Source: Company reports

Source: Company reports

4Q16 RESULTS

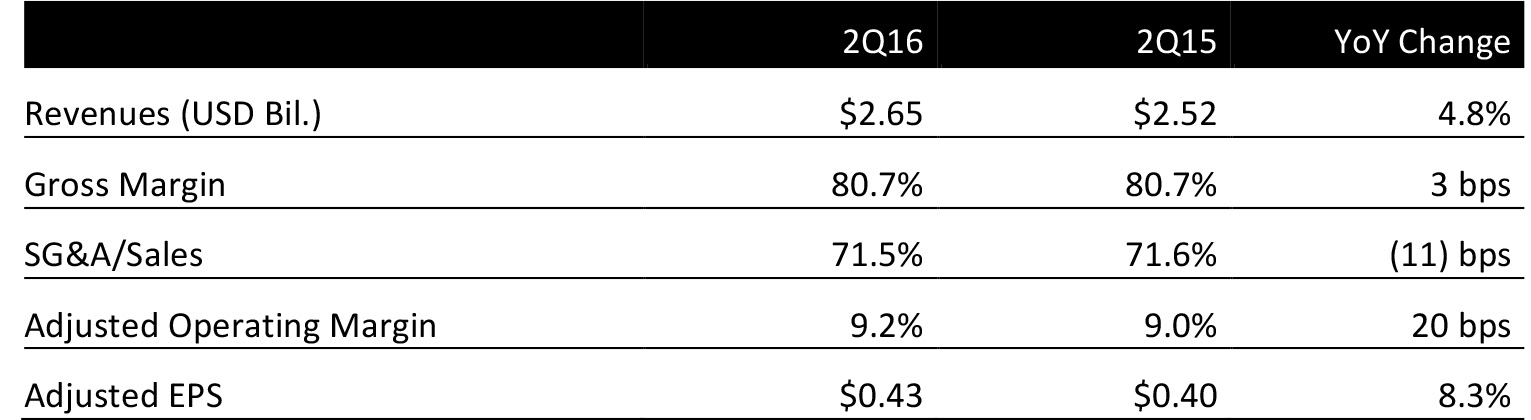

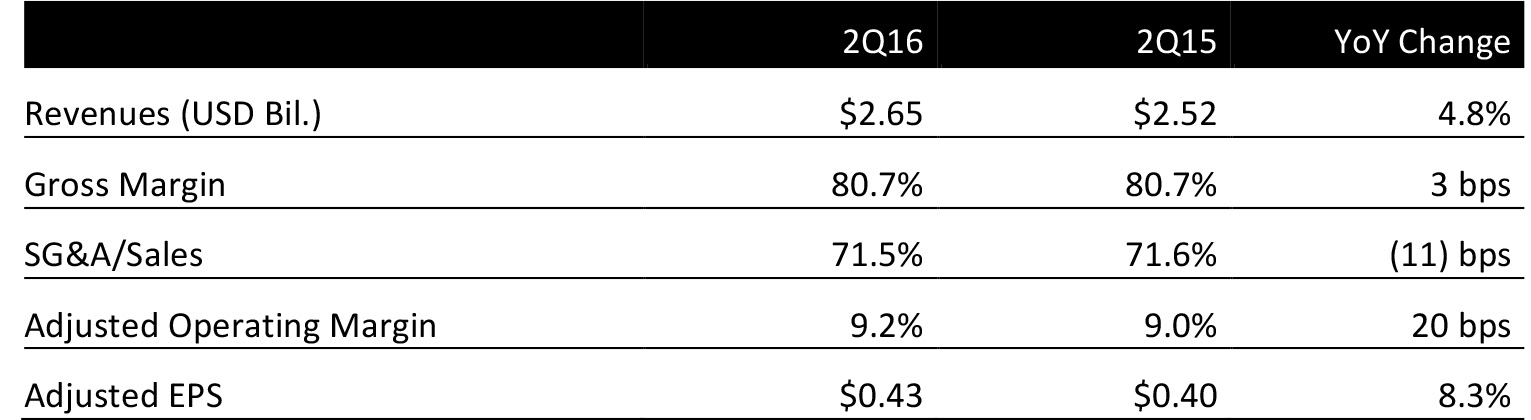

Estée Lauder reported 4Q2016 revenues of $2.65 billion, up 4.8% year over year and slightly below the consensus estimate. Revenues increased 7% excluding currency effects. Sales increased in all regions and product categories except fragrance.

Adjusted EPS was $0.43, ahead of the $0.40 consensus estimate and up 8.3% year over year, and excludes $99.4 million of restructuring and other charges. GAAP EPS was $0.25.

By Product Category

Skin Care sales increased 2% (3% in local currency) in the quarter. Makeup sales increased 10% (12% in local currency), Fragrance sales declined 2% but increased 2% in local currency and Hair Care sales increased 3%, 5% in local currency.

For the year:

- Skin Care—Sales declined 1% but increased 3% in local currency, owing to double-digit sales gains for Genaissance de La Mer The Serum Essence, The Renewal Oil and The Lifting Eye Serum, as well as strong growth from Origins. This was offset by lower skin care sales from Estée Lauder and Clinique, partially due to to lower sales in certain Asia-Pacific countries, particularly Hong Kong.

- Makeup—Sales increased 9% and 15% in local currency, owing to double-digit increases from M•A•C, Smashbox and Tom Ford and solid gains from Bobbi Brown, in addition to higher sales for the Estée Lauder and Clinique brands.

Source: Shutterstock

Source: Shutterstock

- Fragrance—Sales declined 5% as reported, but increased 10% in local currency, owing to double-digit gains from luxury brands Jo Malone London and Tom Ford, contributions from recent acquisitions, higher sales from Jo Malone, partially offset by lower sales of certain Estée Lauder, Clinique and designer fragrances.

- Hair Care—Sales increased 4% and 7% in local currency, owing to recent product launches, such as Invati Men, Shampure dry shampoo and the Aveda Thickening Tonic by Aveda, as well as increases in salons, online and travel retail, and from selective global expansion at Bumble and bumble.

By Geographic Region

In the quarter, revenues increased 1% in the Americas (up 3% in local currency), 9% in Europe, the Middle East and Africa (12% in local currency) and 4% in Asia-Pacific (4% in local currency).

For the fiscal year:

- The Americas—Sales in the company’s online business grew by strong double digits, however net sales were impacted by a decline in retail traffic in the US, primarily in mid-tier department and other stores, from a decrease in tourism.

- Europe, the Middle East and Africa—Nearly all countries recorded net sales growth. Many posted double-digit increases, led by the Middle East, Central Europe, the Nordic countries and India. There was solid growth in the UK, Germany and Italy.

- Asia/Pacific—Sales increased in constant currency terms in every region except Hong Kong, including double-digit growth in Australia, the Philippines and New Zealand. Sales gains were solid in Korea, Japan and China, with higher sales in China reflected in most brands and from higher online sales.

FY2016 RESULTS

Fiscal year 2016 net sales were $11.26 billion, up 4.5% and up 9% in constant currency. Adjusted for restructuring and other charges, adjusted EPS was $3.20 (including a $0.26 reduction from currency effects), compared to $3.05 in the prior year. GAAP EPS was $2.96.

OUTLOOK

The company commented the global prestige beauty industry remains vibrant and the industry is estimated to grow approximately 4%–5%. Estée Lauder expects to grow approximately two percentage points faster than the industry for the fiscal year. Risks include social and political issues, currency volatility and economic challenges that affect consumer behavior in certain countries, as well as the decline in retail traffic, primarily in mid-tier department stores and tourist-driven stores in the US.

For fiscal 2017, the company expects:

- Net sales growth of 6%–7%, i.e., $11.94–$12.05 billion, above the consensus estimate of $11.91 billion.

- Adjusted EPS of $3.38–$3.44, below the consensus estimate of $3.52.

For 1Q2017, the company expects:

- Net sales growth of 1%–2%, i.e., $2.86–$2.89 billion, below the consensus estimate of $2.94 billion.

- Adjusted EPS of $0.73–$0.77, below the consensus estimate of $0.89.

Source: Company reports

Source: Company reports Source: Shutterstock

Source: Shutterstock