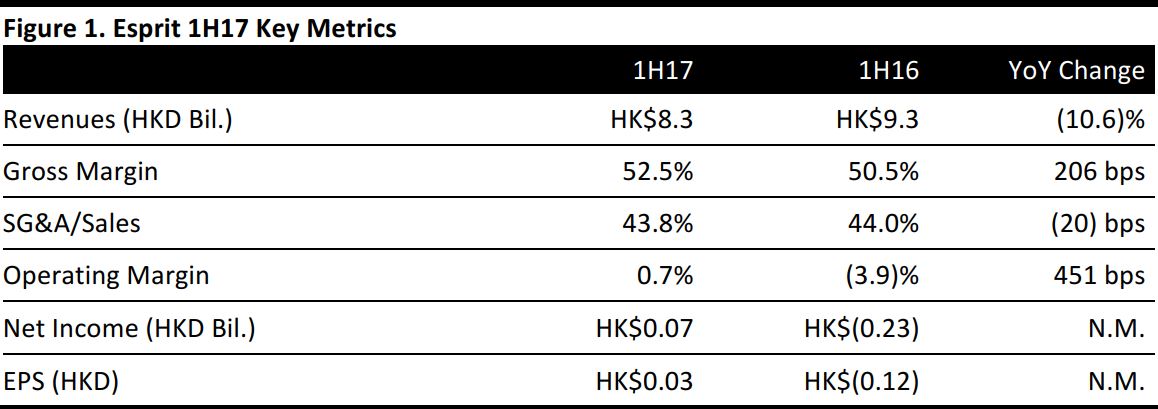

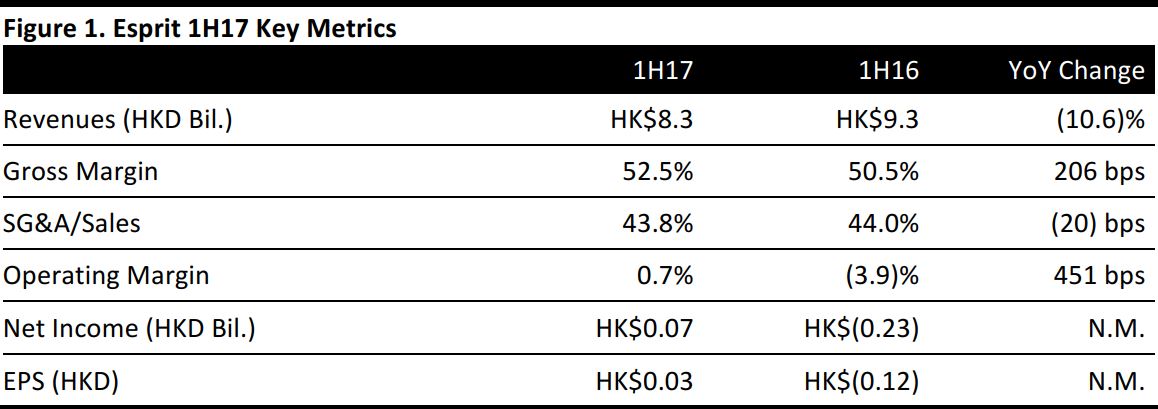

Company financial year ends in June

Source: Company reports/Fung Global Retail & Technology

1H17 Results

Esprit posted a net profit of HK$66 million for 1H17, a turnaround from the net loss of HK$232 million reported in the same period last year. 1H17 revenues declined 10.6% to HK$8.3 billion from HK$9.3 billion in 1H16, attributed to the closure of unprofitable retail stores, mostly in China, as well as the unusually warm weather in Europe last winter.

Gross margin for 1H17 was 52.5%, up from 50.5% in 1H16, despite the negative impact of euro exchange rates. The improvement in gross margin was due to a reduction in promotional activities, price markdowns and wholesale discounts. Operating expenses (excluding exceptional items) declined by 11.2% year over year in local currency, due to the accelerated closure of unprofitable stores and the reduction in overheads and marketing expenses.

Performance by Segment

- Product: All product divisions recorded a decline in revenue. Esprit Women, the largest division, which comprises 47.4% of revenue, recorded a 5.6% decrease in sales in local currency; mainly due to space reductions.

- Distribution channel: Retail sales (excluding eshop), which accounts for 43.4% of revenue, declined by 13.1% in local currency against an 11.1% reduction in retail space. Eshop sales dropped 2.4% in local currency, attributed mainly by a drop in Europe online traffic. APAC Eshop outperformed, up 58.7% year over year. The wholesale segment saw an increase in average sales productivity, with sales declining 10.5% in local currency against a 16.8% reduction in space.

- Geography: Revenue declined across all regions. Germany, which comprises 49.7% of revenue, recorded a 6.3% fall in sales in local currency on an 8.7% reduction in retail space. Rest of Europe sales dropped by 10.8% in local currency against a 15.9% reduction in space. The Asia Pacific region saw the steepest decline in sales and retail space, down 18.8% in local currency and 24.9%, respectively, attributed to the drastic reduction in promotion activities.

Outlook

Esprit expects 2H17 to be similar to 1H17. Management will continue to execute its long-term strategic plan to restore the competitiveness of the company, with its primary focus on improving the bottom line.

In the near term, the company expects revenues to decline, as it continues to reduce unprofitable retail stores. However, this is expected to be countered by improvements in sales productivity and margins and a reduction in operating expenses.