albert Chan

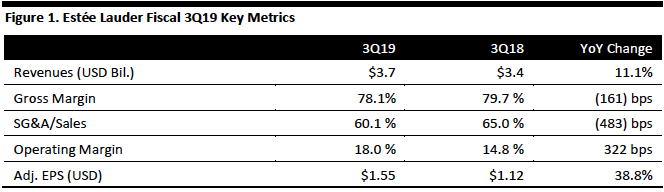

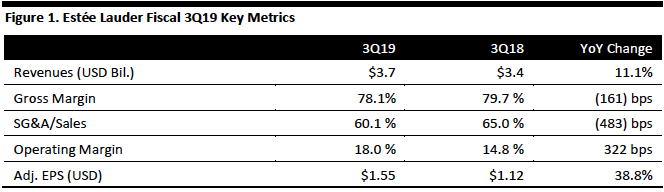

[caption id="attachment_85882" align="aligncenter" width="664"] Source: Company reports/Coresight Research[/caption]

Estée Lauder 3Q19 Results

Estée Lauder reported fiscal 3Q19 adjusted, non-GAAP EPS of $1.55, up 38.8% from $1.12 in the year-ago quarter and beating the consensus estimate of $1.30. The EPS adjustments included restructuring charges, contingency considerations, and intangible asset impairments. The company reported that with the adoption of ASC 602, a revenue recognition model, its 3Q19 EPS was $1.28, a $(0.27) impact.

Total revenues for the quarter were $3.7 billion, up 11.1% year over year and beating the $3.6 billion consensus estimate.

By Category

Estée Lauder posted sales growth in nearly all product categories and geographic regions.

Skincare, the company’s largest and best performing category, comprised 46.6% of its sales, and rose 21% on a reported basis to $1.74 billion from $1.45 billion in the same quarter last year. The company credited the gains in skincare mainly to its Estée Lauder and La Mer brands. Specifically, its Estée Lauder brand delivered double digit net sales growth in most regions and channels. The company credited this growth to its Advanced Night Repair Eye Supercharged Complex and the launch of the Micro Essence Skin Activating Treatment Lotion Fresh with Sakura Ferment in Japan.

The company’s second largest category, makeup, accounted for 39% of sales in 3Q19 and grew 5.3% from $1.38 billion in 3Q18 to $1.46 billion in 3Q19 on a reported basis. The growth was driven by increases in higher net sales in its Tom Ford Beauty, Estée Lauder, and La Mer brands, which were partially offset by lower makeup sales from Clinique and Smashbox. Estée Lauder reported strong makeup sales in its Double Wear line, Futurist Aqua Brilliance foundation and Pure Color product lines.

Fragrance increased 2.6% in 3Q19, from $382 million to $392 million on a reported basis. The fragrance category comprises 10% of the company’s sales. Estée Lauder attributed the growth in its fragrance category to Estée Lauder as well as its luxury fragrances, including Jo Malone London, Tom Ford Beauty, Le Labo and By Kilian. The increases were offset by lower sales from some of the designer fragrances.

Haircare, the company’s smallest category, comprising 4% of sales, decreased 2.2% from $139 million in 3Q18 to $136 million in 3Q19 on a reported basis. The decrease was due to lower net sales from Bumble and Bumble, primarily in the North America salon channel.

By Geographic Region

The Asia Pacific region saw the strongest growth, with sales climbing from $773 million in 3Q18 to $966 million in 3Q19 on a reported basis. Estée Lauder reported the growth was broad-based, with two-thirds of the markets in the region growing double digits. Hong Kong, Japan and emerging markets in Southeast Asia delivered strong growth, while net sales in China and Korea accelerated.

Sales in Europe, the Middle East and Africa grew 15% on an as reported basis, from $1.42 billion to $1.63 billion. The company attributed this growth to travel retail, with more than half of its top-ten brands in the channel growing double digits, including Tom Ford Beauty, Estée Lauder, Origins, MAC and La Mer.

In the Americas, sales declined 2% from $1.18 billion in 3Q18 to $1.15 billion in 3Q19 on an as reported basis. The company attributed lower sales to a deceleration in the prestige beauty industry in the US makeup category.

Outlook

The company forecast full fiscal year revenue growth between 7-8%, compared to prior guidance of 5-6%, and the consensus estimate of 6.4%. The company raised its full year EPS guidance to $5.15-5.19, versus the prior guidance of $4.92-5.00, compared to the consensus estimate of $5.06.

Source: Company reports/Coresight Research[/caption]

Estée Lauder 3Q19 Results

Estée Lauder reported fiscal 3Q19 adjusted, non-GAAP EPS of $1.55, up 38.8% from $1.12 in the year-ago quarter and beating the consensus estimate of $1.30. The EPS adjustments included restructuring charges, contingency considerations, and intangible asset impairments. The company reported that with the adoption of ASC 602, a revenue recognition model, its 3Q19 EPS was $1.28, a $(0.27) impact.

Total revenues for the quarter were $3.7 billion, up 11.1% year over year and beating the $3.6 billion consensus estimate.

By Category

Estée Lauder posted sales growth in nearly all product categories and geographic regions.

Skincare, the company’s largest and best performing category, comprised 46.6% of its sales, and rose 21% on a reported basis to $1.74 billion from $1.45 billion in the same quarter last year. The company credited the gains in skincare mainly to its Estée Lauder and La Mer brands. Specifically, its Estée Lauder brand delivered double digit net sales growth in most regions and channels. The company credited this growth to its Advanced Night Repair Eye Supercharged Complex and the launch of the Micro Essence Skin Activating Treatment Lotion Fresh with Sakura Ferment in Japan.

The company’s second largest category, makeup, accounted for 39% of sales in 3Q19 and grew 5.3% from $1.38 billion in 3Q18 to $1.46 billion in 3Q19 on a reported basis. The growth was driven by increases in higher net sales in its Tom Ford Beauty, Estée Lauder, and La Mer brands, which were partially offset by lower makeup sales from Clinique and Smashbox. Estée Lauder reported strong makeup sales in its Double Wear line, Futurist Aqua Brilliance foundation and Pure Color product lines.

Fragrance increased 2.6% in 3Q19, from $382 million to $392 million on a reported basis. The fragrance category comprises 10% of the company’s sales. Estée Lauder attributed the growth in its fragrance category to Estée Lauder as well as its luxury fragrances, including Jo Malone London, Tom Ford Beauty, Le Labo and By Kilian. The increases were offset by lower sales from some of the designer fragrances.

Haircare, the company’s smallest category, comprising 4% of sales, decreased 2.2% from $139 million in 3Q18 to $136 million in 3Q19 on a reported basis. The decrease was due to lower net sales from Bumble and Bumble, primarily in the North America salon channel.

By Geographic Region

The Asia Pacific region saw the strongest growth, with sales climbing from $773 million in 3Q18 to $966 million in 3Q19 on a reported basis. Estée Lauder reported the growth was broad-based, with two-thirds of the markets in the region growing double digits. Hong Kong, Japan and emerging markets in Southeast Asia delivered strong growth, while net sales in China and Korea accelerated.

Sales in Europe, the Middle East and Africa grew 15% on an as reported basis, from $1.42 billion to $1.63 billion. The company attributed this growth to travel retail, with more than half of its top-ten brands in the channel growing double digits, including Tom Ford Beauty, Estée Lauder, Origins, MAC and La Mer.

In the Americas, sales declined 2% from $1.18 billion in 3Q18 to $1.15 billion in 3Q19 on an as reported basis. The company attributed lower sales to a deceleration in the prestige beauty industry in the US makeup category.

Outlook

The company forecast full fiscal year revenue growth between 7-8%, compared to prior guidance of 5-6%, and the consensus estimate of 6.4%. The company raised its full year EPS guidance to $5.15-5.19, versus the prior guidance of $4.92-5.00, compared to the consensus estimate of $5.06.

Source: Company reports/Coresight Research[/caption]

Estée Lauder 3Q19 Results

Estée Lauder reported fiscal 3Q19 adjusted, non-GAAP EPS of $1.55, up 38.8% from $1.12 in the year-ago quarter and beating the consensus estimate of $1.30. The EPS adjustments included restructuring charges, contingency considerations, and intangible asset impairments. The company reported that with the adoption of ASC 602, a revenue recognition model, its 3Q19 EPS was $1.28, a $(0.27) impact.

Total revenues for the quarter were $3.7 billion, up 11.1% year over year and beating the $3.6 billion consensus estimate.

By Category

Estée Lauder posted sales growth in nearly all product categories and geographic regions.

Skincare, the company’s largest and best performing category, comprised 46.6% of its sales, and rose 21% on a reported basis to $1.74 billion from $1.45 billion in the same quarter last year. The company credited the gains in skincare mainly to its Estée Lauder and La Mer brands. Specifically, its Estée Lauder brand delivered double digit net sales growth in most regions and channels. The company credited this growth to its Advanced Night Repair Eye Supercharged Complex and the launch of the Micro Essence Skin Activating Treatment Lotion Fresh with Sakura Ferment in Japan.

The company’s second largest category, makeup, accounted for 39% of sales in 3Q19 and grew 5.3% from $1.38 billion in 3Q18 to $1.46 billion in 3Q19 on a reported basis. The growth was driven by increases in higher net sales in its Tom Ford Beauty, Estée Lauder, and La Mer brands, which were partially offset by lower makeup sales from Clinique and Smashbox. Estée Lauder reported strong makeup sales in its Double Wear line, Futurist Aqua Brilliance foundation and Pure Color product lines.

Fragrance increased 2.6% in 3Q19, from $382 million to $392 million on a reported basis. The fragrance category comprises 10% of the company’s sales. Estée Lauder attributed the growth in its fragrance category to Estée Lauder as well as its luxury fragrances, including Jo Malone London, Tom Ford Beauty, Le Labo and By Kilian. The increases were offset by lower sales from some of the designer fragrances.

Haircare, the company’s smallest category, comprising 4% of sales, decreased 2.2% from $139 million in 3Q18 to $136 million in 3Q19 on a reported basis. The decrease was due to lower net sales from Bumble and Bumble, primarily in the North America salon channel.

By Geographic Region

The Asia Pacific region saw the strongest growth, with sales climbing from $773 million in 3Q18 to $966 million in 3Q19 on a reported basis. Estée Lauder reported the growth was broad-based, with two-thirds of the markets in the region growing double digits. Hong Kong, Japan and emerging markets in Southeast Asia delivered strong growth, while net sales in China and Korea accelerated.

Sales in Europe, the Middle East and Africa grew 15% on an as reported basis, from $1.42 billion to $1.63 billion. The company attributed this growth to travel retail, with more than half of its top-ten brands in the channel growing double digits, including Tom Ford Beauty, Estée Lauder, Origins, MAC and La Mer.

In the Americas, sales declined 2% from $1.18 billion in 3Q18 to $1.15 billion in 3Q19 on an as reported basis. The company attributed lower sales to a deceleration in the prestige beauty industry in the US makeup category.

Outlook

The company forecast full fiscal year revenue growth between 7-8%, compared to prior guidance of 5-6%, and the consensus estimate of 6.4%. The company raised its full year EPS guidance to $5.15-5.19, versus the prior guidance of $4.92-5.00, compared to the consensus estimate of $5.06.

Source: Company reports/Coresight Research[/caption]

Estée Lauder 3Q19 Results

Estée Lauder reported fiscal 3Q19 adjusted, non-GAAP EPS of $1.55, up 38.8% from $1.12 in the year-ago quarter and beating the consensus estimate of $1.30. The EPS adjustments included restructuring charges, contingency considerations, and intangible asset impairments. The company reported that with the adoption of ASC 602, a revenue recognition model, its 3Q19 EPS was $1.28, a $(0.27) impact.

Total revenues for the quarter were $3.7 billion, up 11.1% year over year and beating the $3.6 billion consensus estimate.

By Category

Estée Lauder posted sales growth in nearly all product categories and geographic regions.

Skincare, the company’s largest and best performing category, comprised 46.6% of its sales, and rose 21% on a reported basis to $1.74 billion from $1.45 billion in the same quarter last year. The company credited the gains in skincare mainly to its Estée Lauder and La Mer brands. Specifically, its Estée Lauder brand delivered double digit net sales growth in most regions and channels. The company credited this growth to its Advanced Night Repair Eye Supercharged Complex and the launch of the Micro Essence Skin Activating Treatment Lotion Fresh with Sakura Ferment in Japan.

The company’s second largest category, makeup, accounted for 39% of sales in 3Q19 and grew 5.3% from $1.38 billion in 3Q18 to $1.46 billion in 3Q19 on a reported basis. The growth was driven by increases in higher net sales in its Tom Ford Beauty, Estée Lauder, and La Mer brands, which were partially offset by lower makeup sales from Clinique and Smashbox. Estée Lauder reported strong makeup sales in its Double Wear line, Futurist Aqua Brilliance foundation and Pure Color product lines.

Fragrance increased 2.6% in 3Q19, from $382 million to $392 million on a reported basis. The fragrance category comprises 10% of the company’s sales. Estée Lauder attributed the growth in its fragrance category to Estée Lauder as well as its luxury fragrances, including Jo Malone London, Tom Ford Beauty, Le Labo and By Kilian. The increases were offset by lower sales from some of the designer fragrances.

Haircare, the company’s smallest category, comprising 4% of sales, decreased 2.2% from $139 million in 3Q18 to $136 million in 3Q19 on a reported basis. The decrease was due to lower net sales from Bumble and Bumble, primarily in the North America salon channel.

By Geographic Region

The Asia Pacific region saw the strongest growth, with sales climbing from $773 million in 3Q18 to $966 million in 3Q19 on a reported basis. Estée Lauder reported the growth was broad-based, with two-thirds of the markets in the region growing double digits. Hong Kong, Japan and emerging markets in Southeast Asia delivered strong growth, while net sales in China and Korea accelerated.

Sales in Europe, the Middle East and Africa grew 15% on an as reported basis, from $1.42 billion to $1.63 billion. The company attributed this growth to travel retail, with more than half of its top-ten brands in the channel growing double digits, including Tom Ford Beauty, Estée Lauder, Origins, MAC and La Mer.

In the Americas, sales declined 2% from $1.18 billion in 3Q18 to $1.15 billion in 3Q19 on an as reported basis. The company attributed lower sales to a deceleration in the prestige beauty industry in the US makeup category.

Outlook

The company forecast full fiscal year revenue growth between 7-8%, compared to prior guidance of 5-6%, and the consensus estimate of 6.4%. The company raised its full year EPS guidance to $5.15-5.19, versus the prior guidance of $4.92-5.00, compared to the consensus estimate of $5.06.