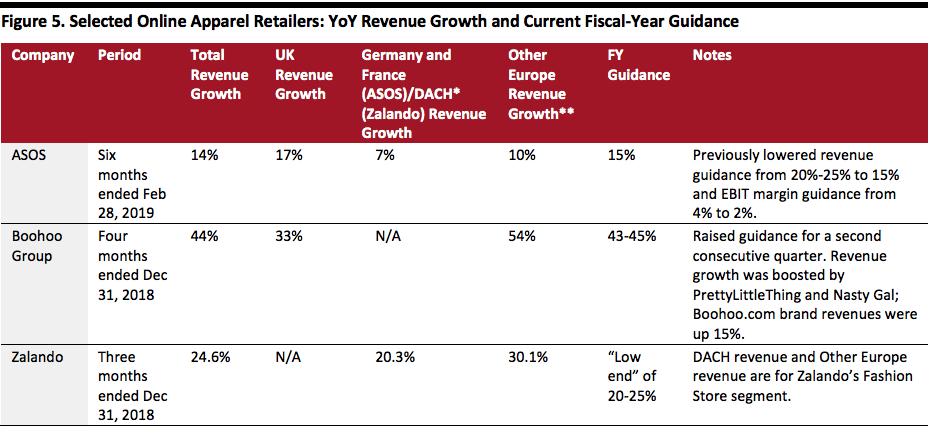

After a weak autumn, the major Internet-only retailers reported an improvement over the holiday season.

Source: ONS/Destatis/Coresight Research[/caption]

We do not expect to see a sustained near-term reversal of the weakness in apparel demand for two main reasons: First, many younger consumers in Europe appear to have deprioritized spending on apparel. Second, shoppers have an abundance of price-competitive options, both online and offline, that help them cut spending on clothing. In this context, fashion-sensitive discounters and price-competitive Internet-only retailers look set to continue to capture share.

Recovery Follows a Weak Autumn for Europe’s Major Apparel Pure Plays

After a weak autumn, the major Internet-only retailers reported an improvement over the holiday season.

*DACH is Germany (D), Austria (A) and Switzerland (CH).

*DACH is Germany (D), Austria (A) and Switzerland (CH).

**At constant currency, except for Zalando. ASOS Other Europe includes Germany and France (also broken out).

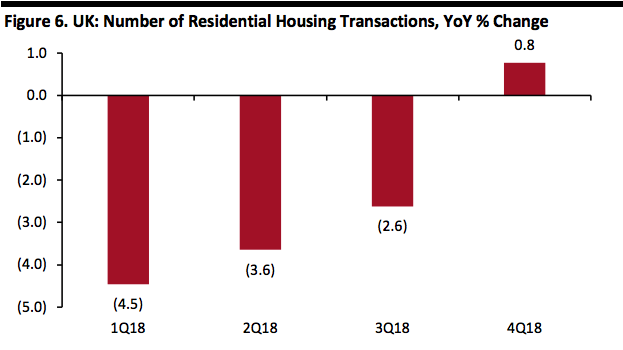

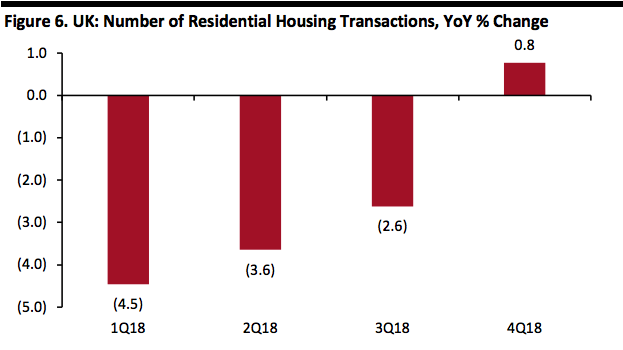

Source: Company reports[/caption] We expect fulfillment costs to remain a major challenge for Internet-only retailers. Zalando has repeatedly pointed to higher fulfillment cost ratios as it has invested in faster and more convenient delivery options. ASOS has also seen fulfillment costs climb as a percentage of sales. Given consumers’ relentlessly increasing expectations regarding delivery speed and convenience, we think Internet-only retailers will face challenges in capping order fulfillment costs. Soft Housing Market and Uncertainty Threaten to Drag on UK Big-Ticket Spending The uncertainty surrounding Brexit negotiations has contributed to a sluggish UK housing market. But that is not the only factor affecting home sales: A 3% stamp duty (property transaction tax) on second homes enacted in 2016, changes to income tax relief for landlords phased in from the 2017-2018 tax year, and more stringent mortgage lending rules have all also suppressed growth in the buy-to-let segment of the housing market. A February 2019 survey by the Royal Institution of Chartered Surveyors (RICS) found that 77% of respondents cited Brexit uncertainty as the biggest challenge facing the housing market. It also recorded that the time taken to complete a property sale remained at its joint-longest average since RICS began the surveying two years earlier. However, some signs point to a healthier, more sustainable mix in the UK property market as the balance tilts back toward owner-occupiers and away from investors. In 2018, the number of mortgages completed for first-time buyers reached its highest level since 2006, according to trade association UK Finance. In December 2018, the number of first-time buyer mortgage completions was up 1.6% year over year while the number of buy-to-let completions was down 5.6% year over year. According to HM Revenue and Customs, and charted below, the trend in total number of residential property transactions is upward. [caption id="attachment_84217" align="aligncenter" width="500"] Source: HM Revenue & Customs[/caption]

Over the medium term, a softer property market may impact big-ticket sales. However, viewed over the longer term, any tilting away from buy-to-let and second home sales in favor of first-time-buyer sales should create greater sustainability in the UK housing market. After years of declining home ownership rates, an ongoing increase in sales to first-time buyers should funnel more owner-occupiers into big-ticket categories for decades to come.

Preparing for Singles’ Day and Black Friday 2019

In 2018, the Singles’ Day shopping festival was bigger than ever in Asia, but European retailers’ participation in the event was limited. In part, this was due to the shopping holiday falling on November 11, which is Armistice Day, a day to remember the end of World War I, a major event in a number of European countries. In addition, 2018 was the 100-year anniversary of the end of the war, so there were larger than usual ceremonies marking the date. Our retail channel checks suggest that Singles’ Day participation in Europe was wholly or largely confined to Internet-only retailers in 2018. Given the challenges presented by the date, we expect to see limited participation again in 2019.

Source: HM Revenue & Customs[/caption]

Over the medium term, a softer property market may impact big-ticket sales. However, viewed over the longer term, any tilting away from buy-to-let and second home sales in favor of first-time-buyer sales should create greater sustainability in the UK housing market. After years of declining home ownership rates, an ongoing increase in sales to first-time buyers should funnel more owner-occupiers into big-ticket categories for decades to come.

Preparing for Singles’ Day and Black Friday 2019

In 2018, the Singles’ Day shopping festival was bigger than ever in Asia, but European retailers’ participation in the event was limited. In part, this was due to the shopping holiday falling on November 11, which is Armistice Day, a day to remember the end of World War I, a major event in a number of European countries. In addition, 2018 was the 100-year anniversary of the end of the war, so there were larger than usual ceremonies marking the date. Our retail channel checks suggest that Singles’ Day participation in Europe was wholly or largely confined to Internet-only retailers in 2018. Given the challenges presented by the date, we expect to see limited participation again in 2019.

Source: Company reports/Coresight Research[/caption]

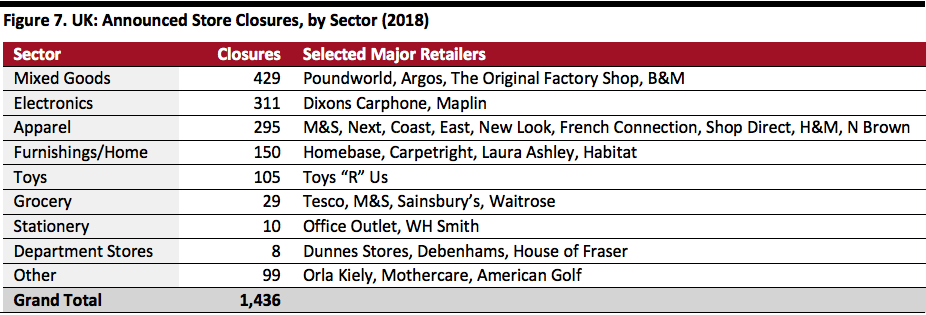

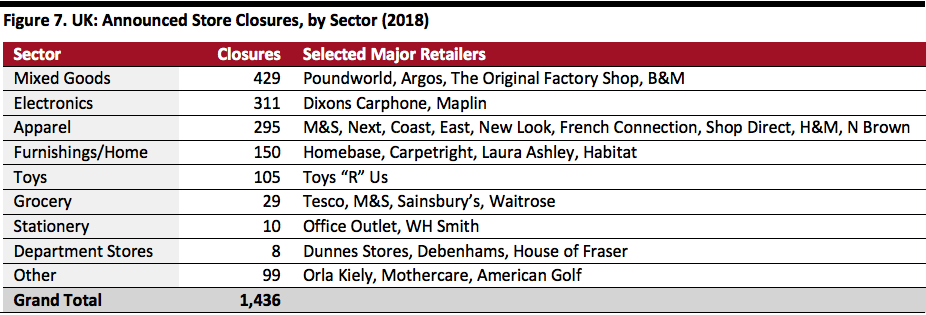

These closures do not reflect the health of retail demand, however, as British shoppers remained willing to spend throughout 2018, with retail sales in general holding up, according to the ONS. We see two specific challenges prompting store closures:

Source: Company reports/Coresight Research[/caption]

These closures do not reflect the health of retail demand, however, as British shoppers remained willing to spend throughout 2018, with retail sales in general holding up, according to the ONS. We see two specific challenges prompting store closures:

Source: Company reports[/caption]

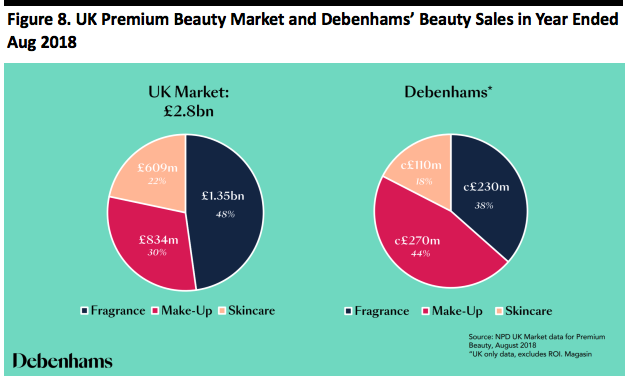

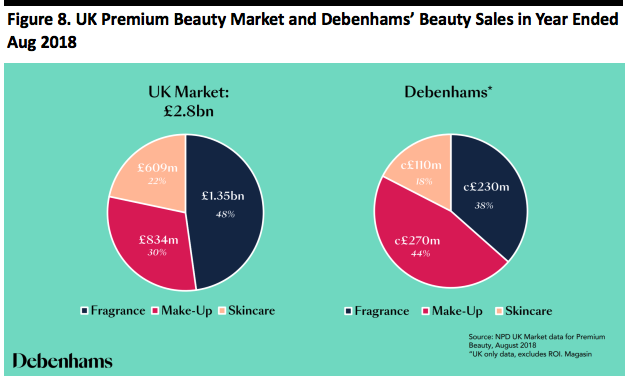

The department stores specialize in the premium skincare, cosmetics and fragrance segments of the beauty market, so any loss of beauty sales would be heavily skewed toward these. John Lewis would likely capture some of these sales, given its similar offering, though its limited store base would restrict the volume that it could gain. Boots would almost certainly gain, but like most major beauty competitors, it lacks the prestige emphasis that the department stores enjoy.

Some consumers have long clamored for LVMH to launch the Sephora beauty chain in the UK. We cautiously conclude department store closures may provide an opportunity for Sephora to make such a foray into the UK market.

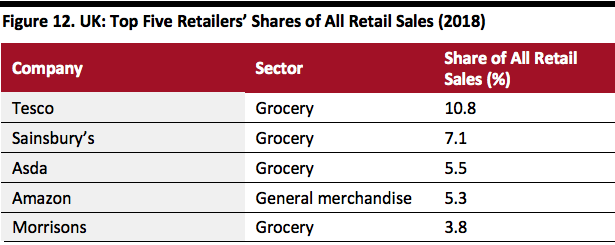

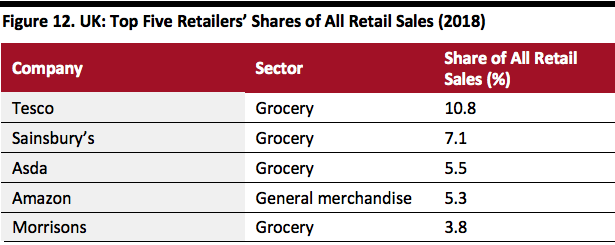

Grocery Discounting: Impact on UK Incumbents

In the UK, the sustained growth of discounters Aldi and Lidl continues to reshape the grocery landscape.

The Big Four domestic grocery retailers — Tesco, Sainsbury’s, Asda and Morrisons — have been forced to invest in price, and for retailers such as Tesco and Sainsbury’s, this has meant a general switch from special offers such as multibuys to more steady everyday lower pricing. At the same time, some retailers have been seeking to rebuild margins after a depletion in recent years. All Big Four have been cutting costs, resulting in thousands of job cuts: Tesco plans to shut fresh-food counters in 90 stores with some other stores switching to a reduced counter service, to cut store-based staff canteens and make further job cuts at its head office, in total impacting 9,000 people.

Tesco has been building its own discounter-type brands. In January 2019, the company reported that its new low-price “Exclusively at Tesco” brands had been 95% rolled out and that 82% of Tesco shoppers had bought items from the range. On the company’s 3Q19 earnings call, CEO Dave Lewis acknowledged demand for these low-price products, which replaced its previous Everyday Value range, had brought some trading down from more expensive (meaning higher-margin) ranges, but said that he was “very comfortable with the level of adoption” and its impact on the business.

Tesco has launched discount-format stores, too. In autumn 2018, the company launched Jack’s, which, like Aldi and Lidl, is built on a proposition of small stores, limited ranges and a private-label focus. However, we perceive Jack’s to be pitched at the lower end of the discounter space, which will likely limit its impact on Aldi and Lidl, which have successfully attracted more affluent customers with premium ranges. As of March 15, 2019, Jack’s had just nine stores — and we think the chain will need to achieve scale to have a serious chance of success.

Several of the biggest grocery retailers have looked outside their core grocery retail operations for opportunities to grow sales and build margins:

Source: Company reports[/caption]

The department stores specialize in the premium skincare, cosmetics and fragrance segments of the beauty market, so any loss of beauty sales would be heavily skewed toward these. John Lewis would likely capture some of these sales, given its similar offering, though its limited store base would restrict the volume that it could gain. Boots would almost certainly gain, but like most major beauty competitors, it lacks the prestige emphasis that the department stores enjoy.

Some consumers have long clamored for LVMH to launch the Sephora beauty chain in the UK. We cautiously conclude department store closures may provide an opportunity for Sephora to make such a foray into the UK market.

Grocery Discounting: Impact on UK Incumbents

In the UK, the sustained growth of discounters Aldi and Lidl continues to reshape the grocery landscape.

The Big Four domestic grocery retailers — Tesco, Sainsbury’s, Asda and Morrisons — have been forced to invest in price, and for retailers such as Tesco and Sainsbury’s, this has meant a general switch from special offers such as multibuys to more steady everyday lower pricing. At the same time, some retailers have been seeking to rebuild margins after a depletion in recent years. All Big Four have been cutting costs, resulting in thousands of job cuts: Tesco plans to shut fresh-food counters in 90 stores with some other stores switching to a reduced counter service, to cut store-based staff canteens and make further job cuts at its head office, in total impacting 9,000 people.

Tesco has been building its own discounter-type brands. In January 2019, the company reported that its new low-price “Exclusively at Tesco” brands had been 95% rolled out and that 82% of Tesco shoppers had bought items from the range. On the company’s 3Q19 earnings call, CEO Dave Lewis acknowledged demand for these low-price products, which replaced its previous Everyday Value range, had brought some trading down from more expensive (meaning higher-margin) ranges, but said that he was “very comfortable with the level of adoption” and its impact on the business.

Tesco has launched discount-format stores, too. In autumn 2018, the company launched Jack’s, which, like Aldi and Lidl, is built on a proposition of small stores, limited ranges and a private-label focus. However, we perceive Jack’s to be pitched at the lower end of the discounter space, which will likely limit its impact on Aldi and Lidl, which have successfully attracted more affluent customers with premium ranges. As of March 15, 2019, Jack’s had just nine stores — and we think the chain will need to achieve scale to have a serious chance of success.

Several of the biggest grocery retailers have looked outside their core grocery retail operations for opportunities to grow sales and build margins:

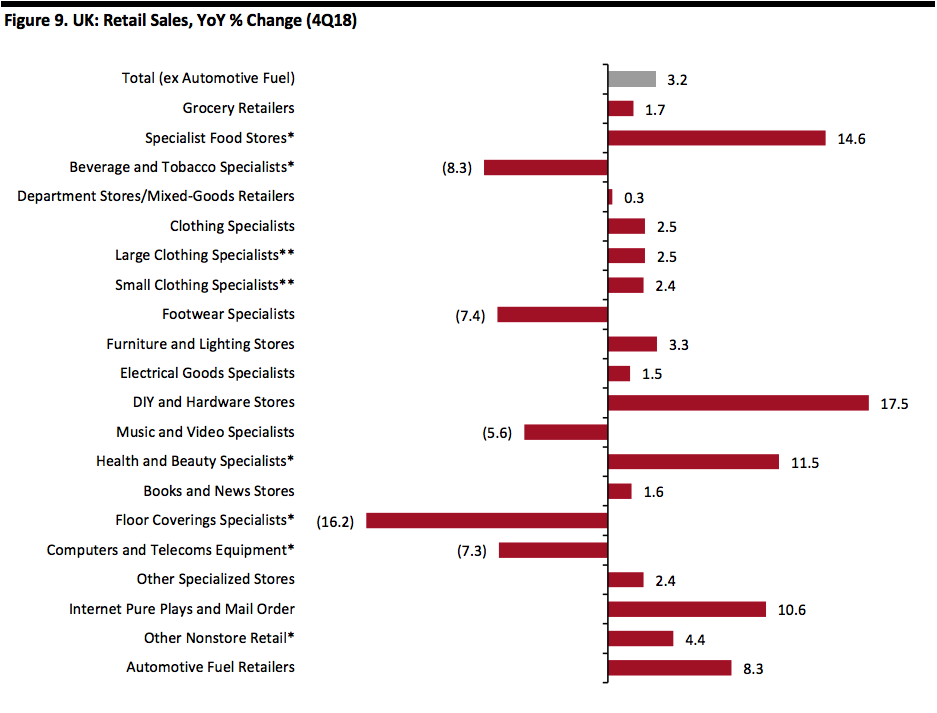

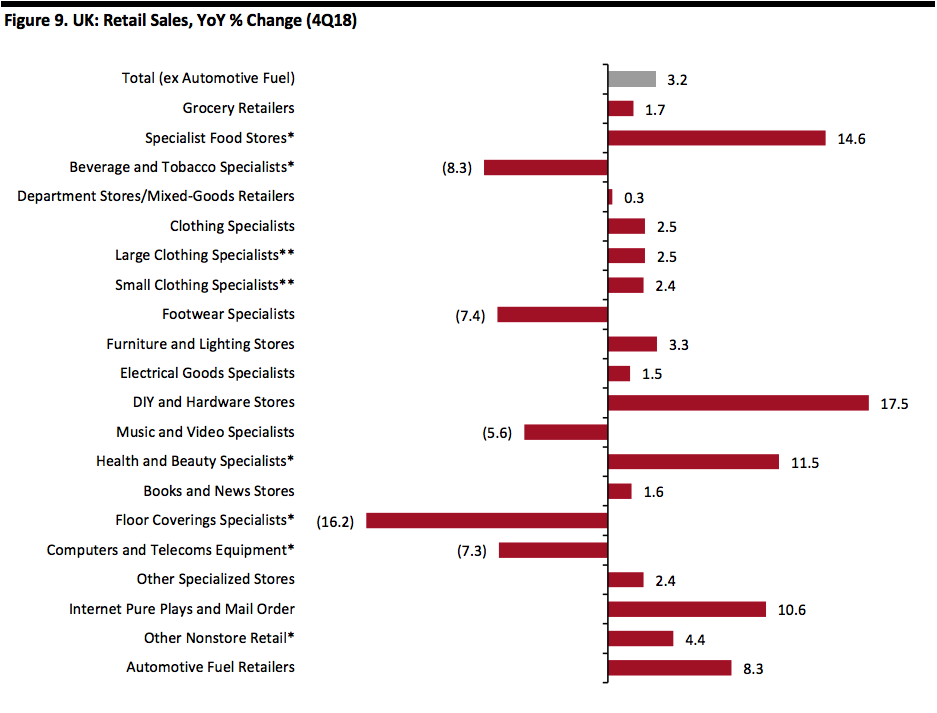

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

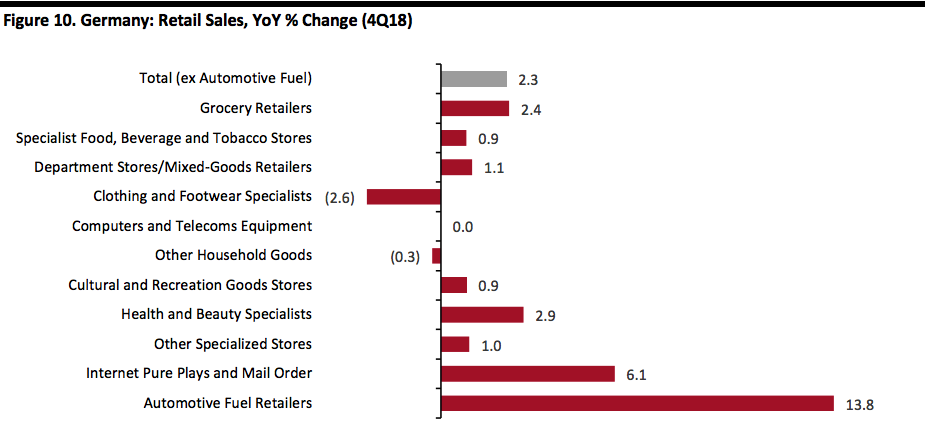

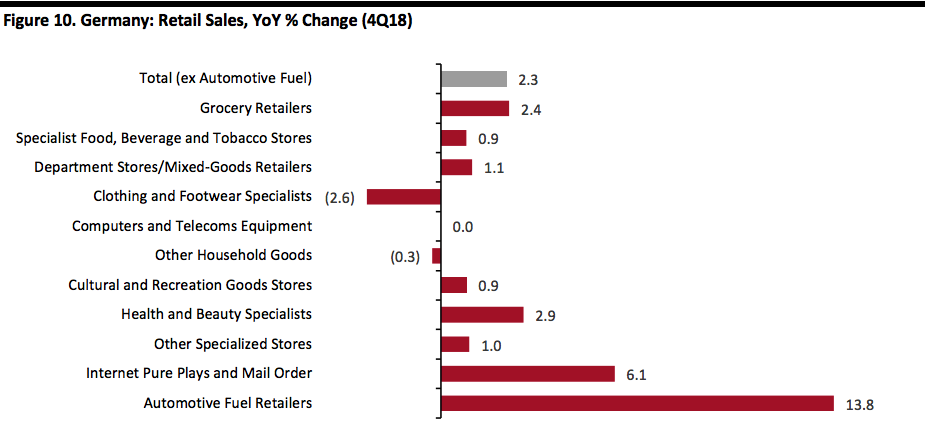

Source: ONS/Coresight Research[/caption] In Germany, total growth in the fourth quarter of 2018 was supported by food retailers and health and beauty stores, both of which include a substantial nondiscretionary element. Retailers in sectors that are more reliant on discretionary spending, such as apparel, department stores and household goods, saw weak or negative growth. [caption id="attachment_84223" align="aligncenter" width="720"] Source: Eurostat/Coresight Research[/caption]

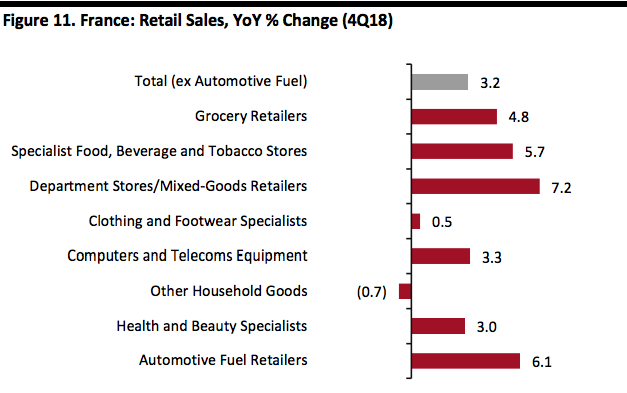

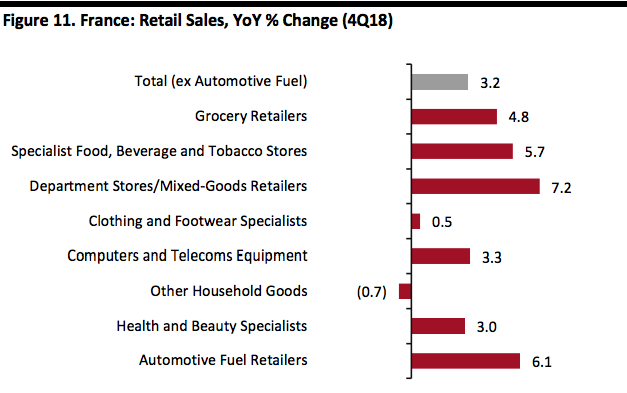

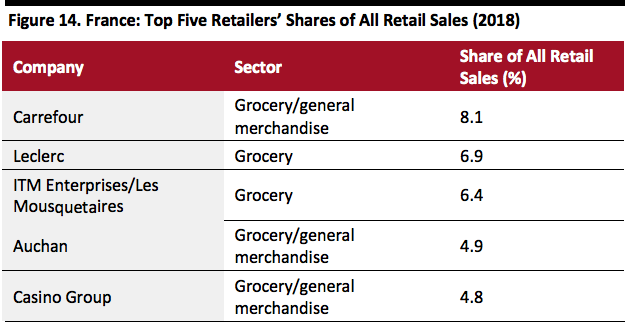

Data from France show a 3.2% increase in total retail sales in the fourth quarter, driven by food retailers and department stores/mixed-goods retailers.

[caption id="attachment_84224" align="aligncenter" width="500"]

Source: Eurostat/Coresight Research[/caption]

Data from France show a 3.2% increase in total retail sales in the fourth quarter, driven by food retailers and department stores/mixed-goods retailers.

[caption id="attachment_84224" align="aligncenter" width="500"] Source: Eurostat/Coresight Research[/caption]

Headwinds and Tailwinds

UK Sector Headwinds

Source: Eurostat/Coresight Research[/caption]

Headwinds and Tailwinds

UK Sector Headwinds

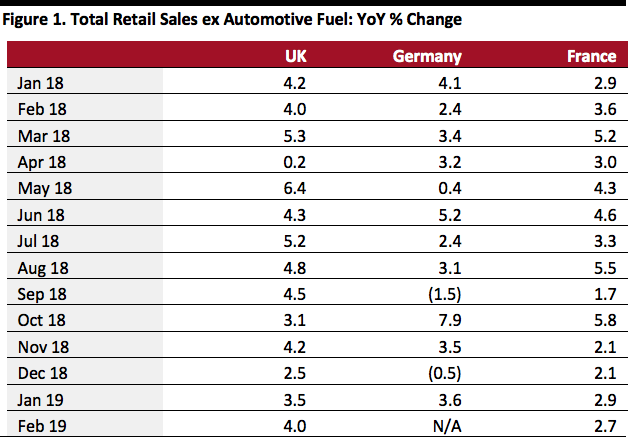

Source: Euromonitor International[/caption]

[caption id="attachment_84226" align="aligncenter" width="500"]

Source: Euromonitor International[/caption]

[caption id="attachment_84226" align="aligncenter" width="500"] Source: Euromonitor International[/caption]

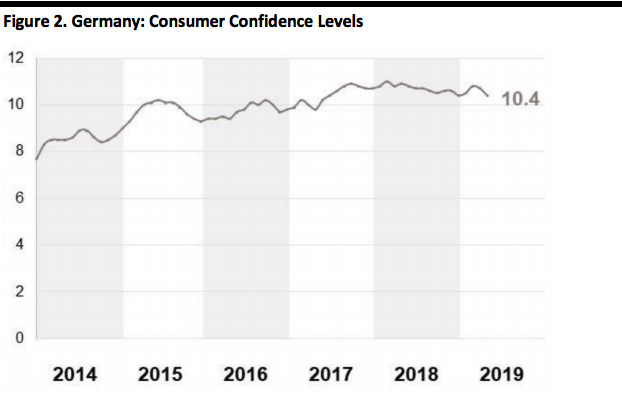

[caption id="attachment_84227" align="aligncenter" width="500"]

Source: Euromonitor International[/caption]

[caption id="attachment_84227" align="aligncenter" width="500"] Source: Euromonitor International[/caption]

Innovators and Disruptors

Structural shifts to the online and discount channels continue to cause the biggest disruptions in European retail. The result is that undifferentiated, middle-ground brick-and-mortar retailers are experiencing an ongoing squeeze:

Source: Euromonitor International[/caption]

Innovators and Disruptors

Structural shifts to the online and discount channels continue to cause the biggest disruptions in European retail. The result is that undifferentiated, middle-ground brick-and-mortar retailers are experiencing an ongoing squeeze:

- A discussion of key sector themes.

- A review of retail sector momentum in the UK, Germany and France.

- A summary of the sector landscape, including market shares for the top retailers in our three focus countries.

- The outlook for European retail.

- UK retail was solid, though the data from the ONS have been supported by unusually strong reported growth rates for small retailers; large retailers, which are the mainstay of the retail sector, have posted softer numbers.

- French retail sales weakened toward the end of the year, with some sectors and channels impacted by the “Gilet Jaune” (yellow vests) protests.

Source: ONS/Destatis/Eurostat/Coresight Research[/caption]

Focus on Germany

Apparently alarmed by world events such as Brexit and tariff wars, and in a context of slowly climbing inflation, German consumers retrenched discretionary spending through much of 2018.

In 2018, German GDP rose 1.4%, versus 2.2% in both 2017 and 2016. However, unemployment fell to an annual rate of 3.2% in 2018 versus 3.5% in 2017.

Consumer caution dragged Germany’s economy into a decline in the third quarter of 2018: The country’s gross domestic product contracted by 0.2% quarter over quarter in real terms, in part due to a 0.3% contraction in total consumer spending on the same basis. In the fourth quarter of 2018, GDP was flat, quarter over quarter, with the national statistics office noting a slight quarter-over-quarter increase in consumer spending.

Confirming that shoppers’ caution continues into 2019, research firm GfK noted a slight decline in consumer confidence in March 2019, though the overall trend appears to be leveling confidence levels.

[caption id="attachment_84202" align="aligncenter" width="500"]

Source: ONS/Destatis/Eurostat/Coresight Research[/caption]

Focus on Germany

Apparently alarmed by world events such as Brexit and tariff wars, and in a context of slowly climbing inflation, German consumers retrenched discretionary spending through much of 2018.

In 2018, German GDP rose 1.4%, versus 2.2% in both 2017 and 2016. However, unemployment fell to an annual rate of 3.2% in 2018 versus 3.5% in 2017.

Consumer caution dragged Germany’s economy into a decline in the third quarter of 2018: The country’s gross domestic product contracted by 0.2% quarter over quarter in real terms, in part due to a 0.3% contraction in total consumer spending on the same basis. In the fourth quarter of 2018, GDP was flat, quarter over quarter, with the national statistics office noting a slight quarter-over-quarter increase in consumer spending.

Confirming that shoppers’ caution continues into 2019, research firm GfK noted a slight decline in consumer confidence in March 2019, though the overall trend appears to be leveling confidence levels.

[caption id="attachment_84202" align="aligncenter" width="500"] Source: GfK, on behalf of the European Commission[/caption]

German consumers are notoriously sensitive to macroeconomic and political events — in fact, the prospect of Brexit appears to be impacting German shoppers’ behavior much more than that of their British peers — and there has been a consequent cyclical pullback in German consumer spending. German retail is likely to remain sluggish until we see greater security and certainty in world and European affairs.

Underlying Softness in Clothing Sales Is a Structural Challenge

Reflecting soft demand for apparel and structural channel shifts, the clothing specialist sectors in Germany and France have continued to see meaningful declines.

The relative strength of UK sector sales has at times been driven by reported strong growth for small retailers (defined as one with fewer than 100 employees or with revenues of £60 million or less per year). According to the ONS, this segment, which accounts for only around 10% of the UK clothing specialist sector, has proven volatile, sometimes growing at double-digit rates — and such growth is hard to account for. We include data for large UK clothing specialist retailers in the table below, as we believe these are a more meaningful measure of sector growth.

[caption id="attachment_84204" align="aligncenter" width="500"]

Source: GfK, on behalf of the European Commission[/caption]

German consumers are notoriously sensitive to macroeconomic and political events — in fact, the prospect of Brexit appears to be impacting German shoppers’ behavior much more than that of their British peers — and there has been a consequent cyclical pullback in German consumer spending. German retail is likely to remain sluggish until we see greater security and certainty in world and European affairs.

Underlying Softness in Clothing Sales Is a Structural Challenge

Reflecting soft demand for apparel and structural channel shifts, the clothing specialist sectors in Germany and France have continued to see meaningful declines.

The relative strength of UK sector sales has at times been driven by reported strong growth for small retailers (defined as one with fewer than 100 employees or with revenues of £60 million or less per year). According to the ONS, this segment, which accounts for only around 10% of the UK clothing specialist sector, has proven volatile, sometimes growing at double-digit rates — and such growth is hard to account for. We include data for large UK clothing specialist retailers in the table below, as we believe these are a more meaningful measure of sector growth.

[caption id="attachment_84204" align="aligncenter" width="500"] Source: ONS/Destatis/INSEE/Coresight Research[/caption]

High-growth Internet pure plays partially account for weak sector performance (these pure plays are not included in the sector data for clothing specialists). Yet quarterly consumer spending data confirm sporadic declines in total demand in Germany — as we show below, a year-over-year decline in the third quarter of 2018 was followed by a modest increase in the fourth quarter.

The weekly apparel sales index from trade publication TextilWirtschaft recorded a very weak January in Germany followed by a strong recovery in February (including year-over-year growth of 15% in week 4 of February) and then a mixed March (ranging from a 6% decline in week 1 to an 8% increase in week 3).

In the UK, the ONS estimates that consumer spending on clothing and footwear continues to rise. In 2018, the sector grew at a slower pace than the ONS reported in prior years, when ONS estimates for apparel growth outpaced those reported by other sources, such as market measurement service Kantar Worldpanel. A comparable quarterly breakout of spending is not available for France.

Primark owner Associated British Foods pointed to a “difficult German market” for the fashion chain in its January 2019 trading update. ASOS noted a “challenging performance” in Germany and France in its half-year results, published in April. However, Zalando reported a strong, 20% increase in revenues in the Germany region in the final quarter of 2018 (see later).

[caption id="attachment_84205" align="aligncenter" width="500"]

Source: ONS/Destatis/INSEE/Coresight Research[/caption]

High-growth Internet pure plays partially account for weak sector performance (these pure plays are not included in the sector data for clothing specialists). Yet quarterly consumer spending data confirm sporadic declines in total demand in Germany — as we show below, a year-over-year decline in the third quarter of 2018 was followed by a modest increase in the fourth quarter.

The weekly apparel sales index from trade publication TextilWirtschaft recorded a very weak January in Germany followed by a strong recovery in February (including year-over-year growth of 15% in week 4 of February) and then a mixed March (ranging from a 6% decline in week 1 to an 8% increase in week 3).

In the UK, the ONS estimates that consumer spending on clothing and footwear continues to rise. In 2018, the sector grew at a slower pace than the ONS reported in prior years, when ONS estimates for apparel growth outpaced those reported by other sources, such as market measurement service Kantar Worldpanel. A comparable quarterly breakout of spending is not available for France.

Primark owner Associated British Foods pointed to a “difficult German market” for the fashion chain in its January 2019 trading update. ASOS noted a “challenging performance” in Germany and France in its half-year results, published in April. However, Zalando reported a strong, 20% increase in revenues in the Germany region in the final quarter of 2018 (see later).

[caption id="attachment_84205" align="aligncenter" width="500"] Source: ONS/Destatis/Coresight Research[/caption]

We do not expect to see a sustained near-term reversal of the weakness in apparel demand for two main reasons: First, many younger consumers in Europe appear to have deprioritized spending on apparel. Second, shoppers have an abundance of price-competitive options, both online and offline, that help them cut spending on clothing. In this context, fashion-sensitive discounters and price-competitive Internet-only retailers look set to continue to capture share.

Recovery Follows a Weak Autumn for Europe’s Major Apparel Pure Plays

After a weak autumn, the major Internet-only retailers reported an improvement over the holiday season.

Source: ONS/Destatis/Coresight Research[/caption]

We do not expect to see a sustained near-term reversal of the weakness in apparel demand for two main reasons: First, many younger consumers in Europe appear to have deprioritized spending on apparel. Second, shoppers have an abundance of price-competitive options, both online and offline, that help them cut spending on clothing. In this context, fashion-sensitive discounters and price-competitive Internet-only retailers look set to continue to capture share.

Recovery Follows a Weak Autumn for Europe’s Major Apparel Pure Plays

After a weak autumn, the major Internet-only retailers reported an improvement over the holiday season.

- For the first half of fiscal 2019, ASOS reported mixed top-line figures with a solid UK offset by weaknesses in France and Germany, where sales grew by a modest 7% at constant currency; its international growth was also impacted by disruption from the launch of a new US distribution center. ASOS had previously lowered its full-year guidance (see table below) and this revised guidance remained unchanged at its half-year.

- Reporting its third-quarter update, Boohoo Group raised full-year revenue guidance for a second consecutive quarter. Growth is being fueled by two brands that were consolidated in early 2017: PrettyLittleThing (consolidated at the start of 2017) and Nasty Gal (consolidated at the start of March 2017). In March 2019, Boohoo Group acquired the MissPap womenswear brand.

- Zalando reported a very strong final quarter, with consensus-beating revenue growth of 24.6%, versus 11.7% in the third quarter. At the company’s capital markets day, Birgit Haderer, SVP of Finance, characterized it as a “good conclusion to a bumpy 2018” and noted that growth was supported by “very strong” customer key performance indicators, such as customer growth and purchase frequency. In an apparently weak German market, Zalando reported regional growth of just over 20% in its most recent quarter (see below).

*DACH is Germany (D), Austria (A) and Switzerland (CH).

*DACH is Germany (D), Austria (A) and Switzerland (CH).**At constant currency, except for Zalando. ASOS Other Europe includes Germany and France (also broken out).

Source: Company reports[/caption] We expect fulfillment costs to remain a major challenge for Internet-only retailers. Zalando has repeatedly pointed to higher fulfillment cost ratios as it has invested in faster and more convenient delivery options. ASOS has also seen fulfillment costs climb as a percentage of sales. Given consumers’ relentlessly increasing expectations regarding delivery speed and convenience, we think Internet-only retailers will face challenges in capping order fulfillment costs. Soft Housing Market and Uncertainty Threaten to Drag on UK Big-Ticket Spending The uncertainty surrounding Brexit negotiations has contributed to a sluggish UK housing market. But that is not the only factor affecting home sales: A 3% stamp duty (property transaction tax) on second homes enacted in 2016, changes to income tax relief for landlords phased in from the 2017-2018 tax year, and more stringent mortgage lending rules have all also suppressed growth in the buy-to-let segment of the housing market. A February 2019 survey by the Royal Institution of Chartered Surveyors (RICS) found that 77% of respondents cited Brexit uncertainty as the biggest challenge facing the housing market. It also recorded that the time taken to complete a property sale remained at its joint-longest average since RICS began the surveying two years earlier. However, some signs point to a healthier, more sustainable mix in the UK property market as the balance tilts back toward owner-occupiers and away from investors. In 2018, the number of mortgages completed for first-time buyers reached its highest level since 2006, according to trade association UK Finance. In December 2018, the number of first-time buyer mortgage completions was up 1.6% year over year while the number of buy-to-let completions was down 5.6% year over year. According to HM Revenue and Customs, and charted below, the trend in total number of residential property transactions is upward. [caption id="attachment_84217" align="aligncenter" width="500"]

Source: HM Revenue & Customs[/caption]

Over the medium term, a softer property market may impact big-ticket sales. However, viewed over the longer term, any tilting away from buy-to-let and second home sales in favor of first-time-buyer sales should create greater sustainability in the UK housing market. After years of declining home ownership rates, an ongoing increase in sales to first-time buyers should funnel more owner-occupiers into big-ticket categories for decades to come.

Preparing for Singles’ Day and Black Friday 2019

In 2018, the Singles’ Day shopping festival was bigger than ever in Asia, but European retailers’ participation in the event was limited. In part, this was due to the shopping holiday falling on November 11, which is Armistice Day, a day to remember the end of World War I, a major event in a number of European countries. In addition, 2018 was the 100-year anniversary of the end of the war, so there were larger than usual ceremonies marking the date. Our retail channel checks suggest that Singles’ Day participation in Europe was wholly or largely confined to Internet-only retailers in 2018. Given the challenges presented by the date, we expect to see limited participation again in 2019.

Source: HM Revenue & Customs[/caption]

Over the medium term, a softer property market may impact big-ticket sales. However, viewed over the longer term, any tilting away from buy-to-let and second home sales in favor of first-time-buyer sales should create greater sustainability in the UK housing market. After years of declining home ownership rates, an ongoing increase in sales to first-time buyers should funnel more owner-occupiers into big-ticket categories for decades to come.

Preparing for Singles’ Day and Black Friday 2019

In 2018, the Singles’ Day shopping festival was bigger than ever in Asia, but European retailers’ participation in the event was limited. In part, this was due to the shopping holiday falling on November 11, which is Armistice Day, a day to remember the end of World War I, a major event in a number of European countries. In addition, 2018 was the 100-year anniversary of the end of the war, so there were larger than usual ceremonies marking the date. Our retail channel checks suggest that Singles’ Day participation in Europe was wholly or largely confined to Internet-only retailers in 2018. Given the challenges presented by the date, we expect to see limited participation again in 2019.

- In 2018, Cdiscount in France offered deals on Huawei phones and Singer vacuum cleaners on Singles’ Day.

- In the Netherlands, Bol.com offered promotions across various categories, including apparel, beauty and electronics.

- In the UK, Boohoo.com offered 20% off all women’s clothing across the Singles’ Day weekend. We did not observe rival ASOS offering discounts related to Singles’ Day.

Source: Company reports/Coresight Research[/caption]

These closures do not reflect the health of retail demand, however, as British shoppers remained willing to spend throughout 2018, with retail sales in general holding up, according to the ONS. We see two specific challenges prompting store closures:

Source: Company reports/Coresight Research[/caption]

These closures do not reflect the health of retail demand, however, as British shoppers remained willing to spend throughout 2018, with retail sales in general holding up, according to the ONS. We see two specific challenges prompting store closures:

- First, retailers have seen costs rise. This has been partly due to the tight labor market and partly due to high business rates. The migration of sales online, which deleverages the fixed costs of brick-and-mortar stores, compounds these pressures.

- Second, structural changes continue to squeeze legacy retailers hard. Major structural shifts — notably to the discount and e-commerce channels — have enabled legacy retailers’ competitors to steal share, while limiting traditional retailers’ ability to pass on higher costs to shoppers.

- Just over one-quarter of Debenhams’ sales derive from beauty products, giving it £610 million in beauty sales in the year ended August 2018. Based on average gross transaction value per store, the eventual closure of 50 stores out of a UK total of 164 would free up an estimated £186 million in beauty sales (at 2018 prices), although the stores penciled in for closure may turn over less than the average store.

- We think 12 House of Fraser store closures could free up around £71 million of beauty sales (at 2018 prices) for rivals to capture. This assumes beauty items make up a similar proportion of sales at House of Fraser as they do at Debenhams and is based on average gross transaction value per store for the year ended January 2017 (latest available data).

Source: Company reports[/caption]

The department stores specialize in the premium skincare, cosmetics and fragrance segments of the beauty market, so any loss of beauty sales would be heavily skewed toward these. John Lewis would likely capture some of these sales, given its similar offering, though its limited store base would restrict the volume that it could gain. Boots would almost certainly gain, but like most major beauty competitors, it lacks the prestige emphasis that the department stores enjoy.

Some consumers have long clamored for LVMH to launch the Sephora beauty chain in the UK. We cautiously conclude department store closures may provide an opportunity for Sephora to make such a foray into the UK market.

Grocery Discounting: Impact on UK Incumbents

In the UK, the sustained growth of discounters Aldi and Lidl continues to reshape the grocery landscape.

The Big Four domestic grocery retailers — Tesco, Sainsbury’s, Asda and Morrisons — have been forced to invest in price, and for retailers such as Tesco and Sainsbury’s, this has meant a general switch from special offers such as multibuys to more steady everyday lower pricing. At the same time, some retailers have been seeking to rebuild margins after a depletion in recent years. All Big Four have been cutting costs, resulting in thousands of job cuts: Tesco plans to shut fresh-food counters in 90 stores with some other stores switching to a reduced counter service, to cut store-based staff canteens and make further job cuts at its head office, in total impacting 9,000 people.

Tesco has been building its own discounter-type brands. In January 2019, the company reported that its new low-price “Exclusively at Tesco” brands had been 95% rolled out and that 82% of Tesco shoppers had bought items from the range. On the company’s 3Q19 earnings call, CEO Dave Lewis acknowledged demand for these low-price products, which replaced its previous Everyday Value range, had brought some trading down from more expensive (meaning higher-margin) ranges, but said that he was “very comfortable with the level of adoption” and its impact on the business.

Tesco has launched discount-format stores, too. In autumn 2018, the company launched Jack’s, which, like Aldi and Lidl, is built on a proposition of small stores, limited ranges and a private-label focus. However, we perceive Jack’s to be pitched at the lower end of the discounter space, which will likely limit its impact on Aldi and Lidl, which have successfully attracted more affluent customers with premium ranges. As of March 15, 2019, Jack’s had just nine stores — and we think the chain will need to achieve scale to have a serious chance of success.

Several of the biggest grocery retailers have looked outside their core grocery retail operations for opportunities to grow sales and build margins:

Source: Company reports[/caption]

The department stores specialize in the premium skincare, cosmetics and fragrance segments of the beauty market, so any loss of beauty sales would be heavily skewed toward these. John Lewis would likely capture some of these sales, given its similar offering, though its limited store base would restrict the volume that it could gain. Boots would almost certainly gain, but like most major beauty competitors, it lacks the prestige emphasis that the department stores enjoy.

Some consumers have long clamored for LVMH to launch the Sephora beauty chain in the UK. We cautiously conclude department store closures may provide an opportunity for Sephora to make such a foray into the UK market.

Grocery Discounting: Impact on UK Incumbents

In the UK, the sustained growth of discounters Aldi and Lidl continues to reshape the grocery landscape.

The Big Four domestic grocery retailers — Tesco, Sainsbury’s, Asda and Morrisons — have been forced to invest in price, and for retailers such as Tesco and Sainsbury’s, this has meant a general switch from special offers such as multibuys to more steady everyday lower pricing. At the same time, some retailers have been seeking to rebuild margins after a depletion in recent years. All Big Four have been cutting costs, resulting in thousands of job cuts: Tesco plans to shut fresh-food counters in 90 stores with some other stores switching to a reduced counter service, to cut store-based staff canteens and make further job cuts at its head office, in total impacting 9,000 people.

Tesco has been building its own discounter-type brands. In January 2019, the company reported that its new low-price “Exclusively at Tesco” brands had been 95% rolled out and that 82% of Tesco shoppers had bought items from the range. On the company’s 3Q19 earnings call, CEO Dave Lewis acknowledged demand for these low-price products, which replaced its previous Everyday Value range, had brought some trading down from more expensive (meaning higher-margin) ranges, but said that he was “very comfortable with the level of adoption” and its impact on the business.

Tesco has launched discount-format stores, too. In autumn 2018, the company launched Jack’s, which, like Aldi and Lidl, is built on a proposition of small stores, limited ranges and a private-label focus. However, we perceive Jack’s to be pitched at the lower end of the discounter space, which will likely limit its impact on Aldi and Lidl, which have successfully attracted more affluent customers with premium ranges. As of March 15, 2019, Jack’s had just nine stores — and we think the chain will need to achieve scale to have a serious chance of success.

Several of the biggest grocery retailers have looked outside their core grocery retail operations for opportunities to grow sales and build margins:

- In March 2016, Sainsbury’s issued an ultimately successful bid for Home Retail Group, whose main interest was the Argos general-merchandise chain.

- In January 2017, Tesco announced a merger with Booker, the UK’s largest cash-and-carry wholesale supplier.

- In February 2016, Morrisons struck a wholesale supply deal with Amazon, under which the supermarket chain will supply groceries for sale on Amazon Pantry and Prime Now. In August 2017, Morrisons signed a wholesale deal to supply grocery products to convenience chain McColl’s.

- Disposing of a large tranche of stores, or even one of the Sainsbury’s or Asda banners, could undermine the economics of the merger.

- The merged company may struggle to dispose of a large number of superstore sites: Rivals may not be interested in taking on superstores given that UK grocery retailers are shifting from large stores to smaller formats — and are generally opening fewer stores.

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.

*A relatively small or fragmented sector, in which reported figures have traditionally been volatile.**A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

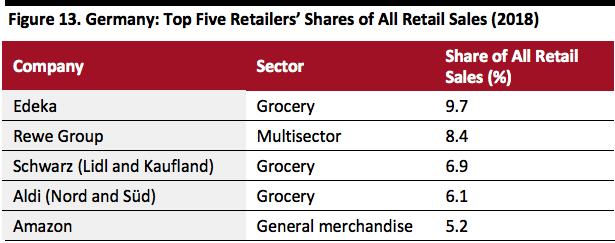

Source: ONS/Coresight Research[/caption] In Germany, total growth in the fourth quarter of 2018 was supported by food retailers and health and beauty stores, both of which include a substantial nondiscretionary element. Retailers in sectors that are more reliant on discretionary spending, such as apparel, department stores and household goods, saw weak or negative growth. [caption id="attachment_84223" align="aligncenter" width="720"]

Source: Eurostat/Coresight Research[/caption]

Data from France show a 3.2% increase in total retail sales in the fourth quarter, driven by food retailers and department stores/mixed-goods retailers.

[caption id="attachment_84224" align="aligncenter" width="500"]

Source: Eurostat/Coresight Research[/caption]

Data from France show a 3.2% increase in total retail sales in the fourth quarter, driven by food retailers and department stores/mixed-goods retailers.

[caption id="attachment_84224" align="aligncenter" width="500"] Source: Eurostat/Coresight Research[/caption]

Headwinds and Tailwinds

UK Sector Headwinds

Source: Eurostat/Coresight Research[/caption]

Headwinds and Tailwinds

UK Sector Headwinds

- At the time of writing, uncertainty persists over the country’s exit from the EU — now delayed until as late as October 31. This uncertainty has apparently had only a moderate impact on consumer spending, according to various sources including ONS data. But it has prompted retailers to invest in contingency plans and stockpiling in case of a no-deal Brexit: In January 2019, the Confederation of British Industry reported that stockpiling by UK retailers and wholesalers was at its highest level since the 2008 financial crisis.

- After Brexit, the UK and the EU will still need to agree on future trading arrangements, so businesses will likely still face a degree of uncertainty over the medium term.

- Future interest rate increases are a looming cloud for consumers. The Bank of England raised its interest rate to 0.75% in August 2018 and Bank Governor Mark Carney said that there would be further “gradual” and “limited” rate increases.

- We expect the UK retail sector to face sustained disruption from challengers, especially in the discount and e-commerce segments.

- The UK is enjoying near-record employment levels. The unemployment rate was 3.9% in the period November 2018 to January 2019. ONS data show it has not been lower since the November 1974 to January 1975 period. In the tight labor market, wages are growing faster than inflation.

- Consumer price inflation has slowed following the annualization of sterling’s depreciation.

- UK retail sales growth has proven robust.

- When the UK finalizes its withdrawal from the EU, we expect to see a jump in business investment as greater clarity releases pent-up demand.

- Brexit uncertainty hangs over Europe. German consumers have been retrenching discretionary spending in the face of Brexit and tariff conflicts between the US and the EU.

- Germany’s unemployment rate has shown a trend of falling to record lows. The rate showed a declining tendency in 2018 and into 2019, and as of February 2019 (latest available), it stood at just 3.1%, according to Eurostat.

- Consumer price inflation has eased since late 2018, and stood at 1.4% in March 2019, down from a 2018 peak of 2.6% in October. German consumers are traditionally more sensitive to price increases than peers in other countries.

- Adjusted for inflation, German workers’ wages have been rising — albeit at a relatively slow pace.

- Consumer confidence remains weak in France, according to Eurostat. Political discontent deepened in the final two months of 2018 and continued into this year, causing disruption to retailers and making for a precarious near-term retail outlook.

- French household consumption expenditure was flat, quarter over quarter, in the fourth quarter of 2018 (in volume terms), according to Insee; this was a slowdown from a 0.4% quarter-over-quarter increase in the third quarter.

- France has tended to lag the UK and Germany in terms of e-commerce penetration. This suggests that French brick-and-mortar retailers will face future challenges as consumers migrate online in the coming years.

- France’s 8.8% unemployment rate in February 2019 (latest) was more than double the UK’s rate and almost triple Germany’s rate in the same period.

- Retail sales growth in France has remained broadly solid, with a weak holiday season proving to be something of an exception.

- On a volume basis, France’s quarter-over-quarter GDP growth strengthened from 0.2% in the second quarter of 2018 to 0.4% in the third quarter and continued to grow at 0.3% in the fourth quarter.

- France’s unemployment rate has been declining slowly.

- Consumer price inflation has declined: As of March 2019, the provisional figure of 1.3% CPI compared to a 2018 peak of 2.6% in July and August.

Source: Euromonitor International[/caption]

[caption id="attachment_84226" align="aligncenter" width="500"]

Source: Euromonitor International[/caption]

[caption id="attachment_84226" align="aligncenter" width="500"] Source: Euromonitor International[/caption]

[caption id="attachment_84227" align="aligncenter" width="500"]

Source: Euromonitor International[/caption]

[caption id="attachment_84227" align="aligncenter" width="500"] Source: Euromonitor International[/caption]

Innovators and Disruptors

Structural shifts to the online and discount channels continue to cause the biggest disruptions in European retail. The result is that undifferentiated, middle-ground brick-and-mortar retailers are experiencing an ongoing squeeze:

Source: Euromonitor International[/caption]

Innovators and Disruptors

Structural shifts to the online and discount channels continue to cause the biggest disruptions in European retail. The result is that undifferentiated, middle-ground brick-and-mortar retailers are experiencing an ongoing squeeze:

- Major internet pure plays such as Amazon, ASOS and Zalando are set for sustained market share gains, and their growth will be underpinned by investments in convenience. Examples of these include Amazon’s launch of its Prime Wardrobe service in the UK in 2018 and Zalando’s extension of same-day and next-day delivery options.

- Sophisticated discount players are likely to continue to win share, too. Aside from grocery discounters, these include B&M European Value Retail, whose main operations are complemented by its Jawoll chain in Germany and its October 2018 acquisition of Babou, a 95-store French chain. Primark is another name likely to capture further market share in Europe. For the year ended September 2018, Primark noted underlying sales growth in Germany and “especially strong” growth in France.

- In June 2018, Carrefour announced a strategic partnership with Google. The alliance is designed to help Carrefour digitally transform its operations by introducing technologies such as AI, cloud computing, the Internet of things and new shopping interfaces.

- In June 2018, M&S and Microsoft launched a strategic partnership to “investigate and test the capabilities of technology and artificial intelligence in a retail environment.”

- In late 2017, Casino Group signed a deal for Ocado to support Casino’s e-commerce service. Casino’s Monoprix banner started offering products through Amazon Prime Now on September 12, and in October, Casino management said that the number of orders placed through Prime Now had exceeded its projections.