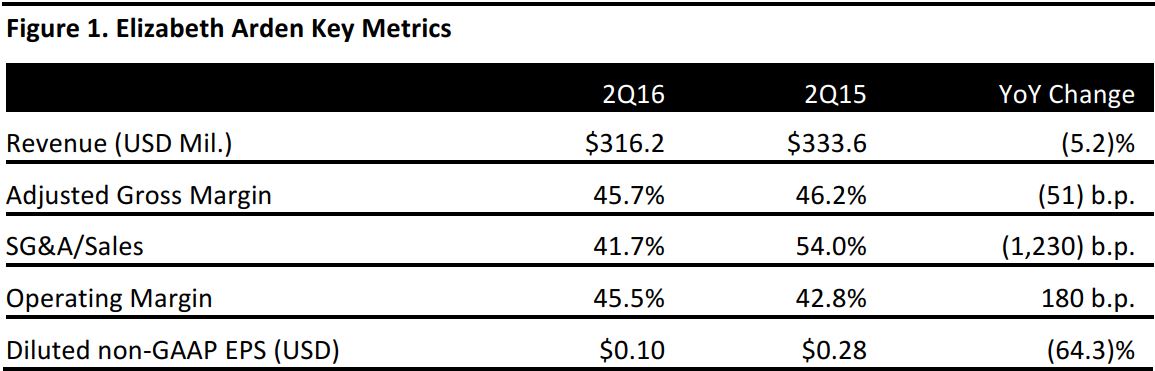

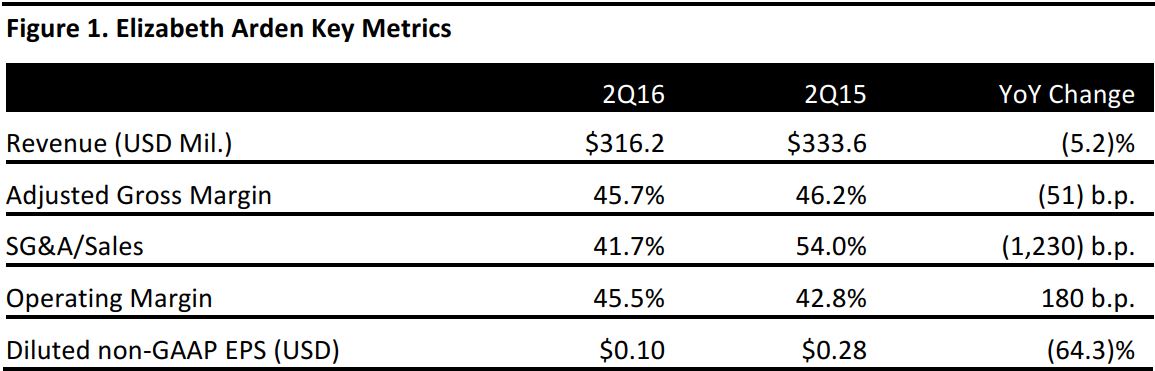

Source: Company reports

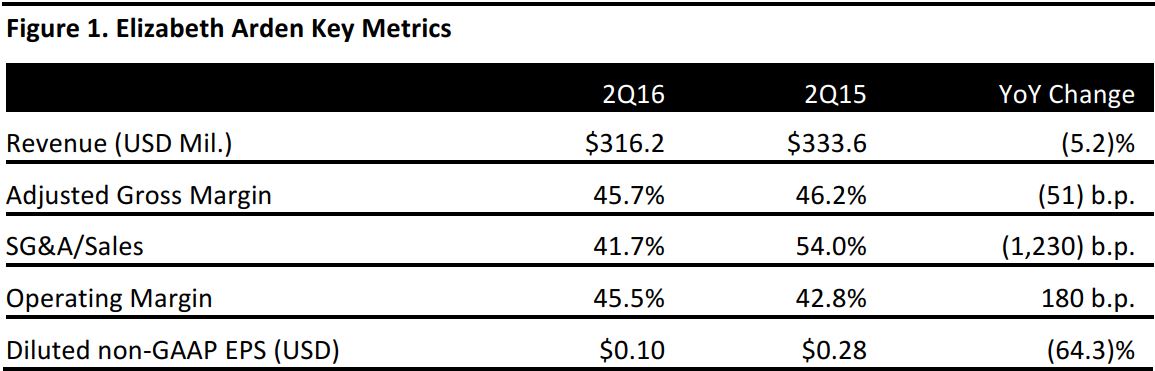

Beauty products company Elizabeth Arden reported quarterly sales of $316.2 million for 2Q16, missing the consensus estimate of $340.9 million and down 1.0% year over year in constant foreign currency. The company reported a loss of $4.9 million for the quarter.

The figures cited below are adjusted and in constant foreign currency.

Elizabeth Arden brand: Elizabeth Arden branded products are a key revenue driver for the company. Sales of these increased by 3% in the quarter, with growth driven by higher fragrance and skin care sales, which increased by 8% and 2%, respectively.

Fragrance portfolio: Net sales of fragrances outside the Elizabeth Arden brand decreased by 4%. Within the segment, designer fragrances experienced strong, 7% growth during the period, driven by the John Varvatos fragrance brand and growth in Juicy Couture fragrances. The increase was offset by lower sales of celebrity fragrances; such sales declined by 3.6%, to $582.2. The company manufactures fragrances for four celebrities: Justin Bieber, Taylor Swift, Mariah Carey and Nicki Minaj.

Go-to-market capability: Net sales experienced strong growth in the European region, where they increased by 9% year over year. The improved performance of the Elizabeth Arden brand drove the growth. In Greater China, net sales increased by 18%. Management noted that the company’s joint ventures in Southeast Asia and the Middle East are now fully operational and focused on accelerating sales.

Despite the negative foreign currency headwinds, fiscal-year-to-date adjusted gross margin increased by 60 basis points, to 44.2%. Management indicated that the cost savings are on track to achieve or exceed the high end of its previously communicated estimate of $47–$50 million of annualized savings.

Guidance: The company expects net sales increases to be driven by the international business and the Elizabeth Arden brand. Management expects foreign currency headwinds to negatively impact full-year net sales growth by approximately 3.75%. In November 2015, the company had estimated a negative impact of 3%.