Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/US Energy Information Administration (EIA)/University of Michigan/US Census Bureau/Federal Reserve Board/Fung Global Retail & Technology

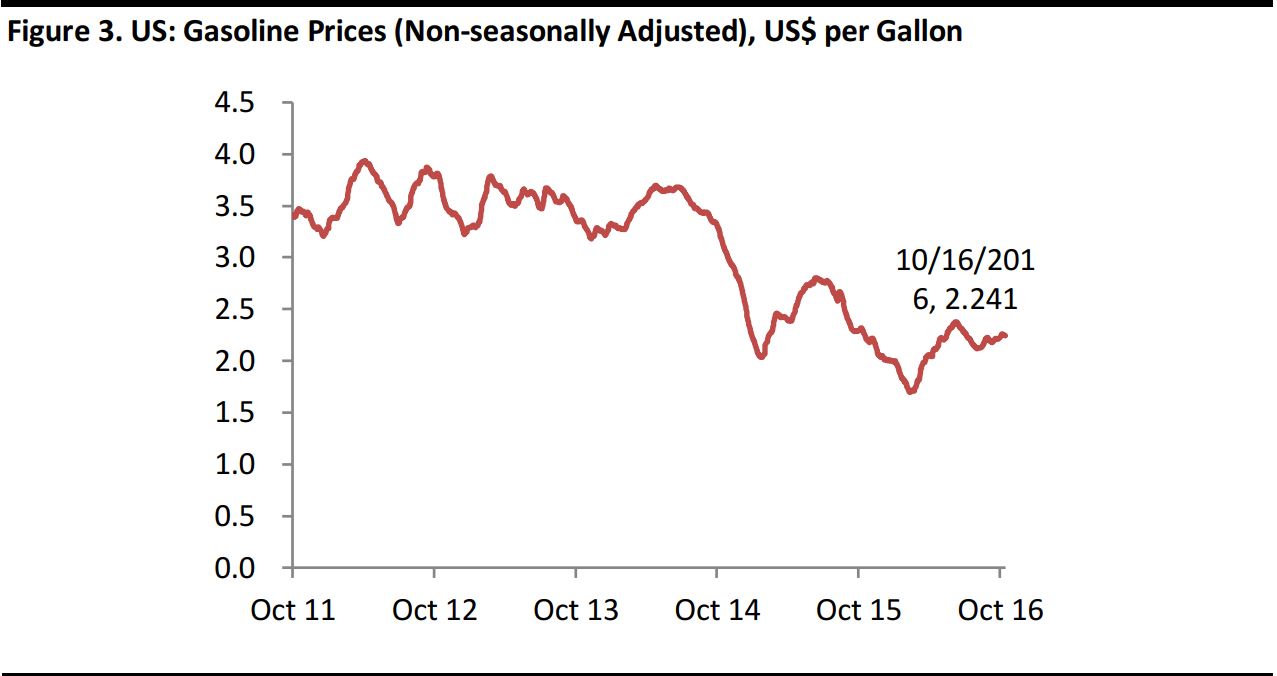

Job Market

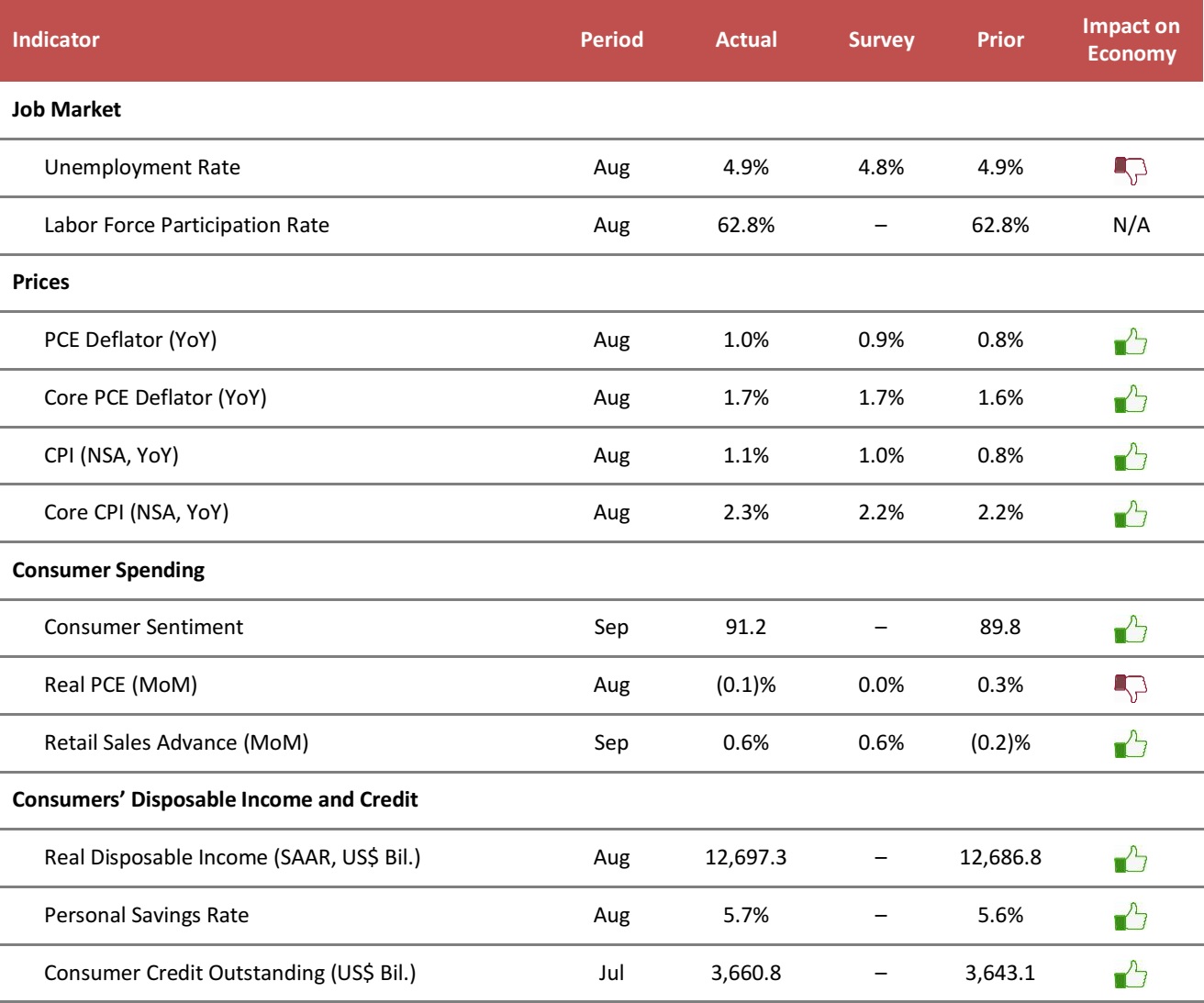

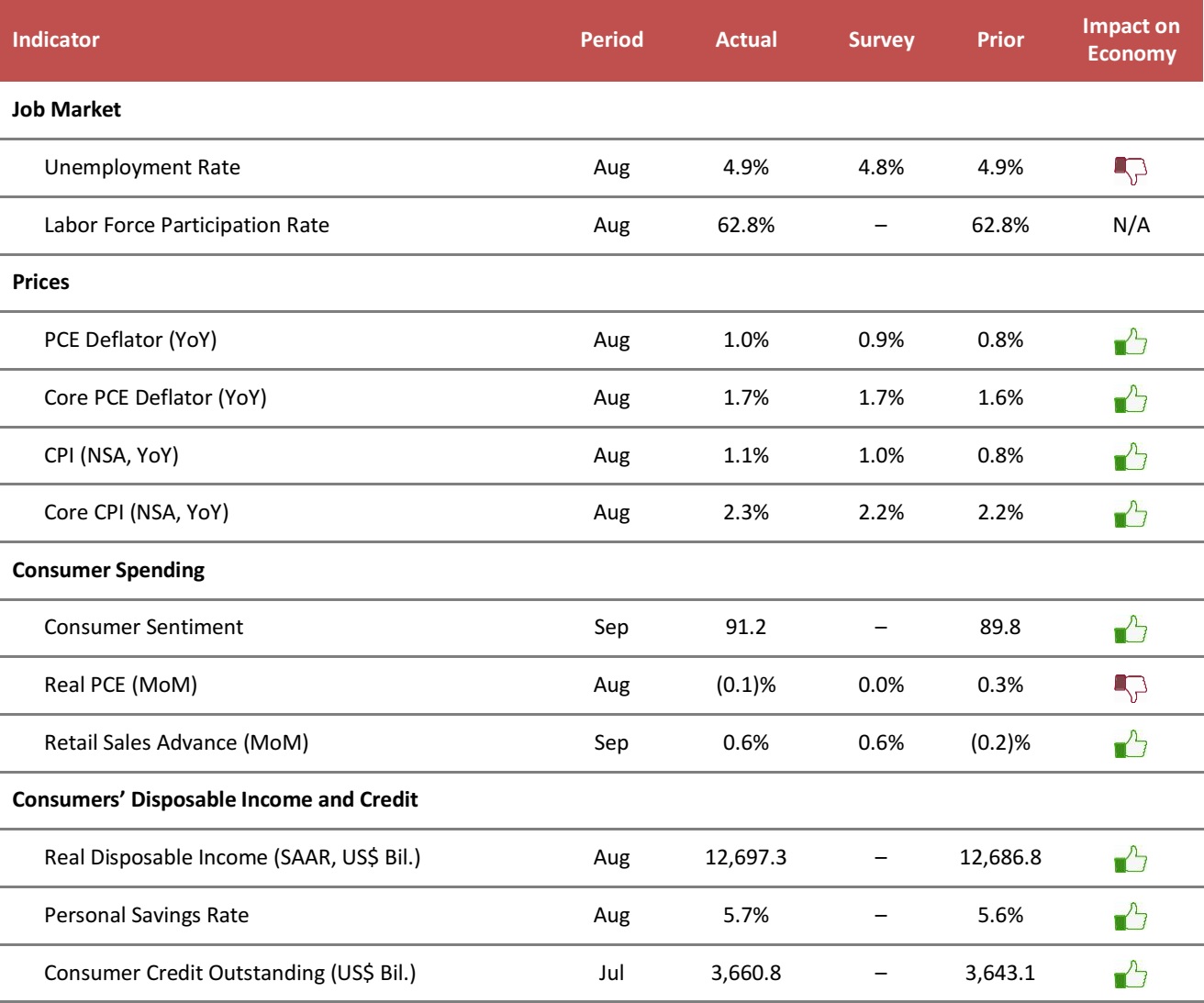

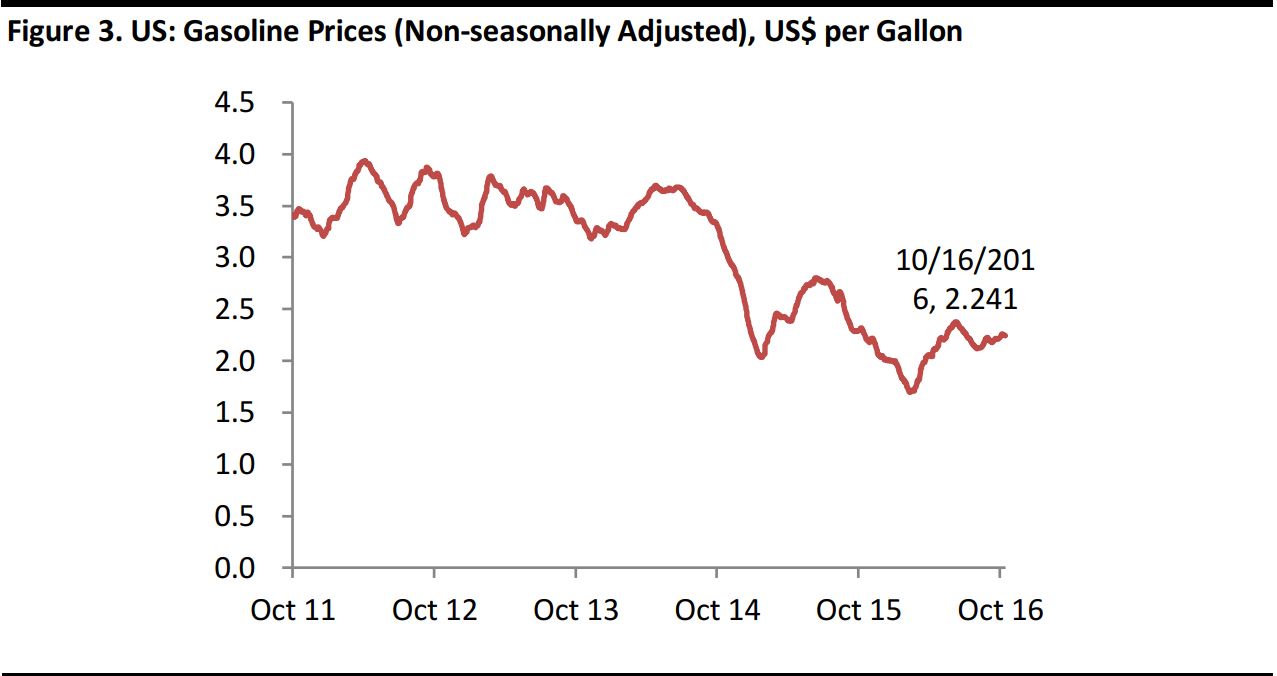

The US unemployment rate in August was unchanged at 4.9% for the third consecutive month, and was slightly higher than the 4.8% rate that had been expected. Total nonfarm payroll employment increased by 151,000, and the labor force participation rate during the month was unchanged from July, at 62.8%. Job gains were seen in professional and technical services, financial activities and healthcare. The mining industry continued to see job losses in August.

Source: US Bureau of Labor Statistics

Consumer Prices

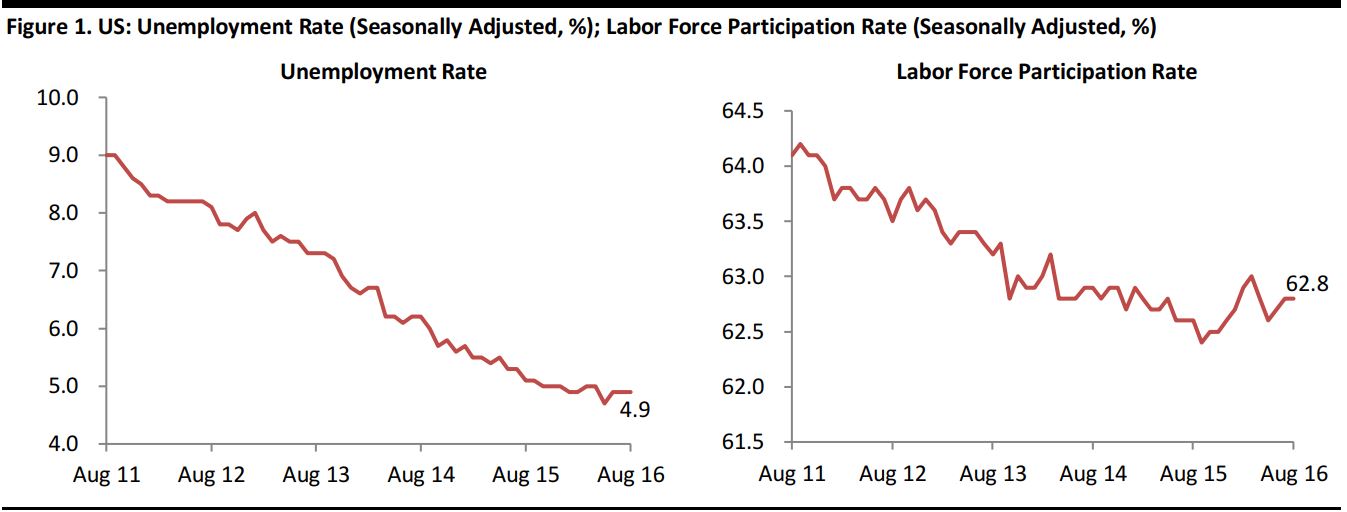

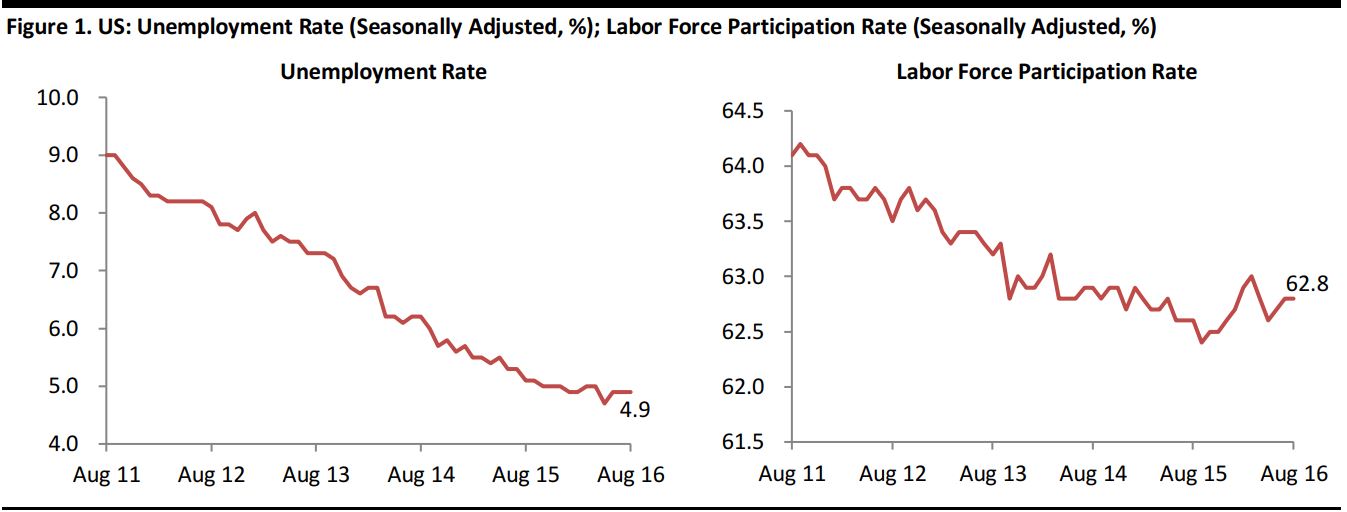

The PCE deflator, which is the Fed’s preferred measurement of the inflation rate, rose by 1.0% year over year in August. The core PCE deflator, which excludes food and energy prices, increased by 1.7% year over year; the rate was below, but closer to, the Fed’s 2% target than the July reading, and was in line with the consensus estimate.

Source: US Bureau of Economic Analysis

The US CPI increased by 1.1% year over year in August and by 0.2% month over month. Core CPI, which excludes food and energy price movements, was up by 2.3% year over year, achieving the Fed’s target of 2%. However, the Fed considers next week’s PCE deflator to be a better inflation measure.

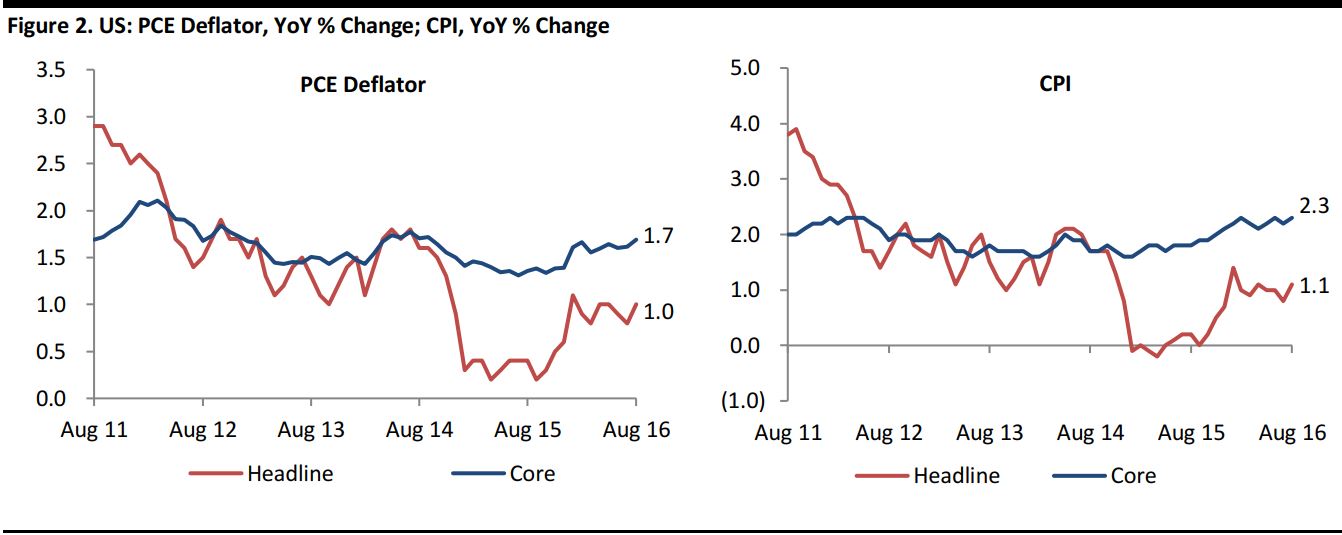

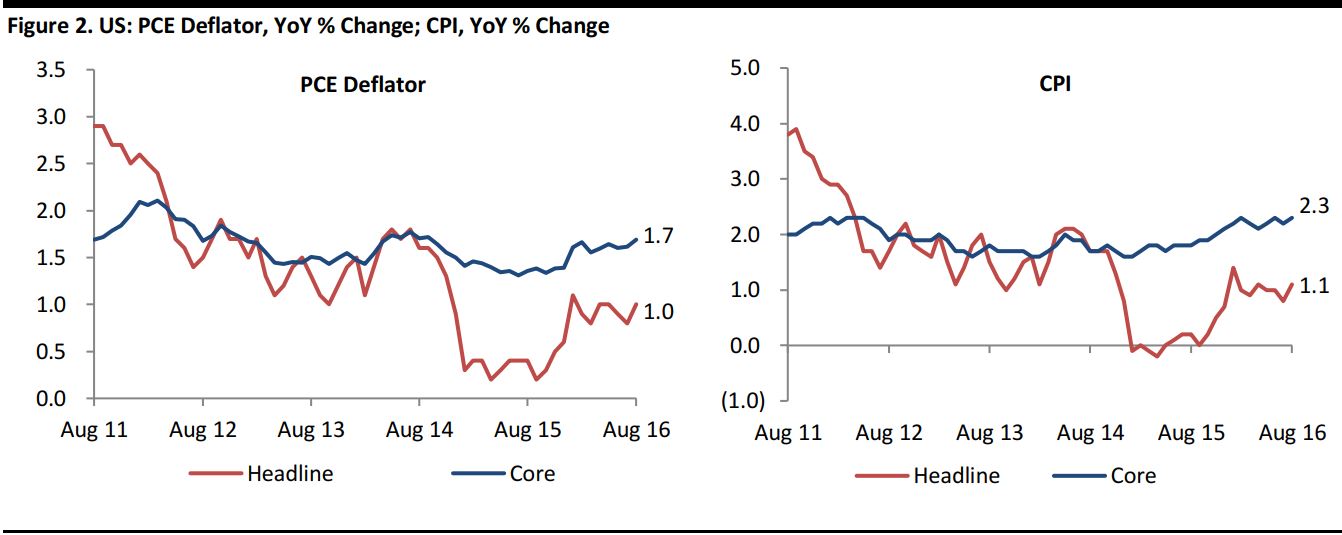

The gas price fell from US$2.40 per gallon in June to US$2.15 per gallon in August this year. The price then rose moderately from August to October, reaching US$2.241 per gallon on October 16, 2016. The OPEC production cut and crude oil hovering above US$50 a barrel tend to drive gas prices higher, which reduces consumption spending in other categories.

Source: EIA

Consumer Spending

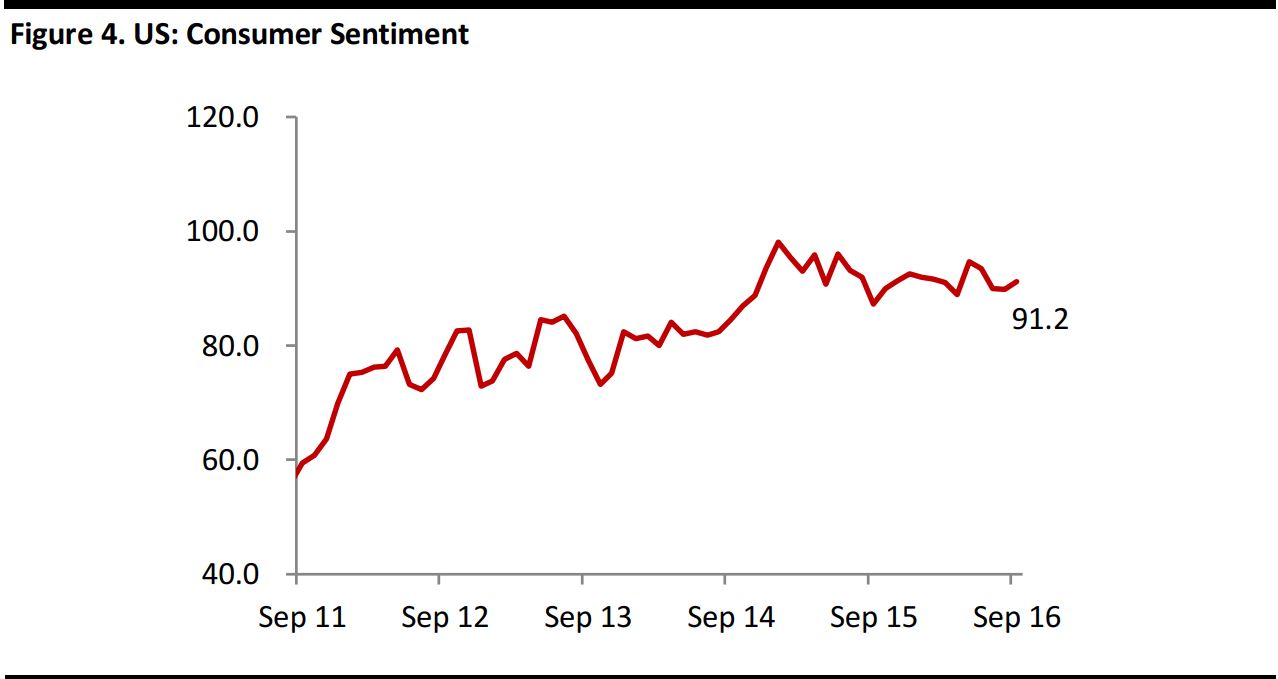

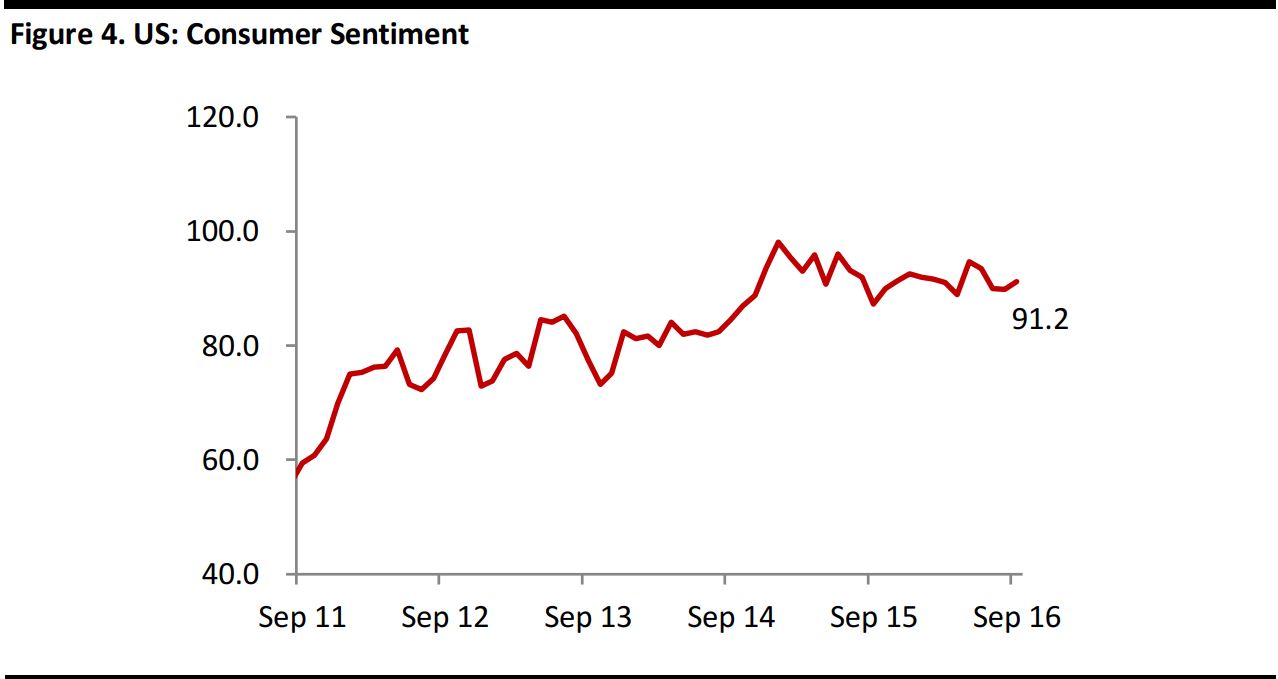

The University of Michigan Consumer Sentiment Index stood at 91.2 in September, up from 89.8 in August. The improvement was driven by gains among higher income households. However, the gauge has hardly budged throughout the year, with the average level of the index standing at 91.4.

Source: University of Michigan

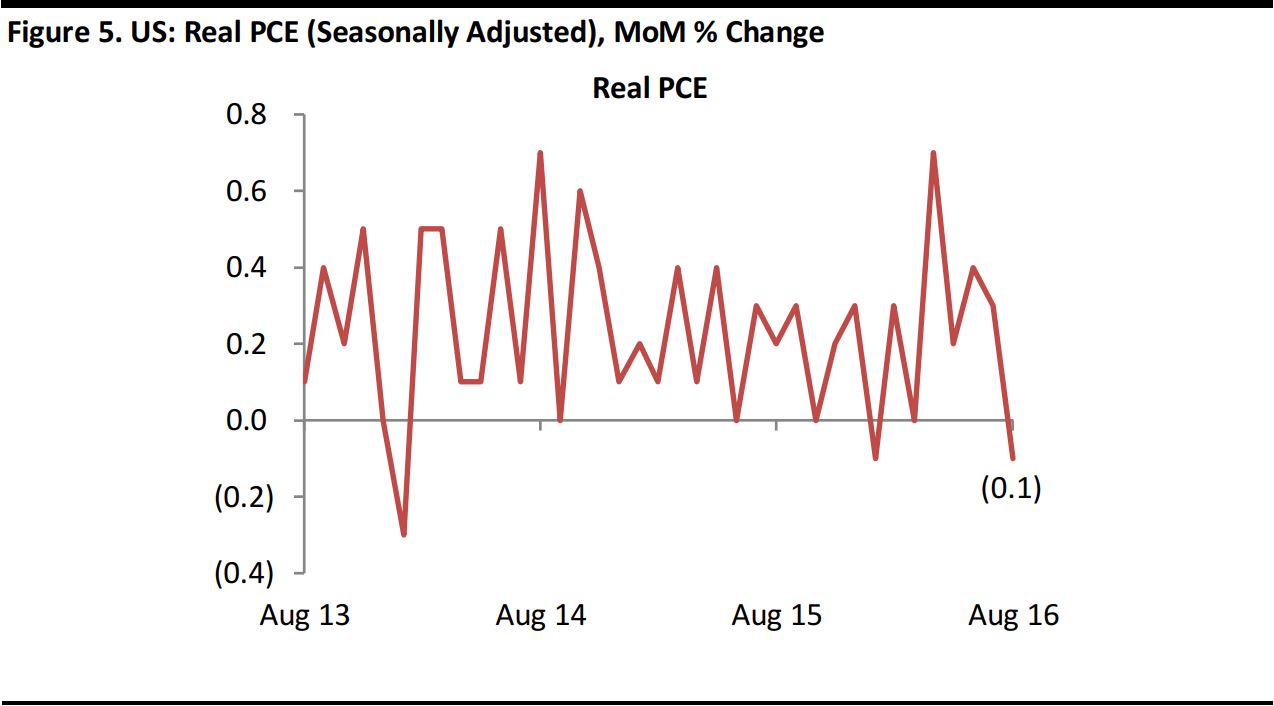

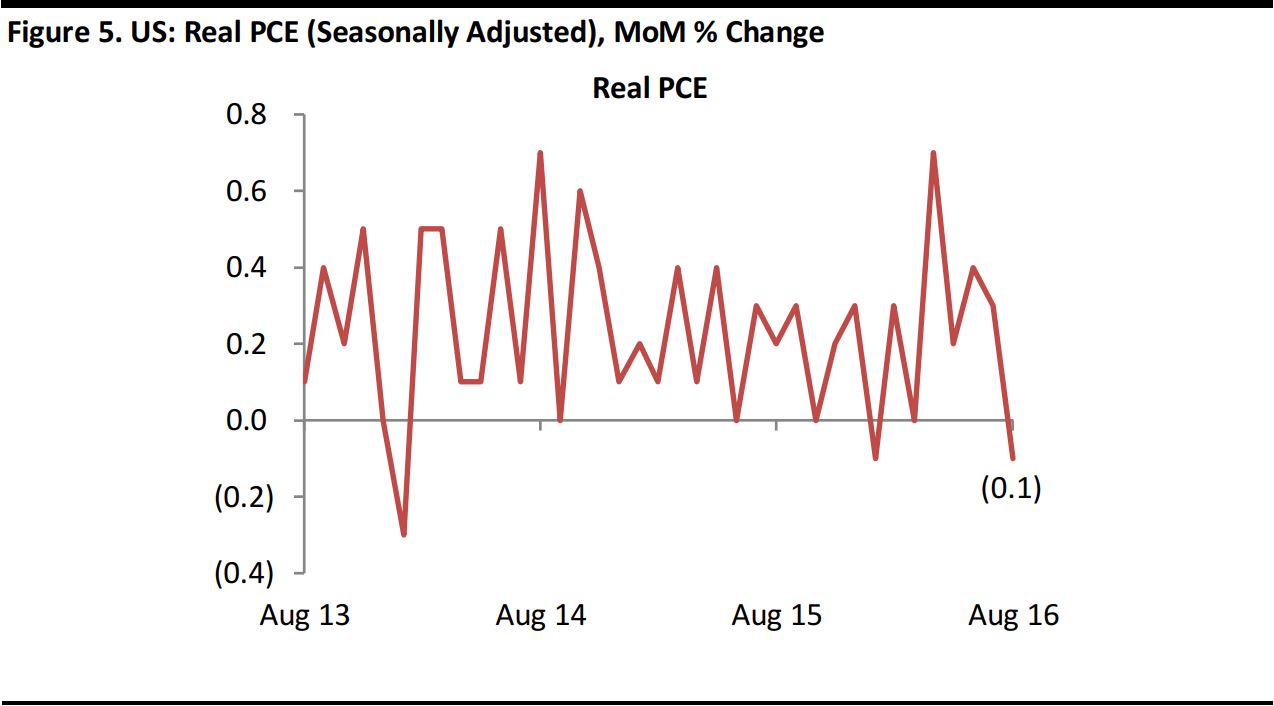

Real PCE in August decreased by 0.1% month over month. The modest drop reflected a decrease in spending on durable goods, which was partially offset by an increase in spending on services.

Source: US Bureau of Economic Analysis

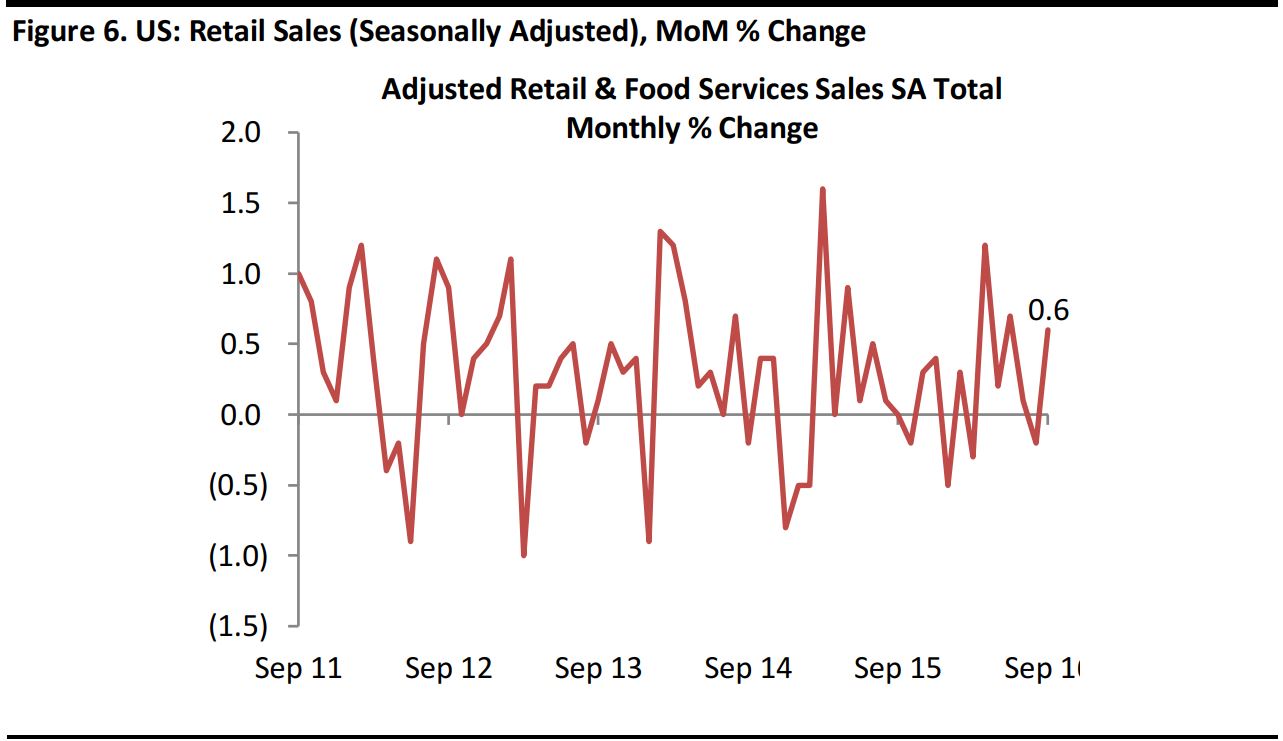

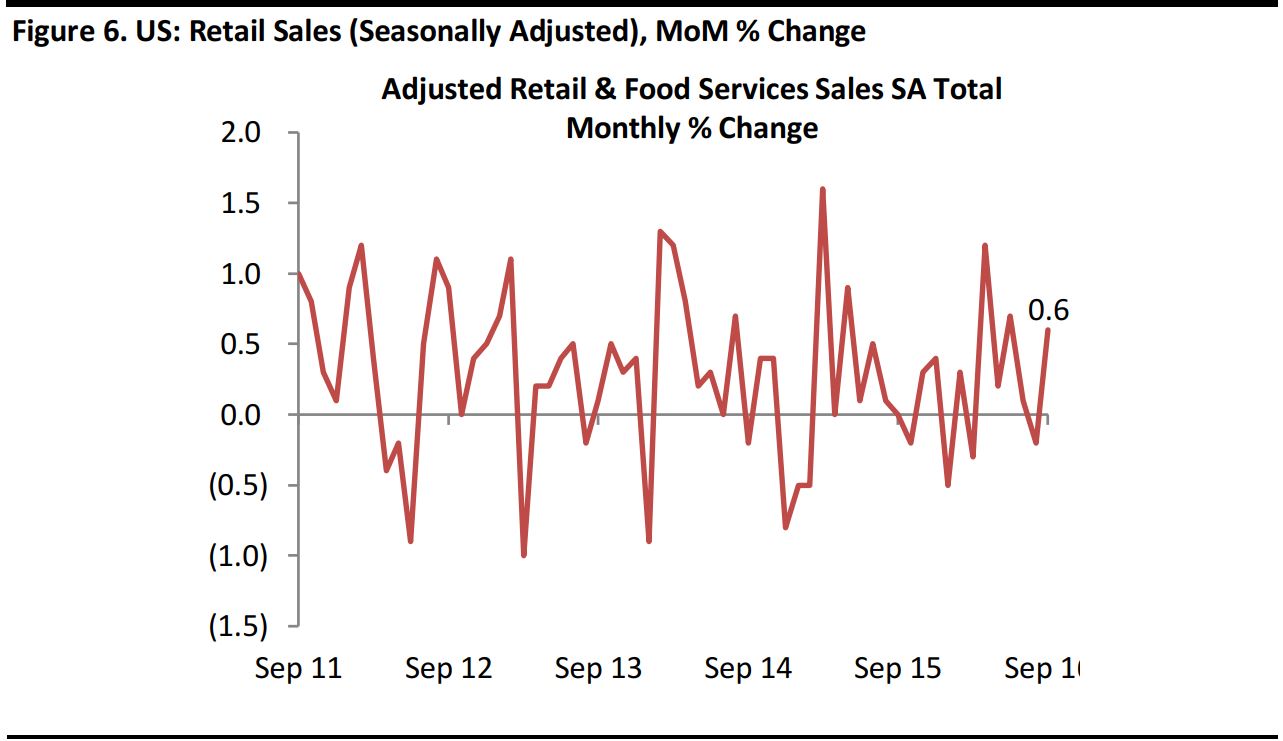

In the US, advance estimates of September retail sales were US$459.8 billion, up by 0.6% month over month and 2.7% year over year, buoyed by stronger auto sales and higher gasoline prices.

Auto retail sales increased by 1.1% month over month and retail sales of gas stations increased by 2.4% month over month. Control group sales, which are used for the estimate of personal consumption expenditure, were weak, up 0.1%.

Source: US Census Bureau

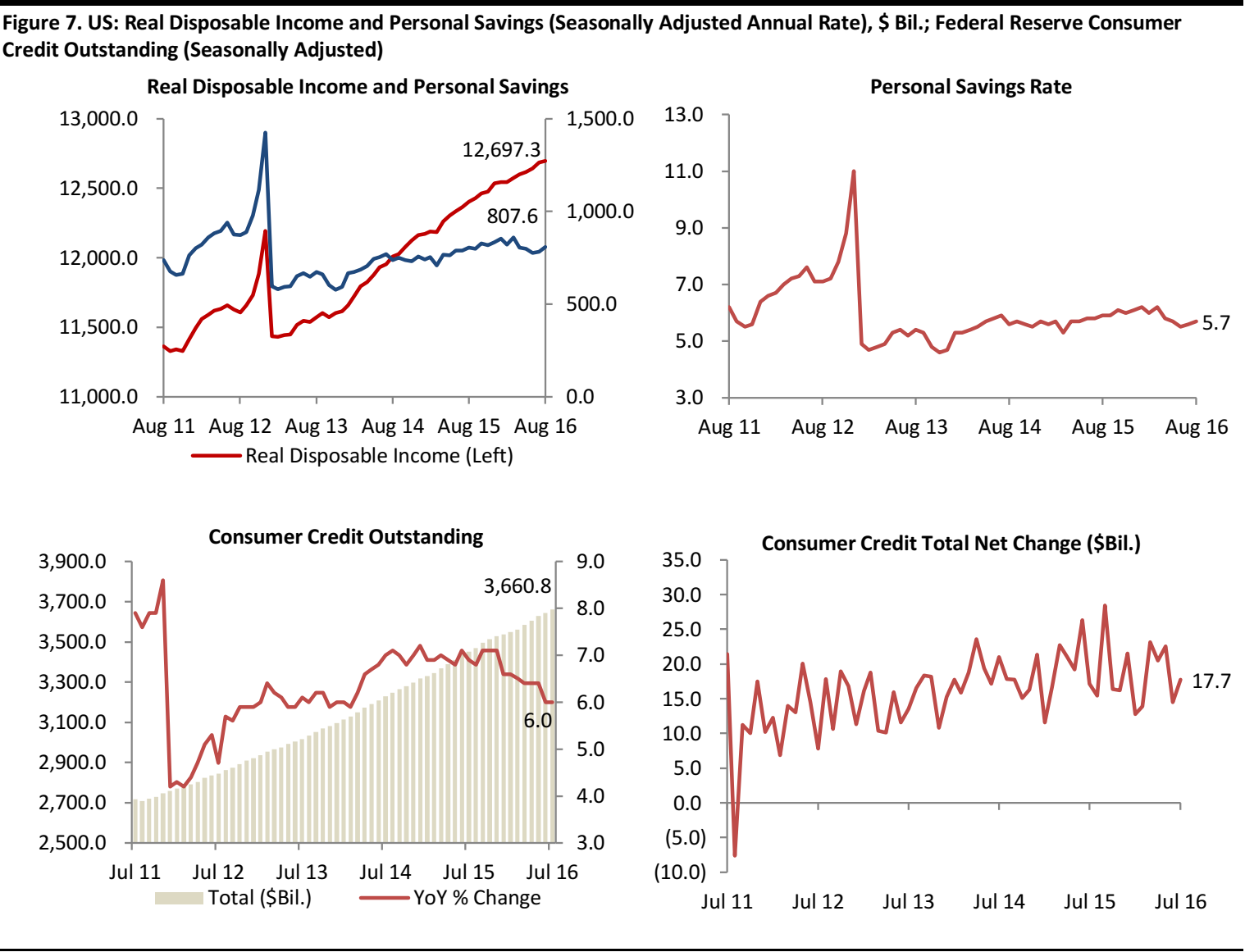

Consumers’ Disposable Income and Credit

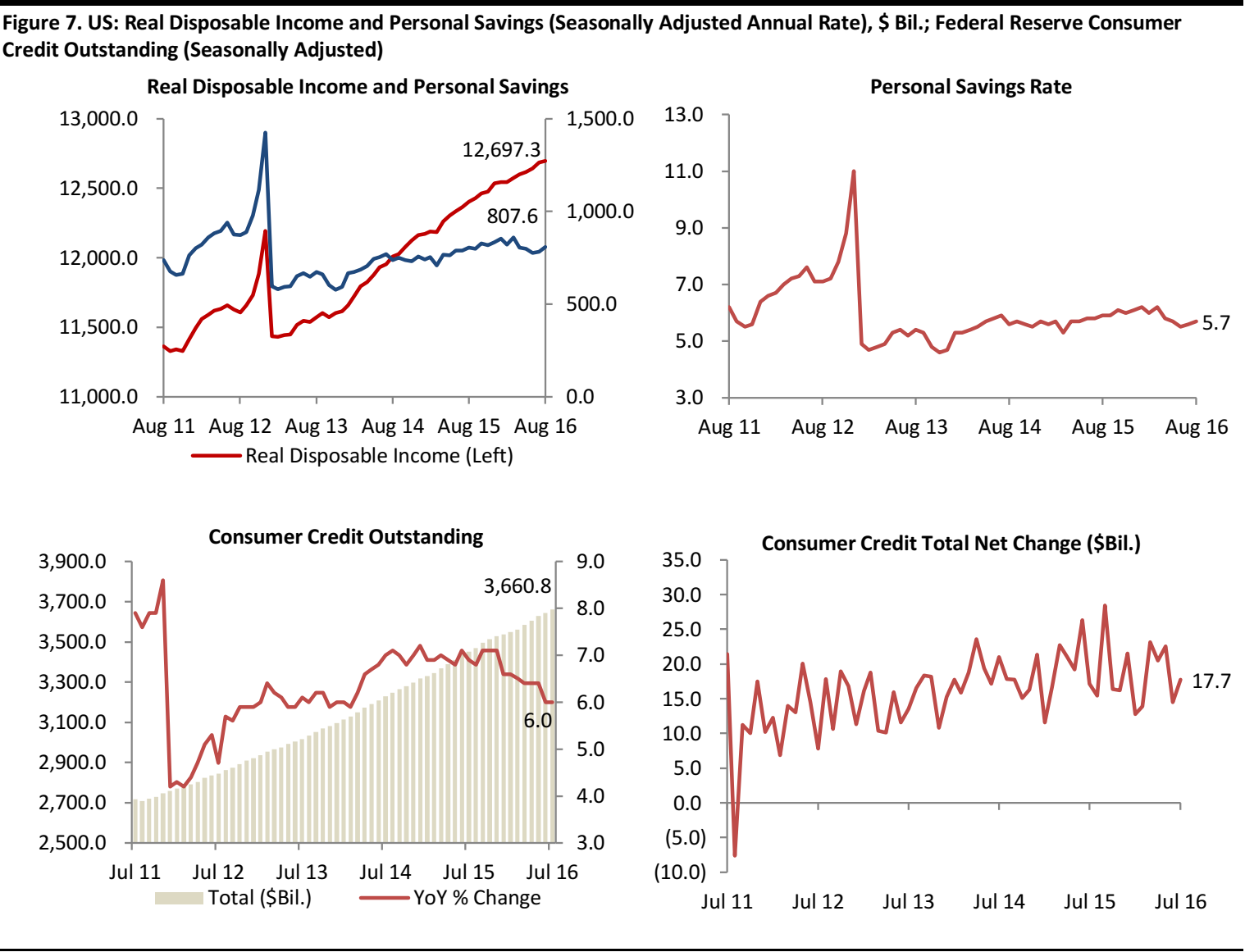

Real disposable personal income totaled US$12,697 billion, ticking up by 0.1% month over month in August, reflecting increases in wages and salaries, assets and government social benefits. Personal savings stood at US$807.6 billion in August, and the savings rate was 5.7%.

In July, consumer credit outstanding totaled US$3,660.8 billion, up 6.0% year over year, or US$17.7 billion month over month.

Source: US Bureau of Economic Analysis/Federal Reserve Board