DIpil Das

Introduction: The Booming Esports Industry

Esports is competitive video gaming, where professional gamers play in organized leagues or tournaments, often for prize money. Esports has become a global phenomeon, with the total number of viewers set to reach 645 million in 2022—representing a 63% growth from 395 million in 2018—according to market intelligence firm Newzoo, a provider of esports analytics. The coronavirus outbreak has had a positive impact on viewership of esports, as more people are staying at home rather than going out. The number of hours esports viewers spent on Twitch saw a 10% year-over-year increase in February 2020, according to esports streaming service provider StreamElements. In addition, more participants are playing esports during the coronavirus period. In our occasional series of reports on esports through 2020, we will discuss how brands and retailers can leverage the rising popularity of competitive video gaming to sell and market their products. In this report, we provide an overview of global esports viewership and identify the top esports games in the industry. We explore how brands and retailers can work with an esports game to extend their reach to targeted audiences.Overview: Esports Viewership

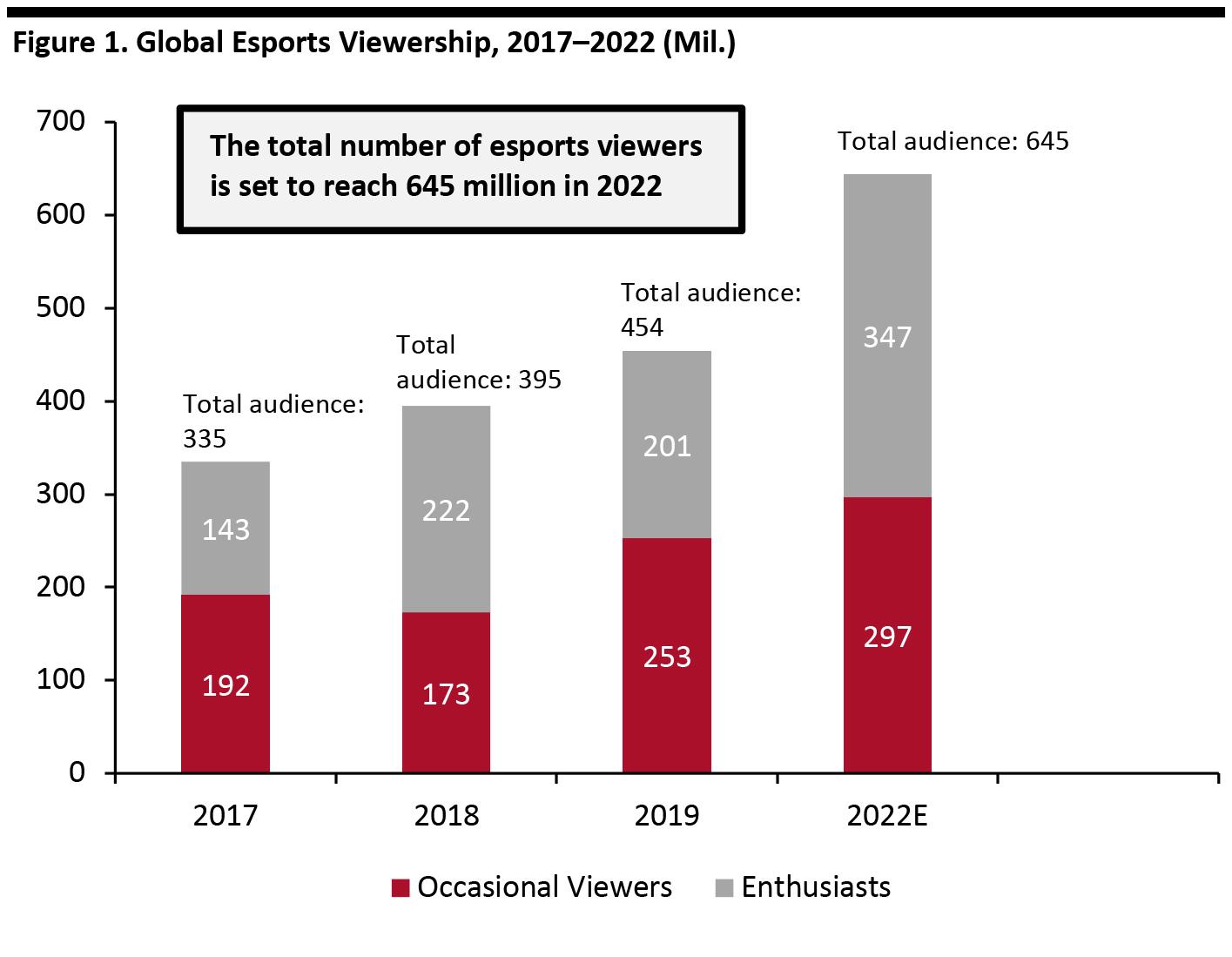

There are typically two types of esports viewers: Esports enthusiasts, who watch gaming content more than once a month and have a more significant role in the growth of total viewership; and occasional viewers, who watch esports content less frequently but comprise a greater proportion of the total audience. The number of esports enthusiasts will rise by 73% between 2019 and 2022, according to Newzoo—from 201 million to 347 million. Occasional viewership will also see growth over the same period but at a slower rate of 17%, from 253 million in 2019 to 297 million in 2022. [caption id="attachment_106064" align="aligncenter" width="700"] Totals may not sum due to rounding

Totals may not sum due to rounding Source: Newzoo [/caption] In terms of the popularity of esports in different countries, China has the greatest proportion of esports viewers as a percentage of its total Internet users. Around 26% of China’s Internet users fall into our definition of “enthusiast,” watching esports content at least once per month, according to survey conducted in the third quarter of 2019 by research firm Ampere Analysis; this amounts to around 222 million viewers, based on the number of Internet users in China reaching 854 million as of June 2019. Next in the ranking of proportional viewership are Denmark and Sweden, where 9% (489,000) and 8% (773,000) of Internet users watch esports, respectively. However, in terms of total numbers, the US directly follows China, as it has around 19 million esports viewers (approximately 6% of US Internet users). The gender difference in esports audiences worldwide is stark: Global viewership comprises 65% men and 35% women, as of the third quarter of 2019, according to Ampere Analysis. Among female esports viewers, 40% are over 35 years old. However, Ampere Analysis found that the key demographic for esports is made up of men aged between 18 and 34 years old who are usually skilled in using technology. Esports Participation Amidst the Coronavirus Disruption The coronavirus outbreak has had a positive impact on participation in esports, as more people are staying at home rather than going out. The number of hours esports viewers spent on Twitch saw a 10% year-over-year increase in February 2020, according to esports streaming service provider StreamElements. In addition, more participants are playing esports during the coronavirus period. Daily active users of Tencent’s Honor of Kings game have increased by 7% to 2 million on Chinese iOS devices since late January 2020, according to data firm Apptopia. Counter Strike: Global Offensive broke its all-time peak number of players on March 15, 2020, with 1,023,229 concurrent players in the US, according to esports data website Steam Charts. This is 106,233 higher than the previous peak in February. In Europe, first-time Twitch app downloads increased significantly during the second week of March. Downloads saw week-over-week growth of 50%, 41%, and 26% in Greece, Italy and Spain, respectively.

Esports Games with the Highest Viewership

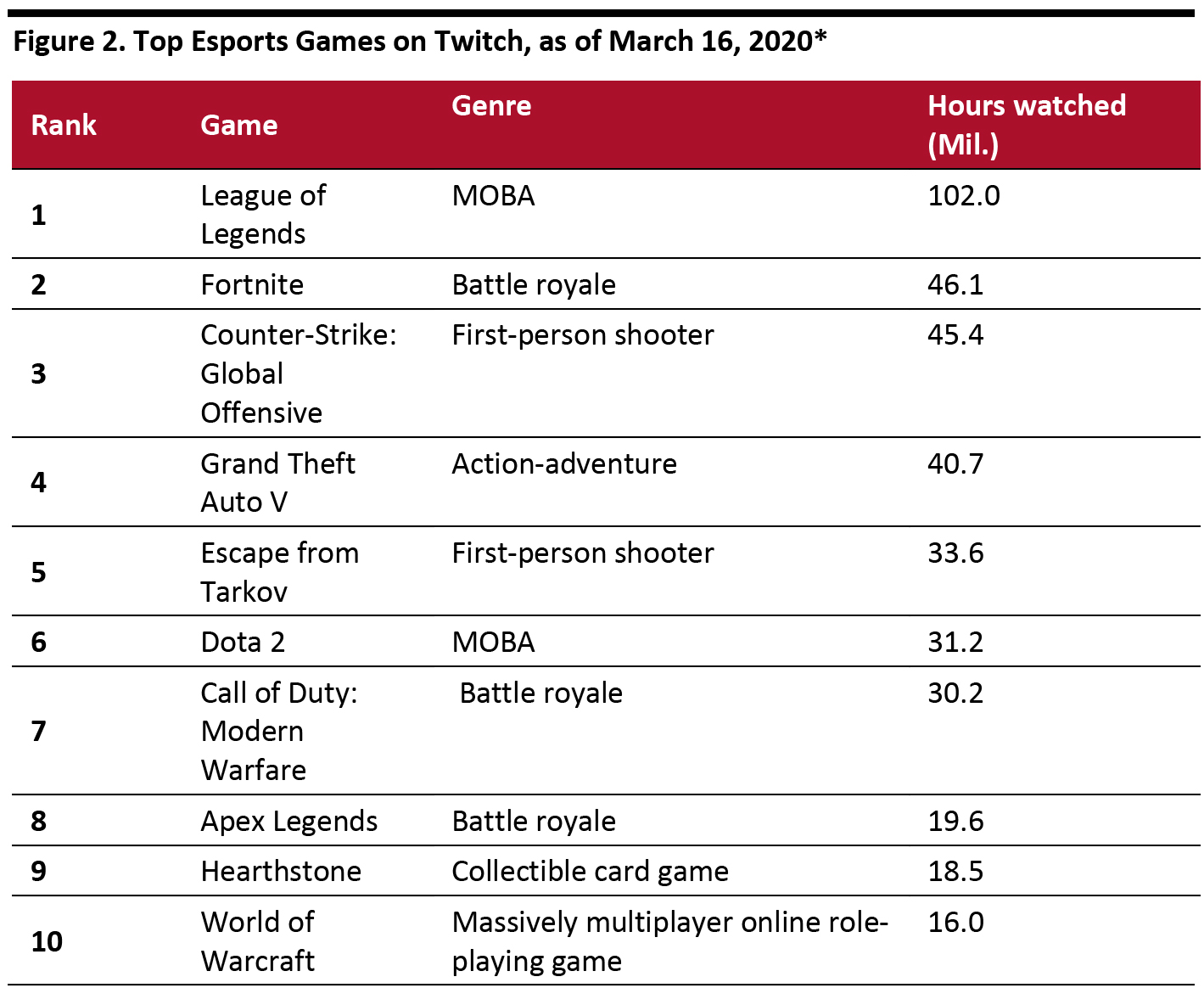

There are only a few games that dominate the top tier of esports in terms of viewership. League of Legends is the world’s most watched esport on Amazon’s livestreaming site, Twitch—the game clocked 102.0 million hours watched in the last 30 days as of March 16, 2020, according to the site’s analytics platform Twitchmetrics (see Figure 3). Twitch is one of the main online streaming channels on which esports gaming is distributed, alongside YouTube. The platform was introduced in 2011 and acquired by Amazon in 2014. Since then, the livestreaming video service has been used to host major esports tournaments. Twitch enables individual gamers to livestream while playing at home, and the platform is also used to broadcast music and creative content. In terms of esports game genres, League of Legends is a “multiplayer online battle arena” (MOBA) game. This type of video game involves two teams of players competing against each other to achieve a predefined primary objective, with each player controlling a virtual character. In League of Legends, a team wins the battle by destroying the opposition’s main structure, called a “Nexus.” Another popular genre is “battle royale,” where games center around player survival, with elements such as exploration, scavenging and fighting against opponents; the end goal for the player is to be the sole survivor. Other popular game genres include action-adventure (such as Grand Theft Auto V), collectible card game (Hearthstone), real-time strategy (StarCraft) and first-person shooter (Call of Duty: Modern Warfare). [caption id="attachment_106065" align="aligncenter" width="700"] *Based on viewership over the last 30 days

*Based on viewership over the last 30 days Source: Twitchmetrics [/caption]

How Brands Can Work with Top Games To Target the Right Audiences

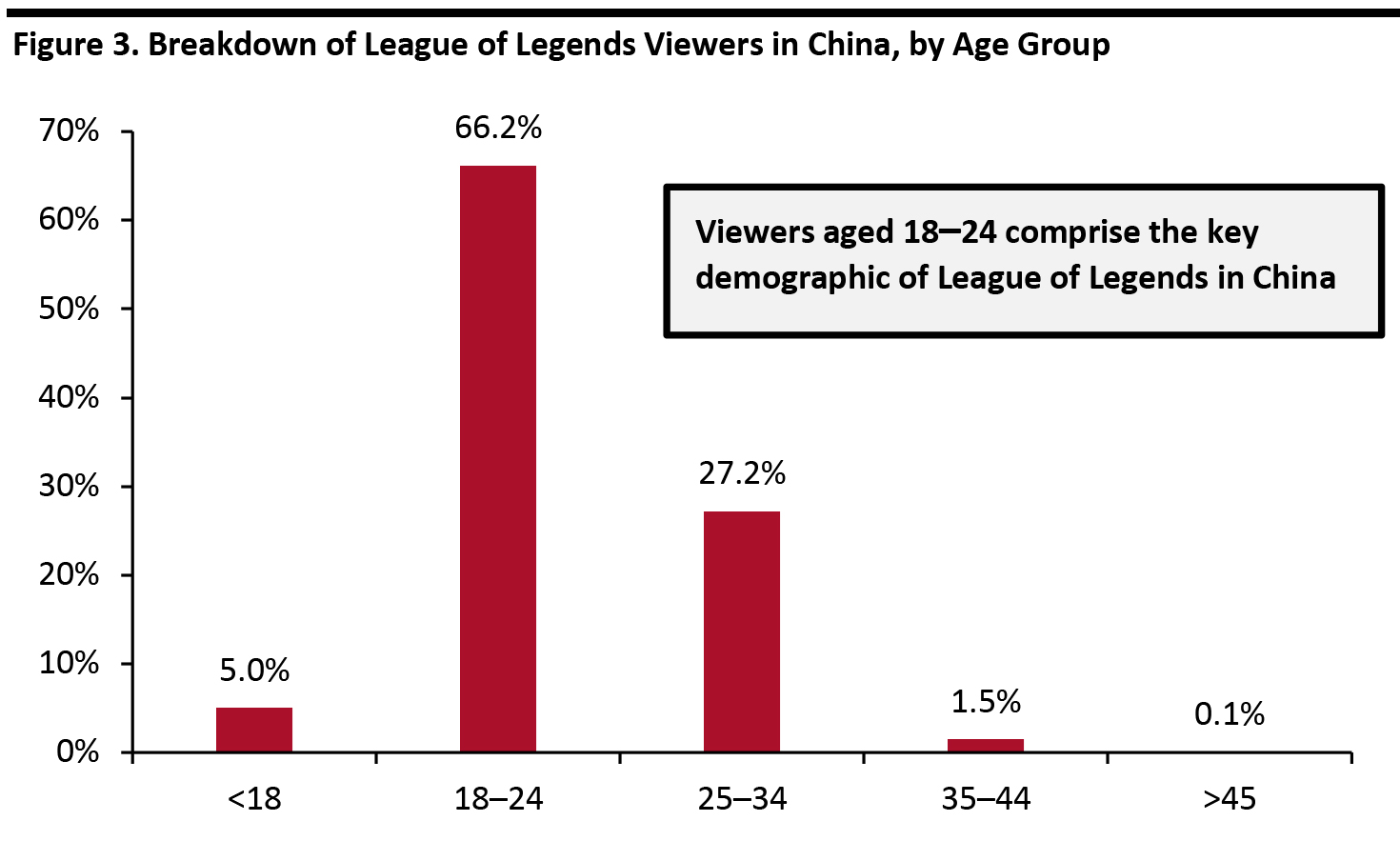

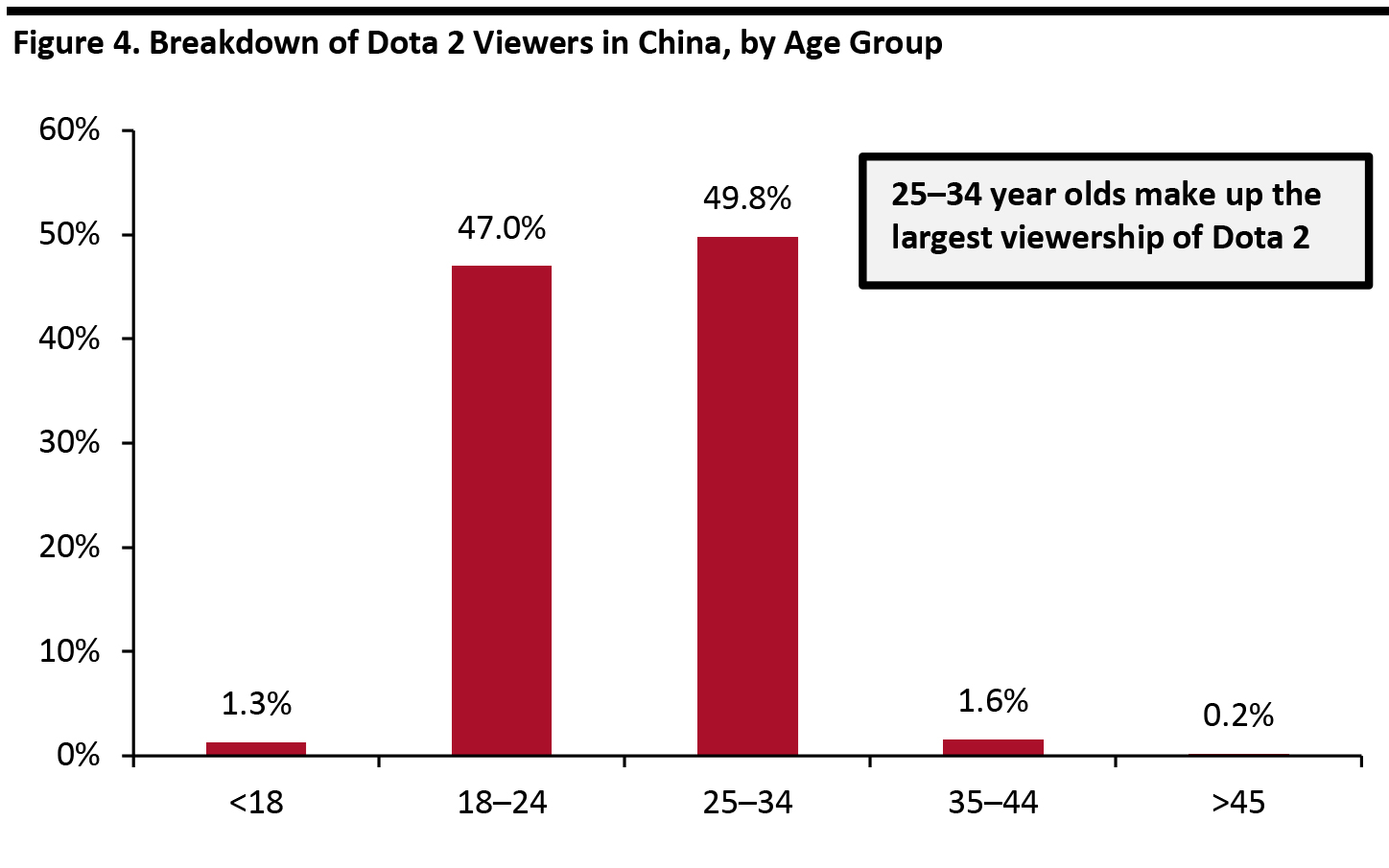

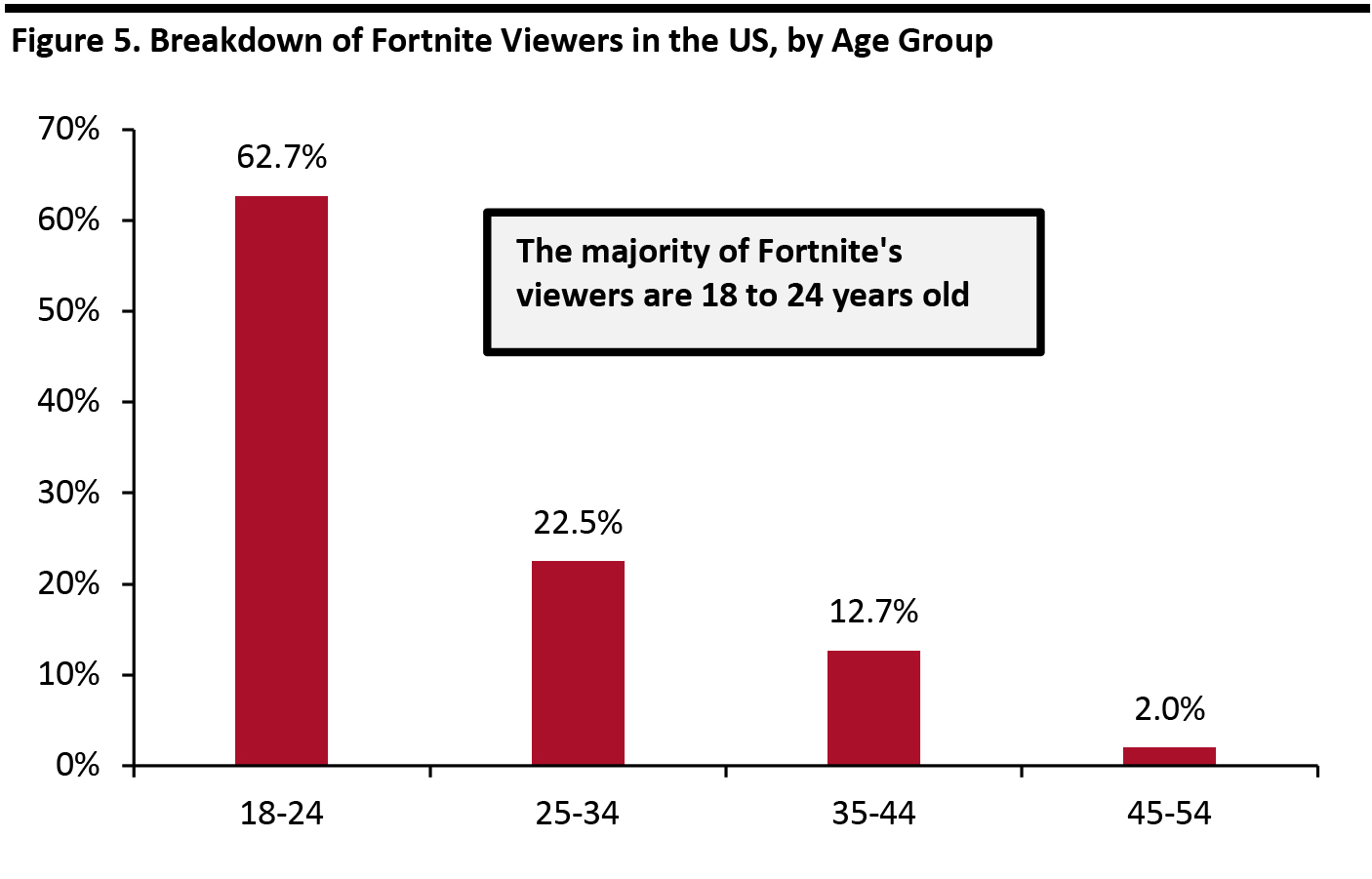

Esports viewers typically become a fan of one specific game: Around 71% of viewers watch only one game, according to Newzoo. Brands therefore need to select a game to partner with that shares their intended demographic. For example, a large proportion of the viewers that watch League of Legends and Fortnite are aged 18–24 (around 66.2% and 62.7% of each game’s total viewership, respectively), according to data firm MobTech and research firm Verto. By comparison, viewers aged 25–34 comprise the largest demographic for Dota 2, totaling 49.8%. It is worth noting that, for the purposes of our discussion, viewers under 18 years old do not comprise a large audience for these games. This is because the source data for Fortnite only looked at adult viewing figures, and League of Legends and Dota 2 is focused on viewers in China: The Chinese government has imposed limits on how much time minors spend on esports. In terms of participation, for example, China’s National Press and Publication Administration implemented regulations that ban gamers who are under 18 years old from playing video games between 10:00 p.m. and 8:00 a.m. Furthermore, they are limited to playing for 90 minutes on weekdays and three hours on weekends and holidays. We further explore the viewership profiles of these three top games and present examples of the partnerships that League of Legends, Fortnite and Dota 2 have formed with retail brands. League of Legends Chinese Viewers Among viewers of League of Legends in China, men account for 94.7%, as of September 2019, according to MobTech. Viewers aged 18–24 comprise the largest proportion of total viewership (66.2%), followed by those aged 25–34 (27.2%). [caption id="attachment_106066" align="aligncenter" width="700"] Source: MobTech[/caption]

Brands that Work with League of Legends

Luxury brand Louis Vuitton partnered with League of Legends to release co-branded apparel designs in September 2019, targeted at the game’s young audience. Luxury spending by China’s post-80s consumers (those born after 1980) and post-90s consumers (those born after 1990) account for 56% and 23% of the total spending by Chinese consumers, according to McKinsey’s 2019 luxury report.

The Louis Vuitton x League of Legends capsule collection includes handbags, leather jackets, T-shirts and sneakers, and it incorporates design features that are exclusive to the collaboration, such the “Monogram Canvas” camouflage print.

[caption id="attachment_106067" align="aligncenter" width="556"]

Source: MobTech[/caption]

Brands that Work with League of Legends

Luxury brand Louis Vuitton partnered with League of Legends to release co-branded apparel designs in September 2019, targeted at the game’s young audience. Luxury spending by China’s post-80s consumers (those born after 1980) and post-90s consumers (those born after 1990) account for 56% and 23% of the total spending by Chinese consumers, according to McKinsey’s 2019 luxury report.

The Louis Vuitton x League of Legends capsule collection includes handbags, leather jackets, T-shirts and sneakers, and it incorporates design features that are exclusive to the collaboration, such the “Monogram Canvas” camouflage print.

[caption id="attachment_106067" align="aligncenter" width="556"] Louis Vuitton x League of Legends collection

Louis Vuitton x League of Legends collection Source: Louis Vuitton [/caption] Louis Vuitton also designed a virtual look for League of Legends character Qiyana, upgrading her outfit with signature Louis Vuitton accessories, including the Dauphine bag and Star Trail boots. Qiyana’s ring blade was updated with the designer’s classic Monogram as well as V-shaped ornaments. [caption id="attachment_106068" align="aligncenter" width="700"]

League of Legends character Qiyana with Louis Vuitton-designed look

League of Legends character Qiyana with Louis Vuitton-designed look Source: Louis Vuitton [/caption] South Korean car manufacturer Kia partnered with League of Legends’ game publisher Riot Games and the League of Legends European Championship (LEC) in 2019, in an effort to extend its reach to potential customers. According to Newzoo, viewers who watch League of Legends tend to have “cars and motorbikes” as their interest/hobby. The partnership continued in 2020, with Kia launching a music video for the season opening of LEC on January 14. Entitled “I Want the LEC Back!,” the music video features an original track performed by LECtronic—a band of six LEC professional players who role play as band members—as well as the fully electric Kia Niro EV car model. Within six days of its official release on January 14, 2020, the video received around 220,000 organic views and more than 19,000 interactions on League of Legends’ official YouTube channel. [caption id="attachment_106069" align="aligncenter" width="700"]

Kia launched a music video for the LEC season opening

Kia launched a music video for the LEC season opening Source: Kia [/caption] Dota 2 Chinese Viewers For Dota 2, the proportion of male viewers in China is even larger than League of Legends, totaling 97% according to MobTech. Dota 2 also has a slightly older demographic, with viewers aged 25–34 comprising the largest group among the total viewers in China (49.8%), followed by 18–24 year olds. [caption id="attachment_106070" align="aligncenter" width="700"]

Figures may not total 100% due to rounding

Figures may not total 100% due to rounding Source: MobTech [/caption] Brands that Work with Dota 2 To reach young consumers in China, Italian sportswear brand Kappa became an official apparel sponsor for Chinese esports organization Royal Never Give Up (RNG)’s Dota 2 team in January 2020. Under the partnership, Kappa will provide custom team jerseys for RNG players during Dota 2 competitions. Kappa has also become the title sponsor of RNG’s Dota 2 team, which is now named “Kapp. RNG Dota 2.” [caption id="attachment_106071" align="aligncenter" width="700"]

Kappa x RNG Dota 2 parnership

Kappa x RNG Dota 2 parnership Source: Kappa [/caption] Chinese sportswear brand Li Ning partnered with a Dota 2 team within Chinese esports organization Newbee in February 2019. The team wear Li Ning-branded apparel during Dota 2 competitions. Li Ning also launched its first co-branded shoe with the esports organization in February 2019, featuring Newbee’s name in the design. [caption id="attachment_106072" align="aligncenter" width="500"]

Li Ning x Newbee Dota 2 co-branded shoe

Li Ning x Newbee Dota 2 co-branded shoe Source: Newbee [/caption] Fortnite US Viewers Among viewers of Fortnite in the US, men account for 72%, according to Verto. Viewers aged 18–24 comprise the majority of total viewership (62.7%), as shown in Figure 5. [caption id="attachment_106073" align="aligncenter" width="700"]

Figures may not total 100% due to rounding

Figures may not total 100% due to rounding Source: Verto [/caption] Brands that Work with Fortnite Sportswear brand Nike started to collaborate with Fortnite in May 2019, to promote its Jordan line of basketball sneakers to young viewers of the game. The partnership started with a new “limited-time mode” (LTM) game scenario within Fortnite, called Downtown Drop. It featured Michael Jordan’s Jumpman brand, and the plot saw players use skateboards to virtually roam around a downtown area to complete challenges to earn beautification items. [caption id="attachment_106074" align="aligncenter" width="700"]

Nike partnered with Fortnite to promote the Jordan Jumpman brand

Nike partnered with Fortnite to promote the Jordan Jumpman brand Source: Fortnite [/caption] Marvel Studios partnered with Fortnite to produce a crossover LTM with superhero film Avengers: Endgame in April 2019. Each player could play as a superhero or villain and hunt for prizes such as Thor’s axe. [caption id="attachment_106075" align="aligncenter" width="700"]

Avengers: Endgame characters in the Fortnite game

Avengers: Endgame characters in the Fortnite game Source: Fortnite [/caption]