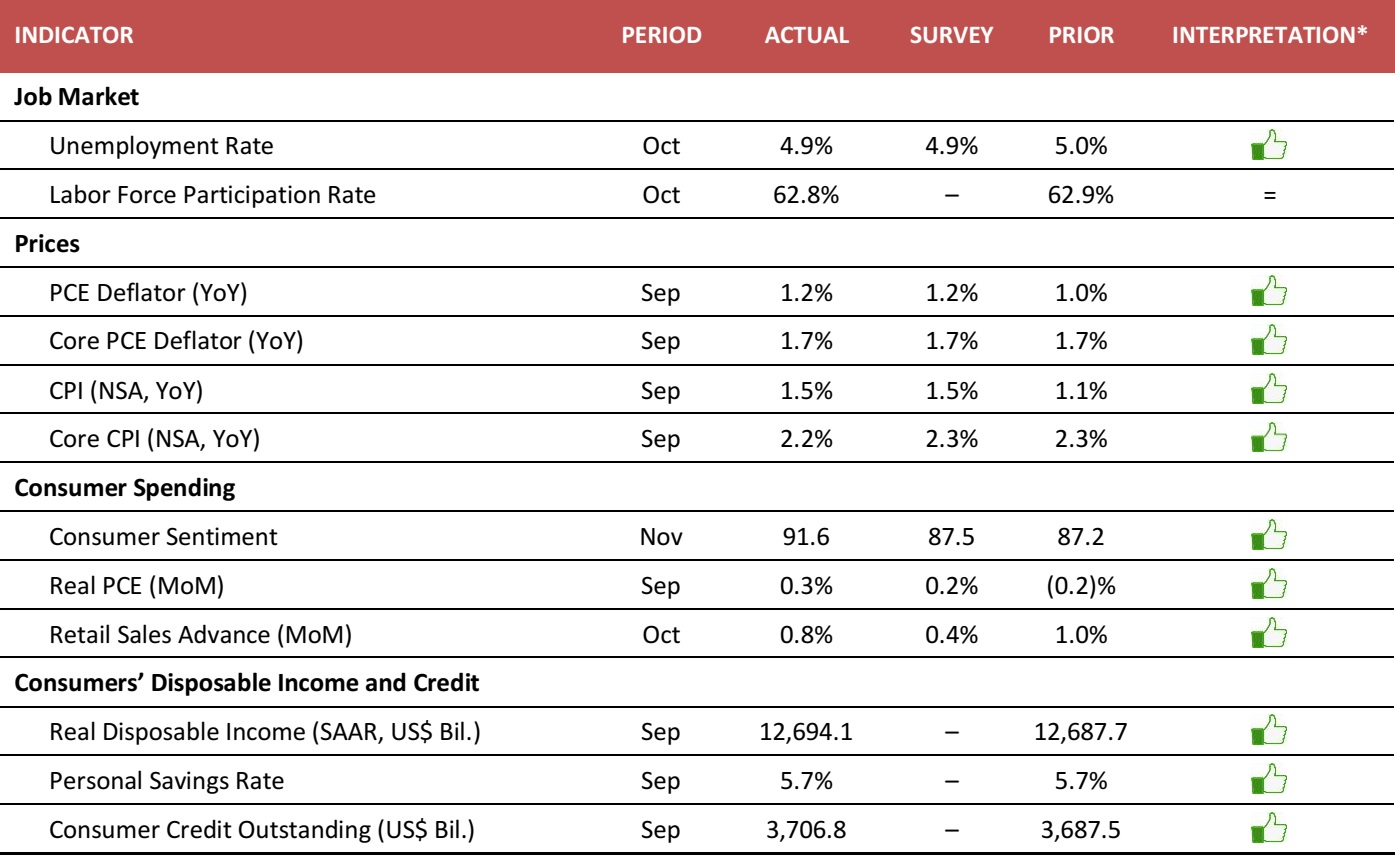

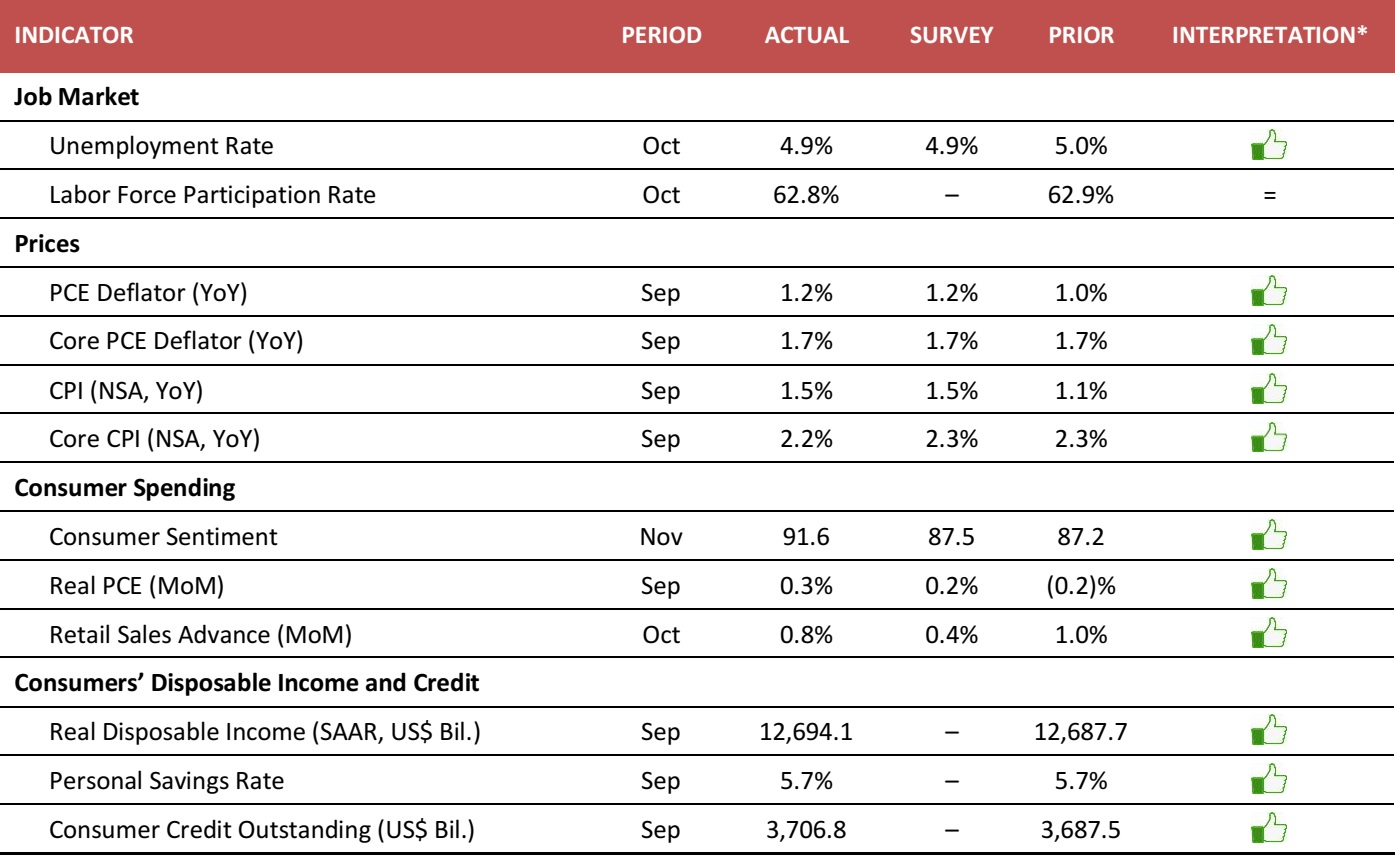

* indicates a positive signal for the country’s economy,

* indicates a positive signal for the country’s economy,

indicates a negative signal and = indicates not significantly positive or negative.

Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/US Energy Information Administration (EIA)/University of Michigan/US Census Bureau/Federal Reserve Board/Fung Global Retail & Technology

indicates a negative signal and = indicates not significantly positive or negative.

Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/US Energy Information Administration (EIA)/University of Michigan/US Census Bureau/Federal Reserve Board/Fung Global Retail & Technology

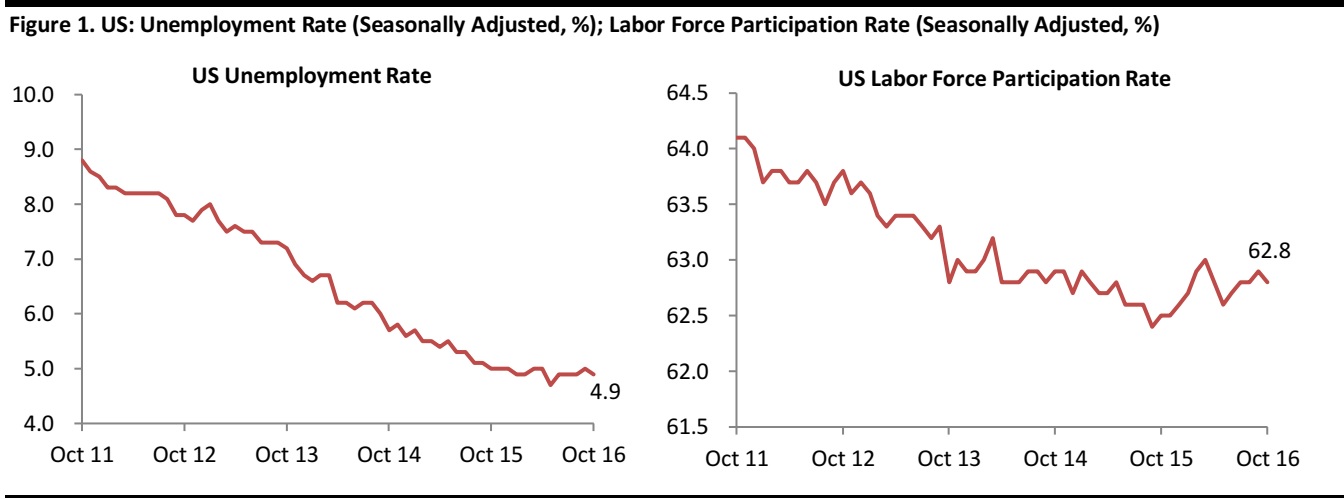

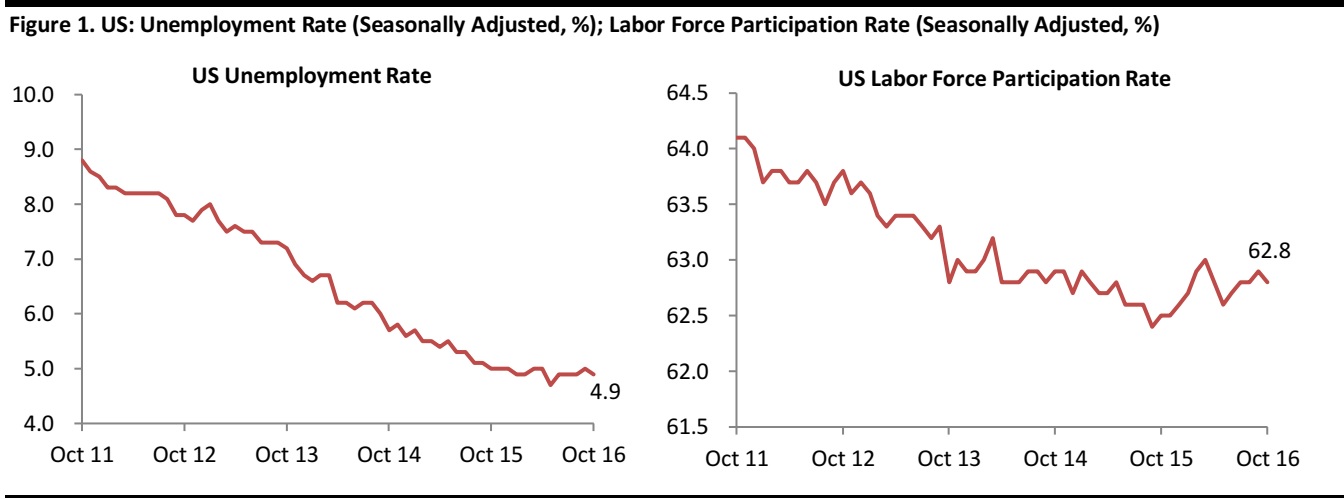

Job Market

The US unemployment rate in October edged down to 4.9%, which was in line with the consensus estimate and lower than the September reading of 5.0%. Total nonfarm payroll employment increased by 161,000 in October, following an upward revision of September’s reading, from 156,000 to 191,000. The labor force participation rate in October edged down by 0.1% from September, reaching 62.8%.

Source: US Bureau of Labor Statistics

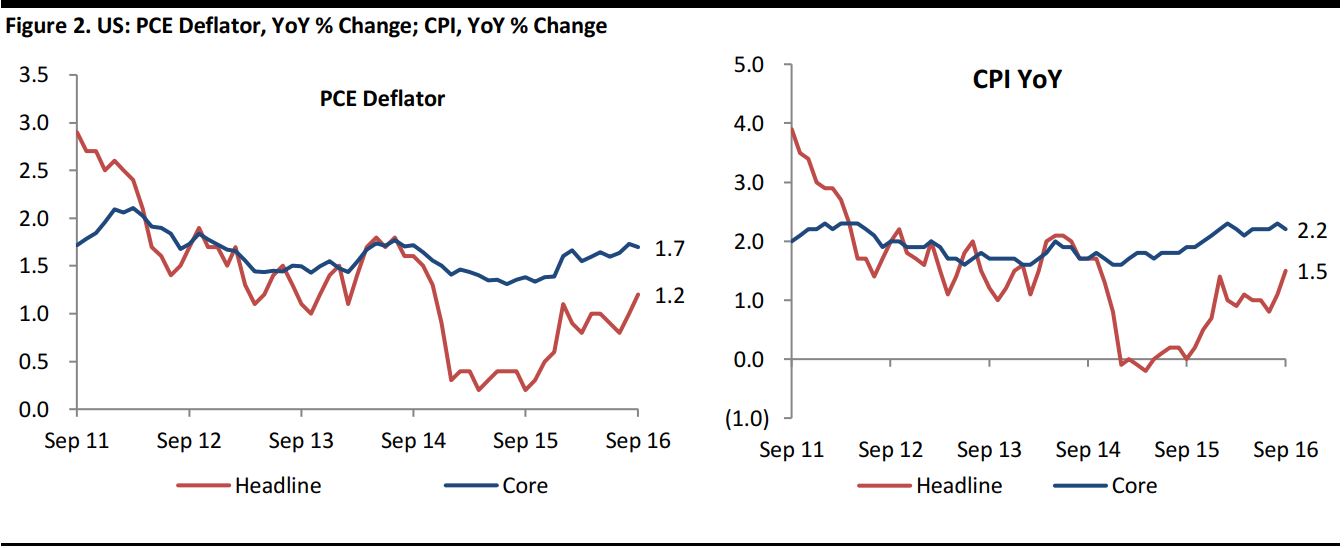

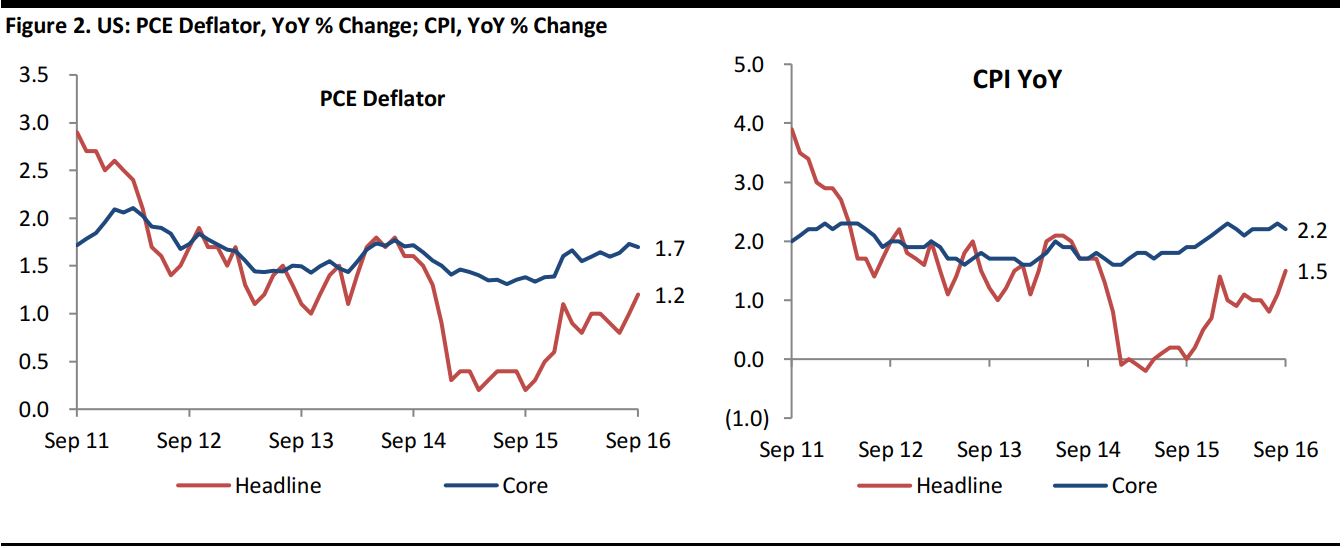

Consumer Prices

The PCE deflator, which is the Fed’s preferred measurement of the inflation rate, ticked up by 1.2% year over year in September. The core PCE deflator, which excludes food and energy prices, increased by 1.7% year over year; the rate was still slightly below the Fed’s 2% target, but was in line with the consensus estimate.

Source: US Bureau of Economic Analysis

The US CPI increased by 1.5% year over year in September and by 0.3% month over month. Core CPI, which excludes food and energy price movements, was up by 2.2% year over year, achieving the Fed’s target of 2%. However, the Fed considers next week’s PCE deflator to be a better inflation measure.

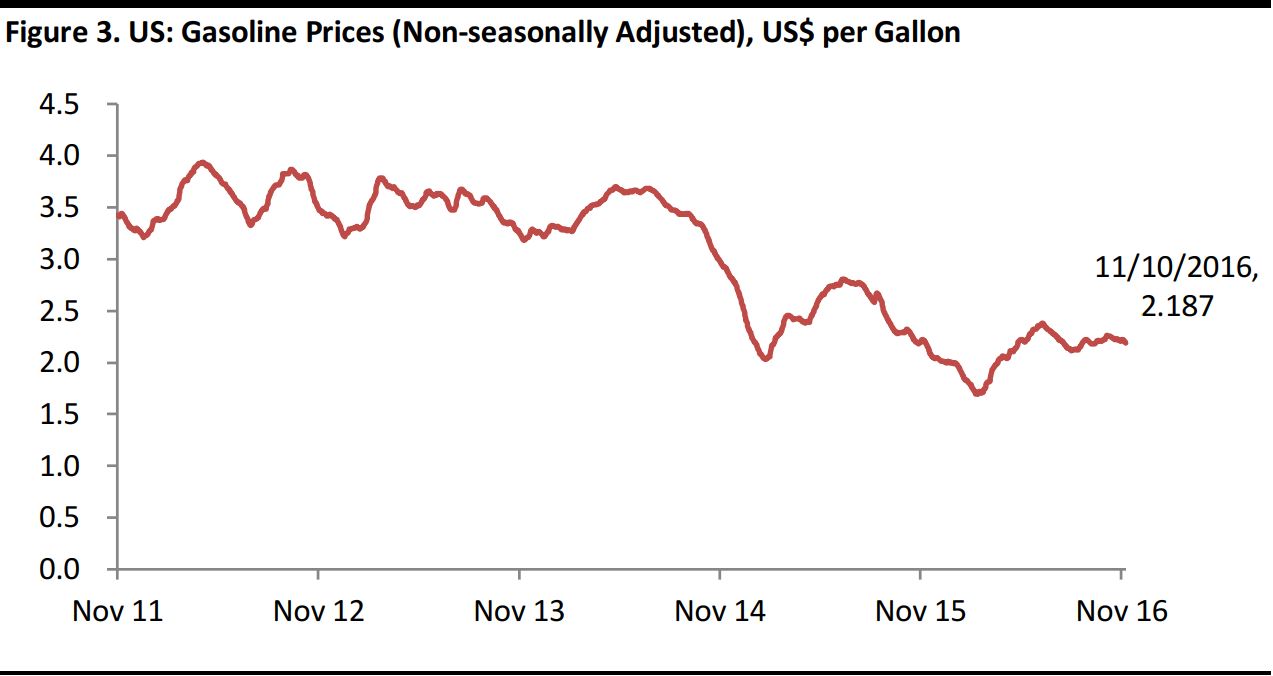

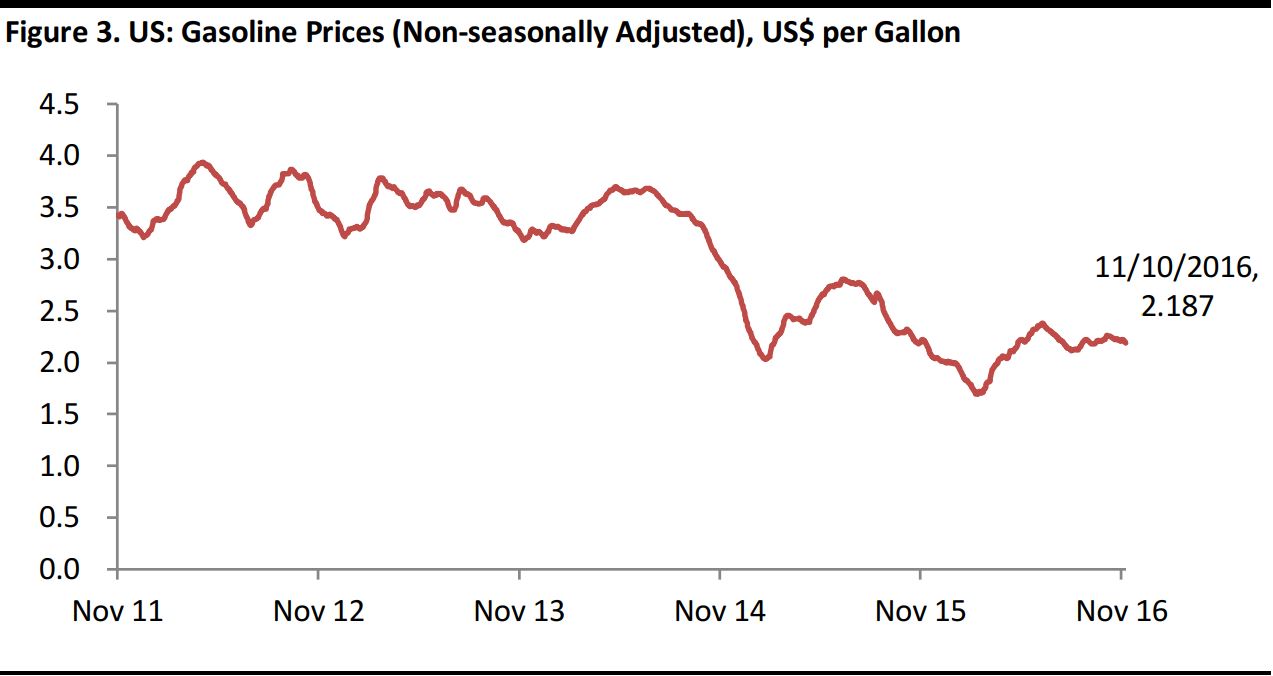

The gas price has been range-bound between US$2.15 and US$2.26 from October to the midst of November, and closed at US$2.187 on November 10, 2016. The OPEC production cut has failed to drive oil prices higher or sustain at levels above US$50 per barrel.

Source: EIA

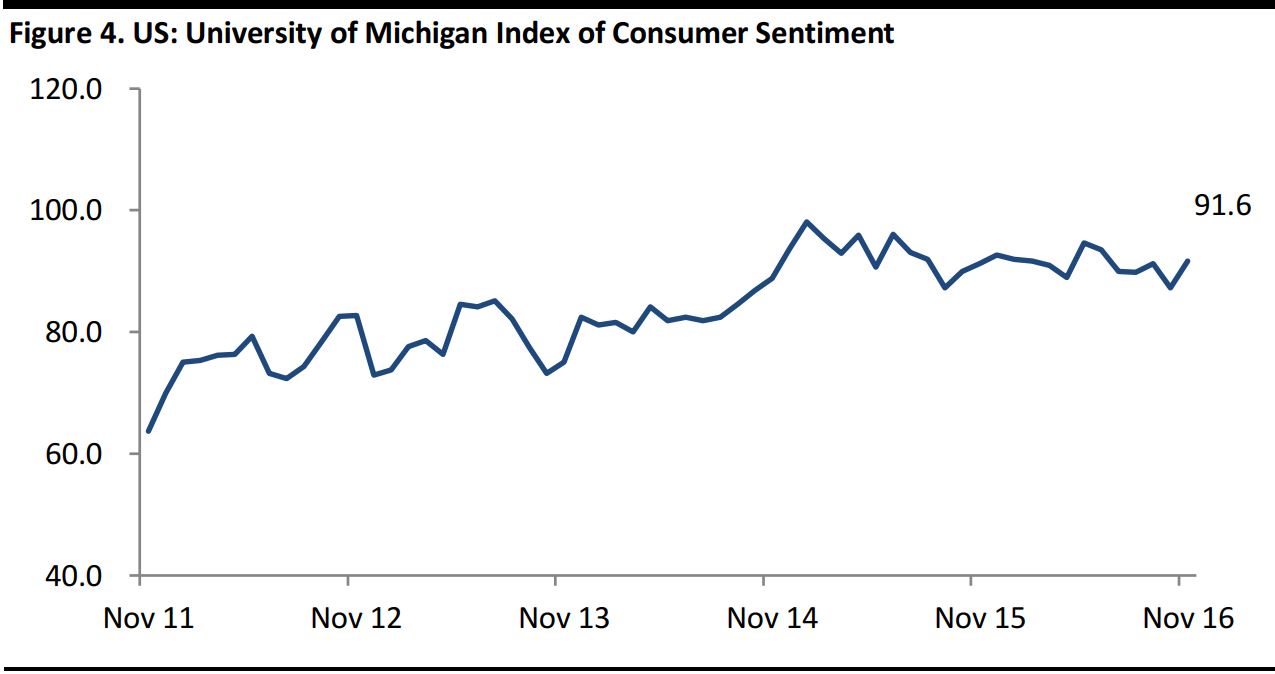

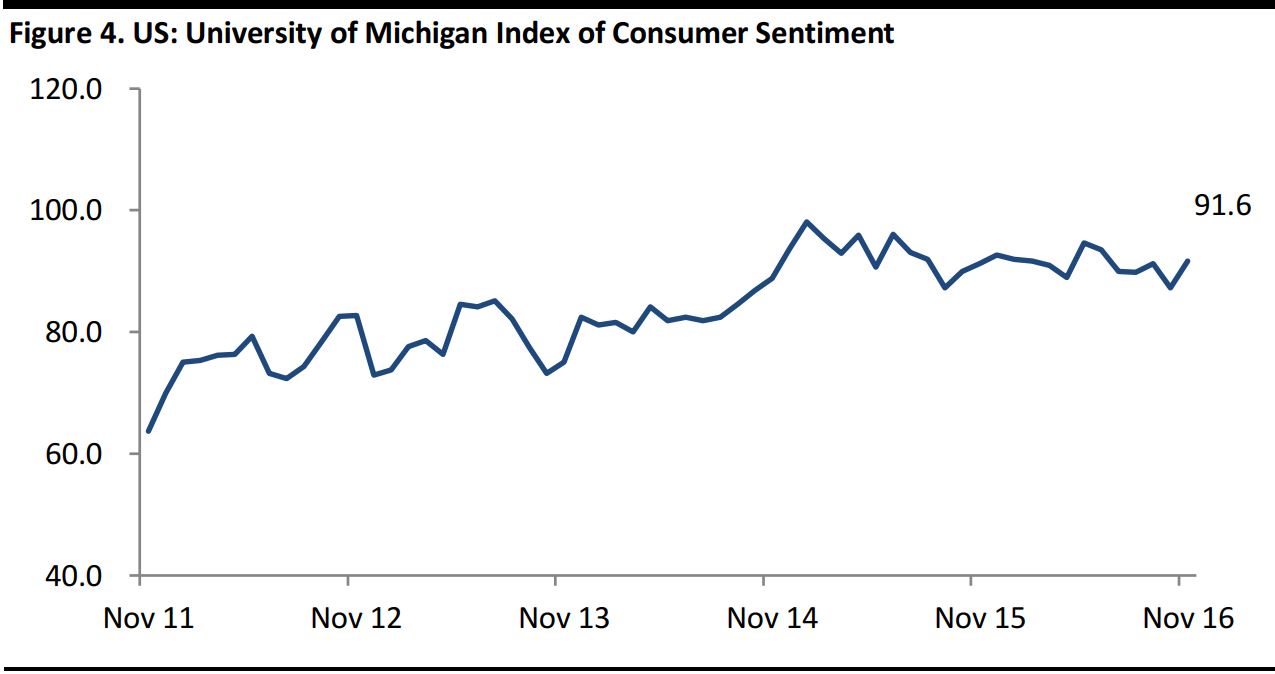

Consumer Spending

US consumer sentiment, as measured by the University of Michigan Index of Consumer Sentiment, hit 91.6 in November, above the market’s expectation of 87.5 and the prior month’s reading of 87.2. The gain was driven by an improved outlook for the economy. However, the November data were collected prior to the November 8 US presidential election, so further evidence may be needed from the coming months in order to confirm that consumer sentiment has indeed picked up.

Source: University of Michigan

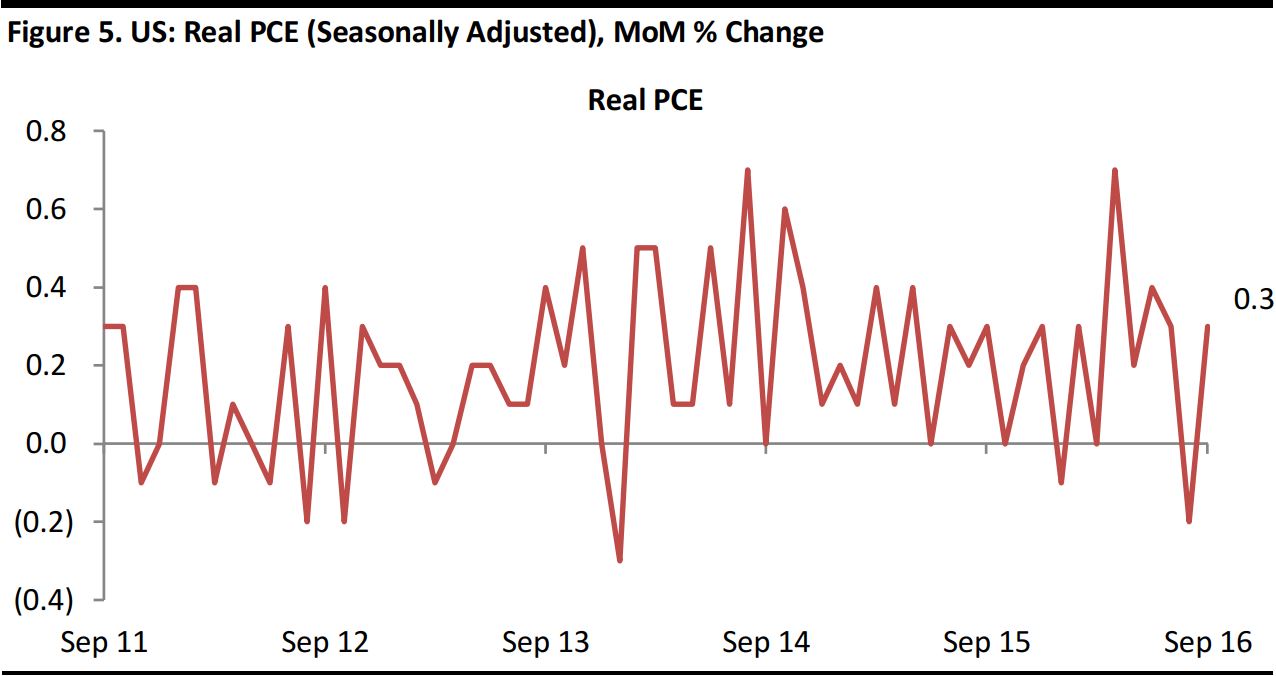

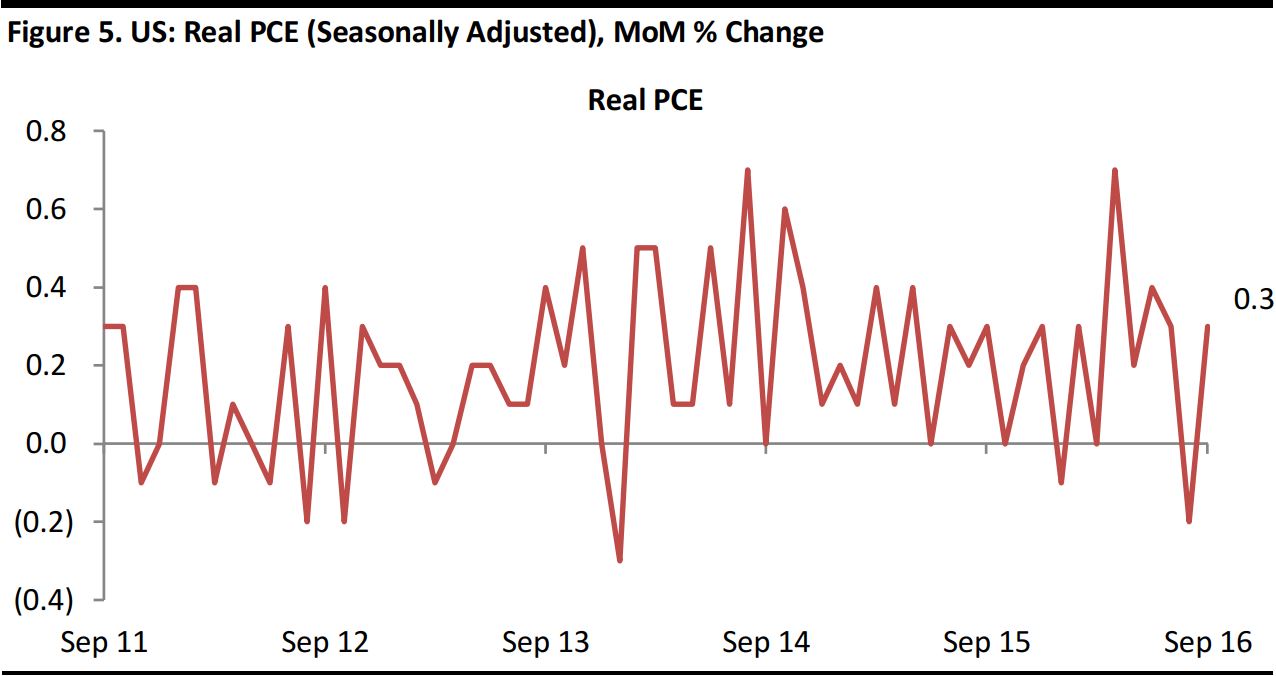

In the US, real PCE in September increased by 0.3% month over month, reflecting an increase in spending on durable goods, as consumer spending has been supported by rising wages and low unemployment rates.

Source: US Bureau of Economic Analysis

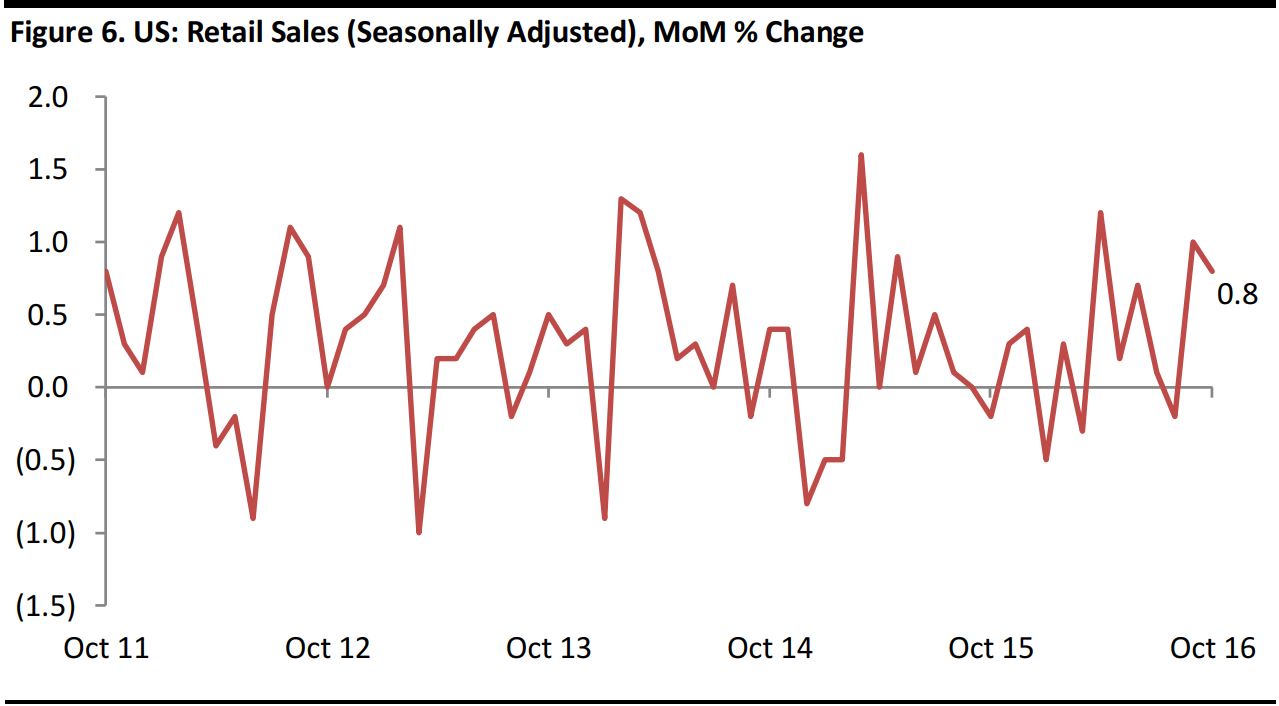

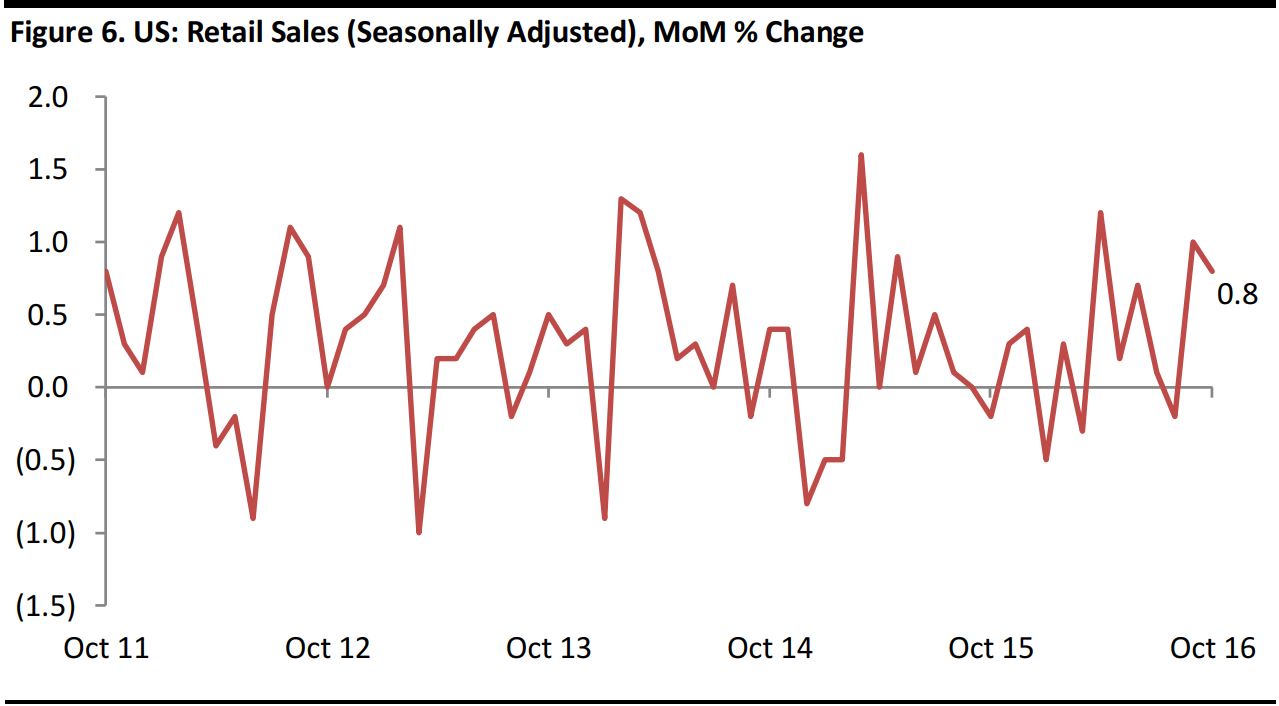

In the US, advance estimates of October retail sales were US$465.9 billion, up by 0.8% month over month and 4.3% year over year.

Retail sales were buoyed partly by stronger auto sales. Auto retail sales increased by 1.1% month over month and retail sales of gas stations increased by 2.2% month over month.

Source: US Census Bureau

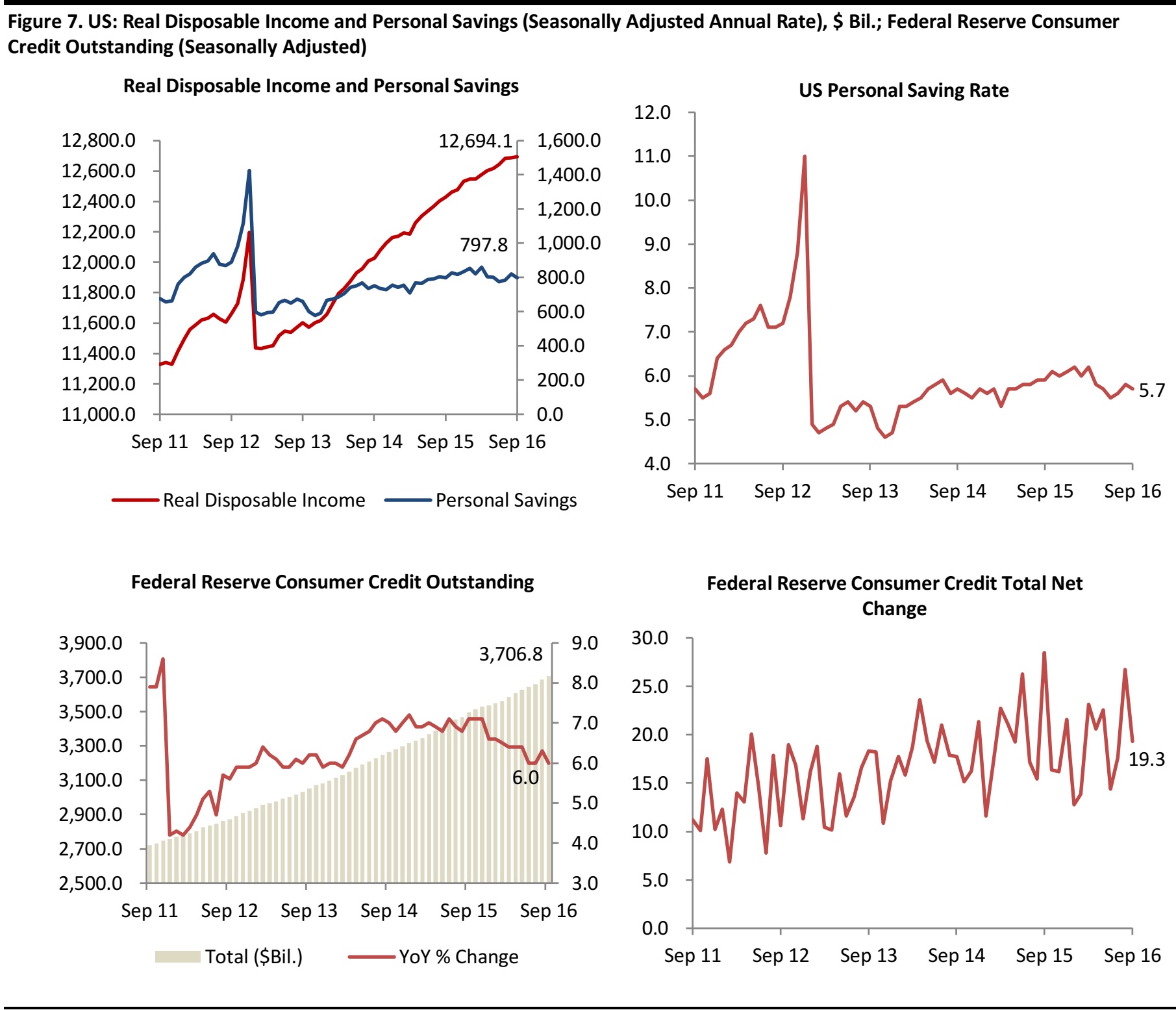

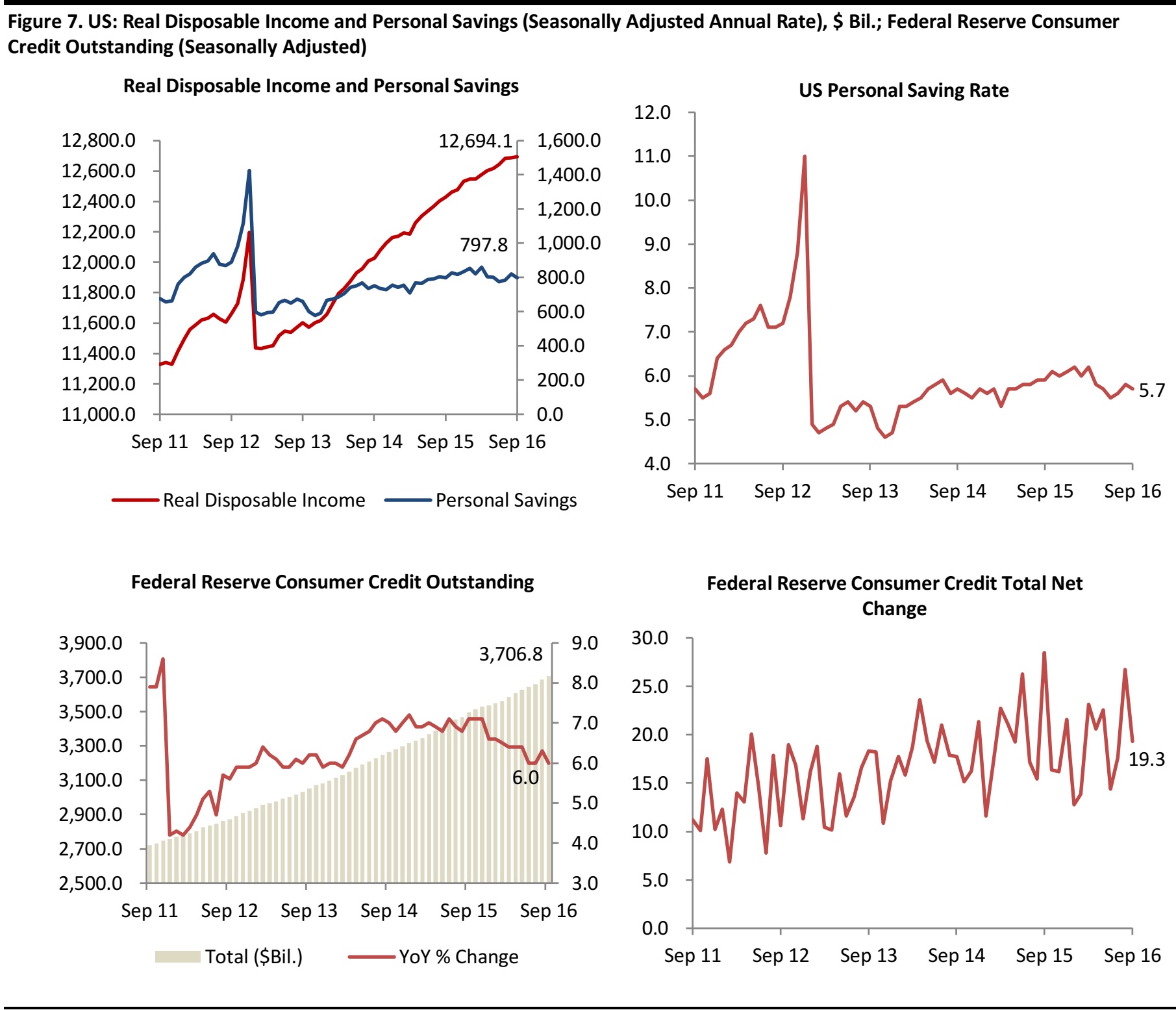

Consumers’ Disposable Income and Credit

Real disposable personal income totaled US$12,694 in September, which was flat month over month for the second consecutive month, as inflation eroded most of the gains in employees’ compensation and in nonfarm proprietors’ income.

In September, consumer credit outstanding totaled US$3,706.8 billion, up 6.0% year over year, or US$19.3 billion month over month.

Source: US Bureau of Economic Analysis/Federal Reserve Board

* indicates a positive signal for the country’s economy,

* indicates a positive signal for the country’s economy,

indicates a negative signal and = indicates not significantly positive or negative.

Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/US Energy Information Administration (EIA)/University of Michigan/US Census Bureau/Federal Reserve Board/Fung Global Retail & Technology

indicates a negative signal and = indicates not significantly positive or negative.

Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/US Energy Information Administration (EIA)/University of Michigan/US Census Bureau/Federal Reserve Board/Fung Global Retail & Technology