Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

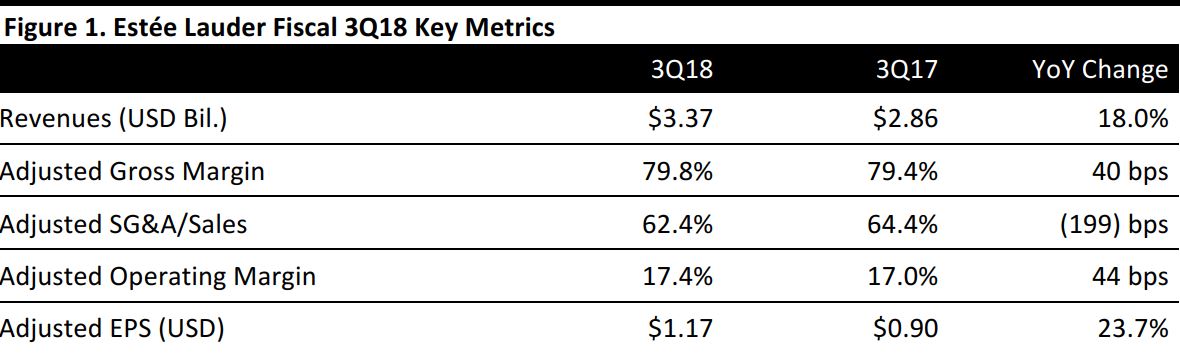

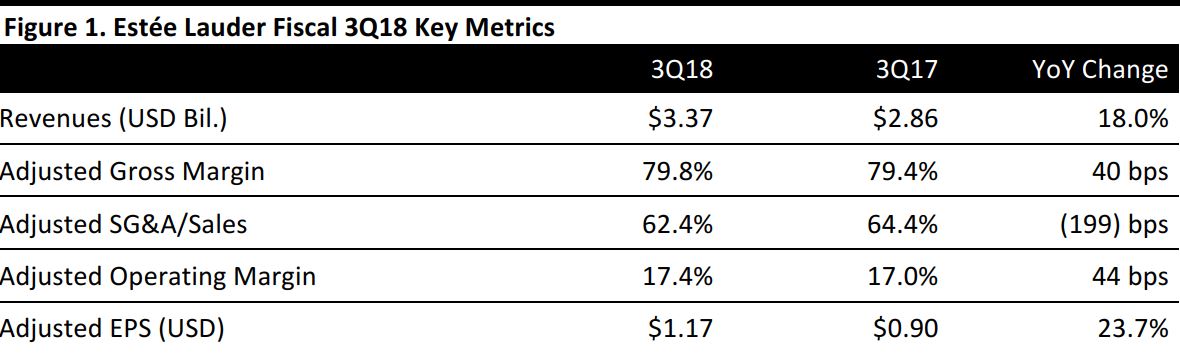

Fiscal 3Q18 Results

Estée Lauder reported fiscal 3Q18 revenues of $3.37 billion, up 18.0% year over year and beating the consensus estimate of $3.25 billion. Excluding foreign currency translation, net sales increased by 13%.

Adjusted EPS was $1.17, beating the consensus estimate by a dime and up 23.7% year over year. GAAP EPS was $0.99, compared with $0.80 in the year-ago quarter.

Management cited travel retail, online and Asia as engines of growth, and said it saw strong momentum in other channels and markets. Performance in the quarter was driven by global demand across the portfolio, with nearly all brands posting sales growth. The company’s three biggest brands grew globally, and the Estée Lauder brand reported exceptional growth.

Results by Segment

Skin Care

- Skin care revenues were $1.45 billion, up 31% as reported and up 25% in constant currency year over year.

- Sales growth benefited from strength in Asia, where skin care represents about two-thirds of the product category mix.

- Growth also derived from hero products and increasing demand from younger consumers.

Makeup

- Makeup revenues were $1.39 billion, up 9% as reported and up 5% in constant currency.

- Sales growth was primarily driven by double-digit increases from Estée Lauder and Tom Ford and solid gains from MAC and Clinique.

- Estée Lauder sales were driven by the Double Wear foundation and Pure Color product lines. Tom Ford sales growth was driven primarily by strength in the eye shadow subcategory.

Fragrance

- Fragrance revenues were $382 million, up 14% as reported and up 7% in constant currency.

- Net sales were driven by strong, double-digit growth from luxury brands.

- Jo Malone London delivered double-digit growth in every region and in travel retail, and the launch of the English Fields fragrance collection contributed to higher sales.

Hair Care

- Hair care revenues were $139 million, up 10% as reported and up 7% in constant currency.

- Aveda grew due to solid performance in the online and travel retail channels, along with contributions from the launches of Invati Advanced and Full Spectrum Demi+. Growth from Bumble and Bumble was driven by success at Ulta Beauty. Sales growth for Aveda and Bumble and Bumble were partially offset by softness in the salon channel in North America.

Other

- Other revenues were $14 million, down 26% as reported and down 32% in constant currency.

Results by Geography

- Revenues from the Americas were $1.18 billion, up 1% both as reported and in constant currency.

- Revenues from the Europe, Middle East and Africa region were $1.42 billion, up 26% as reported and up 17% in constant currency.

- Revenues from the Asia-Pacific region were $773 million, up 38% as reported and up 30% in constant currency.

Outlook

Management offered the following guidance for FY18:

- Total net sales growth of 15%–16%, i.e., to $13.6–$13.7 billion.

- A benefit to sales of approximately 4% from foreign currency translation.

- GAAP EPS of $2.78–$2.86.

- Adjusted EPS of $4.38–$4.42.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research