Source: Company reports/Fung Global Retail & Technology

Results

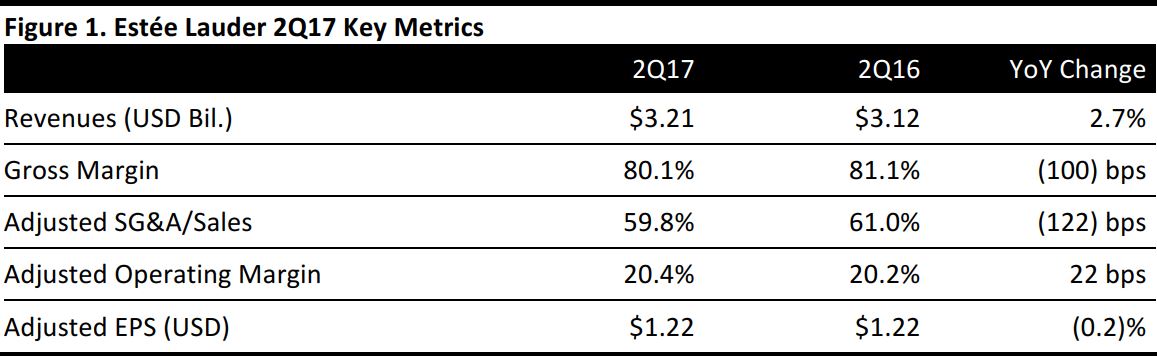

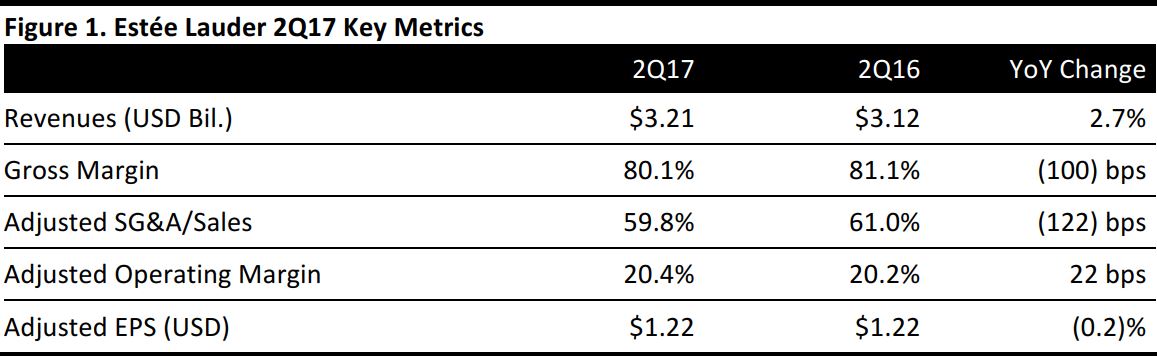

Estée Lauder reported fiscal 2Q17 net sales of $3.21 billion, up 2.7% year over year but slightly missing the $3.24 billion consensus estimate. Sales increased by 5% excluding foreign currency. Incremental sales from the company’s recent acquisitions of By Kilian, Becca Cosmetics and Too Faced contributed approximately 90 basis points to sales growth; of that gain, less than half was attributable to Too Faced.

For fiscal 2Q17, adjusted EPS was $1.22, flat year over year but beating the $1.17 consensus estimate. GAAP EPS, which includes restructuring and other charges, was $1.15, and currency-neutral EPS was $1.28, owing to $41 million, or $0.07 per share, in charges associated with the company’s previously announced Leading Beauty Forward initiative. Restructuring charges amounted to $0.03 per share in the year-ago quarter.

Performance by Product Category

- Skincare: Net sales increased by 1% year over year (up 3% in constant currency), to $1.25 billion, and were driven by strong, double-digit gains from La Mer and new and existing products, and by expanded targeted consumer reach. The Estée Lauder brand delivered solid sales growth from recent product launches; the gains were offset by lower skincare sales from Clinique and Origins.

- Makeup: Net sales increased by 4% year over year (up 7% in constant currency), to $1.31 billion, owing to a double-digit increase from Tom Ford, strong growth from Estée Lauder and La Mer, solid gains from Smashbox, and incremental sales from the acquisitions of Becca and Too Faced.

- Fragrance: Net sales increased by 6% year over year (up 11% in constant currency), to $487 million, due to double-digit gains from luxury brands Jo Malone London, Tom Ford, Le Labo and Frédéric Malle and incremental sales from By Kilian. The gains were partially offset by lower sales of certain Estée Lauder and designer fragrances.

- Haircare: Net sales decreased by 8% year over year (down 7% in constant currency), to $137 million; several Aveda product launches in the prior-year period made for a difficult comparison.

Performance by Geographic Region

- North America:Net sales increased by 1% year over year (up1% in constant currency), to $1.24 billion, due to a combination of double-digit gains from Tom Ford, La Mer and Smashbox; strong growth from Jo Malone; low-single-digit growth from the Estée Lauder brand;and incremental sales from the recent acquisitions of By Kilian, Becca and Too Faced, which were more than offset by sales decreases due to declining retail traffic in US mid-tier department stores. The traffic decline principally affected the Clinique and MAC Cosmetics brands.

- Europe, the Middle East, and Africa: Net sales increased by 3% year over year (up 9% in constant currency), to $1.31 billion. Sales growth was driven by double-digit increases in Russia, India, Italy, France, Central Europe, and the Balkans; strong growth in Germany; and new travel-retail launch initiatives. Within the region, lower sales were primarily seen in the Middle East and were driven by retailer inventory rebalancing.

- Asia-Pacific: Net sales increased by 5% year over year (up 5% in constant currency), to $659 million, owing to double-digit increases in China and the Philippines. However, sales in Hong Kong declined, reflecting continuing challenges due to fewer Chinese tourists, particularly for the Estée Lauder, Clinique and La Mer brands.

Outlook

The company commented that it expects global prestige beauty to grow by approximately 4%–5% and that it expects sales growth to progressively accelerate in its fiscal third and fourth quarters due to strong innovation programs, greater outreach to target consumers, regular price increases, organic growth, easier comparisons in certain markets, and incremental sales from recent acquisitions.

For the full year, the company expects:

- Net sales to increase by 4%–5%, with currency effects having a negative impact of 2%. The consensus revenue estimate of $11.86 billion represents 5% growth.

- Adjusted EPS of $3.29–$3.33, which is below the current consensus estimate of $3.39.

For the fiscal third quarter, the company expects:

- Net sales growth of 5%–6%, with currency effects having a negative impact of 2%. The consensus revenue estimate of $2.89 billion represents 9% growth.

- Adjusted EPS of $0.65–$0.70, which is below the current consensus estimate of $0.84.