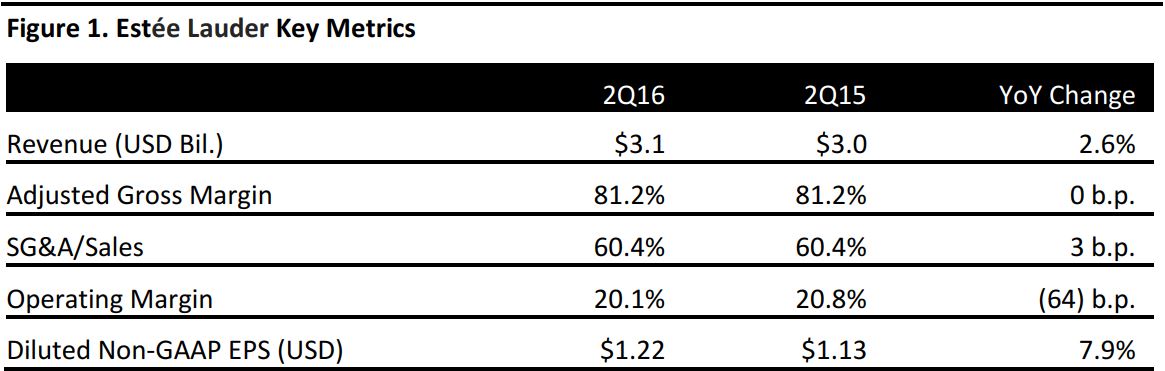

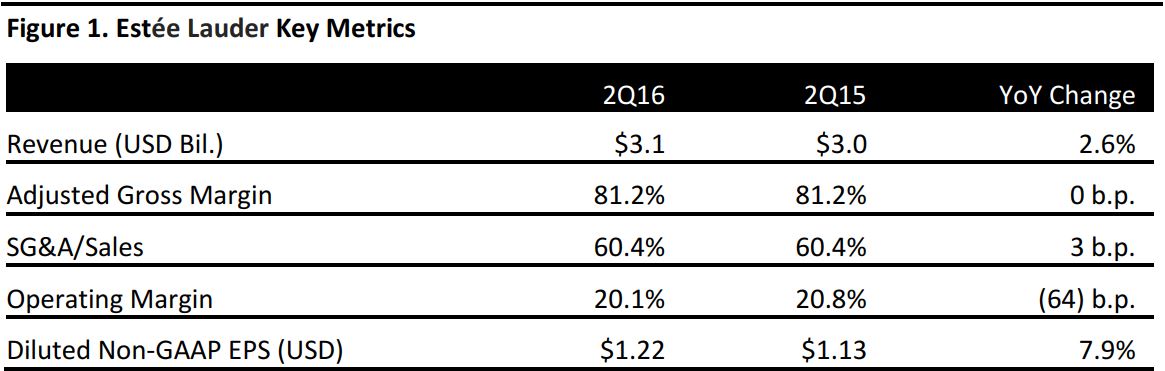

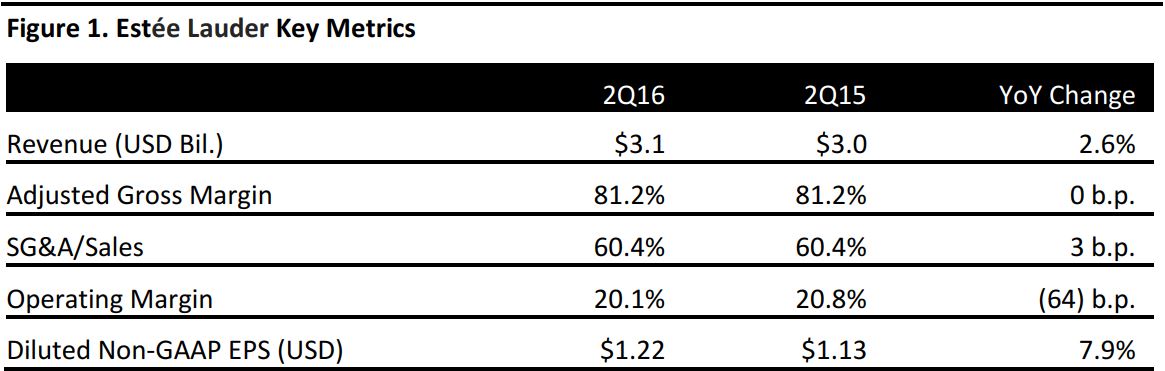

Source: Company reports

During the second quarter, Estée Lauder recorded charges of $18.5 million in connection with its global technology infrastructure, which the company is transitioning to a primarily vendor-owned model. Excluding these charges, net earnings were $458.6 million, up 5%, and diluted EPS was $1.22. On a constant currency basis, revenue growth beat the first-quarter guidance of 6%–7%. Diluted EPS was above the expected increase of 1%–5%.

Skin care sales were down 3%, but up 2% in constant currency, to $1.2 billion, versus consensus of $1.3 billion. The increase was primarily driven by strong gains from La Mer, one of the company’s luxury skin care brands, and Origins.

Makeup sales were up 6% year over year, or 13% in constant currency, to $1.6 billion, beating the consensus of $1.2 billion. Results were primarily driven by an increase in sales of lipsticks and foundation and from strong, double-digit growth from Smashbox and Tom Ford.

Fragrance sales increased by 7%, or 12% in constant currency, to $470.6 million, beating the consensus of $462.7 million. Sales were primarily driven by strong, double-digit gains from luxury brands Jo Malone London and Tom Ford.

Hair care sales were up 9%, or 14% in constant currency, to $149.0 million, beating the consensus of $141.5 million. The category benefited from expanded global distribution, primarily in salons, freestanding stores and travel retail for Aveda, and from specialty multibrand retailers for Bumble and bumble.

Sales in the Americas increased by 2.1%, while sales in Europe, the Middle East and Africa grew by 4.7%. Sales in the Asia-Pacific region fell 0.3%.

For the third quarter, Estée Lauder expects revenue to increase by 2%–3%, but sees the stronger dollar hurting sales by about 4%. The company expects adjusted EPS of $0.53–$0.58, below analysts’ estimates of $0.76.

For fiscal 2016, the company expects constant currency net sales growth of 7% to 8% and double-digit earnings per share growth. The company lowered its forecast of diluted EPS to $3.07–$3.12 from $3.10–$3.17 previously. The guidance is below the consensus estimate of $3.18.