Nitheesh NH

On March 5, 2019, Estée Lauder hosted its Investor Day in New York City. The company focused on prestige beauty growth, innovation, digital strategy, travel retail, and the three-year strategic outlook.

The day featured many management presentations, including those by: Fabrizio Freda, President and CEO; Andrew George Ross, Executive Vice President of Strategy and New Business Development; John D. Demsey, Executive Group President; Jane Hertzmark, Hudis Group President; Olivier Bottrie Global President of Travel Retail & Retail Development.

The overall prestige beauty category has generated average sales growth of 6% over the last five years, while Estée Lauder Company has grown at a faster rate than the industry average, each year.

Management opened the investor day with an overview and background of the overall prestige beauty category and a discussion on growth and opportunities in the prestige beauty sector. Management commented that the prestige beauty category is a fast-growing consumer sector. Prestige beauty has generated average sales growth of 6% over the last five years according to Euromonitor International data, about double the 3% of consumer staples according to the S&P Consumer Staple Index (FactSet). Estée Lauder reported its growth in constant currency has outpaced the overall prestige beauty market year after year.

[caption id="attachment_80139" align="aligncenter" width="620"] Source: Company reports [/caption]

Estée Lauder Company net sales rose an average 8% annually over the past 10 years.

Management reported that its net sales rose, on average, 8% over the past 10 years. The company reported it added $1.4 billion in sales in calendar 2018 as it added new consumers and grew its prestige beauty category.

[caption id="attachment_80144" align="aligncenter" width="620"]

Source: Company reports [/caption]

Estée Lauder Company net sales rose an average 8% annually over the past 10 years.

Management reported that its net sales rose, on average, 8% over the past 10 years. The company reported it added $1.4 billion in sales in calendar 2018 as it added new consumers and grew its prestige beauty category.

[caption id="attachment_80144" align="aligncenter" width="620"] Source: Company reports[/caption]

Estée Lauder’s share of the global premium cosmetic market has risen from 13% in calendar 2009 to 14.4% in calendar 2017.

Estée Lauder reported that its share of the global premium cosmetics, premium fragrances and premium skincare markets has risen consistently every year, from 13.0% in calendar year 2009 (CY09) to 14.4% in CY17.

[caption id="attachment_80145" align="aligncenter" width="620"]

Source: Company reports[/caption]

Estée Lauder’s share of the global premium cosmetic market has risen from 13% in calendar 2009 to 14.4% in calendar 2017.

Estée Lauder reported that its share of the global premium cosmetics, premium fragrances and premium skincare markets has risen consistently every year, from 13.0% in calendar year 2009 (CY09) to 14.4% in CY17.

[caption id="attachment_80145" align="aligncenter" width="620"] Source: Company reports[/caption]

The middle class is growing and consumers are spending more on prestige beauty.

Estée Lauder management said the growing middle class provides an opportunity, particularly for prestige makeup, as many women in the middle class aspire to prestige beauty brands. The company estimated the global middle class will grow by 600 million people, representing greater than $5 trillion in added global spending power by 2028, an increase of 50%. Estée Lauder expects growth of the middle class to be driven by increasing wealth in developing countries, the largest in China, India, Southeast Asia and Brazil, even in more mature economies such as the US.

[caption id="attachment_80146" align="aligncenter" width="620"]

Source: Company reports[/caption]

The middle class is growing and consumers are spending more on prestige beauty.

Estée Lauder management said the growing middle class provides an opportunity, particularly for prestige makeup, as many women in the middle class aspire to prestige beauty brands. The company estimated the global middle class will grow by 600 million people, representing greater than $5 trillion in added global spending power by 2028, an increase of 50%. Estée Lauder expects growth of the middle class to be driven by increasing wealth in developing countries, the largest in China, India, Southeast Asia and Brazil, even in more mature economies such as the US.

[caption id="attachment_80146" align="aligncenter" width="620"] Source: Company reports[/caption]

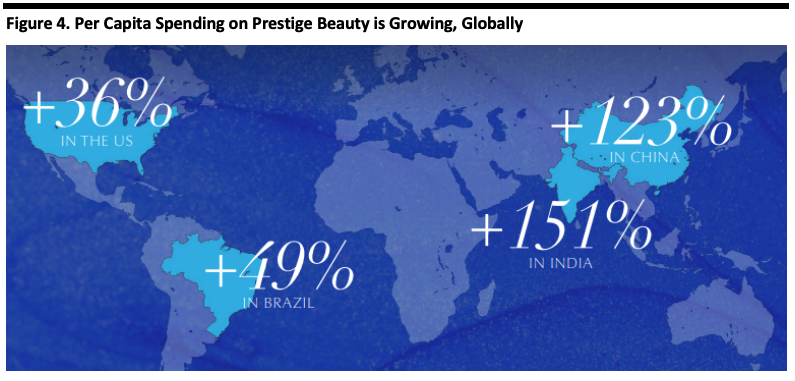

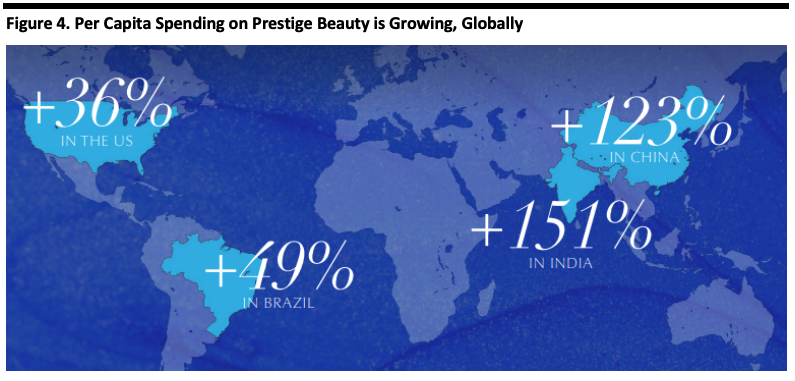

Consumer spending is shifting towards prestige brands, globally.

Management commented that consumer beauty regimens are becoming more sophisticated and consumers are spending more on prestige beauty products. For example, women in China between the ages of 15 and 65 spend $23 annually on prestige beauty today compared to $255 in the US. Korea, which was an emerging market in prestige beauty only 20 years ago, women spend an average of $276. In Brazil, women spend an average of $21 per year, in India, just $2 – a huge growth opportunity for the prestige industry.

[caption id="attachment_80147" align="aligncenter" width="620"]

Source: Company reports[/caption]

Consumer spending is shifting towards prestige brands, globally.

Management commented that consumer beauty regimens are becoming more sophisticated and consumers are spending more on prestige beauty products. For example, women in China between the ages of 15 and 65 spend $23 annually on prestige beauty today compared to $255 in the US. Korea, which was an emerging market in prestige beauty only 20 years ago, women spend an average of $276. In Brazil, women spend an average of $21 per year, in India, just $2 – a huge growth opportunity for the prestige industry.

[caption id="attachment_80147" align="aligncenter" width="620"] Source: Company reports[/caption]

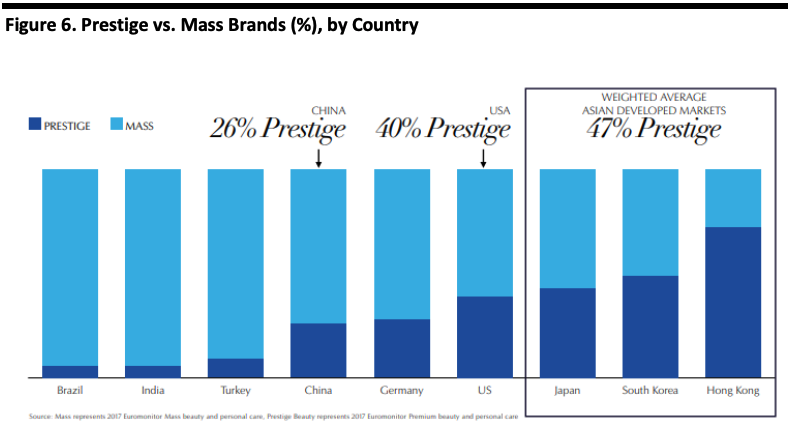

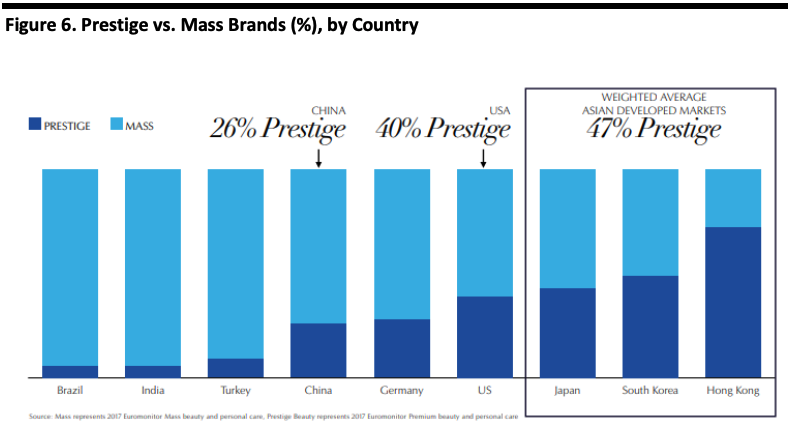

There is an opportunity to trade up from mass cosmetics to prestige cosmetics, as prestige cosmetics have grown faster than the overall mass beauty market over the past five years.

In the past five years, total prestige beauty has grown much faster than overall mass beauty. In the US market, prestige beauty is approximately 40% of total beauty sales, below the 47% average in developed Asian markets. This, combined with increasing wealth in many developing countries, create an opportunity to migrate more consumers from mass to prestige. In China, the percentage beauty products sold in the prestige category is 26%, far lower than in developed markets elsewhere in Asia.

[caption id="attachment_80148" align="aligncenter" width="620"]

Source: Company reports[/caption]

There is an opportunity to trade up from mass cosmetics to prestige cosmetics, as prestige cosmetics have grown faster than the overall mass beauty market over the past five years.

In the past five years, total prestige beauty has grown much faster than overall mass beauty. In the US market, prestige beauty is approximately 40% of total beauty sales, below the 47% average in developed Asian markets. This, combined with increasing wealth in many developing countries, create an opportunity to migrate more consumers from mass to prestige. In China, the percentage beauty products sold in the prestige category is 26%, far lower than in developed markets elsewhere in Asia.

[caption id="attachment_80148" align="aligncenter" width="620"] Source: Company reports[/caption]

Innovations and successful product launches accounted for nearly 30% of net sales in the first half of fiscal year 2019.

Innovation is inspired by data analytics and consumer insights. The company has improved the success rate of its product launches, accounting for nearly 30% of net sales in the first half of this fiscal year, 2019.

[caption id="attachment_80151" align="aligncenter" width="620"]

Source: Company reports[/caption]

Innovations and successful product launches accounted for nearly 30% of net sales in the first half of fiscal year 2019.

Innovation is inspired by data analytics and consumer insights. The company has improved the success rate of its product launches, accounting for nearly 30% of net sales in the first half of this fiscal year, 2019.

[caption id="attachment_80151" align="aligncenter" width="620"] Source: Company reports[/caption]

Management highlighted a few of its skincare and cosmetic innovations:

Source: Company reports[/caption]

Management highlighted a few of its skincare and cosmetic innovations:

Source: Company reports[/caption]

E-commerce accounts for nearly 30% of the company’s sales in China, with nine brands online.

Estée Lauder launched its first boutique on China’s Tmall in 2013. Today, the company has nine brands in China that account for nearly 30% of its e-commerce sales there. The company stated its Tmall business grew over tenfold over the past four years. The company generated $150 million in 24 hours alone on Singles’ Day in 2018.

Estée Lauder will continue to focus on travel retail as an area of opportunity; the segment grew at an annual rate of 14% over the past four years, estimated to be $28 billion in CY18.

Management said it will continue its focus on travel retail as an area of opportunity. Over the past four years, travel retail grew at an annual growth rate of 14%, and the company said it has been a key contributor to the company’s success in the past ten years. Estée Lauder is focusing on engaging shoppers before, during, and after travel through the ability to purchase products in airports kiosks, at pop-ups and in duty-free shops. Additionally, the company is using social media to increase brand visibility to more consumers.

[caption id="attachment_80153" align="aligncenter" width="620"]

Source: Company reports[/caption]

E-commerce accounts for nearly 30% of the company’s sales in China, with nine brands online.

Estée Lauder launched its first boutique on China’s Tmall in 2013. Today, the company has nine brands in China that account for nearly 30% of its e-commerce sales there. The company stated its Tmall business grew over tenfold over the past four years. The company generated $150 million in 24 hours alone on Singles’ Day in 2018.

Estée Lauder will continue to focus on travel retail as an area of opportunity; the segment grew at an annual rate of 14% over the past four years, estimated to be $28 billion in CY18.

Management said it will continue its focus on travel retail as an area of opportunity. Over the past four years, travel retail grew at an annual growth rate of 14%, and the company said it has been a key contributor to the company’s success in the past ten years. Estée Lauder is focusing on engaging shoppers before, during, and after travel through the ability to purchase products in airports kiosks, at pop-ups and in duty-free shops. Additionally, the company is using social media to increase brand visibility to more consumers.

[caption id="attachment_80153" align="aligncenter" width="620"] Source: Company reports[/caption]

Estée Lauder confirms its three-year target of 6-8% net sales growth and double-digit EPS growth.

The company reported that over the next three years, it expects 6-8% sales growth. Management reported it expects to derive about two percentage points of net sales growth annually from pricing to offset cost inflation and to keep its brands aspirational. The company plans to expand geographically and into channels such as online and travel retail, and expects this distribution to contribute approximately two additional percentage points of growth. The company expect acquisitions to contribute about one point of growth over three years.

[caption id="attachment_80154" align="aligncenter" width="620"]

Source: Company reports[/caption]

Estée Lauder confirms its three-year target of 6-8% net sales growth and double-digit EPS growth.

The company reported that over the next three years, it expects 6-8% sales growth. Management reported it expects to derive about two percentage points of net sales growth annually from pricing to offset cost inflation and to keep its brands aspirational. The company plans to expand geographically and into channels such as online and travel retail, and expects this distribution to contribute approximately two additional percentage points of growth. The company expect acquisitions to contribute about one point of growth over three years.

[caption id="attachment_80154" align="aligncenter" width="620"] Source: Company reports[/caption]

Source: Company reports[/caption]

Source: Company reports [/caption]

Estée Lauder Company net sales rose an average 8% annually over the past 10 years.

Management reported that its net sales rose, on average, 8% over the past 10 years. The company reported it added $1.4 billion in sales in calendar 2018 as it added new consumers and grew its prestige beauty category.

[caption id="attachment_80144" align="aligncenter" width="620"]

Source: Company reports [/caption]

Estée Lauder Company net sales rose an average 8% annually over the past 10 years.

Management reported that its net sales rose, on average, 8% over the past 10 years. The company reported it added $1.4 billion in sales in calendar 2018 as it added new consumers and grew its prestige beauty category.

[caption id="attachment_80144" align="aligncenter" width="620"] Source: Company reports[/caption]

Estée Lauder’s share of the global premium cosmetic market has risen from 13% in calendar 2009 to 14.4% in calendar 2017.

Estée Lauder reported that its share of the global premium cosmetics, premium fragrances and premium skincare markets has risen consistently every year, from 13.0% in calendar year 2009 (CY09) to 14.4% in CY17.

[caption id="attachment_80145" align="aligncenter" width="620"]

Source: Company reports[/caption]

Estée Lauder’s share of the global premium cosmetic market has risen from 13% in calendar 2009 to 14.4% in calendar 2017.

Estée Lauder reported that its share of the global premium cosmetics, premium fragrances and premium skincare markets has risen consistently every year, from 13.0% in calendar year 2009 (CY09) to 14.4% in CY17.

[caption id="attachment_80145" align="aligncenter" width="620"] Source: Company reports[/caption]

The middle class is growing and consumers are spending more on prestige beauty.

Estée Lauder management said the growing middle class provides an opportunity, particularly for prestige makeup, as many women in the middle class aspire to prestige beauty brands. The company estimated the global middle class will grow by 600 million people, representing greater than $5 trillion in added global spending power by 2028, an increase of 50%. Estée Lauder expects growth of the middle class to be driven by increasing wealth in developing countries, the largest in China, India, Southeast Asia and Brazil, even in more mature economies such as the US.

[caption id="attachment_80146" align="aligncenter" width="620"]

Source: Company reports[/caption]

The middle class is growing and consumers are spending more on prestige beauty.

Estée Lauder management said the growing middle class provides an opportunity, particularly for prestige makeup, as many women in the middle class aspire to prestige beauty brands. The company estimated the global middle class will grow by 600 million people, representing greater than $5 trillion in added global spending power by 2028, an increase of 50%. Estée Lauder expects growth of the middle class to be driven by increasing wealth in developing countries, the largest in China, India, Southeast Asia and Brazil, even in more mature economies such as the US.

[caption id="attachment_80146" align="aligncenter" width="620"] Source: Company reports[/caption]

Consumer spending is shifting towards prestige brands, globally.

Management commented that consumer beauty regimens are becoming more sophisticated and consumers are spending more on prestige beauty products. For example, women in China between the ages of 15 and 65 spend $23 annually on prestige beauty today compared to $255 in the US. Korea, which was an emerging market in prestige beauty only 20 years ago, women spend an average of $276. In Brazil, women spend an average of $21 per year, in India, just $2 – a huge growth opportunity for the prestige industry.

[caption id="attachment_80147" align="aligncenter" width="620"]

Source: Company reports[/caption]

Consumer spending is shifting towards prestige brands, globally.

Management commented that consumer beauty regimens are becoming more sophisticated and consumers are spending more on prestige beauty products. For example, women in China between the ages of 15 and 65 spend $23 annually on prestige beauty today compared to $255 in the US. Korea, which was an emerging market in prestige beauty only 20 years ago, women spend an average of $276. In Brazil, women spend an average of $21 per year, in India, just $2 – a huge growth opportunity for the prestige industry.

[caption id="attachment_80147" align="aligncenter" width="620"] Source: Company reports[/caption]

There is an opportunity to trade up from mass cosmetics to prestige cosmetics, as prestige cosmetics have grown faster than the overall mass beauty market over the past five years.

In the past five years, total prestige beauty has grown much faster than overall mass beauty. In the US market, prestige beauty is approximately 40% of total beauty sales, below the 47% average in developed Asian markets. This, combined with increasing wealth in many developing countries, create an opportunity to migrate more consumers from mass to prestige. In China, the percentage beauty products sold in the prestige category is 26%, far lower than in developed markets elsewhere in Asia.

[caption id="attachment_80148" align="aligncenter" width="620"]

Source: Company reports[/caption]

There is an opportunity to trade up from mass cosmetics to prestige cosmetics, as prestige cosmetics have grown faster than the overall mass beauty market over the past five years.

In the past five years, total prestige beauty has grown much faster than overall mass beauty. In the US market, prestige beauty is approximately 40% of total beauty sales, below the 47% average in developed Asian markets. This, combined with increasing wealth in many developing countries, create an opportunity to migrate more consumers from mass to prestige. In China, the percentage beauty products sold in the prestige category is 26%, far lower than in developed markets elsewhere in Asia.

[caption id="attachment_80148" align="aligncenter" width="620"] Source: Company reports[/caption]

Innovations and successful product launches accounted for nearly 30% of net sales in the first half of fiscal year 2019.

Innovation is inspired by data analytics and consumer insights. The company has improved the success rate of its product launches, accounting for nearly 30% of net sales in the first half of this fiscal year, 2019.

[caption id="attachment_80151" align="aligncenter" width="620"]

Source: Company reports[/caption]

Innovations and successful product launches accounted for nearly 30% of net sales in the first half of fiscal year 2019.

Innovation is inspired by data analytics and consumer insights. The company has improved the success rate of its product launches, accounting for nearly 30% of net sales in the first half of this fiscal year, 2019.

[caption id="attachment_80151" align="aligncenter" width="620"] Source: Company reports[/caption]

Management highlighted a few of its skincare and cosmetic innovations:

Source: Company reports[/caption]

Management highlighted a few of its skincare and cosmetic innovations:

- In skincare, Clinique ID provides custom-fit moisturizing treatments with 15 different combinations to address consumer desire for more personalization in beauty products.

- Estée Lauder Sakura essence treatment lotion was developed in Asia, targeting the Asian skincare market, using local ingredients such as cherry blossom.

- Bobbi Brown Crushed Liquid Lip combines the look of a liquid lipstick with the feel of balm and the sheen of a gloss.

- Too Faced makeup expanded the shade range of its “Born This Way Foundation,” which helped attract new customers.

Source: Company reports[/caption]

E-commerce accounts for nearly 30% of the company’s sales in China, with nine brands online.

Estée Lauder launched its first boutique on China’s Tmall in 2013. Today, the company has nine brands in China that account for nearly 30% of its e-commerce sales there. The company stated its Tmall business grew over tenfold over the past four years. The company generated $150 million in 24 hours alone on Singles’ Day in 2018.

Estée Lauder will continue to focus on travel retail as an area of opportunity; the segment grew at an annual rate of 14% over the past four years, estimated to be $28 billion in CY18.

Management said it will continue its focus on travel retail as an area of opportunity. Over the past four years, travel retail grew at an annual growth rate of 14%, and the company said it has been a key contributor to the company’s success in the past ten years. Estée Lauder is focusing on engaging shoppers before, during, and after travel through the ability to purchase products in airports kiosks, at pop-ups and in duty-free shops. Additionally, the company is using social media to increase brand visibility to more consumers.

[caption id="attachment_80153" align="aligncenter" width="620"]

Source: Company reports[/caption]

E-commerce accounts for nearly 30% of the company’s sales in China, with nine brands online.

Estée Lauder launched its first boutique on China’s Tmall in 2013. Today, the company has nine brands in China that account for nearly 30% of its e-commerce sales there. The company stated its Tmall business grew over tenfold over the past four years. The company generated $150 million in 24 hours alone on Singles’ Day in 2018.

Estée Lauder will continue to focus on travel retail as an area of opportunity; the segment grew at an annual rate of 14% over the past four years, estimated to be $28 billion in CY18.

Management said it will continue its focus on travel retail as an area of opportunity. Over the past four years, travel retail grew at an annual growth rate of 14%, and the company said it has been a key contributor to the company’s success in the past ten years. Estée Lauder is focusing on engaging shoppers before, during, and after travel through the ability to purchase products in airports kiosks, at pop-ups and in duty-free shops. Additionally, the company is using social media to increase brand visibility to more consumers.

[caption id="attachment_80153" align="aligncenter" width="620"] Source: Company reports[/caption]

Estée Lauder confirms its three-year target of 6-8% net sales growth and double-digit EPS growth.

The company reported that over the next three years, it expects 6-8% sales growth. Management reported it expects to derive about two percentage points of net sales growth annually from pricing to offset cost inflation and to keep its brands aspirational. The company plans to expand geographically and into channels such as online and travel retail, and expects this distribution to contribute approximately two additional percentage points of growth. The company expect acquisitions to contribute about one point of growth over three years.

[caption id="attachment_80154" align="aligncenter" width="620"]

Source: Company reports[/caption]

Estée Lauder confirms its three-year target of 6-8% net sales growth and double-digit EPS growth.

The company reported that over the next three years, it expects 6-8% sales growth. Management reported it expects to derive about two percentage points of net sales growth annually from pricing to offset cost inflation and to keep its brands aspirational. The company plans to expand geographically and into channels such as online and travel retail, and expects this distribution to contribute approximately two additional percentage points of growth. The company expect acquisitions to contribute about one point of growth over three years.

[caption id="attachment_80154" align="aligncenter" width="620"] Source: Company reports[/caption]

Source: Company reports[/caption]