albert Chan

Introduction

Wearable technology has shown promising growth, with applications in healthcare, fitness, retail and education using devices such as smartwatches, smart glasses, activity trackers, wearable cameras and audio, among others. Enterprise wearables are devices that are used in businesses to perform work-related activities. In this report, we discuss the enterprise wearables market, by size and notable players. We also look at case studies of retail and healthcare enterprises using wearable devices.Market Overview

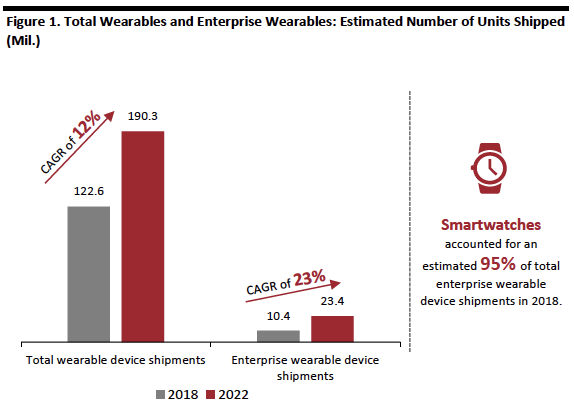

Total wearable device shipments were estimated at 122.6 million units in 2018 and are expected to reach 190.3 million units by 2022, growing at a CAGR of 12%, according to IDC. And, advancements in technology have made wearable devices potentially valuable tools for business. Coresight Research estimates the number of enterprise wearable device shipments was approximately 10.4 million units in 2018, and we expect it to grow at a CAGR of 23% until 2022 to reach approximately 23.4 million in total shipments. [caption id="attachment_86804" align="aligncenter" width="574"] Note: Coresight Research estimates the total shipments of enterprise wearables based on overall shipments of wearable devices. We have applied market penetration percentages for enterprise device shipments on total shipments of smartwatches, wristbands, smart clothing, earwear and smart glasses.

Note: Coresight Research estimates the total shipments of enterprise wearables based on overall shipments of wearable devices. We have applied market penetration percentages for enterprise device shipments on total shipments of smartwatches, wristbands, smart clothing, earwear and smart glasses.Source: IDC/Coresight Research[/caption] We estimate shipments of smartwatches accounted for around 95% of total enterprise wearable device shipments in 2018; however, we expect this share to fall to approximately 89% in 2022 as devices such as smart clothing and smart glasses gain share. Growth will be supported by advancements in technology and increased mobile penetration. Bring Your Own Device (BYOD) that allows employees to bring their own personal devices has gained traction and in return, there has been an increase in the services, applications and data stored on the devices, including more data exchanged between devices. The coming 5G technology is also expected to boost the market as the expansion of the Internet of Things (IoT) which will support increased communication between mobile devices and business infrastructure. As discussed in our April 2019 report on 5G and retail, the number of devices connected to IoT systems is expected to rise as in-store technology improves – further boosting wearables’ potential as response times (latency) fall.

Competitor Landscape

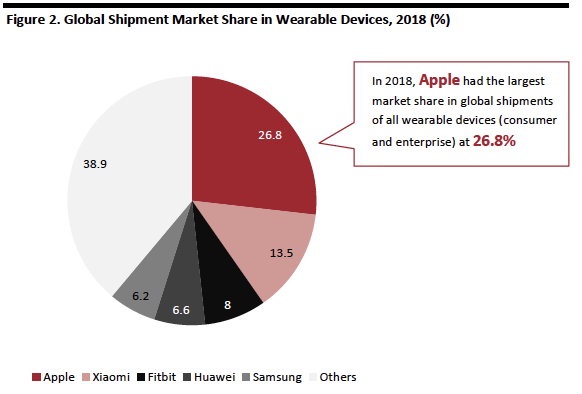

We focus on the three largest companies that cater to enterprises based on share of global shipments according to IDC data. In 2018, Apple had the largest market share in global shipments of all wearable devices (consumer and enterprise) at 26.8%, followed by Xiaomi at 13.5%, Fitbit with 8%, Huawei with 6.6% and Samsung with 6.2%. Although Xiaomi and Huawei have a higher share of global shipments than Samsung, the two companies’ enterprise penetration is negligible as they focus on consumers. For this reason, we discuss Samsung, which has a substantial offering in enterprise wearables, but not Xiaomi or Huawei. [caption id="attachment_86805" align="aligncenter" width="582"] Source: IDC[/caption]

Source: IDC[/caption]

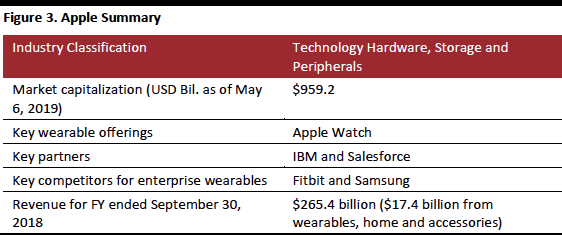

Source: S&P Capital IQ/company reports[/caption]

Apple Wearables: Enterprise Usage and Functionality

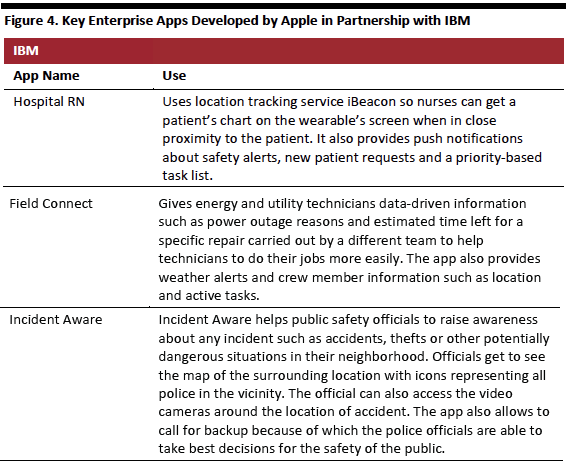

Apple Watch is the only wearable Apple offers that has applications for the enterprise sector (AirPods do not have an established enterprise use). These are some of the key enterprise apps for the Apple watch:

Source: S&P Capital IQ/company reports[/caption]

Apple Wearables: Enterprise Usage and Functionality

Apple Watch is the only wearable Apple offers that has applications for the enterprise sector (AirPods do not have an established enterprise use). These are some of the key enterprise apps for the Apple watch:

- Good Technology: In 2015, enterprise mobile device management company Good Technology launched an app for the Apple watch that allows users to receive Outlook emails and calendar invites. It is customizable, so the user can set what information from an email is displayed.

- Microsoft: In April 2015 Microsoft announced the launch of OneNote, PowerPoint and OneDrive apps for Apple Watch. OneNote is a free-form information gathering tool that lets people share notes, drawings, screen clippings and audio clips.

- Trello: Collaboration and planning app Trello is also available on Apple Watch. Users can add or remove “cards” that are used to track progress of a specific project and view recent notifications.

- Slack: Team communication app Slack is also available for Apple Watch. Slack is a team collaboration tool that lets users write, post, receive and reply to messages. The user can also switch between chats while on a call and see how many people are online on a group chat.

Source: S&P Capital IQ/company reports[/caption]

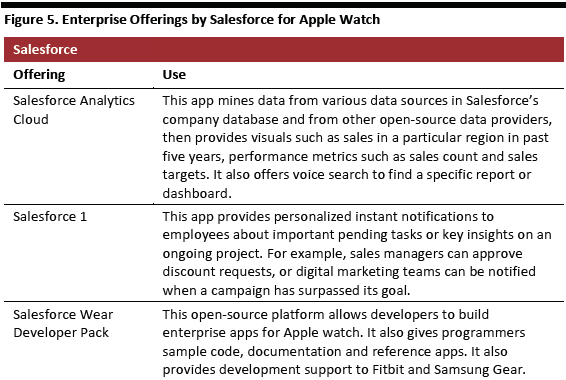

Cloud computing and software development company Salesforce has developed around 20 apps for Apple Watch since 2015. We discuss key Salesforce offerings below:

[caption id="attachment_86809" align="aligncenter" width="566"]

Source: S&P Capital IQ/company reports[/caption]

Cloud computing and software development company Salesforce has developed around 20 apps for Apple Watch since 2015. We discuss key Salesforce offerings below:

[caption id="attachment_86809" align="aligncenter" width="566"] Source: S&P Capital IQ/company reports[/caption]

Company Outlook

Currently, Apple Watch’s enterprise market penetration is believed to be low, but Apple follows a more diverse approach in targeting businesses than its competitors: It caters to companies in banking, retail, IT and healthcare. We expect that with increased use of Apple hardware in enterprises and increased ability to connect Apple watches to other Apple devices, Apple watch may make inroads in enterprise in the coming years.

Source: S&P Capital IQ/company reports[/caption]

Company Outlook

Currently, Apple Watch’s enterprise market penetration is believed to be low, but Apple follows a more diverse approach in targeting businesses than its competitors: It caters to companies in banking, retail, IT and healthcare. We expect that with increased use of Apple hardware in enterprises and increased ability to connect Apple watches to other Apple devices, Apple watch may make inroads in enterprise in the coming years.

Source: S&P Capital IQ/company reports[/caption]

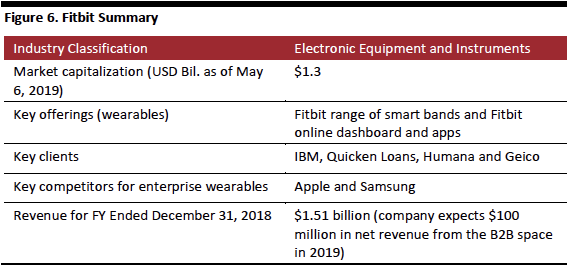

Fitbit Wearables: Enterprise Usage and Functionality

Fitbit’s B2B sales grew 8% year over year, the company reported in its 2018 results, and said it expects B2B sales to reach $100 million in 2019 with growth climbing into the double digits, driven by global growth and revenue from solutions-based software. These are some key Fitbit offerings for enterprises.

Source: S&P Capital IQ/company reports[/caption]

Fitbit Wearables: Enterprise Usage and Functionality

Fitbit’s B2B sales grew 8% year over year, the company reported in its 2018 results, and said it expects B2B sales to reach $100 million in 2019 with growth climbing into the double digits, driven by global growth and revenue from solutions-based software. These are some key Fitbit offerings for enterprises.

- Fitbit Care: In September 2018, Fitbit launched Fitbit Care, a connected health platform for enterprises, health plans and health systems that offers a mix of health coaching and virtual care through the Fitbit Plus app. The health coaching feature assigns a coach to corporate teams, who prepares customized plans. The coaches can use the app to communicate with clients to support them in achieving goals. Fitbit Care is sold to corporates and healthcare service providers through Fitbit’s health solutions platform. It is accessible only by invitation from an employer or healthcare provider.

- Fitbit Plus: Fitbit Plus is an application user on the Fitbit Care platform can use. It allows individuals to track advanced health metrics such as blood pressure and medication adherence. Users can track data from their Fitbit device to see trends over time. Fitbit acquired cloud-based health management firm Twine Health in February 2018 to bolster Fitbit’s offering for patients suffering from diabetes and hypertension. Twine Health was later incorporated into Fitbit Plus.

Source: S&P Capital IQ/company reports[/caption]

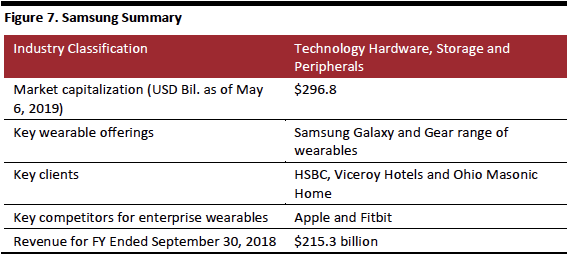

Samsung Wearables: Enterprise Usage and Functionality

Samsung offers enterprise solutions in industries including retail, finance, hospitality, transportation, public safety, government and education. In the US, Samsung wearables offered include Gear and the Galaxy Watch, priced between $199.99 and $379.99. Samsung offers app customization and its own open-source operating system, Tizen, that makes it easy for developers to customize features. Below are Samsung’s key wearable offerings for enterprises:

Source: S&P Capital IQ/company reports[/caption]

Samsung Wearables: Enterprise Usage and Functionality

Samsung offers enterprise solutions in industries including retail, finance, hospitality, transportation, public safety, government and education. In the US, Samsung wearables offered include Gear and the Galaxy Watch, priced between $199.99 and $379.99. Samsung offers app customization and its own open-source operating system, Tizen, that makes it easy for developers to customize features. Below are Samsung’s key wearable offerings for enterprises:

- Galaxy and Gear watch: Samsung’s two wearable devices that consumers and enterprises can use. The Galaxy and Gear watches are equipped with Samsung’s enterprise mobility management (EMM) software that makes it easier to manage data. The watches also use the Tizen operating system, and open source software that makes it easier for enterprises to customize or develop applications suited to the company workflow. Samsung also offers customization software Knox, which lets businesses upload data, logos and graphics onto the wearable device through the app.

- Tizen: Samsung watches use its own open-source operating system, Tizen, developed by Samsung and Intel. The applications on Tizen are highly customizable and can be launched on different platforms. Tizen and Samsung’s inbuilt safety platform Knox provide enterprise-specific software and services.

- EMM: Samsung SDS, the information and communication technology (ICT) arm of Samsung, offers EMM for enterprise wearables that bolsters security of the wearable device. Administrators can remotely manage the applications installed on the wearable device, prevent certain apps from being loaded and other features that make them less vulnerable to malware.

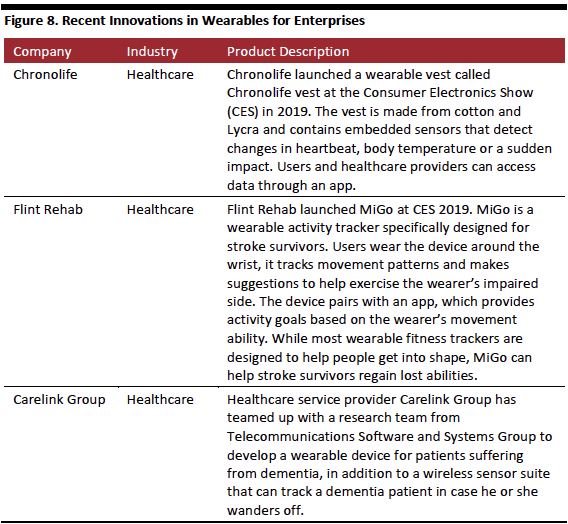

Recent Innovations

Below are some recent innovations in the enterprise wearables space: [caption id="attachment_86814" align="aligncenter" width="568"] Source: Company reports[/caption]

Source: Company reports[/caption]

Industry Case Studies

Wearable devices are opening new avenues for organizations to give employees real-time, hands-free access to information and applications that help them do their jobs more efficiently. Next, we look at wearable use in retail and healthcare.Retail

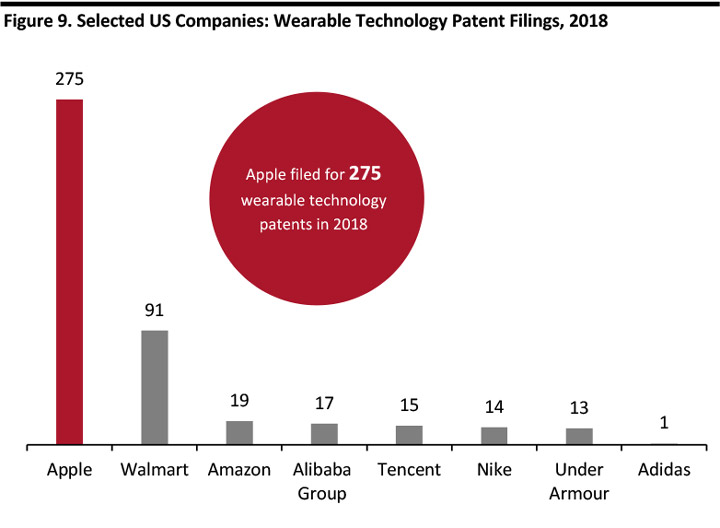

Wearables are becoming more mainstream in retail, helping retailers improve the customer experience. Also, as wearables become common, technologies such as radio-frequency identification (RFID) and mobile payments can enhance the shopping experience by eliminating the need for check out. In June 2016, storage and kitchenware retailer The Container Store (TCS) introduced voice-controlled wearables offered by wearable tech company Theatro after a successful pilot. TCS rolled out the technology in 70 of its 80 stores. The wearable is a credit card sized voice-controlled device that can be connected to Wi-Fi and gives staff access to store information such as inventory and product location. According to investment intelligence and data provider Grata Data, Apple filed for 275 wearable technology patents in the US in 2018. Apple was granted 750 wearable technology patents in 2018, for a total of 1,025 filed and granted. Apple was followed by Walmart with 91 patent filings and Amazon with 19 filings in 2018. Patent filings for wearables remain focused on consumer devices, but Coresight Research believes technology advances will push wearables into retail use. [caption id="attachment_87230" align="aligncenter" width="574"] Source: Grata Data[/caption]

Source: Grata Data[/caption]