DIpil Das

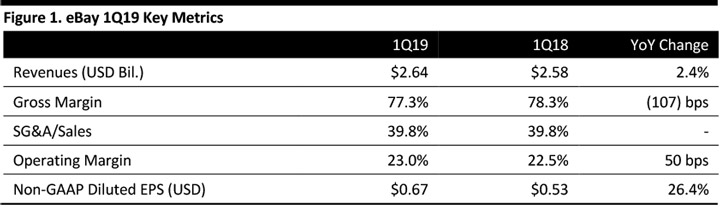

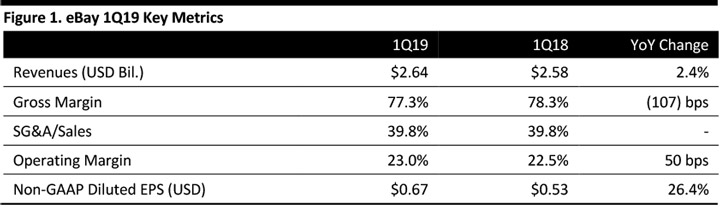

[caption id="attachment_85175" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

eBay reported revenues of $2.64 billion in the first quarter, ended March 31, 2019, up 2.4% year over year and beating the consensus estimate of $2.58 billion. GMV was $22.6 billion, down 4% as reported and .

In the quarter, active global buyer numbers across eBay’s platforms grew 4% year over year to a total of 180 million.

Breakdown of revenue segments:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

eBay reported revenues of $2.64 billion in the first quarter, ended March 31, 2019, up 2.4% year over year and beating the consensus estimate of $2.58 billion. GMV was $22.6 billion, down 4% as reported and .

In the quarter, active global buyer numbers across eBay’s platforms grew 4% year over year to a total of 180 million.

Breakdown of revenue segments:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

eBay reported revenues of $2.64 billion in the first quarter, ended March 31, 2019, up 2.4% year over year and beating the consensus estimate of $2.58 billion. GMV was $22.6 billion, down 4% as reported and .

In the quarter, active global buyer numbers across eBay’s platforms grew 4% year over year to a total of 180 million.

Breakdown of revenue segments:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

eBay reported revenues of $2.64 billion in the first quarter, ended March 31, 2019, up 2.4% year over year and beating the consensus estimate of $2.58 billion. GMV was $22.6 billion, down 4% as reported and .

In the quarter, active global buyer numbers across eBay’s platforms grew 4% year over year to a total of 180 million.

Breakdown of revenue segments:

- Marketplace platforms recorded revenue of $2.2 billion, up 3% as reported and up 4% on a currency-neutral basis. The platforms delivered GMV of $21.6 billion, down 4% as reported and 1% on a currency-neutral basis.

- StubHub platforms recorded revenue of $230 million, flat both as reported and on a currency-neutral basis. GMV was $1.0 billion, down 3% as reported and down 2% on a currency-neutral basis.

- Classifieds platforms recorded revenue of $256 million, up 4% as reported and up 12% on a currency-neutral basis.

- The new managed payment system launched in 2018 has saved sellers $2.7 million in payment-related expenses to date.

- Over 800,000 active sellers have used promoted listing placements, which contributed over $65 million of advertising revenue in the quarter, up almost 110% year over year.

- The company introduced an expedited registration process for shoppers on mobile and desktop and launched a search feature that allows shoppers to discover products through pictures and words.

- Enhanced Seller Hub with a new “Offer to Buyers” feature that helps sellers make offers to interested buyers.

- Completed acquisition of UK-based classifieds site Motors.co.uk to offer more than 620,000 car listings together with eBay Motors UK.

- Revenues of $2.64-69 billion in 2Q19, growth of 2-4% on a currency-neutral basis,and non-GAAP diluted EPS of $0.61-0.63.

- Revenues of $10.83-10.93 billion in FY19, representing growth of 2-3% on a currency-neutral basis,and non-GAAP diluted EPS of $2.64-2.70.