Source: Company reports

1H16 RESULTS

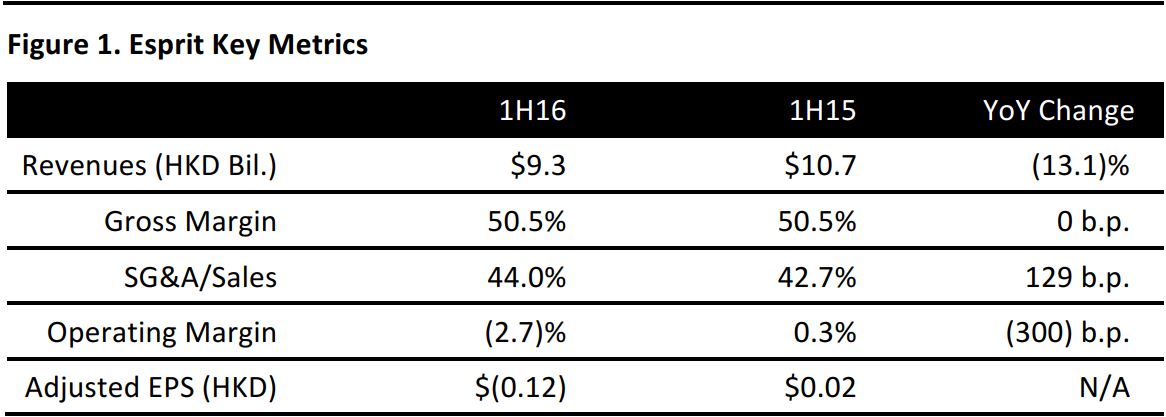

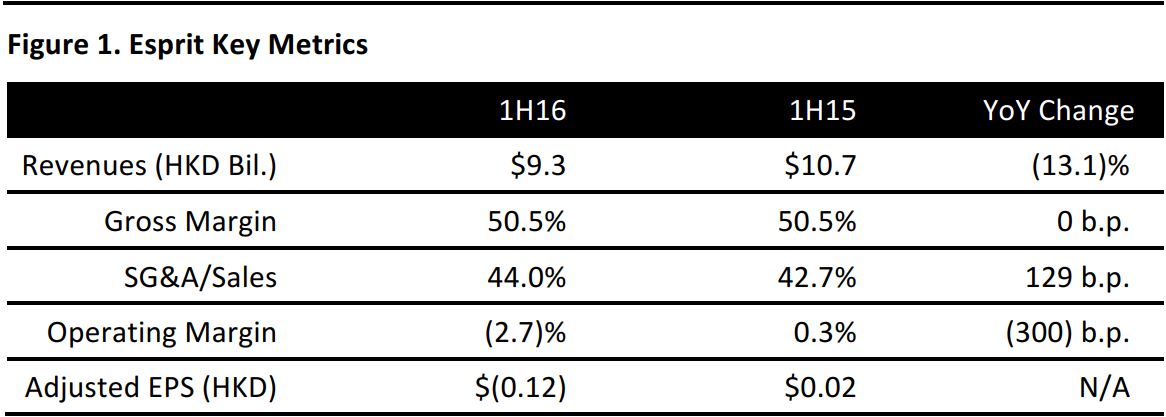

Esprit’s 1H16 revenues declined by 0.4% year over year in local currency terms, representing a substantial improvement over the four prior half-year periods. Revenue growth was driven by a 6.0% retail sales increase (in local currency) despite a 4.9% reduction in net sales area, and it was helped by positive, 8.0% comps (also in local currency). Wholesale sales, though, remain challenging.

In local currency terms, retail sales in Europe increased by 8.6%, driven by 8.3% comps. The company’s brick-and-mortar stores in Germany outperformed the market by 10.2 percentage points every month from July through December 2015. The Asia-Pacific region remains challenging, however.

On a product basis, growth was driven by the women’s divisions (including the Esprit and edc brands), which recorded 9.7% year-over-year sales growth and 11.9% comps (both in local currency terms).

Esprit is focusing on its omni-channel initiatives, and saw 23% year-over-year growth in the number of active Esprit Friends members, an 11% increase in Esprit Friends members making omni-channel (i.e., both online and offline) purchases, a 49% increase in E-Shop traffic and a 92% increase in smartphone sales.

The company was able to hold the line on gross margins, which were flat. However, operating expenses increased by 5.1% year over year in local currency due to increased brand-marketing efforts, an inventory provision of HK$18 million and a one-off reversal of an HK$257 million write-off last year.

Management characterized the HK$238 million net loss as in line with the market’s expectation.

GUIDANCE

Management reiterated that it is vigilant about controlling costs and about its debt-free status. The company had a healthy net cash balance of HK$4.2 billion as of December 31, 2015.

Esprit reiterated the guidance from its FY14/15 annual results presentation. It expects:

- A slight decline in retail space and a continued decline in wholesale space, offset by improving product performance, improved channel operations and intensified marketing efforts.

- A stable or slight increase in gross margins due to reduced levels of markdowns.

- A reduction of most of the recurring operating expense lines, offset by higher marketing and omni-channel expenses.

- Higher capex due to omni-channel initiatives, an acceleration of store refurbishment and upgrades of warehouses to improve replenishment capabilities.

Management also commented that it expects structural changes to begin to reduce operating expenses in the second half of FY16, with the full impact to take effect over the next two to three years.

The current FY16 consensus revenue estimate is HK$18.2 billion, which is 6.1% lower than the FY15 revenue figure of HK$19.4 billion. The current FY16 EPS consensus estimate is for a loss of HK$0.16 per share, compared to a loss of HK$1.90 per share in FY15.