DIpil Das

What’s the Story?

While the overall Western European apparel and footwear market continues to see gradual post-pandemic recovery, pure-play e-commerce retail companies are witnessing very strong trends. We discuss the competitive landscape and outlook for three leading European apparel and footwear e-commerce retail firms in our Coresight 100 list: ASOS, Boohoo Group and Zalando. We cover four key investment areas for these e-commerce players, as well as three trends we are watching. While we term these companies “platforms,” as we discuss later, their business models vary—from private label-focused retailer Boohoo Group to multibrand retail and marketplace company Zalando. Currency conversion: All the figures in US dollars and British pounds are converted to euros at a constant exchange rate as of December 31, 2020. (GBP–euro exchange rate = 1.1081) (USD–euro exchange rate = 0.8131) (GBP–USD exchange rate = 1.3691)Why It Matters

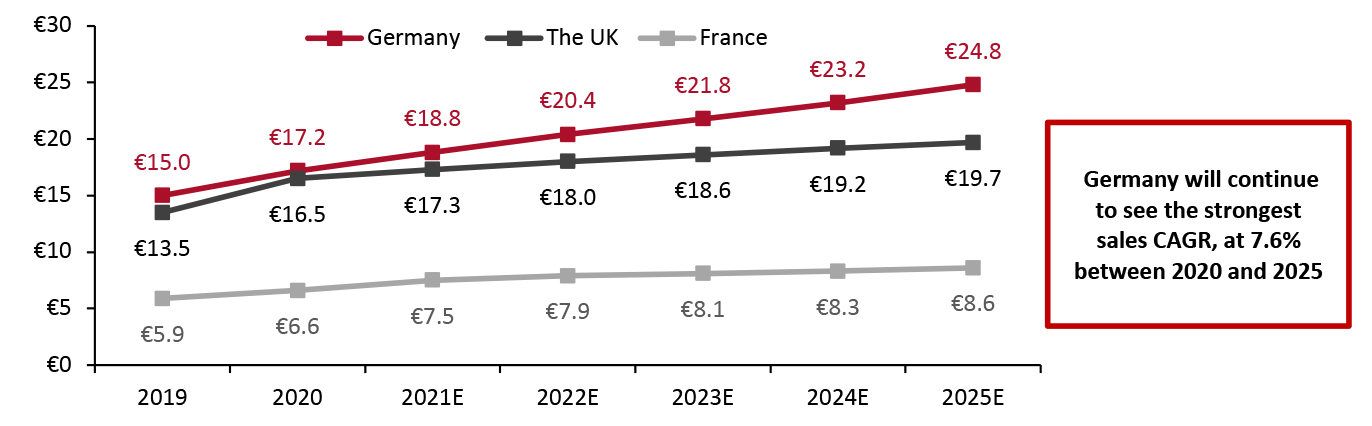

The apparel and footwear e-commerce market in Western Europe is set to grow at a CAGR of 7.4% between 2020 and 2025, reaching €85.3 billion ($104.9 billion) by 2025 and accounting for 26% of the total apparel and footwear market, according to Euromonitor International. This follows on from strong year-over-year sales growth of 21% in 2020, reaching €59.7 billion ($73.4 billion), with e-commerce penetration at 25%. In contrast, the overall apparel and footwear market in Western Europe, which declined by 19% year-over-year to €241.7 billion ($297.3 billion) in 2020, is witnessing a gradual recovery. In 2021, the market is set to grow 12% year over year to €269.7 billion ($331.7 billion), still 9% below the 2019 pre-pandemic level. We expect the upsurge in online shopping to likely sustain once the pandemic subsides. Moreover, we anticipate that cross-border e-commerce activities, which had seen growth prior to pandemic-related travel restrictions, will return to substantial growth in the near future, benefitting European e-commerce platforms. The market landscape varies across Western Europe—France, Germany and the UK are the three largest apparel and footwear e-commerce markets, comprising an almost 65% share of the total Western Europe market.- France’s online apparel and footwear market is around half the size of the markets in Germany and the UK, recording sales of €6.6 billion ($8.1 billion) in 2020—albeit a significant increase of 11.9% year over year. The market is set to grow at a CAGR of 5.4% and reach €8.6 billion ($10.6 billion) by 2025, accounting for 25% of the total apparel and footwear market in France, versus 21% in 2020, according to Euromonitor International.

- Germany’s online apparel and footwear sales totaled €17.2 billion ($21.2 billion) in 2020, up 14.7% year over year and accounted for 32% of the total apparel and footwear market. Sales will reach €24.8 billion ($30.5 billion) by 2025, representing a CAGR of 7.6% and comprising 33% of Germany’s total apparel and footwear sales, according to Euromonitor International. We expect Germany to continue to be the largest online apparel and footwear market in Western Europe for the near future.

- Theonline apparel and footwear market in the UK saw the strongest growth in 2020 among countries in Western Europe, with a sales increase of 22.1% in 2020, reaching £14.9 billion ($20.4 billion). Between 2020 and 2025, online sales will grow at a CAGR of 3.6%, with the market reaching £17.8 billion ($24.4 billion) by 2025, comprising 31% of the UK’s total apparel and footwear sales versus 33% in 2020, according to Euromonitor International. The UK will hold its position as the second-largest apparel and footwear e-commerce market in Western Europe.

Figure 1. France, Germany and the UK: Online Apparel and Footwear Market, 2019–2025E (EUR Bil.) [caption id="attachment_131169" align="aligncenter" width="725"]

UK figures have been converted from British pounds at a constant exchange rate as of December 31, 2020

UK figures have been converted from British pounds at a constant exchange rate as of December 31, 2020 Source: Euromonitor International Limited 2021 © All rights reserved [/caption]

European Apparel and Footwear E-Commerce Platforms: A Deep Dive

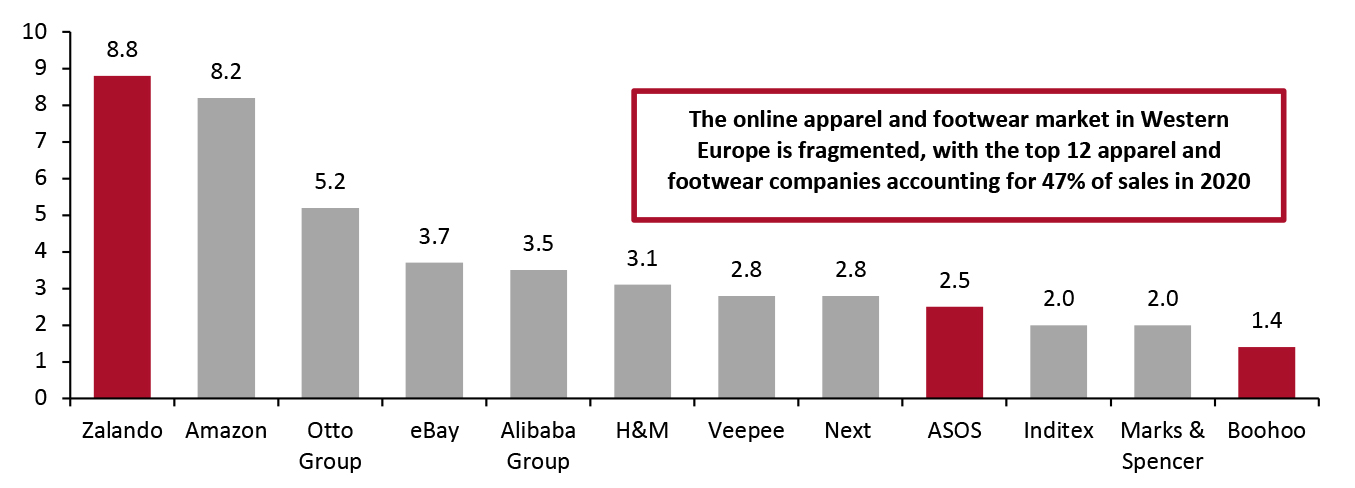

Competitive Landscape The European online apparel and footwear market is a very competitive retail space—with Zalando holding the leading position. The company increased its continent-wide market share from 7.1% in 2015 to 8.8% in 2020, according to Euromonitor International. By 2025, Zalando aims to gain a share of over 10% of Europe’s fashion market, by expanding key infrastructure and capabilities, including logistics network, technology and data platform and payments platform. Our two other covered platforms, the only pure-play apparel and footwear retailers in the top 12 shown in Figure 2, ASOS and Boohoo Group, fall far behind Zalando in terms of sales and, thus, in its share of channel sales. In 2020, ASOS held ninth position, with a market share of 2.5%, versus a 2.3% share in 2015. Boohoo Group held twelfth position in 2020, with a market share of 1.4%, versus a 0.4% share in 2015. Boohoo Group’s recent acquisitions, including the Coast, Karen Millen, Nasty Gal, Oasis and Warehouse brands in the first half of 2020 have supported the expansion in the Group’s market share. Furthermore, Boohoo Group expects its acquisition of Burton, Dorothy Perkins and Wallis brands in February 2021 to enable the company to grow its market share across a broader demographic in the near future. We believe all three covered e-commerce platforms will continue to gain market share going forward, particularly from distressed apparel specialists and department stores. As shown in Figure 2, Western Europe’s online sales remain fragmented, with even major platforms currently holding only single-digit shares—consolidation presents opportunities to the major platforms. Overall, we expect the high level of competition in the European online apparel and footwear market to continue in the near future owing to low switching costs, easy price comparisons and minimal entry barriers given low fixed costs for new entrants.Figure 2. Top 12 Online Apparel and Footwear Retailers in Western Europe: Market Share, 2020 (%) [caption id="attachment_131170" align="aligncenter" width="725"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

The three platforms we cover are distinct, reflecting the many ways in which the apparel market can be broken down—such as by brand versus private label, price and quality tiers, or demographic and region.

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

The three platforms we cover are distinct, reflecting the many ways in which the apparel market can be broken down—such as by brand versus private label, price and quality tiers, or demographic and region.

- Zalando’s focus on brands, and its apparently symbiotic partnerships with the kind of strong, desirable fashion and sportswear brands that often seem reluctant to wholesale to Amazon, makes it one of the biggest (or in the case of some brand owners the biggest), distributor for large clothing and footwear brands in Europe. In addition, as we discuss later, Zalando is making what we consider to be positive moves in areas such as inclusivity, sustainability, third-party fulfillment and resale—as well as having a toehold in off-price/outlet retailing. We see Zalando’s differentiated and high-quality proposition as a bulwark against any accelerated incursion into European apparel by Amazon.

- ASOS also has a strong branded offering, although with a much higher private-label penetration and a more clearly focused proposition focused on young, trend-focused shoppers. ASOS is making efforts in sustainability, too.

- Boohoo Group is an agglomeration of owned and acquired brands—an increasingly esoteric collection that includes Karen Millen, Oasis and multibrand department store Debenhams—as well as its eponymous Boohoo banner. Demand for the core formula of cheap, ultrafast fashion has shown little sign of waning, although we note risks from controversies over conditions in the supply chain and greater consumer consideration of sustainability. We also struggle to see how centerground names such as Debenhams sit easily alongside those such as PrettyLittleThing and Nasty Gal.

Figure 3. ASOS, Boohoo and Zalando: An Overview of Key Metrics and Fulfillment Capacity [wpdatatable id=1183 table_view=regular]

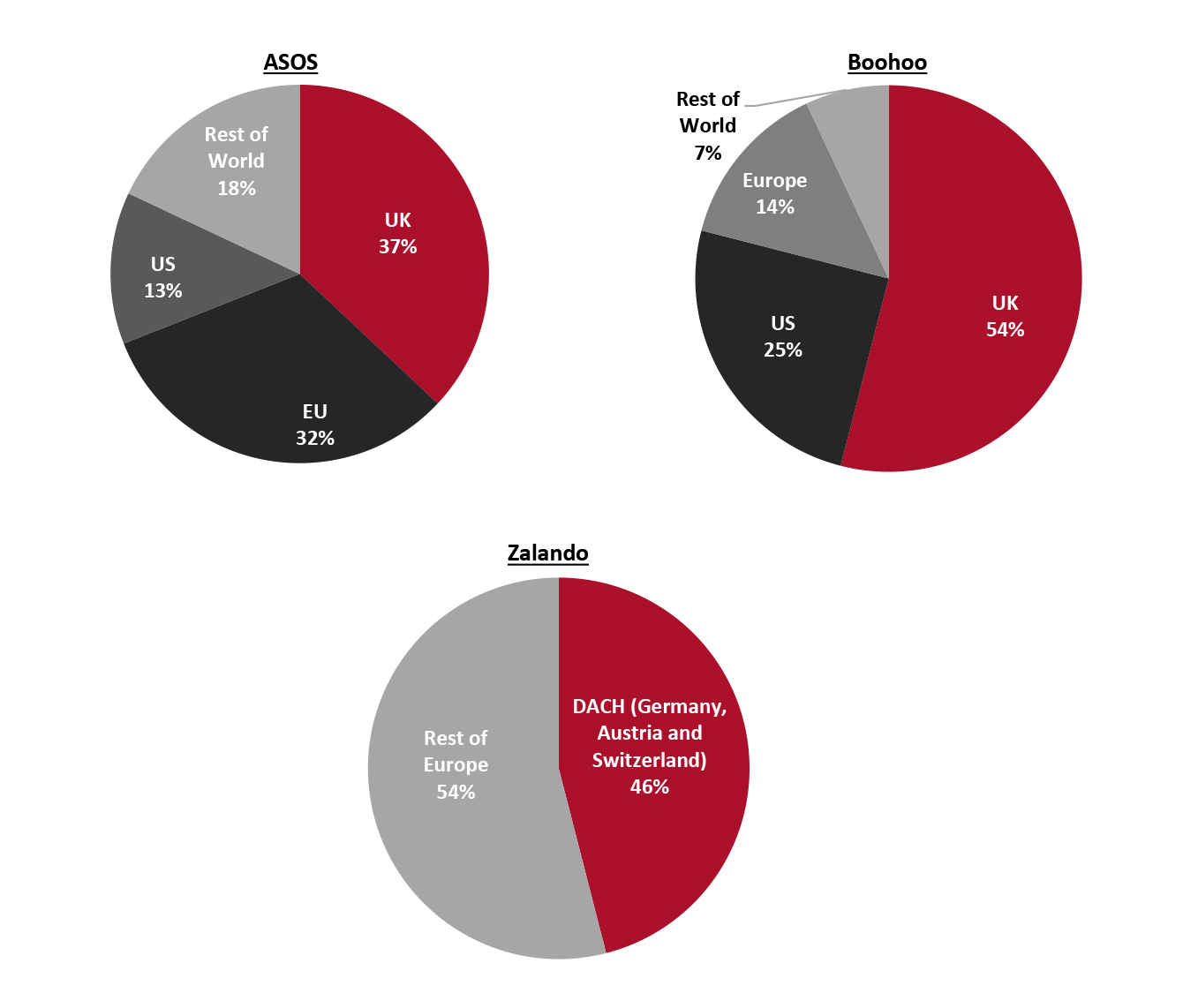

Source: Company reports/Coresight Research Revenue Breakdown by Geography ASOS, Boohoo Group and Zalando have put international expansions at the heart of their strategies and see strong opportunities for further growth overseas. After entering the international market in 2006, ASOS has massively expanded its global presence. Sales outside of the UK accounted for 63% of the total in fiscal 2020 ended August 30, 2020. The US remains one of the key markets for ASOS, contributing about 13% of the total sales. Boohoo Group generates the majority of its revenues from its home country, the UK. Outside of the UK, the company is deepening its push into the US, its second-largest market, which contributes 25% of Boohoo’s total sales. Zalando generates 100% of its revenues from Europe, with Austria, Germany and Switzerland (referred to as DACH by the company) being the primary markets, contributing more than 45% of its total revenues. The company is looking to expand its presence in France and Italy, where it has a 6% population penetration (active customers as a percentage of total population), versus 21% population penetration in the DACH region.

Figure 4. ASOS, Boohoo and Zalando: Revenue Breakdown by Geography in the Last Reported Fiscal Year [caption id="attachment_131171" align="aligncenter" width="725"]

Source: Company reports[/caption]

Outlook

The pandemic has put e-commerce at the forefront of the European apparel and footwear market, to the significant benefit of online platforms—ASOS, Boohoo and Zalando have posted strong double-digit sales growth in the past four reported quarters.

Amid the pandemic, the three platforms quickly adjusted their product offerings in line with changing consumer preferences, such as the substitution of office wear for home attire and loungewear. In Figure 5, we present recent sales growth and the outlook for ASOS, Boohoo and Zalando.

Source: Company reports[/caption]

Outlook

The pandemic has put e-commerce at the forefront of the European apparel and footwear market, to the significant benefit of online platforms—ASOS, Boohoo and Zalando have posted strong double-digit sales growth in the past four reported quarters.

Amid the pandemic, the three platforms quickly adjusted their product offerings in line with changing consumer preferences, such as the substitution of office wear for home attire and loungewear. In Figure 5, we present recent sales growth and the outlook for ASOS, Boohoo and Zalando.

Figure 5. ASOS, Boohoo and Zalando: Sales Growth and Outlook [wpdatatable id=1184 table_view=regular]

Source: Company reports Key Investment Areas for European Apparel E-commerce Platforms To drive market share in Europe and globally, apparel and footwear e-commerce platforms are investing heavily in fulfillment center automation, as well as expanding their logistic networks, marketing and advertising initiatives, and improving data infrastructure. 1. Automation of Fulfillment Centers European apparel and footwear e-commerce platforms are accelerating automation in their fulfillment centers to improve efficiency in picking, packing and delivery, and reduce costs. ASOS has invested £47 million ($64 million) in automating its Euro Hub fulfillment center in Berlin, Germany, which went live in 2019. In its fiscal 2020 earnings conference call in October 2020, ASOS management stated that the Euro Hub automation had improved the company’s delivery propositions in Germany and France, with an improvement in the number of pick units per hour of 57%, and 14% for pack units. CFO Mathew Dunn said, “On an underlying basis, we realized £27 million ($37 million) worth of benefit from the improved efficiency in Euro Hub following automation.” Furthermore, ASOS is automating its US warehouse in Atlanta, with the project set to complete by the second half of fiscal 2023 and subsequently increase the warehouse stockholding capacity by 50% to 15.5 million units, with a warehouse throughput of 3.1 million units per week. The company forecasts that this will lead to a total net sales throughput expansion of more than £2.0 billion ($2.7 billion) over the two years following completion. Boohoo Group’s automation initiatives at its Burnley warehouse went live in April 2019. The company noted that automation was instrumental in improving efficiency—helping the facility to handle large customer orders and maintain high customer service levels. In the first half of 2021, Boohoo commenced Phase 2 of automation at Burnley, which is set to boost the peak load capacity of the warehouse. Furthermore, Boohoo is investing in automating its warehouse in Sheffield. In its fiscal 2021 earnings conference call in May 2021, the company noted that these investments will help Boohoo to remain ahead of the business’ growth curve. Zalando is automating its Lahr fulfillment center in Germany. In August 2019, the online retailer initiated the use of two “TORU” robots on real customer orders after eight trial months at its Erfurt fulfillment center, working in collaboration with robotics company Magazino. Carl-Friedrich zu Knyphausen, Head of Logistics Development at Zalando, said that the initial test was successful in terms of error-free handling of the company’s products (e.g., shoe cartons)—any lost time due to errors was made up for by the robot’s improved efficiency as compared to humans. The company’s strategy is to foster effective collaboration between its employees and technology. Furthermore, Zalando has installed a fully automated labeling system with two labeling applicators machines in tandem at its Lahr fulfillment center. These applicators automatically prepare and affix labels to the shipment and verify the legibility through the final inspection of the order package. The automated labeling system has increased Zalando’s throughput and reduced delivery times through correct printing and accurate application of 2,200 labels per hour, according to Maik Bukhart, Technical Manager at Zalando. Management stated that the company also plans to automate its new site in Rotterdam, the Netherlands. [caption id="attachment_131172" align="aligncenter" width="726"]

Zalando, in collaboration with Magazino, trialing its logistics robot TORU alongside employees at its distribution center in Erfurt, Germany

Zalando, in collaboration with Magazino, trialing its logistics robot TORU alongside employees at its distribution center in Erfurt, Germany Source: Magazino [/caption] 2. Expansion of Logistics Networks We have seen European apparel and footwear e-commerce platforms expanding their logistic networks to support their international operations’ growth and bolster their services offerings, including same-day delivery and geo-localized delivery. ASOS is investing £90 million ($123 million) in a new distribution center in Lichfield, Staffordshire, which will handle parcels for its online clothing and beauty business, with a total stockholding capacity of 6 million units. The warehouse spans 437,000 square feet and is set to begin operating by early 2022, serving customers in the UK and overseas. ASOS expects the new facility to support its growing customer demand and enable the online retailer to expand its delivery capabilities and product offerings. Boohoo Group recently extended its UK warehousing capacity with the opening of a new site in April 2021, known as UK3. The new site supports Boohoo’s major distribution center in Burnely, Manchester. Boohoo plans to use UK3 to support growth across its Coast, Karen Millen, Nasty Gal, Oasis and Warehouse brands, which the online retailer acquired in June 2020. Zalando is expanding its European logistics network by adding five new fulfillment centers to its existing network by 2023, increasing the total count to 15. One new fulfillment center in both the Netherlands and Spain is set to go live in 2021. The construction of the remaining three fulfillment centers will begin in early 2022. Zalando expects the new fulfillment centers to enable the company’s ambition of achieving GMV of €30 billion ($36 billion) by 2025 from €11 billion ($13 billion) in 2020 by supporting growth opportunities in existing and new markets–the company plans to expand its operations to eight new markets in Europe in 2021, including Croatia, Hungary and Romania. 3. Advertising and Marketing In recent years, European apparel and footwear e-commerce platforms have been scaling up their investment in digital marketing and social media to raise brand awareness, drive customer engagement and acquisition, and increase traffic to their platforms. Nevertheless, in the past couple of years prior to the pandemic, the overall increase in marketing spend has been lower as compared to the total sales growth for most e-commerce platforms, including ASOS and Zalando, resulting in lower marketing cost-ratios (marketing or advertising costs as a proportion of revenue). In contrast, post-pandemic marketing cost-ratios have slightly increased year over year for ASOS and Zalando but declined for Boohoo. ASOS has been increasing its spending on digital marketing and social media to drive new customer acquisition. In the first half of fiscal 2021, ended February 28, 2021, the retailer’s marketing cost-ratio has increased by 120 basis points to 5.5. During its Capital Markets Day event held in April 2021, ASOS stated that its continued investment in social media channels, particularly TikTok, is a key tool for the company to better understand its global target consumer base. In terms of followers on leading social media channels, such as Instagram, ASOS has substantially outperformed Boohoo and Zalando (as shown in figure 6 below). ASOS’s continued partnerships with social media celebrities and influencers are helping the company to engage shoppers and produce style edits tailored to different consumer fashion preferences. As compared to ASOS, the Boohoo banner has a slightly smaller following on some of the leading social media platforms. However, Boohoo has witnessed robust growth in its overall social media following over the two prior fiscal years, surging by 74% to 47 million, as shown in Figure 6. A major part of Boohoo Group’s marketing strategy is to focus on targeting consumers through collaborations with global bloggers and influencers, including mega influencers such as Kim Kardashian and Kylie Jenner. In its fiscal 2021, ended February 28, 2021, Boohoo Group’s marketing costs increased by 36% year over year to £159 million ($217 million); however, its marketing cost ratio decreased by 40 basis points year over year. In the first half of its fiscal year, during the early stages of lockdown, the retailer planned more cautiously on marketing campaigns, but increased its marketing activity in the second half, investing in its new brands and driving international sales growth. In the medium-term, Boohoo expects its marketing cost as a percentage of sales to be in the range of 9.0–9.5%. Likewise, social media channels are an integral part of Zalando’s marketing strategy. To offer scalable and personalized marketing for third-party brands, the company has created a marketing department with cross-functional teams of artificial intelligence (AI) and data scientists, marketing domain experts, product managers and software engineers, who capitalize on the latest technologies. Moreover, the retailer’s in-house marketing offering Zalando Marketing Services (ZMS) provides data-infused marketing capabilities and extensive media and content creation services to its brand partners. In fiscal 2020, Zalando’s marketing-cost ratio increased by 20 basis points to 8.3.

Figure 6. ASOS, Boohoo and Zalando: Followers/Subscribers on Selected Social Media Platforms as of July 8, 2021 [wpdatatable id=1185 table_view=regular]

Source: Facebook/Instagram/TikTok/YouTube 4. Data Infrastructure To improve customer experiences, European apparel and footwear e-commerce platforms are investing in data infrastructures, with a focus on customization and personalization. In November 2020, Zalando announced that it will be using Amazon Web Services (AWS) as its cloud provider, making use of AWS’s machine learning service to reduce the time it takes to design, launch and scale new features for its e-commerce platforms. AWS will also enable Zalando’s engineering teams to utilize customer purchase data to create personalized shopping features, such as size and individual product recommendations, as well as for predicting a customer’s outfit preferences and for inventory forecasting. Furthermore, Zalando will be offering digital avatars that allow customers to try clothes virtually to determine the fit. ASOS plans to advance its use of data science and AI to offer a personalized experience to its customers. In early 2021, the retailer incorporated AI into its “New In” feature that recommends newly launched products on ASOS’s platform to shoppers based on their shopping behavior. The company also introduced a “For You” feature that displays personalized product recommendations. Furthermore, ASOS rolled out a homepage countdown review feature that informs consumers of how much time remains to shop specific products at discounted prices. In its earnings call for the first half of fiscal 2021 in April 2021, the company stated that the homepage countdown review feature drove an overall increase in conversion rates. Similarly, data strategy has become a key component of Boohoo Group’s business. In June 2021, Boohoo partnered with AI platform Bloomreach Engagement to build a unified consumer data platform that brings together data from all customer touchpoints across Boohoo-owned brands. In addition to the consumer data platform, Bloomreach Engagement will offer services including app tracking, email campaigns and managing mobile push notifications.

Key Trends We Are Watching

1. Sustainability Consumers’ increasing awareness of the fashion industry’s impact on the environment has kickstarted a fast-growing market for more sustainable practices in apparel and footwear in Europe. Our three covered e-commerce platforms continued to prioritize sustainable initiatives and aim for a shift toward a more sustainable future. ASOS: In the company’s Capital Markets Day 2021 on April 20, 2021, Womenswear Buying Director Nikki Tattersall stated that around 85% of the cotton used for the company’s in-house brand ASOS Design is either organic or from the Better Cotton Initiative—a non-profit organization that advocates for better standards in cotton farming and practices across 21 countries. Furthermore, the brand’s new denim collection uses 50% less water during the washing and finishing process versus conventional jeans. Vanessa Spence, Head of Design at ASOS, said that 70% of the company’s swimwear is made from recycled materials. Spence also reported that ASOS will train its whole retail team in circular practices by fall 2021, following on from the launch of its first Circular Collection in September 2020. The products in the collection are made from 20% recycled cotton, use less water than their conventional equivalents and are easy to recycle. During its 2021 Capital Markets Day, the company also noted that each brand must meet the following five minimum requirements to be featured on the ASOS platform:- Ethical trade policies—Adopt a responsible and sustainable approach to sourcing and supply chain management.

- Chemical compliance–Understand the use of chemicals and ensure the use of safer products with lower environmental impacts.

- Abolition of modern slavery practices—Ensure that employees’ conditions in supplier factories are socially responsible, including wage payment.

- Animal welfare—Ensure that suppliers do not use certain animal-derived materials, including alpaca wool, cashmere, feathers, horn, mohair, shell or silk, and any part of endangered or wild species.

- Visibility of Tier 1 factories—Trace Tier 1 suppliers to ensure they meet compliance directives, avoid bottlenecks and track products through to delivery.

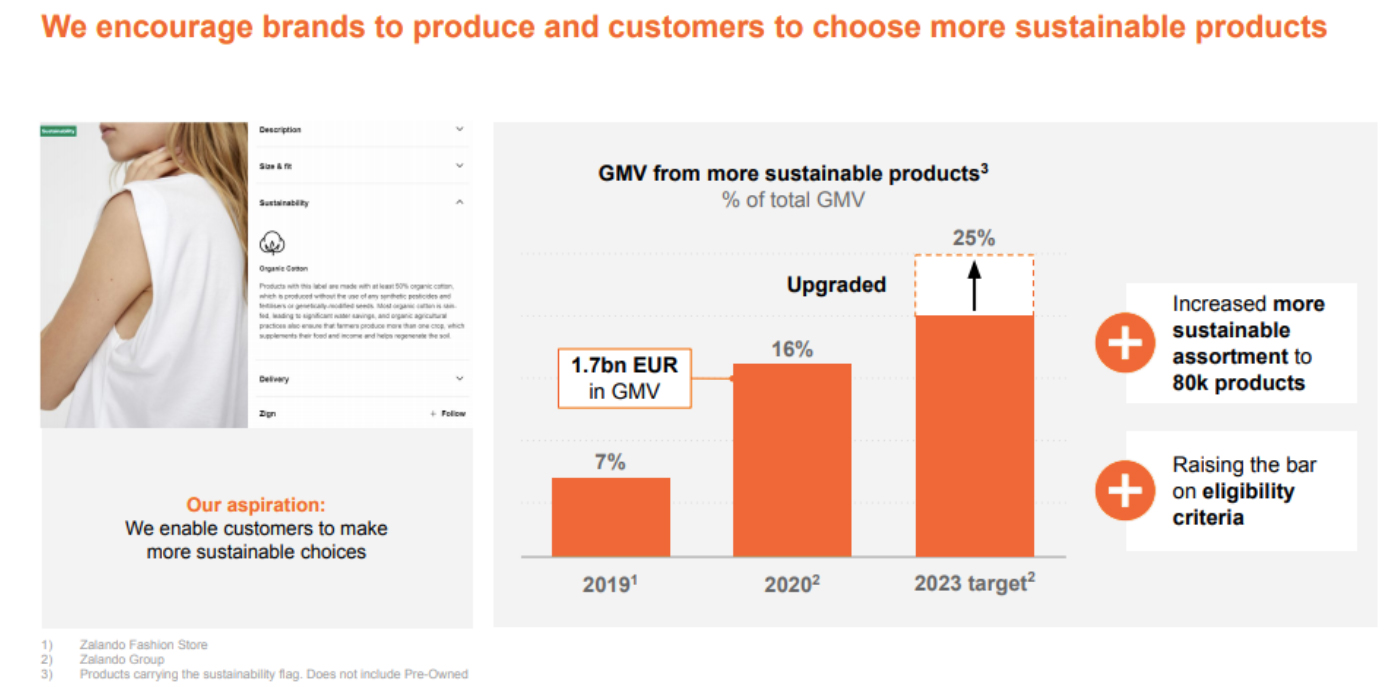

Zalando’s 2023 goals for sustainable product assortment

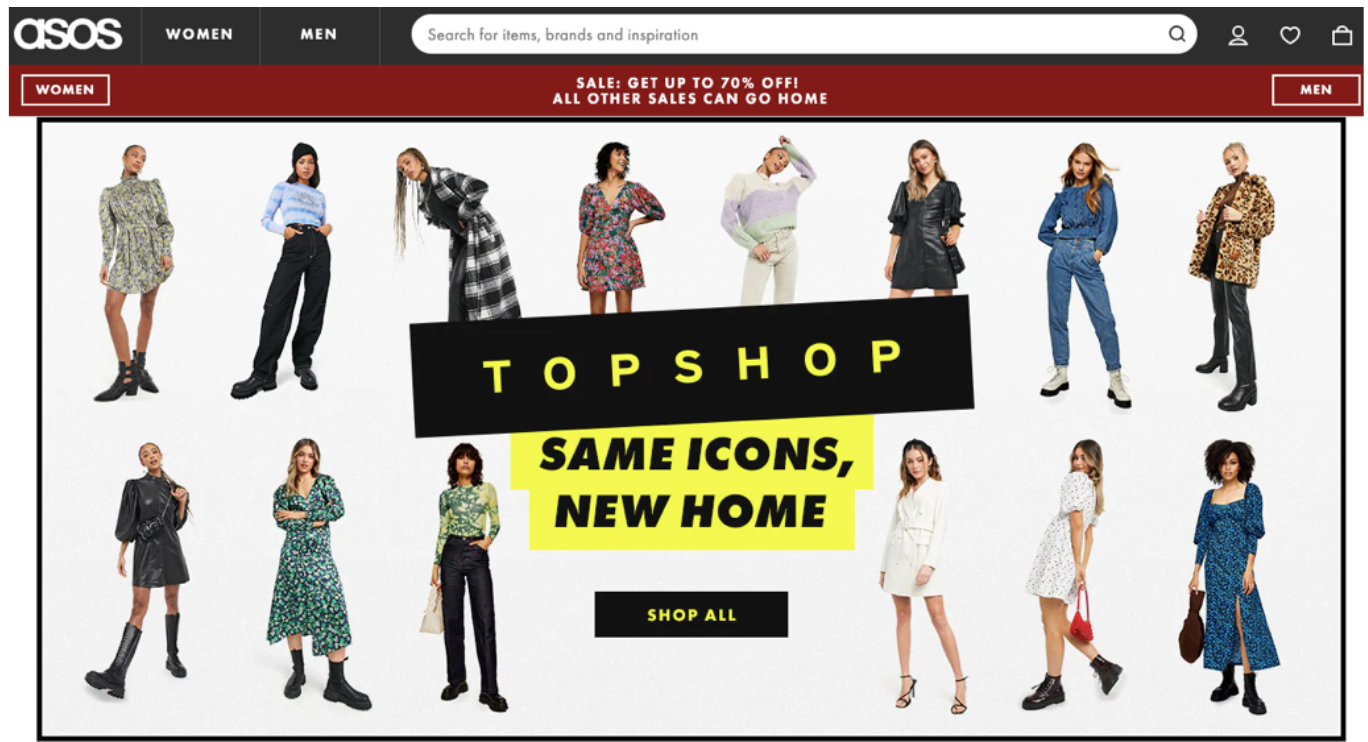

Zalando’s 2023 goals for sustainable product assortment Source: Zalando [/caption] 2. Acquisition Activity: Expanding the Addressable Market ASOS: In February 2021, ASOS entered into an agreement to acquire the UK-based apparel brand owns HIIT, Miss Selfridge, Topman and Topshop from Arcadia Group for £295 million ($405 million). While ASOS only acquired the e-commerce businesses and did not buy any of the brands’ physical stores, it is considering allowing Topshop’s flagship store in Oxford Circus to sell Topshop clothes through a third-party arrangement. The abovementioned four brands reported combined revenue of £1.0 billion ($1.3 billion) in 2019, primarily driven by growth in Germany. ASOS is looking to capitalize on this opportunity for further growth in Europe and the company expects the acquired brands to benefit from ASOS’s strength in other global territories where they were not previously available. In its earnings call for the first half of fiscal 2021 in April 2021, ASOS noted that it has seen a significant rise in site traffic since the acquisition, with 226% growth in traffic on launch day alone, driving strong sales momentum. On July 12, 2021, ASOS formed a joint venture with US-based department store Nordstrom, which will invest a minority stake in HIIT, Miss Selfridge, Topman and Topshop brands. Under the terms of the alliance, ASOS will hold creative and operational control while capitalizing Nordstrom’s US market expertise and extensive customer reach to accelerate the online retailer’s growth in the US market. As part of the agreement, ASOS brands, both the acquired brands and ASOS Design, will be rolled out across Nordstrom.com and in selected Nordstrom stores. Furthermore, ASOS’s click and collect services will be launched across the wider Nordstrom store estate to improve the ASOS proposition for its US customers. We believe that this move will help both ASOS and Nordstrom to expand their customer bases and market shares in Europe and the US. Boohoo Group: The company has been strategically expanding its product offering beyond its own-brand apparel, footwear and accessories, making seven acquisitions between 2017 and early 2021. The acquired brands—Coast, Karen Millen, Misspap, Nasty Gal, Oasis, PrettyLittleThing and Warehouse—have helped transform Boohoo into a multibrand e-commerce company. Furthermore, Boohoo Group’s acquisitions of department store Debenhams in January 2021 for £55.0 million ($75.4 million) and Arcadia Group brands Burton, Dorothy Perkins and Wallis for £25.2 million ($35.2 million) in February 2021 have been significant steps in its aspiration to create the UK’s largest marketplace. The move significantly increased Boohoo Group’s target addressable market and enabled it to enter new product categories at scale, such as beauty. In contrast, Zalando has not been partaking in such acquisition activity and continues with its organic approach to expanding its addressable market. In its earnings call for the second quarter of fiscal 2020 in August 2020, Zalando’s CFO David Schroder said, “Zalando has grown organically ever since it was founded in 2008. And we continue to see a very large market opportunity ahead of us that we will continue to focus on. And therefore, we will remain focused primarily on organic growth in order to become the starting point for fashion in Europe. However, we do not rule out strategic opportunities that may arise.” While Zalando focuses on organic retail growth, the retailer looks to selective mergers and acquisitions to boost its technology infrastructure. For instance, Zalando acquired Switzerland-based body scanning software developer Fision in October 2020. The acquisition was part of Zalando’s ongoing commitment to continuously invest in cutting-edge technology to enhance customer experience. [caption id="attachment_131174" align="aligncenter" width="725"]

Topshop’s product assortment on the ASOS website

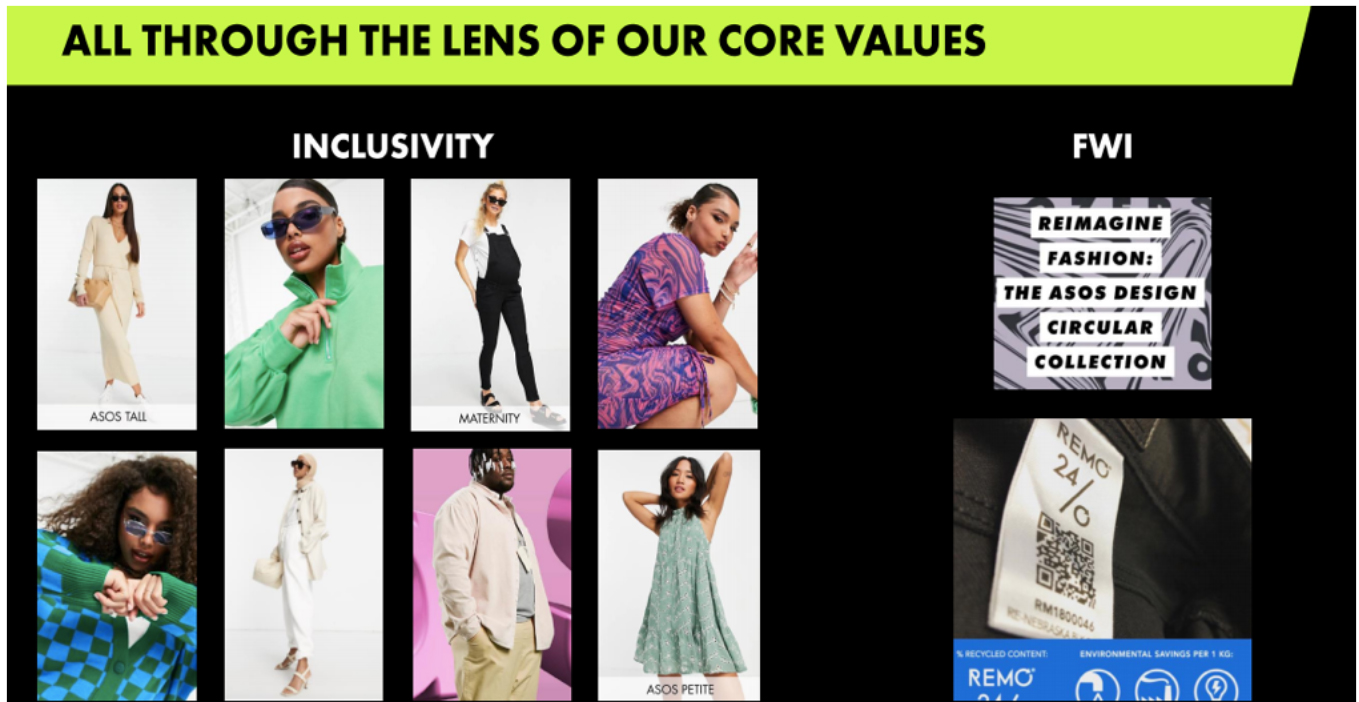

Topshop’s product assortment on the ASOS website Source: ASOS [/caption] 3. Inclusivity As consumers around the world increasingly expect brands and retailers to ensure inclusivity throughout their business model, our three featured online platforms are taking new steps toward an inclusive apparel and footwear retail market. these measures encompass adaptive product designs as well as extended sizes and improved representation.

- Read more in Coresight Research’s Playbook: Inclusivity in Retail.

ASOS’s inclusivity clothing collection

ASOS’s inclusivity clothing collection Source: ASOS [/caption]

What We Think

Apparel and footwear e-commerce is one of the fastest-growing markets in Western Europe, with strong opportunities in France, Germany and the UK. While the necessity for digital transformation has been building incrementally, the pandemic has accelerated this trend. We expect the strong positioning of Zalando, ASOS and Boohoo in Western Europe’s online apparel and footwear market, along with their technology expertise, to help these companies to report consistent strong sales over the next few years. We expect upcoming investment in automation, logistics and marketing engagement by ASOS to improve the company’s delivery efficiency and reduce fulfillment costs. Furthermore, we believe that the recently acquired Topshop and Topman brands bring a further opportunity for ASOS in the US through the recent strategic joint venture with Nordstrom. Boohoo Group has been steadily investing in diversifying its offering through acquisitions and has grown from a single-brand into a multibrand retailer. The diverse nature of the company’s recent acquisitions, of department store banner Debenhams and legacy Arcadia Group brands Burton, Dorothy Perkins and Wallis, do not offer an obvious fit with Boohoo Group’s origins (less so than ASOS’s acquisition of Topshop, for instance), and while any diversification offers potential to increase sales and market share, the rationale for some of these acquisitions remains a little unclear. We view Zalando’s Partner Program and Connected Retail program as a key long-term growth driver for the company—and in continuing Zalando’s shift from retailer to marketplace. Other growth drivers include improved personalization, new product categories and new market entries. We expect online shopping behavior adopted during the pandemic to sustain post-Covid, and we anticipate a rise in cross-border e-commerce activities in the near future. Nevertheless, instead of considering this as a threat to brick-and-mortar, traditional retailers and brand owners should learn from the e-commerce platforms and look to offer an integrated, seamless online-offline shopping experience. Implications for Brand Owners and Retailers- Brands and retailers should stay on top of the key trends that are revolutionizing the way shoppers interact with e-commerce platforms. Instead of seeking immediate profitability, retailers should try to budget a part of their spending on testing out new retail concepts, such as virtual try-ons.

- When competing with huge pure-play retailers such as ASOS and Boohoo, retailers should ensure that their websites stand out through digital personalization, exclusive offers and discounts, early access to sales, and an attractive loyalty program, among other initiatives.

- Brands and retailers should invest in autonomous delivery technologies, such as delivery robots, to improve efficiency and reduce costs in the long term. Similarly, automating logistic networks will help retailers to meet increased consumer demand for fast delivery and standardize the order fulfillment process as well as increase the overall accuracy.

- Internationalization can help retailers expand their addressable market. To expand successfully, retailers must understand the shoppers within each individual market and avoid a one-size-fits-all approach—for instance, through country-specific websites. Retailers must leverage customer data to gain valuable insights into market localization. Furthermore, identifying potential local competitors ahead of time will also serve retailers well.

- Retailers should incorporate inclusive and sustainable initiatives to attract customers, investors and employees.

- Technology companies have significant opportunities to collaborate with retailers on automation and robotics technologies for warehousing, fulfillment efficiency and storage capacity.

Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved