albert Chan

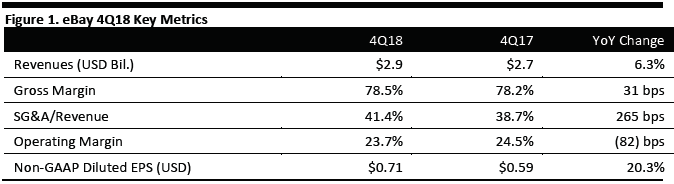

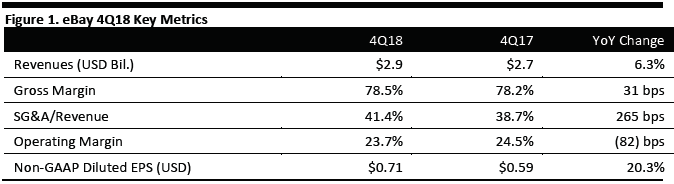

[caption id="attachment_68595" align="aligncenter" width="674"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

eBay reported revenues of $2.88 billion in 4Q18, up 6.3% year over year and beating the consensus estimate of $2.86 billion recorded by Bloomberg. GMV was $24.6 billion, up 1% as reported and 2% on a currency-neutral basis. Gross margin increased 31 basis points to 78.5% and operating margin decreased 82 basis points to 23.7%. Non-GAAP diluted EPS increased 20.3% to $0.71, beating consensus of $0.68.

eBay’s Marketplace platforms recorded revenue of $2.3 billion, up 7% as reported and 6% on a currency-neutral basis, versus 5% currency-neutral revenue growth in 3Q18. Marketplace platforms delivered GMV of $23.2 billion, up 1% as reported and 3% on a currency-neutral basis.

StubHub recorded revenue of $314 million, up 2% both as reported and on a currency-neutral basis, versus 7% currency-neutral growth in the prior quarter. GMV was $1.4 billion, down 2% as reported and 1% on a currency-neutral basis.

Classified platforms recorded revenue of $263 million, up 8% as reported while growth on a currency-neutral basis was 11%, the same as that reported for the prior quarter.

In the quarter, active global buyers across eBay’s platforms grew 4% year over year to a total of 179 million.

FY18 Results

eBay reported FY18 revenues of $10.7 billion, up 8% as reported and 6% on a currency-neutral basis. GMV was $95 billion, up 7% as reported and 5% on a currency-neutral basis.

During the year, eBay generated operating cash of $2.7 billion and free cash of $2.0 billion. The company also repurchased $4.5 billion of common stock.

Non-GAAP Diluted EPS increased 16% to $2.32.

Management commented that the company delivered record earnings for the fourth quarter and full year 2018 and will continue to focus on improving the eBay user experience and pursue growth in advertising and payments.

Outlook

The company provided the following guidance for FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

eBay reported revenues of $2.88 billion in 4Q18, up 6.3% year over year and beating the consensus estimate of $2.86 billion recorded by Bloomberg. GMV was $24.6 billion, up 1% as reported and 2% on a currency-neutral basis. Gross margin increased 31 basis points to 78.5% and operating margin decreased 82 basis points to 23.7%. Non-GAAP diluted EPS increased 20.3% to $0.71, beating consensus of $0.68.

eBay’s Marketplace platforms recorded revenue of $2.3 billion, up 7% as reported and 6% on a currency-neutral basis, versus 5% currency-neutral revenue growth in 3Q18. Marketplace platforms delivered GMV of $23.2 billion, up 1% as reported and 3% on a currency-neutral basis.

StubHub recorded revenue of $314 million, up 2% both as reported and on a currency-neutral basis, versus 7% currency-neutral growth in the prior quarter. GMV was $1.4 billion, down 2% as reported and 1% on a currency-neutral basis.

Classified platforms recorded revenue of $263 million, up 8% as reported while growth on a currency-neutral basis was 11%, the same as that reported for the prior quarter.

In the quarter, active global buyers across eBay’s platforms grew 4% year over year to a total of 179 million.

FY18 Results

eBay reported FY18 revenues of $10.7 billion, up 8% as reported and 6% on a currency-neutral basis. GMV was $95 billion, up 7% as reported and 5% on a currency-neutral basis.

During the year, eBay generated operating cash of $2.7 billion and free cash of $2.0 billion. The company also repurchased $4.5 billion of common stock.

Non-GAAP Diluted EPS increased 16% to $2.32.

Management commented that the company delivered record earnings for the fourth quarter and full year 2018 and will continue to focus on improving the eBay user experience and pursue growth in advertising and payments.

Outlook

The company provided the following guidance for FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

eBay reported revenues of $2.88 billion in 4Q18, up 6.3% year over year and beating the consensus estimate of $2.86 billion recorded by Bloomberg. GMV was $24.6 billion, up 1% as reported and 2% on a currency-neutral basis. Gross margin increased 31 basis points to 78.5% and operating margin decreased 82 basis points to 23.7%. Non-GAAP diluted EPS increased 20.3% to $0.71, beating consensus of $0.68.

eBay’s Marketplace platforms recorded revenue of $2.3 billion, up 7% as reported and 6% on a currency-neutral basis, versus 5% currency-neutral revenue growth in 3Q18. Marketplace platforms delivered GMV of $23.2 billion, up 1% as reported and 3% on a currency-neutral basis.

StubHub recorded revenue of $314 million, up 2% both as reported and on a currency-neutral basis, versus 7% currency-neutral growth in the prior quarter. GMV was $1.4 billion, down 2% as reported and 1% on a currency-neutral basis.

Classified platforms recorded revenue of $263 million, up 8% as reported while growth on a currency-neutral basis was 11%, the same as that reported for the prior quarter.

In the quarter, active global buyers across eBay’s platforms grew 4% year over year to a total of 179 million.

FY18 Results

eBay reported FY18 revenues of $10.7 billion, up 8% as reported and 6% on a currency-neutral basis. GMV was $95 billion, up 7% as reported and 5% on a currency-neutral basis.

During the year, eBay generated operating cash of $2.7 billion and free cash of $2.0 billion. The company also repurchased $4.5 billion of common stock.

Non-GAAP Diluted EPS increased 16% to $2.32.

Management commented that the company delivered record earnings for the fourth quarter and full year 2018 and will continue to focus on improving the eBay user experience and pursue growth in advertising and payments.

Outlook

The company provided the following guidance for FY19:

Source: Company reports/Coresight Research[/caption]

4Q18 Results

eBay reported revenues of $2.88 billion in 4Q18, up 6.3% year over year and beating the consensus estimate of $2.86 billion recorded by Bloomberg. GMV was $24.6 billion, up 1% as reported and 2% on a currency-neutral basis. Gross margin increased 31 basis points to 78.5% and operating margin decreased 82 basis points to 23.7%. Non-GAAP diluted EPS increased 20.3% to $0.71, beating consensus of $0.68.

eBay’s Marketplace platforms recorded revenue of $2.3 billion, up 7% as reported and 6% on a currency-neutral basis, versus 5% currency-neutral revenue growth in 3Q18. Marketplace platforms delivered GMV of $23.2 billion, up 1% as reported and 3% on a currency-neutral basis.

StubHub recorded revenue of $314 million, up 2% both as reported and on a currency-neutral basis, versus 7% currency-neutral growth in the prior quarter. GMV was $1.4 billion, down 2% as reported and 1% on a currency-neutral basis.

Classified platforms recorded revenue of $263 million, up 8% as reported while growth on a currency-neutral basis was 11%, the same as that reported for the prior quarter.

In the quarter, active global buyers across eBay’s platforms grew 4% year over year to a total of 179 million.

FY18 Results

eBay reported FY18 revenues of $10.7 billion, up 8% as reported and 6% on a currency-neutral basis. GMV was $95 billion, up 7% as reported and 5% on a currency-neutral basis.

During the year, eBay generated operating cash of $2.7 billion and free cash of $2.0 billion. The company also repurchased $4.5 billion of common stock.

Non-GAAP Diluted EPS increased 16% to $2.32.

Management commented that the company delivered record earnings for the fourth quarter and full year 2018 and will continue to focus on improving the eBay user experience and pursue growth in advertising and payments.

Outlook

The company provided the following guidance for FY19:

- Net revenue is anticipated to be $2.55–$2.60 billion in the first quarter 2019, equivalent to organic growth of 0%–2% on a currency-neutral basis.

- Net revenue is anticipated to be $10.7–$10.9 billion in the full year 2019, equivalent to organic growth of 1%–3% on a currency-neutral basis.

- Distribution of a quarterly dividend of $0.14 per share. The first quarterly dividend will be paid around March 20, 2019 to shareholders of record as of the close of business on March 1, 2019.

- Returning approximately $7.0 billion to shareholders through dividends and repurchases over the next two years, with around $5.5 billion and $1.5 billion in 2019 and 2020 respectively.