Company financial year ends in June

Source: Company reports/Fung Global Retail & Technology

Company financial year ends in June

Source: Company reports/Fung Global Retail & Technology

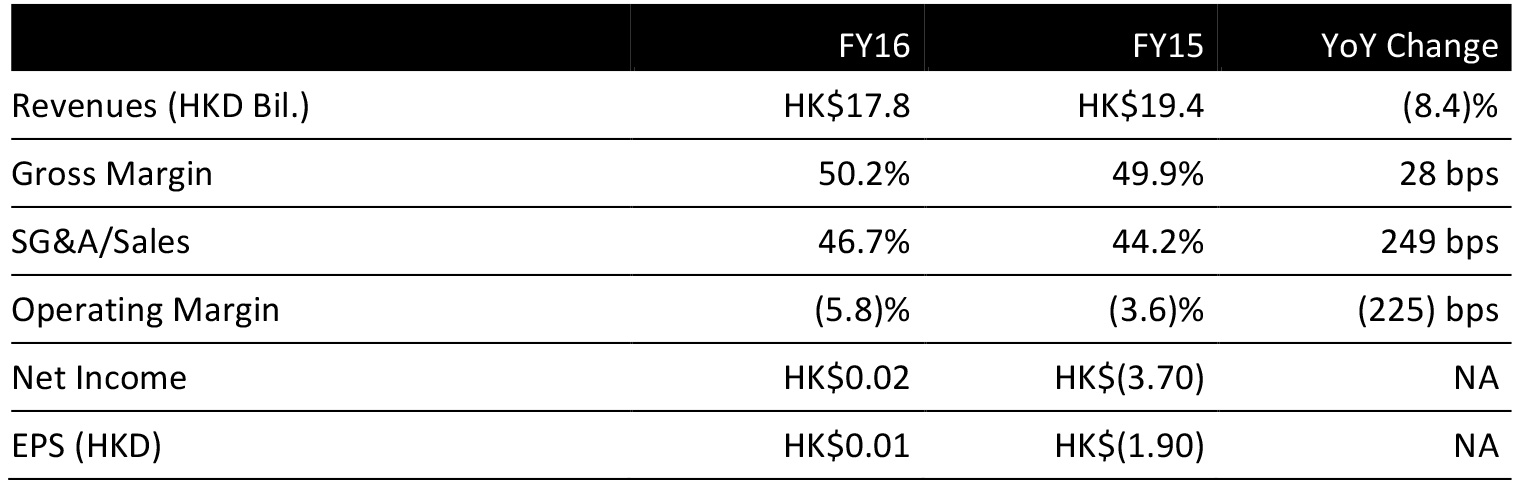

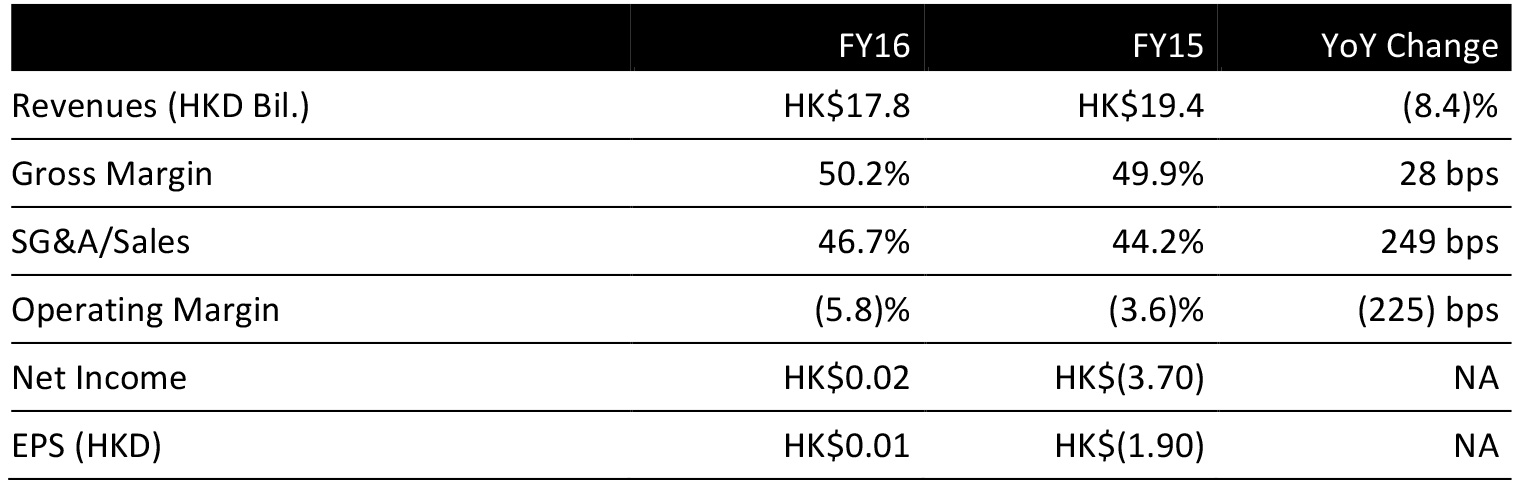

FY16 RESULTS

Esprit announced a net profit of HK$21 million for FY16, a turnaround from the net loss of HK$3.7 billion the previous year. FY16 revenues declined by 1% in local currency (down 8% in HKD), stabilizing after four consecutive years of decline. The stabilizing revenue trend, against a 13% reduction in retail space, was driven primarily by sales productivity gains and strong sales growth in e-shops.

Gross margin for FY16 was 50.2%, up from 49.9% in FY15, due to a higher proportion of retail revenue partially offset by a weak euro. Operating expenses (excluding exceptional items) declined by 2% year over year in local currency, due to a reduction in overheads. SG&A costs, representing 46.7% of revenues, was up from 44.2% a year ago, due to high marketing costs incurred for the new brand campaigns and omni-channel initiatives.

SEGMENT OPERATIONS

The group provides revenue breakdown by region, product and distribution channel.

- Revenue by geography: Germany, the largest region, which comprises 48% of revenue, recorded 2% sales growth in local currency on a 10% reduction in retail space. Revenue for the Rest of Europe was flat against a 14% reduction in retail space. The Asia Pacific region underperformed, with revenue dropping 13% year over year.

- Revenue by product: From a product perspective, the divisions where the vertical model was implemented (the Esprit Women brand and edc) outperformed Esprit Men and Lifestyle. In local currency, Esprit Women recorded 2% year-over-year sales growth and that for the edc brand fell modestly by 1%.

- Revenue by distribution channel: Retail sales, which comprises 44% of revenue, declined modestly by 1% against an 11% reduction in retail space. The e-shop segment was the bright spot, as sales increased 15% in local currency. The wholesale segment underperformed, with sales down by 10% in local currency, while retail space declined by 15%.

GUIDANCE

Esprit’s long-term strategic growth plan is to leverage the benefits of the new vertical and omni-channel models to drive sustainable top-line growth and a healthy cost base to increase profitability. Management will seek to sustain future sales productivity increases, enhance profitability of the business via cost reductions and find solutions for the Wholesale channel and Asia Pacific region, two business areas where performance is declining.

In its letter to shareholders, management stated its immediate priorities for FY16/17 as:

- Reduce retail space by high a single-digit percentage, due to the decision to speed up the closure of loss-making retail space

- Raise sales productivity by enhancing the execution of vertical and omni-channel models

- Ensure gross profit margin remains stable or achieve a modest increase

- Significantly reduce operating expenses via store closures, ongoing cost restructuring measures and lower marketing and advertising expenses

Company financial year ends in June

Source: Company reports/Fung Global Retail & Technology

Company financial year ends in June

Source: Company reports/Fung Global Retail & Technology