DIpil Das

Introduction

A Changing World At the time of writing, Europe is in the midst of a severe public health crisis, with the World Health Organization having declared the region to be the new global center of the coronavirus pandemic on March 13, 2020. Several countries in the continent have declared a state of national emergency and have taken actions to contain the spread of virus, such as temporarily closing down cafés, shopping centers, restaurants, theaters and public parks. For Europe’s apparel retailers, the coronavirus crisis came on top of a depressed Christmas trading period. The apparel industry is expected to face major disruption as a result of shuttering stores and plummeting consumer demand. The European Union (EU) has already warned member states to brace for the economic impact, as the coronavirus pandemic is set to push a number of countries into recession. Much of the research for this report was undertaken before the impact of the coronavirus outbreak reached severe levels in Europe. This report analyzes the full-year results and Christmas trading performance of selected retailers in 2019. The 2020 guidance figures of companies quoted in this report do not take into account the economic impact of the coronavirus crisis. Note: “Apparel” in this report refers to clothing and does not include footwear. Currency conversion: All the figures in British pounds are converted to euros at constant exchange rate. (Euro–GBP Exchange rate = 0.885) (Euro–USD Exchange rate = 1.119) Structural Shifts A number of discount retailers and online pure plays continue to go against the grain in European apparel retail, posting impressive growth as well as expanding their geographical reach. These outperforming retailers are gaining market share by capitalizing on consumers’ desire for broader product selection, coupled with shifting shopper tastes and preferences. Consumers are increasingly opting to shop through three growth segments:- The value space—high-quality, low-price, private-label retailers including Primark and Boohoo.com, and brand-heavy discounters such as T.K. Maxx

- Online multibrand pure plays—notably Amazon, ASOS and Zalando

- Sports and sustainable brands, which are increasingly selling through direct-to-consumer channels, while also partnering with fast-growing multibrand online platforms such as ASOS and Zalando

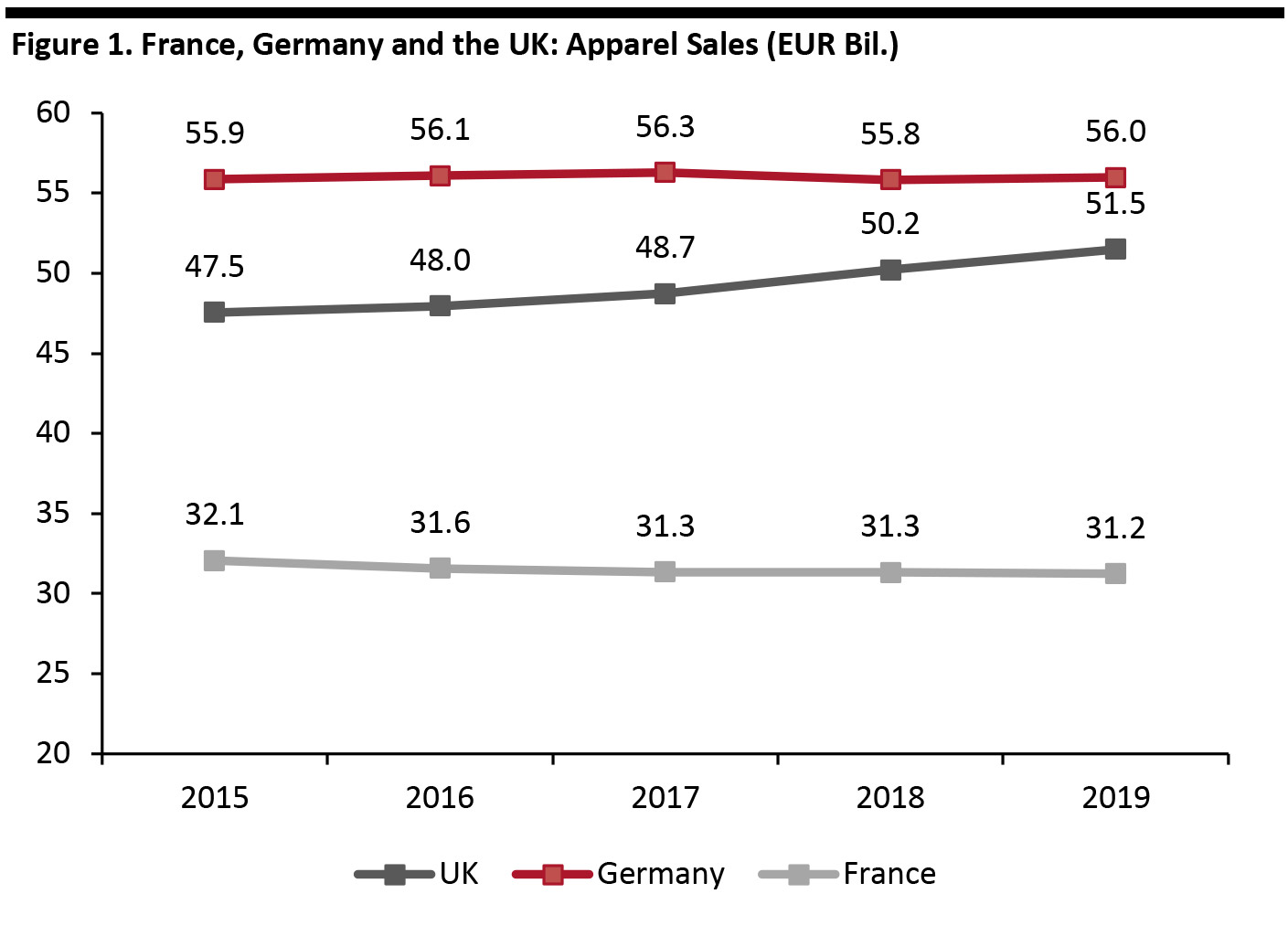

Apparel Sales in France, Germany and the UK

Apparel sales in France and Germany were sluggish over the 2015–2019 period, according to market research firm Euromonitor International. Apparel sales in France declined, registering (0.3)% year-over-year growth in 2019. Germany’s apparel sales stagnated in the same period and grew a meagre 0.3% year over year in 2019. The UK, on the other hand, reported relatively stronger growth, with apparel sales growing at a CAGR of 2% at constant exchange rates from 2015 to 2019. Last year, apparel sales grew by 2.5% in the UK. [caption id="attachment_107591" align="aligncenter" width="700"] UK figures have been converted from British pounds at constant exchange rates.

UK figures have been converted from British pounds at constant exchange rates. Source: Euromonitor International Limited 2020 © All rights reserved [/caption]

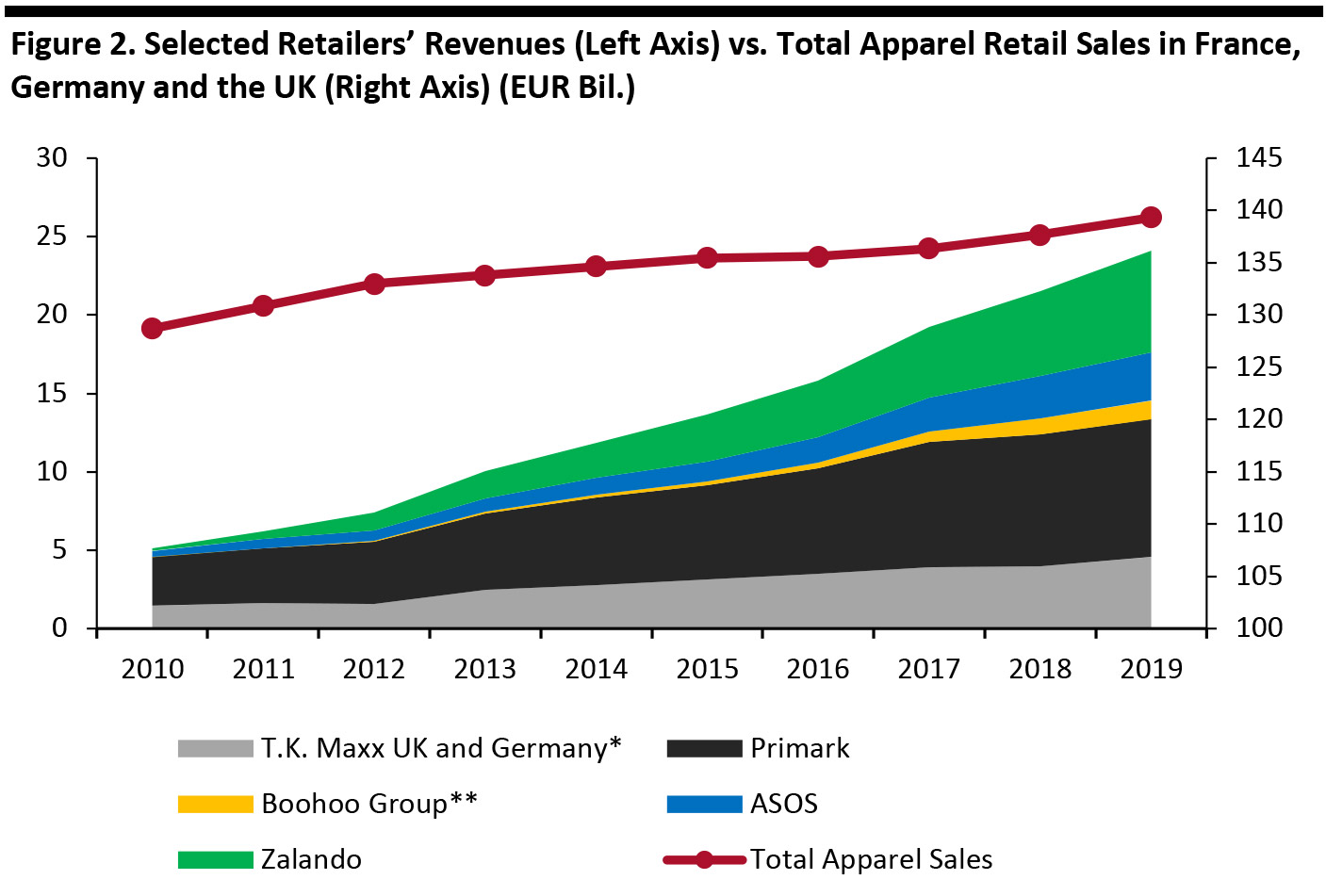

A Handful of Online Pure Plays and Discounters Buck the Doom-and-Gloom Trend

Although several traditional retailers struggling to maintain growth, scaling back their retail footprint and filing for bankruptcies, a number of online pure plays and discount retailers are bucking this negative trend. Below, we chart the growth of five retailers that showed exceptional growth over the 2010–2019 period:- In discount, Primark and T.K. Maxx

- In multibrand e-commerce, ASOS and Zalando

- In discount and e-commerce, Boohoo Group

Companies’ revenues have been attributed to the closet calendar year for better comparison. Revenues of retailers reporting in British pounds is converted to euros at constant exchange rates. UK apparel retail sales is converted to euros at constant exchange rates.

Companies’ revenues have been attributed to the closet calendar year for better comparison. Revenues of retailers reporting in British pounds is converted to euros at constant exchange rates. UK apparel retail sales is converted to euros at constant exchange rates. *Total revenues of TJX Deustschland (estimated for 2019) and TJX UK

**2019 figure is trailing 12-month revenues, as of August 31, 2019

Source: Company reports/Euromonitor International Limited 2020 © All rights reserved/Coresight Research [/caption]

Value Retailers Expand Their Reach and Footprint

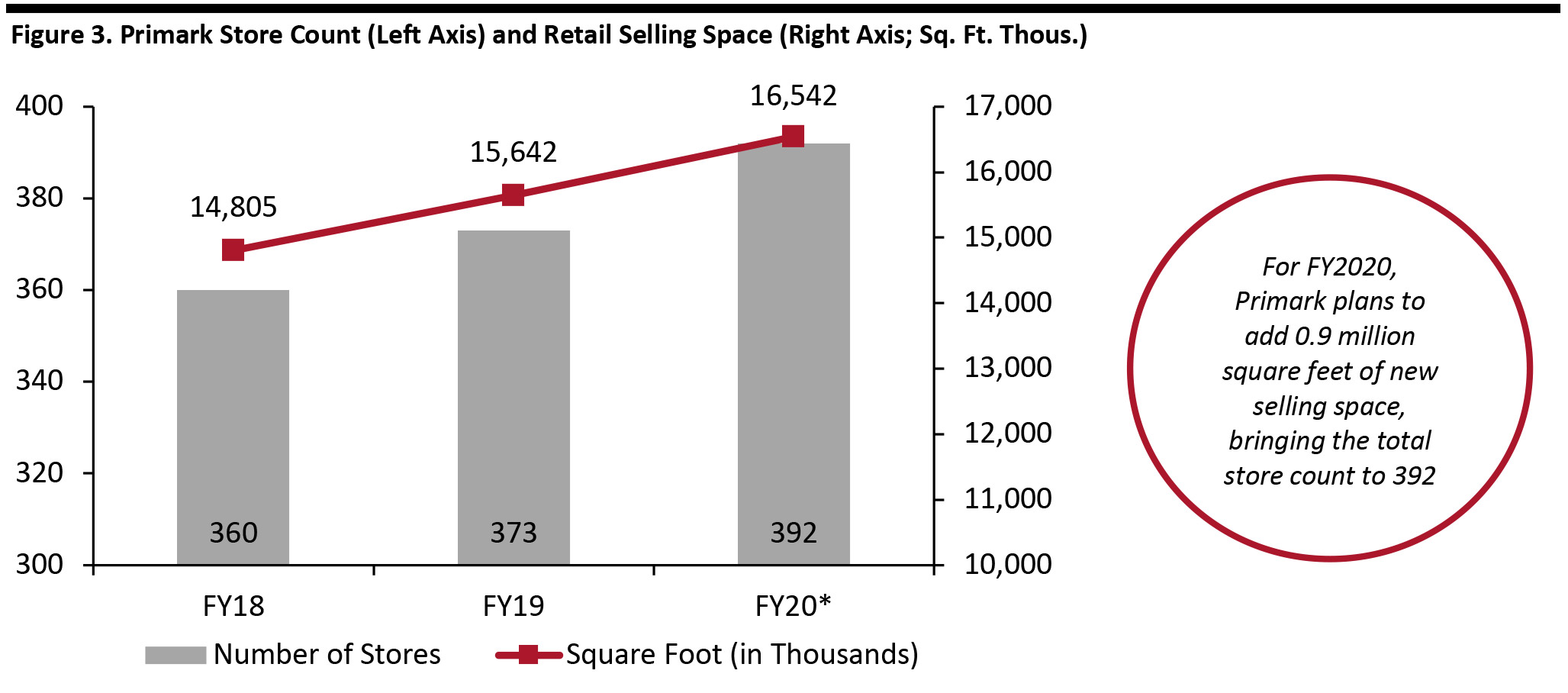

Primark FY2019: Primark reported revenues of £7.8 billion (€8.8 billion) for the fiscal year ended September 14, 2019, up 4.2% year over year. This was driven by increased selling space, with the company having invested heavily in new freehold and leasehold properties in Germany, Spain, Ireland and the UK, adding 14 new stores in total during the fiscal year. However, Primark’s comparable sales performance was sluggish, registering a decline of 2.0%. In the UK, the retailer saw sales growth of 2.5%, driven by the continued expansion of its store portfolio (four stores added in 2019), but its comparable sales declined by 1%. The eurozone segment registered a comparable sales decline of 2.9%, mainly driven by a weak performance in Germany. Primark has appointed a new managing director in Germany who is leading several initiatives, according to the company, including consolidation of retail space and targeted local marketing campaigns. Christmas trading period: The UK saw a downturn in apparel sales that hit many British retailers across the Christmas 2019 trading period. Among those impacted was Primark. In the UK, which is Primark’s most important market, the retailer saw a decline of 1.3% in comparable sales for the 24 weeks ended February 29, 2020. Comparable sales for the eurozone segment were 0.5% ahead, with France and Italy seeing the strongest comparable sales growth. Primark also recorded a notable improvement in comparable sales in Germany, due to a series of operational changes made by the new management team, according to the company. Primark plans to add 0.9 million square feet of new selling space in fiscal year 2020, with over 0.5 million square feet to be added in the second quarter. In 2020, the company expects to open 19 new stores, with most retail space to be added in France and Spain. In addition, Eastern Europe will be next frontier for Primark in Europe: The company will mark its entry into Poland by opening a new store in Warsaw in spring 2020, and it has signed leases for new store openings in Poznan, Poland; Bratislava, Slovakia; and Prague and Berno, Czech Republic. (These plans were announced before the coronavirus crisis deepened.) [caption id="attachment_107593" align="aligncenter" width="700"] *Management’s forecast

*Management’s forecast Source: Company reports [/caption] Amid ongoing coronavirus disruption, Primark announced the temporary closure of all of its 376 stores in 12 countries on March 23, 2020, effective until further notice. The company added that it stands to lose around £650 million (€734.4 million) from sales each month that the shops are shut. Under such circumstances, the retailer has reportedly written to its UK landlords informing them it will be withholding its quarterly rent payments, due in March 2020, on 110 UK stores. The letter asks for each landlord to agree on terms that may help Primark mitigate some of the impact of the coronavirus crisis. Primark also announced that it has canceled future orders due to the coronavirus outbreak and has asked suppliers to halt all current and future production for the retailer. H&M: As part of its ongoing transformation work, H&M has been making significant investments in recent years to build a more efficient supply chain and upgrade its tech infrastructure. For the fiscal year ended November 2019, the company reported net sales of SEK232.7 billion (€21.3 billion), up 11% year over year. In constant currency, net sales increased by 6%. Then-CEO Karl-Johan Persson commented that H&M’s transformation work is on the right track, leading to well-received collections and increased market share. H&M announced low net store opening guidance, with 25 net store openings in 2020, compared to 108 in 2019. The company will open around 200 new stores in “growth markets”—including Asia (excluding China), Eastern Europe, Russia and South America—and will close 175 stores in the more mature markets of China, Western Europe and the US. This significant slowdown in retail expansion signals H&M’s changed focus, which is now on improving the performance of its existing store portfolio, covering customer experience, product assortment and sales densities. In addition, the company continues to roll-out omnichannel initiatives with stronger integration of the online channel. With the retailer’s transformation plan yielding positive gains, the founding family of H&M decided to bring in changes in top management to maintain the company’s momentum. Stefan Persson stepped down as chairman and was succeeded by his son Karl-Johan Persson, who was CEO of H&M from 2009. He handed over the reins to Helena Helmersson, who had been the company’s COO for 18 months and has worked for the company since 1997. T.K. Maxx: In the UK, T.K. Maxx posted a 6.4% jump in sales to £3.16 billion (€3.57 billion) for the fiscal year ended February 2, 2019. Sales growth was particularly driven by a 5.4% year-over-year increase in store count, which involved the launch of eight new T.K. Maxx stores and 13 Homesense furnishing stores over the financial year. For 2019, the retailer’s parent company, The TJX Companies, has announced that it will open over 40 additional stores in Europe.

Online Pure Plays in Upward Growth Trajectory

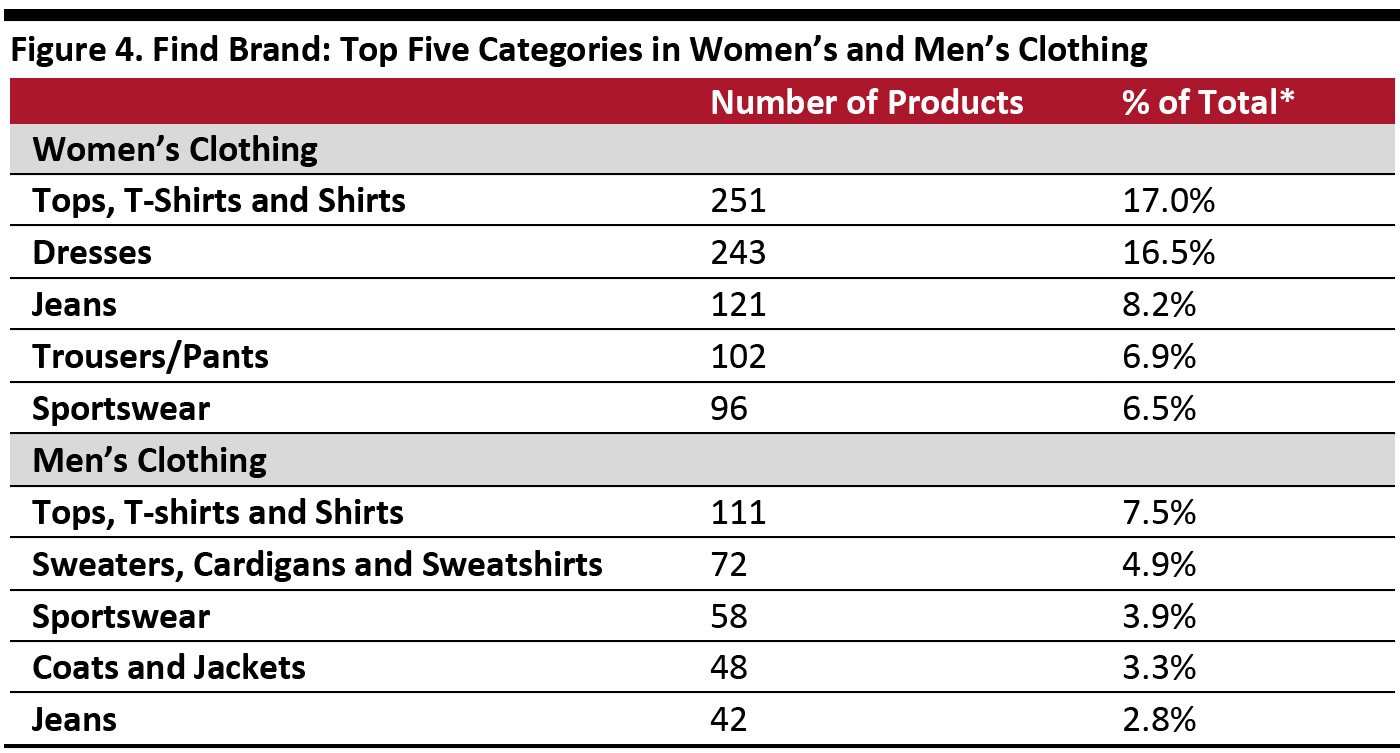

According to Euromonitor International, Zalando leads the Western European apparel and footwear e-commerce market. The company increased its estimated market share from 7.1% in 2015 to 9.5% in 2019. Amazon, the closest competitor to Zalando, had an estimated 8.3% market share in 2019—although it is worth noting that nobody really knows Amazon’s sales by category. ASOS and Boohoo had 2.9% and 1.1% market share, respectively. Amazon: Europe is Amazon’s largest overseas market. It operates e-commerce websites in France, Germany, Italy, the Netherlands, Spain and the UK, supported by 53 fulfillment centers across Europe, as of 2019. Germany and UK—the company’s two biggest markets after the US—together generated $39.76 billion in revenue in 2019, representing 14.2% of Amazon’s top line. Amazon carries a broader range of apparel products on its European websites than its European counterparts. Amazon UK, for example, has the biggest selection of apparel in the UK e-commerce market, according to Coresight Research analysis, which identified 1.9 million women’s and men’s clothing products listed on Amazon.co.uk. For comparison, ASOS claims to offer around 85,000 products, and Zalando says it offers more than 400,000 products. At the time of our analysis, Amazon UK featured 4,037 clothing brands compared to around 1,000 third-party brands at ASOS and over 2,000 brands at Zalando. Although Amazon is predominantly a marketplace for third-party sellers, it has been ramping up private-label fashion too. Our Amazon UK website analysis found 1,475 products listed under the Amazon UK’s flagship apparel private-label brand “Find,” split 70% womenswear and 30% menswear. Casual wear leads the Find offering, with women’s tops and dresses comprising around one-third of all the brand’s listings. Sportswear is also prominent in the Find brand offering and accounts for an aggregate 10.4% of all Find clothing listings. [caption id="attachment_107594" align="aligncenter" width="700"] *Base: 1,475 Find product listings

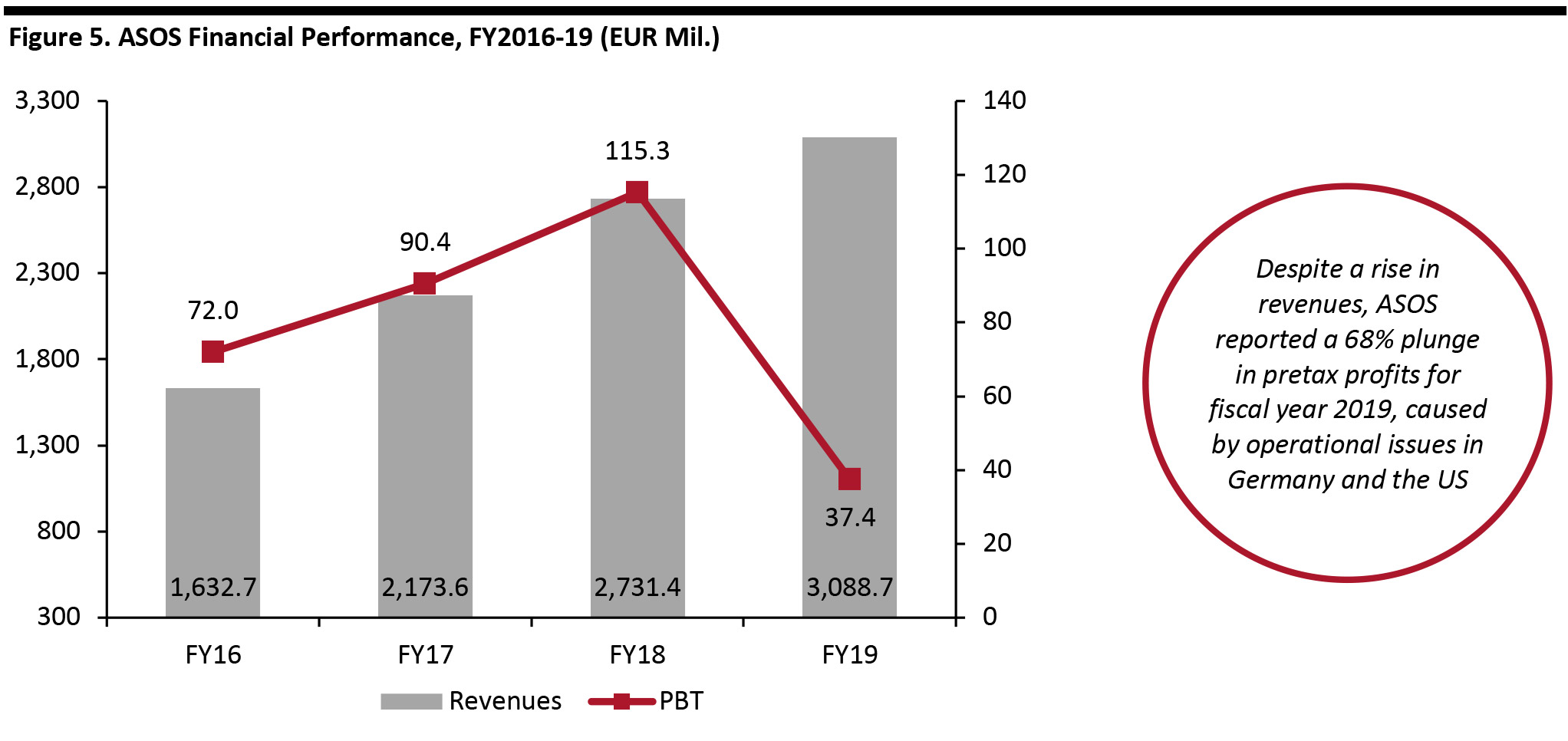

*Base: 1,475 Find product listings Source: DataWeave/Coresight Research[/caption] Zalando: Zalando closed a successful year by reporting 23.6% year-over-year growth in gross merchandise volume (GMV) to €8.2 billion, coupled with 39.1% growth in EBIT at €165.8 million for fiscal year 2019. The company recorded more than 4 billion site visits, 145 million orders and 4.6 million additional active users in the 12-month period. Growth was boosted by a strong final quarter, supported by a strong performance in Cyber Week (including Black Friday and Cyber Monday), which saw 840,000 new customers and a GMV increase of 32% from 2018. Zalando reported that it will make several investments in 2020, in line with its ambition to become the “starting point for fashion,” as announced on the company’s 2019 Capital Markets Day. On March 30, 2020, Zalando warned that it expects revenue and GMV growth in the first quarter to be significantly below the analysts' consensus, despite a strong start to the year—due to the impact of the coronavirus pandemic. The company withdrew its prior guidance for 2020. Earlier in 2020, the retailer outlined plans to triple the GMV of its premium segment by 2023, by doubling its assortment of premium and luxury fashion items. The expansion follows 35% year-over-year growth in its premium category in 2019. In 2020, Zalando added Alberta Ferretti, Moschino Couture and Proenza Schouler White Label to its platform. In addition, Zalando will be launching its new pre-owned category, which is scheduled to go live in the third quarter of 2020. This feature will allow users to shop items previously owned by other Zalando customers as well as sell their items on the platform. The initiative follows the company’s successful six-month trial of pre-owned physical store Zircle in Berlin, which “resonated well with consumers,” according to Zalando. ASOS: ASOS saw a troubled fiscal year 2019, as disruption in its international expansion affected profits. Sales over the year rose by 12% (on a constant-currency basis) to £2.73 billion (€3.08 billion), but pretax profits plunged 68% to £33.1 million (€37.4 million) as the company incurred warehouse transition costs of £45 million (€50.8 billion), up £20 million (€22.6 billion) year over year. The retailer struggled with the manual-to-automated order-processing transition at its Berlin warehouse, while its new Atlanta site in the US (which opened in February 2019) failed to keep up with customer demand and ran out of stock. These operational failures restricted product availability and choice for customers in the US and the EU, and as a result, growth in the two regions was lower than expected, at 4% and 9% respectively on a constant-currency basis. The warehouse problems forced ASOS to issue two profit warnings during the financial year. Furthermore, the company reported a net debt of £90.5 million (€102.2 million) as a result of the ongoing and substantial capital expenditure in its global logistics platform. [caption id="attachment_107595" align="aligncenter" width="700"]

Source: Company reports[/caption]

However, a big surge in sales over the Christmas trading period has reassured investors that ASOS is getting back on track after a difficult financial year. The online fashion retailer reported a 20% increase in revenues to £1.1 billion (€1.24 billion) for the four months ended December 31, 2019. US sales were up 20% and EU sales surged 22% on a constant-currency basis. This growth was largely driven by record sales on Black Friday weekend.

As we went to press, ASOS announced group sales down by around 20–25% in its most recent three weeks of trading, due to the impact of the coronavirus crisis.

Boohoo Group: Although the company is small compared with the likes of ASOS and Zalando, posting revenues of £856.9 (€968.2 million) in fiscal year 2019, it continues to show promising growth. Boohoo Group reported a strong Christmas trading period, and revenues surged by 44% to £473.7 million (€535.2 million) in the final four months of 2019. The company recorded growth in all of its markets—with UK sales growing 42% year over year, the rest of Europe growing 54% and the US by 57%. The company saw robust revenue growth across all its brands, which include Nasty Gal, PrettyLittleThing and the eponymous Boohoo brand.

Buoyed by better-than-expected festive sales, Boohoo Group is guiding toward group revenue growth of 40–42% for the year ending February 29, 2020, ahead of previous guidance of 33–38% growth.

Fulfillment Costs

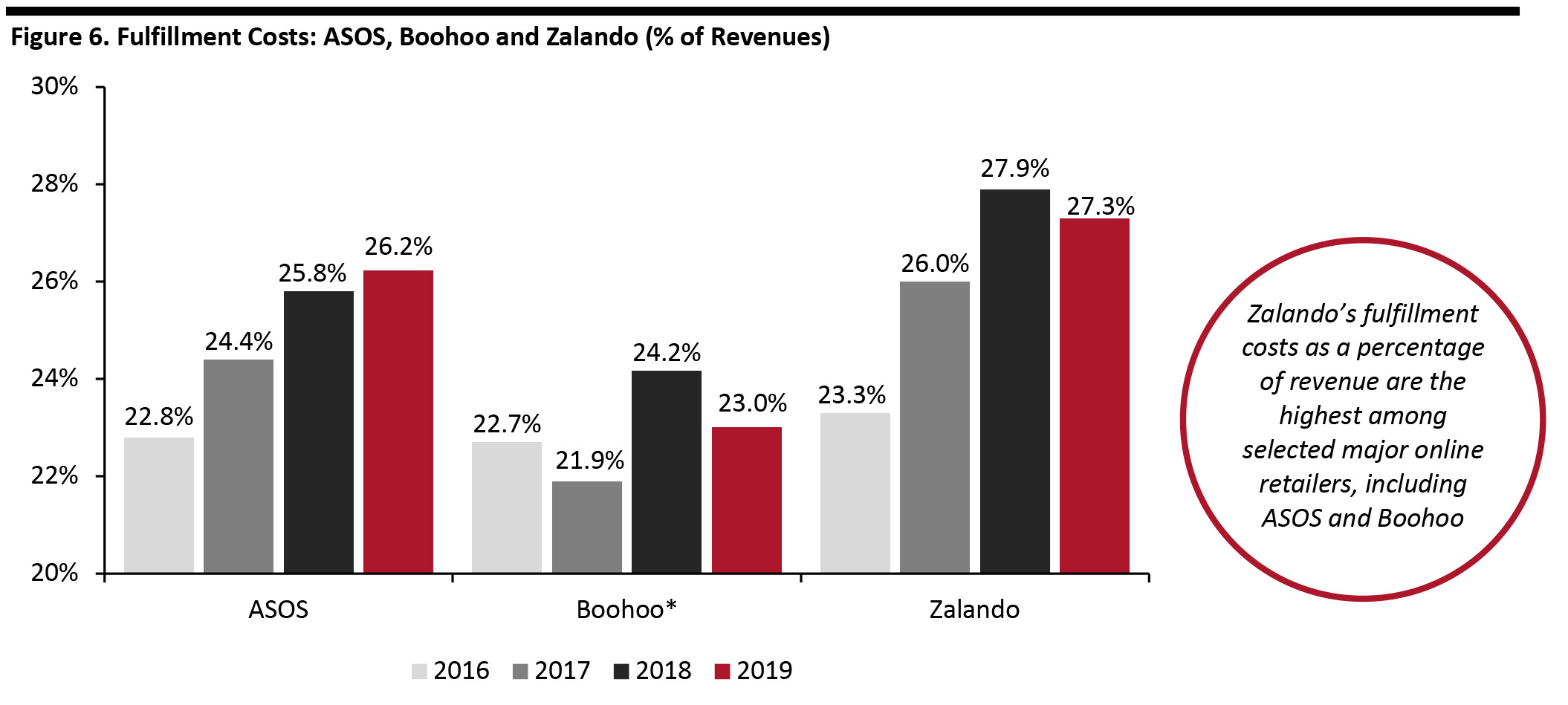

As delivery times shorten and consumers expect free delivery services as given, online pure plays continue to face challenges in capping rising order-fulfillment costs. We perceive rising fulfillment-cost ratios to be a sustained headwind to improved profitability for companies in a sector that is impacted by rising shopper expectations.

For ASOS, fulfillment costs as a share of revenues increased rapidly, from 22.8% in 2016 to 26.2% in 2019. The rise in the fulfillment-cost ratio was largely due to increased warehouse-transition costs resulting from warehouse transformation problems in Europe and the US.

Similarly, Zalando experienced a rise in its fulfillment costs, from 23.3% in 2016 to 27.3% in 2019. The company managed to reduce costs by 60 basis points (bps) from 2018 to 2019. However, its fulfillment costs as a percentage of revenue is the highest among the major online retailers.

Boohoo’s fulfillment costs saw an increase of 230bps from 2017 to 2018, which the company attributed to a higher share of international shipments.

[caption id="attachment_107596" align="aligncenter" width="700"]

Source: Company reports[/caption]

However, a big surge in sales over the Christmas trading period has reassured investors that ASOS is getting back on track after a difficult financial year. The online fashion retailer reported a 20% increase in revenues to £1.1 billion (€1.24 billion) for the four months ended December 31, 2019. US sales were up 20% and EU sales surged 22% on a constant-currency basis. This growth was largely driven by record sales on Black Friday weekend.

As we went to press, ASOS announced group sales down by around 20–25% in its most recent three weeks of trading, due to the impact of the coronavirus crisis.

Boohoo Group: Although the company is small compared with the likes of ASOS and Zalando, posting revenues of £856.9 (€968.2 million) in fiscal year 2019, it continues to show promising growth. Boohoo Group reported a strong Christmas trading period, and revenues surged by 44% to £473.7 million (€535.2 million) in the final four months of 2019. The company recorded growth in all of its markets—with UK sales growing 42% year over year, the rest of Europe growing 54% and the US by 57%. The company saw robust revenue growth across all its brands, which include Nasty Gal, PrettyLittleThing and the eponymous Boohoo brand.

Buoyed by better-than-expected festive sales, Boohoo Group is guiding toward group revenue growth of 40–42% for the year ending February 29, 2020, ahead of previous guidance of 33–38% growth.

Fulfillment Costs

As delivery times shorten and consumers expect free delivery services as given, online pure plays continue to face challenges in capping rising order-fulfillment costs. We perceive rising fulfillment-cost ratios to be a sustained headwind to improved profitability for companies in a sector that is impacted by rising shopper expectations.

For ASOS, fulfillment costs as a share of revenues increased rapidly, from 22.8% in 2016 to 26.2% in 2019. The rise in the fulfillment-cost ratio was largely due to increased warehouse-transition costs resulting from warehouse transformation problems in Europe and the US.

Similarly, Zalando experienced a rise in its fulfillment costs, from 23.3% in 2016 to 27.3% in 2019. The company managed to reduce costs by 60 basis points (bps) from 2018 to 2019. However, its fulfillment costs as a percentage of revenue is the highest among the major online retailers.

Boohoo’s fulfillment costs saw an increase of 230bps from 2017 to 2018, which the company attributed to a higher share of international shipments.

[caption id="attachment_107596" align="aligncenter" width="700"] *Boohoo 2019 data are for the 1H19 ending August 31, 2019 Data are attributed to the closest calendar year

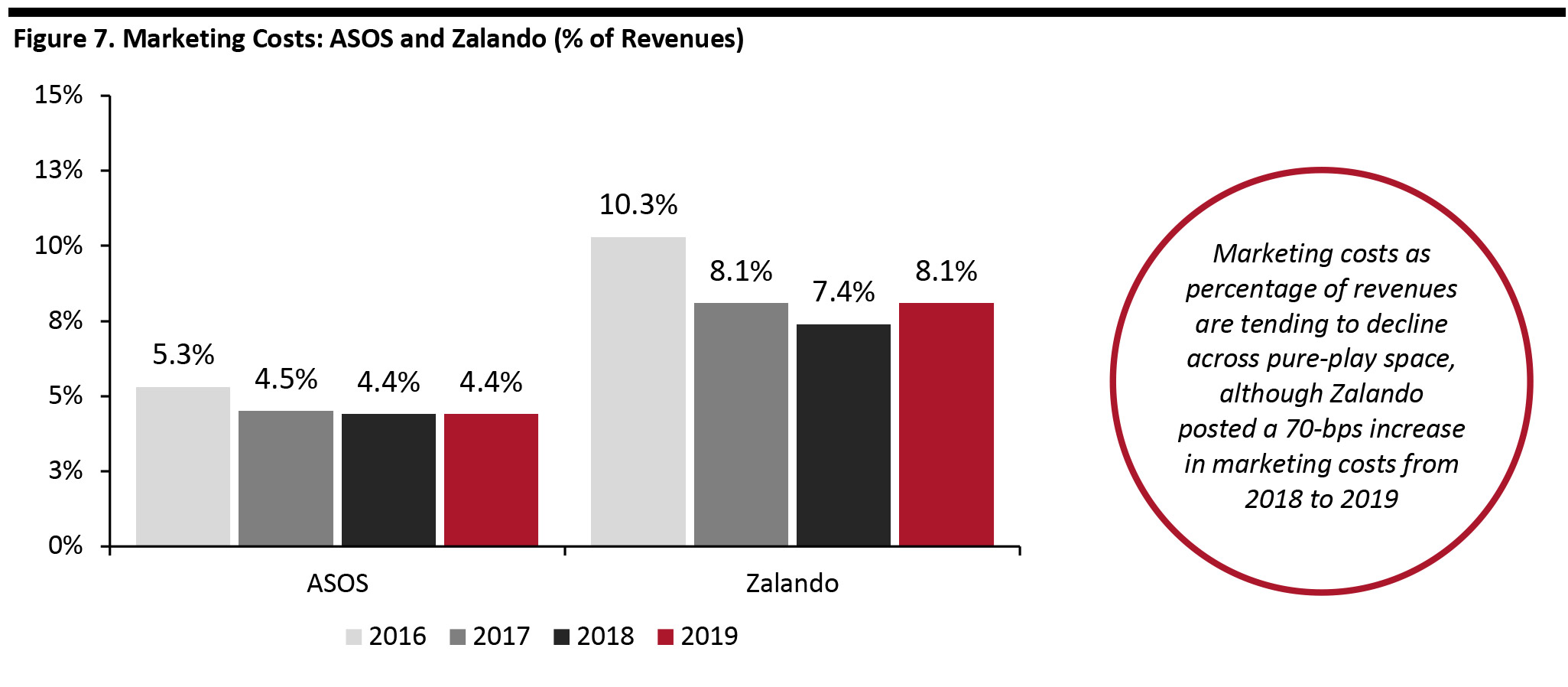

*Boohoo 2019 data are for the 1H19 ending August 31, 2019 Data are attributed to the closest calendar year Source: Company reports [/caption] Marketing Costs Marketing costs have long been pointed to as a challenge for online retailers, given their necessity in acquiring customers. However, marketing costs as a percentage of revenue are tending to decline across the pure-play space, including at ASOS and Zalando (Boohoo Group does not break out marketing costs), although Zalando posted a 70bps increase in marketing costs from 2018 to 2019. The company attributed the rise to increased investments in personalized marketing programs. [caption id="attachment_107597" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]