Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

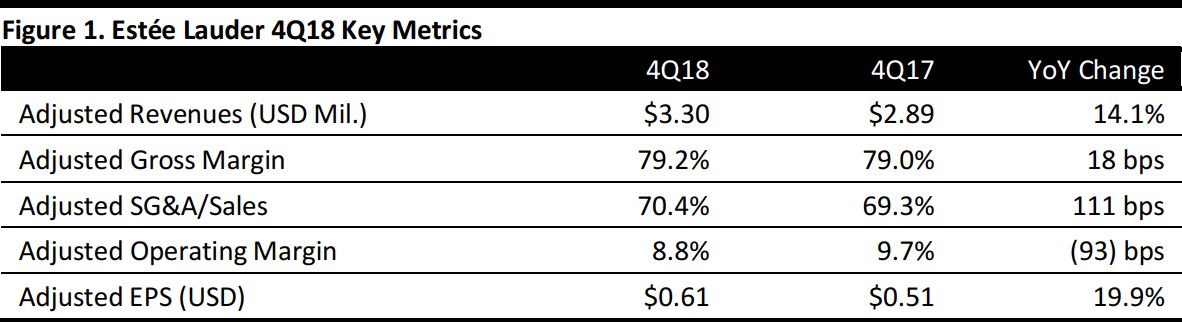

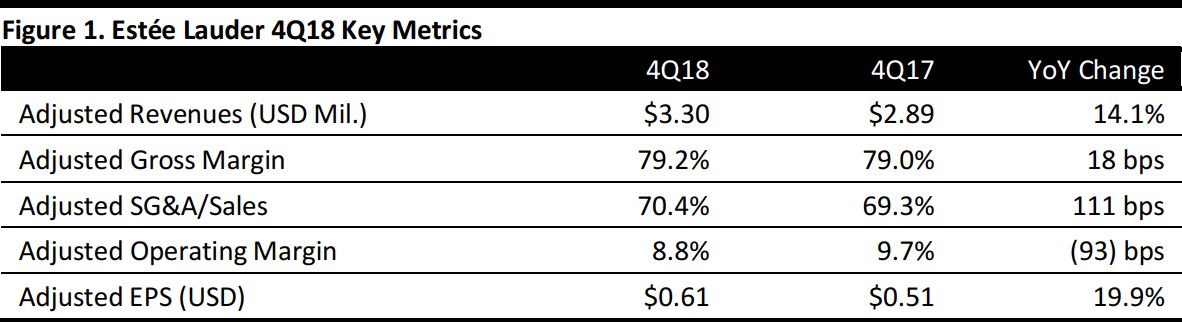

Fiscal 4Q18 Results

Estée Lauder reported fiscal 4Q18 revenues of $3.30 billion, up 14.1% year over year and beating the consensus estimate of $3.25 billion. Excluding foreign currency translation, net sales increased 12%.

Adjusted EPS was $0.61, beating consensus by a nickel and up 19.9% year over year. GAAP EPS was $0.49, compared to $0.61 in the year-ago quarter.

Management commented that during the year, by investing in hero franchises, fast-growing channels and digital and social media, the company generated higher sales in every region and product category and gained global share. In addition, among its top-four brands, the flagship Estée Lauder brand achieved record global sales and grew 22% in constant currency. La Mer became the fourth brand in the portfolio to contribute well over $1 billion in net sales, and sales also increased at MAC and Clinique globally.

Full-Year Results

For the fiscal year, revenues were $13.68 billion, up 16% and up 13% in constant currency. Adjusted EPS was $4.51, up 30%. GAAP EPS was $2.95, compared with $3.35 the prior year.

Results by Segment

Skin Care

- Skin Care revenues were $1.38 billion, up 29% as reported and up 26% in constant currency.

- Sales increased by double digits in every geographic region, and were particularly strong in Europe, the Middle East & Africa, travel retail and China.

- The Estée Lauder, La Mer and Clinique brands were the largest contributors to growth.

Makeup

- Skin Care revenues were $1.36 billion, up 4% as reported and up 2% in constant currency.

Fragrance

- Fragrance revenues were $403 million, up 11% as reported and up 7% in constant currency.

Haircare

- Fragrance revenues were $151 million, up 8% as reported and up 6% in constant currency.

Other

- Other revenues were $12 million, up 33% as reported and up 33% in constant currency.

Results by Geography

- Revenues from the Americas were $1.20 billion, up 2% as reported and up 2% in constant currency.

- Revenues from Europe, the Middle East and Africa were $1.40 billion, up 19% as reported and up 16% in constant currency.

- Revenues from Asia/Pacific were $708 million, up 29% as reported and up 24% in constant currency.

Outlook

For fiscal 2019, management expressed confidence that the company can continue to lead the industry in sales and deliver double-digit EPS growth by focusing on multiple engines of growth across products, geographies, channels and demographics, with the expectation of gaining global share again in the year.

Management offered the following guidance for fiscal 2019:

- Adjusted net sales growth of 7%–8%, ahead of the 5%–6% growth expected for global prestige beauty.

- Reported net sales are expected to experience a penalty of 2% from currency translation and 1% from the adoption of a new revenue-recognition accounting standard.

- Adjusted EPS is projected to be $4.62–$4.71.

- Reported EPS is projected to be $4.38–$4.51.

Management offered the following guidance for fiscal 1Q19:

- Adjusted net sales growth of 9%–10%.

- Adjusted EPS of $1.18–$1.22.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research